Issue #2 – January 2025

The purpose of this review is to provide an analysis of the current situation on the Ukrainian currency market and a forecast of the hryvnia exchange rate against key currencies based on the latest data. We analyze current conditions, key influencing factors, and likely scenarios.

Analysis of the current situation

The hryvnia exchange rate has stabilized in the Ukrainian currency market after the traditional seasonal increase in demand for the currency in December. As of the end of January, the US dollar on the cash market has rolled back after peaking in the middle of the month to the level of UAH 41.8-42.3/$, while the euro continued to grow to UAH 43.57-44.32/€. This is generally within our previous forecast, although in some places higher rates were recorded, which did not reflect the general market trend.

The increase in the NBU’s key policy rate to 14.5% signals the regulator’s attempts to curb inflationary and devaluation expectations of businesses and households. At the same time, the NBU revised its own inflation forecast upward to 8.4%, which may offset its stabilization measures.

An important factor in market stability remains the record volume of cash imports by banks. In December, banks imported USD 1.58 billion, which helped meet high demand and reduce the risk of speculative pressure on the exchange rate. In total, USD 15.9 billion was imported in 2024, which indicates a high level of dollarization of the Ukrainian economy and savings of households and businesses.

The steady deepening of dollarization and the overall currencyization of the economy indicates a low level of confidence among economic agents in statements about currency stability. At the same time, however, there are no factors that would create noticeable distortions in the FX market or a stir that could upset the balance.

The external context also plays an important role, and at the same time, it remains highly dynamic – there are regular reports that can significantly affect the ratio of key currencies, and thus their dynamics in the Ukrainian market. Some of the most notable recent events:

– The European Central Bank (ECB) cut interest rates by 25 basis points, which will affect the attractiveness of the euro for investors.

– Stagnation in the eurozone economy remains an important driver of the euro’s weakening.

– The US Federal Reserve is still maintaining a tight monetary policy, which supports the dollar.

– Potential “exchange rate wars” between the US and the EU could affect global currency markets.

Dollar exchange rate forecast

Short-term forecast

The hryvnia exchange rate against the dollar is expected to enter the range of 41.5-42 UAH/$ in the coming weeks. Demand for currency from businesses and households remains the main driver of exchange rate fluctuations. The NBU’s consistently high foreign exchange reserves, which allow it to quickly manage the market situation, act as a deterrent.

The current spread between the USD buying and selling rates is UAH 0.45, which indicates the stability of the foreign exchange market. Changes in this indicator may signal changes in the supply and demand balance.

Medium-term outlook

In the first half of 2025, the exchange rate is likely to gradually move to 44 UAH/$.

– The risk to the hryvnia will increase if the population continues to actively buy up foreign currency amid high devaluation expectations.

– A possible Fed rate decision in the second quarter of 2025 will have a direct impact on the dollar.

Euro exchange rate forecast

Short-term outlook

The euro is likely to move towards the level of 43.8-44.8 UAH/€.

– The ECB’s rate cut to 2.75% makes the euro less attractive to investors.

– The stable average spread between buying and selling the euro at UAH 0.525 indicates that there are no prerequisites for sharp changes in the euro exchange rate.

Medium-term outlook

Further euro depreciation is possible if:

– Eurozone stagnation deepens due to weak economic activity.

– Further cuts in ECB rates, which will make the euro less competitive against the dollar.

If the ECB continues its policy of gradual easing, the hryvnia exchange rate against the euro may remain more stable than against the dollar.

Key factors influencing the foreign exchange market

1. The NBU’s monetary policy – raising the key policy rate affects liquidity and restrains inflation.

2. Demand for foreign currency – households and businesses continue to buy foreign currency, which is the main internal driver of devaluation and a key factor of pressure on the hryvnia exchange rate.

An exclusive from the KYT Group analyst team for our newsletter recipients: how Ukrainians’ preference for different currencies is changing.

As one of the largest foreign exchange market operators , KYT Group presents its own cross-section of the share of transactions in different currencies that we observed in our network covering approximately 30 major cities of Ukraine, where almost one hundred currency exchange offices operate.

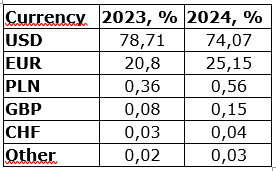

Below is a comparison of the percentage of transactions in different currencies in KYT Group’s FEAs.

Now let’s make a brief analysis of the available data that can be considered representative:

1. Decrease in the share of the US dollar (USD) from 78.71% to 74.07%. Despite this, the US dollar remains the dominant currency of transactions, but its share has decreased, which may indicate an increase in the role of the euro and other currencies in the foreign exchange market.

2. An increase in the share of the euro (EUR) from 20.80% to 25.15%. There has been an increase in the use of the euro, which may be a result of large emigration of economically active Ukrainians to the euro area, more active foreign trade with the EU, changes in business payment preferences, or diversification of household savings.

3. A significant increase in the Polish zloty (PLN) from 0.36% to 0.56%. This may be due to the activity of labor migrants, deepening business ties between the countries, and the growth of financial flows between Ukraine and Poland.

