Oleksandr Sosis owns 99.9999% of the shares of PJSC Ukrainian Joint-Stock Insurance Company ASKA-Life (Kyiv), according to the insurer’s announcement in the information disclosure system of the National Securities and Stock Market Commission (NSSMC). As reported, according to the NSSMC, as of the end of 2024, 55.6667% of the company was owned by SCM Finance Limited, 44.3333% – by Alexander Sosis. At the same time, Sosis is the main shareholder of Alliance Bank (Kyiv) with a stake of 89.289%.

In October 2024, the Antimonopoly Committee of Ukraine (AMCU) granted him permission to acquire control over ASKA-Life.

On April 3, 2025, Anna Dugadko, a member of the Supervisory Board of ASKA-Life as a representative of SCM Finance Limited, was removed from the company’s Supervisory Board after the alienation of the beneficiary’s shares.

ASKA-Life Insurance Company was registered in 2003 and specializes in life insurance.

According to the NBU, in 2024, ASKA Life collected UAH 136.2 million in insurance premiums and made insurance payments of UAH 7.915 million. Its eligible assets amounted to UAH 215 million, and technical reserves amounted to UAH 121.145 million.

The authorized capital is UAH 49.625 million.

Vitagro Group is completing the construction of two new silos with a capacity of 11 thousand tons of simultaneous storage at its elevator in Izyaslav district, Khmelnytsky region, and is preparing a 15 thousand ton storage area in grain bins, the company’s press service reports.

According to the report, the total capacity of the elevator will increase to 66 thousand tons of simultaneous storage. The work is scheduled to be completed in early summer 2025 to store the new winter crop.

“We started working on the project in the fall of 2024. At the same time, we contracted equipment and planned the construction schedule. In total, approximately UAH 153 million will be spent on the first stage of the project. As part of the capacity increase, we will not only increase the storage volume but also add another working tower, which will allow us to accept two different crops at the same time and load grain in parallel on rail and road transport. At the same time, the shipment speed will increase from 1400 tons per day to 2300 tons per day,” explained Alexander Kulygin, Director of Grain Storage at Vitagro Group.

Vitagro reminded that it started developing the elevator business in 2017 with the construction of an elevator in Zakupne village, Kamianets-Podilskyi district, Khmelnytskyi region. The group now owns five elevators in Khmelnytsky and Rivne regions with a total capacity of 385 tons of simultaneous storage. The largest of them is in Zakupne. Its current capacity is 106 thousand tons.

Vitagro Group is one of the largest industrial groups in Ukraine with assets in the agricultural, energy, processing, construction and chemical industries. It was founded and has been operating since 1998. It owns enterprises in Khmelnytsky, Rivne, Volyn, Ivano-Frankivsk and Kyiv regions. The company cultivates about 90 thousand hectares of land and is engaged in livestock farming, horticulture, renewable energy, fertilizer and feed production, construction and building materials production. During the full-scale invasion, the group built and launched 5 processing plants. Vitagro is headquartered in Khmelnytsky.

According to the Unified State Register of Legal Entities and Individual Entrepreneurs, the ultimate beneficiary of the Vitagro investment company is MP Serhiy Labaziuk (For the Future parliamentary faction).

In 2024, coffee producer Galka PrJSC (Lviv) reduced its profit by 7.5% to UAH 2.7 million compared to 2023.

According to the decision of the shareholders’ meeting published in the information disclosure system of the National Securities and Stock Market Commission (NSSMC), it was decided to pay dividends in the amount of UAH 4,497,204, which is UAH 12.85 per ordinary registered share.

The Management Board was obliged to compile a list of persons entitled to receive dividends by April 23, 2025, and to pay dividends directly to shareholders within six months from the date of the general meeting’s decision to pay dividends by transferring them to shareholders’ bank accounts or, at their request, at the company’s cash desk.

“Pay the entire amount of dividends in full. To notify the persons entitled to receive dividends of the date, amount, procedure and term of their payment by posting a relevant notice on the company’s website,” the minutes of the general meeting read.

According to the Opendatabot service, in 2024, Galka slightly increased its revenue to UAH 5.274 million, which actually corresponds to the pre-war level of UAH 5.29 million in 2021. Debt obligations increased by 20.2% to UAH 504.2 thousand, while assets decreased by 6.6% to UAH 24.11 million.

Galka PrJSC was established in 1994 on the basis of a Lviv coffee factory that started its operations in 1932 as the Lviv Cooperative Factory of Coffee Additives “Suspilny Promyshl”. Since its inception, the company has specialized in the production of chicory and malt coffee “Luna”, as well as Prajin coffee substitutes. In 1971, the company installed Niro Atomizer equipment for the production of instant coffee, which Lviv Coffee Factory began exporting. The capacity of the Ukrainian-English manufacturer Galka is currently 120 thousand packs of coffee per day.

The major shareholders are Yaroslav Volynets (8.9%) and Lydia and Andriy Volynets (6.9% each), Natalia, Olga and Yuriy Dubovy (7.7% each), Roman and Volodymyr Pasternak (7.1% and 7.6%), Iryna Popovych (7.1%), and Galka Holding LLC (19.39%).

In January-February 2025, Ukraine produced 0.9 million tons of milk, which is 3.5% less than in the corresponding period of 2024, according to Infagro, an industry information and analytical agency.

In February, agricultural enterprises produced 1.7% more milk than in February 2024. Given that 2024 was a leap year, the annual growth in February was 5.3%, analysts said.

Experts emphasized that as of March 1, there were 1.15 million cows in Ukraine, which is 8.4% less than on the same date last year. Official figures for the number of cows in agricultural enterprises showed a negative annual trend with a slight decrease of 0.1% by March 1, 2024.

“In April, we can expect stabilization of the milk market due to the growth of overall demand, which means that the rate of decline in purchase prices will slow down, price revisions will become pointwise,” Infagro emphasized.

At the same time, in March 2025, the purchase price of raw milk in Ukraine continued to decline, with prices returning to approximately the level of September 2024. The March price correction was more severe than in February. Competition for raw materials has resumed due to the projected growth in promotional sales of dairy products in the domestic market and increased European demand for Ukrainian goods, especially butter.

Analysts noted that the supply of raw materials in the domestic market continues to grow. New production facilities and new projects in the dairy industry are being launched. Therefore, the pressure on the price of milk is still there.

The average cost of raw materials in March 2025 in agricultural enterprises was 16.6 UAH/kg excluding VAT, which is 5.1% lower than in February, but 15% higher than in March 2024; the cost of raw materials from the population was 10.5 UAH/kg excluding VAT, which is 4.1% lower than in February, but 14% higher than in March 2024.

The range of milk prices at the end of March was mainly from agricultural enterprises – 15.8-17.0 UAH/kg excluding VAT, and from households – 9.5-11.0 UAH/kg excluding VAT.

“The estimated margin of milk production continued to decline in March. The average estimated operating margin in March amounted to 15%, which is 7 points less than in February and 29 points lower than in March 2024,” Infagro summarized.