4. An increase in transactions with the British pound (GBP) from 0.08% to 0.15%. This is likely to be a sign of growing interest in British assets or an increase in the share of cross-border settlements between Ukrainians and some economic agents with the UK.

5. The Swiss franc (CHF) increased slightly from 0.03% to 0.04%, indicating a consistently low demand for this currency in the Ukrainian financial segment.

6. The share of other currencies (among which we most often record the forint, Czech koruna, Romanian and Moldovan lei) increased from 0.02% to 0.03%, indicating a slight increase in the use of alternative currencies in settlements or cross-border transactions.

Overall conclusion

The US dollar retains its leadership, but its share is declining, while the euro and Polish zloty are becoming more popular. This may indicate a reorientation of financial flows to the EU, as well as attempts by businesses and individuals to diversify their currency transactions.

This material was prepared by the company’s analysts and reflects their expert, analytical professional judgment. The information presented in this review is for informational purposes only and cannot be considered as a recommendation for action.

The Company and its analysts make no representations and assume no liability for any consequences arising from the use of this information. All information is provided “as is” without any additional guarantees of completeness, obligations of timeliness or updates or additions.

Users of this material should make their own risk assessments and informed decisions based on their own assessment and analysis of the situation from various available sources that they consider to be sufficiently qualified. We recommend that you consult an independent financial advisor before making any investment decisions.

REFERENCE

KYT Group is an international multi-service product FinTech company that has been successfully operating in the non-banking financial services market for 16 years. The company’s flagship business is currency exchange. KYT Group is one of the largest operators in this segment of the Ukrainian financial market, is among the largest taxpayers, and is one of the industry leaders in terms of asset growth and equity.

More than 90 branches in 16 major cities of Ukraine are located in convenient locations for customers and have modern equipment for the convenience, security and confidentiality of each transaction.

The company’s activities comply with the regulatory requirements of the NBU. KYT Group adheres to EU standards, having a branch in Poland and planning cross-border expansion to European countries.

Parallel has expanded its network with a new filling station on Obukhivske highway near Kyiv.

“The filling station offers all types of high-quality fuel from European manufacturers that meet the highest quality standards. All modern services are available for the convenience of drivers,” the company said in a press release.

According to the network, despite the challenges posed by the full-scale war, temporary occupation of some territories and infrastructure damage caused by shelling, Parallel continues to rebuild and develop its network as part of the company’s long-term strategy.

In particular, the company plans to expand its network both by opening new filling stations and by increasing the number of partner complexes operating under the Parallel brand.

“Due to the Russian aggression, we lost about 80% of our filling stations, but we are rebuilding and developing the network, because a working business means paid taxes and support for the country’s economy,” said Parallel owner and CEO Alexander Dubinin.Before the war, the Parallel branded network included 132 filling stations. As a result of the full-scale invasion, the company lost or suspended most of its facilities.

Currently, the company operates 32 filling stations in Dnipropetrovs’k, Odesa, Chernihiv, Kyiv and the government-controlled areas of Donetsk and Zaporizhzhya regions.

“Parallel is regularly ranked among Ukraine’s top 10 fuel importers

Alterra Group has invested $8.5 million in the expansion of the Joule logistics center (Kyiv region, Svyatopetrivske) from 8 to 20 thousand square meters, the company’s press service toldInterfax-Ukraine.

According to Alterra Group’s commercial director Gennadiy Grinenko, the expansion is due to the growing demand for rental space in the facility, with zero vacancy in the first stages. According to the survey, entrepreneurs are increasingly looking for ready-made commercial premises instead of building their own warehouses.

Nine new businesses, companies that combine innovation, social responsibility and a focus on sustainable development, have become residents of the first stages of Joule. Farmak’s pharmaceutical business is among the residents. The expansion of the facility will attract more such residents and create at least 50 new jobs.

“Our experience proves that the more progressive businesses there are in the complex, the more ideas, innovations and collaborations they produce. For example, this happened with our logistics center PORT, where residents actively cooperate with each other. Such an ecosystem not only saves time and money for residents, but also creates a business community where everyone strengthens each other,” says Hrynenko.

Another change in Joule is that it has become more accessible to small businesses. Previously, companies could rent or buy premises ranging from 500 to 6 thousand square meters. Now, the minimum area has been reduced to 200 square meters.

“This makes it possible to get all the necessary infrastructure ready, including access to autonomous heating and lighting, even for businesses that have just started their development,” explained Hrynenko.

Alterra Group is a Ukrainian company specializing in the development and management of commercial real estate on a turnkey basis. The company’s portfolio includes 43 properties with a total area of 175 thousand square meters. These include warehouse and industrial complexes, business centers, shopping and entertainment centers.

A reception organized by the Embassy of India in Ukraine in honor of the 75th anniversary of the Republic Day was held in the capital of Ukraine, Kyiv.

The event brought together representatives of the Ukrainian government, diplomatic corps, Indian diaspora and the public. Deputy Minister for Foreign Affairs of Ukraine Yevhen Perebyinis was the main guest of the event.