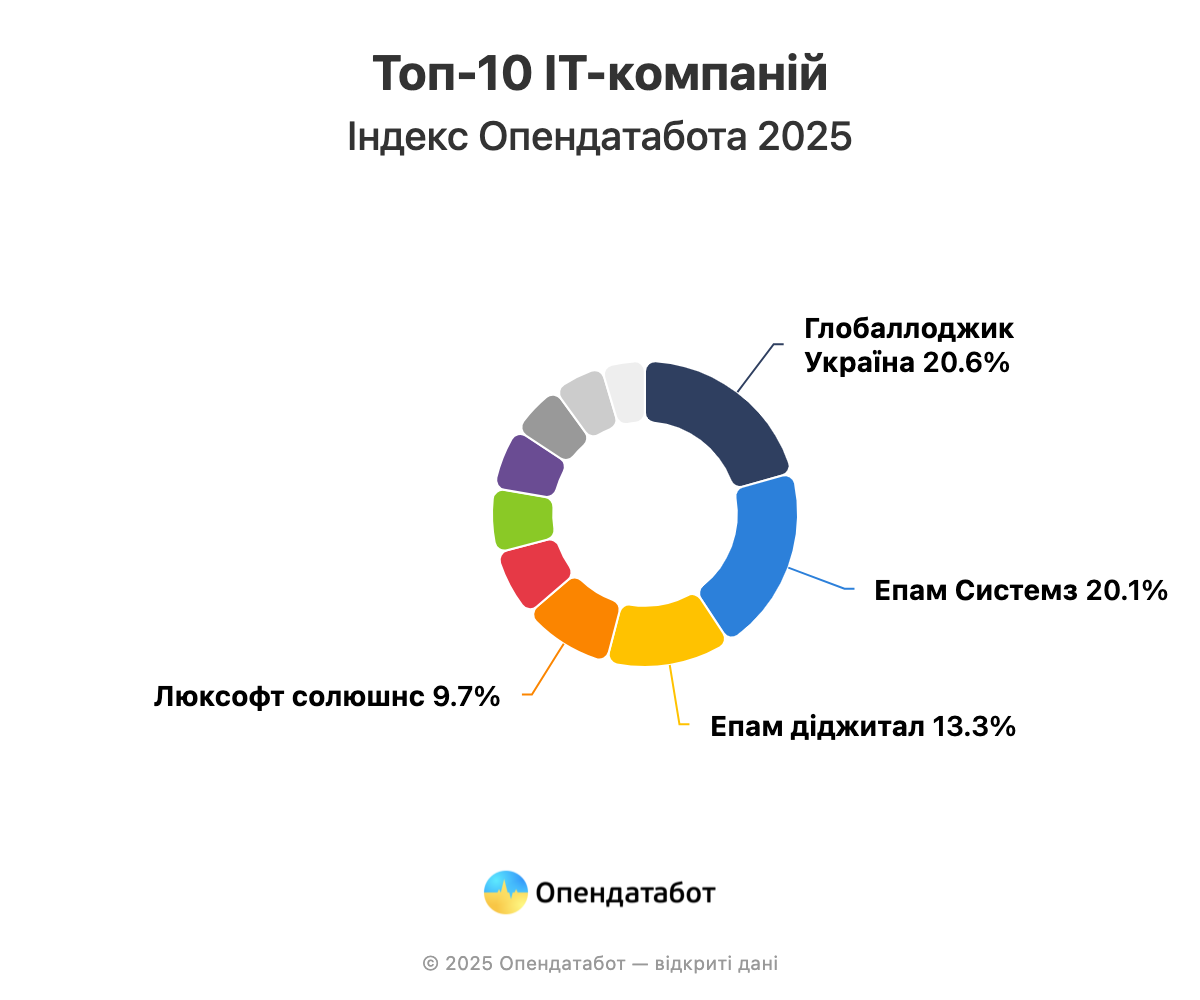

UAH 56.48 billion was the total revenue of the best IT companies in the Opendatabot 2025 Index. The top three leaders belong to American companies, with Globalogic Ukraine taking the first place. Also, 2 companies left the top 10, one of which was included in the Index for 2 years. 7 out of 10 companies in the Index are in the Diia City register

GlobalLogic Ukraine , owned by the American Bonus Technology INC, debuted on the first place in terms of revenue. Revenue for the year changed slightly to UAH 11.66 billion (+2%), while profit decreased by 28% to UAH 653 million. Despite the fact that the company has been in the Index for 3 years, it took the leading position for the first time.

“We are honored to continue and develop our business in Ukraine, as we understand the high price of such an opportunity. GlobalLogic in Ukraine unites thousands of talented engineers. It is their intelligence, education, diligence and high efficiency that helps the company grow in Ukraine and pay taxes to our country’s economy. Our engineering teams in Ukraine create high-tech solutions in the areas of artificial intelligence, automotive, medical, semiconductors, and more. These developments are highly valued by our customers in the US and Europe,” comments Anna Shcherbakova, COO of GlobalLogic Ukraine.

The remaining top 3 positions were shared by two companies of Epam, founded by Arkadiy Dobkin. They account for a third of the top ten earnings. Epam Systems , which previously topped the Index for 2 years in a row, went down a notch with revenue of UAH 11.35 billion. This is 10% less than in 2023. At the same time, its profit increased by 27% to UAH 1.67 billion.

At the same time, Epam Digital ‘s revenues and profits are growing year on year. With revenue of UAH 7.5 billion (+25%) and profit of UAH 838 million (+11%), the company ranked third in the Index. It is worth noting that this legal entity was founded only in December 2021.

“EPAM Ukraine has been a leader in the IT industry for several years in terms of key indicators: the number of specialists, revenue, and the amount of tax payments to the country’s budget. Last year, we paid over UAH 1 billion in taxes, which confirms our position as one of the largest taxpayers in the Ukrainian IT sector. Since the start of the full-scale invasion, the company has committed $100 million to support its Ukrainian team, their families, Ukrainian defenders and the country’s critical needs,” comments Stepan Mitish, Vice President, Head of EPAM Ukraine

For the second year in a row, Luxoft Solutions, a subsidiary of Swiss Luxoft founded by Dmytro Loshchynin, remains fourth in the Index. Its revenue fell by 7% to UAH 5.45 billion, while profit decreased by 12% to UAH 263.6 million.

The Institute of Information Technologies “Intellias” took the 5th place with a revenue of UAH 4.06 billion (-6%). At the same time, the company’s profit increased by 18% to UAH 300.7 million. The business is owned by ITE Limited, whose ultimate owners are Vitaliy Sedler and Mikhail Puzrakov.

SoftServe Technologies, founded by Lviv residents Taras Kitsmey and Yaroslav Lyubynets, moved up two places last year: 6th place. The company’s revenue grew 1.6 times over the year to UAH 3.83 billion, while profit remained the same at UAH 210 million.

Thefintech band, owned by Monobank founders Oleg Gorokhovsky and Mikhail Rogalsky, lost two positions in the Best Index this year. Due to a significant decrease in revenue – by one and a half times – the company was ranked seventh: UAH 3.71 billion. Profits decreased even more significantly: by 2.7 times to UAH 1.15 billion.

Infopulse Ukraine, founded by Oleksiy Sigovyi and Andriy Anisimov, took the ninth place. It is now owned by the Swedish company NUK HOLDING AB. The company’s revenue decreased by 5% to UAH 3.06 billion, while profit decreased by 14% to UAH 332.7 million.

At the same time, this year’s iteration of the Opendatabot Index also includes newcomers that debuted with stunning results. With revenues of UAH 3.22 billion and a record profit of UAH 2.4 billion among the top 10 companies, Highload Solutions (formerly Favbet Tech) by Dmitry Matyukha appeared in the Index. The company, registered in January 2022, accounts for a third of the total profit of the ranked companies.

Another newcomer to the Index rounds out the top ten is the young company Squad Ukraine (SQUAD), established in August 2022. The business is owned by the Cypriot company Squad IT Limited, owned by Ukrainians Lyubomyr Vasyliev and Yuriy Katkov. Last year, Squad’s revenue grew 2.8 times year-on-year to UAH 2.6 billion, and its profit grew 3.4 times to UAH 80.6 million.

It is worth noting that 7 of the top companies chose the Diia City legal regime, except for Epam Systems, Luxoft Solutions, and the Institute of Information Technologies “Intellias”. This means that these companies do not enjoy special tax benefits, a simplified administrative process, and other tools for the development of the IT sector from the state.

At the same time, this year the IT Companies Index was dropped:

https://opendatabot.ua/analytics/index-it-2025