“On January 26, 1950, the Constitution of India came into force, marking the transition of our country to a sovereign, independent, democratic, secular republic. We are proud of the ideals of justice, freedom, equality and fraternity,” said Ambassador Extraordinary and Plenipotentiary of India to Ukraine Ravi Shankar.

In his speech, the diplomat emphasized the significance of Republic Day for the Indian people, stressing that in 75 years India has become one of the fastest growing economies in the world, which is preparing to become the third largest.

“Bold reforms, investments in infrastructure and innovations such as quantum technologies, artificial intelligence and space exploration make our country a key player in global processes. Another priority is the biotechnology industry, in particular the Genome project. It is also worth mentioning the latest achievement – docking in space, which has brought the country into the top four world leaders in the industry,” the ambassador said.

Shankar devoted a significant part of his speech to Ukrainian-Indian relations. He recalled the historic visit of Indian Prime Minister Narendra Modi to Kyiv in August 2024, which became a “landmark” for bilateral cooperation:

“We seek to transform our relationship from a Comprehensive Partnership to a Strategic Partnership. Special attention is paid to humanitarian support for Ukraine. In particular, India has donated mobile hospitals “BHISHM Cubes”, which are now helping to quickly treat the wounded and save precious lives on the front line, and has decided to finance the project “Renovation and modernization of the surgical department of the Zbarazh Central Hospital in Ternopil region worth $1.5 million,” the ambassador said.

He emphasized that India supports a comprehensive, just peace in accordance with international law.

The Ambassador praised the growing interest of Ukrainians in Indian culture, language and traditions. He thanked Ukrainian students who study Hindi and emphasized the importance of cultural exchanges. “The program signed last year opens up new opportunities for academic scholarships, international projects, and preserving our common heritage,” Shankar said.

At the end of the event, guests enjoyed traditional Indian food and music. The event highlighted past achievements and optimistic prospects for cooperation between India and Ukraine in the coming decades.

India recognized Ukraine’s independence on December 26, 1991. On January 17, 1992, diplomatic relations between Ukraine and India were established. Republic Day is a national holiday of India that celebrates the adoption of the Constitution of India and the country’s transition from a British dominion to a republic on January 26, 1950.

Source: https://interfax.com.ua

Private healthcare facilities are ready to work under the Medical Guarantee Program (MGP) and propose to revise approaches to the formation of certain packages for the MGP, which will reduce the cost of medical services and optimize budget expenditures.

This was stated by members of the Association of Private Medical Institutions (APMI) at a press conference at Interfax-Ukraine on Thursday.

Mykola Skavronsky, deputy director general of the Cinevo medical laboratory, noted that the laboratory has not stopped working since the beginning of the war, despite the fact that in 2022 Cinevo lost more than 30 branches in different regions.

“It’s quite a shame to see that recovery programs exist only for state or municipal medicine. This completely ignores the fact that private medicine also suffered from the war. But, unlike the state and municipal ones, all private providers are recovering and continue to work with their own or credit funds, not with budget funds and without assistance,” he said.

Commenting on the first experience of Cinevo’s cooperation with the NHSU in 2024, Skavronsky noted that the laboratory’s entry into the PMG “became a kind of spotlight that highlighted the situation with the laboratory industry in Ukraine as a whole.”

“I can say that the state does not know and does not understand the real need of doctors and patients for laboratory diagnostics. Now it is believed that laboratory diagnostics are needed as much as they are ordered, not as much as they are needed. Cinevo’s cooperation with the NHSU has revealed the fact that there is simply a huge unrealized demand for laboratory diagnostics in Ukraine, in March last year alone, we performed almost 730 thousand tests for 72 thousand people, and we saw that of these people who came to us for PMG, two-thirds were new people,” he said.

Skavronsky noted that at basic prices, Cinevo performed tests for about UAH 528 million, at prices, the cost of tests was about UAH 200 million, while the NHSU paid UAH 44 million for them.

“We asked the NHSU to create a laboratory package that would be transparent and clear, where it would be clear what tests and, most importantly, which doctors can prescribe them and in what quantity. Because it turned out that there were no restrictions at all, doctors prescribed tests that should not have been prescribed. It is not the laboratory that should decide what to do and what not to do, there should be a system that simply does not allow prescribing something wrong,” he said.

According to Skavronsky, one of the most popular tests funded by the budget in 2024 was vitamin D tests, of which the laboratory performed about 100 thousand.

“I don’t think Ukraine is such a rich country to cover vitamin D tests in such volumes at the expense of taxpayers. But doctors prescribe them. Why doctors prescribe them is a bigger question for doctors and pharmaceutical companies,” he emphasized.

Skavronsky also emphasized that the implementation of the proposals developed by the laboratory allowed “not only not to increase the tariff, but even to reduce it.”

“As a private laboratory, we would be ready to work with tariffs that are 15% lower, but subject to clear criteria. In recent years, we have heard that money follows the patient, but over the past year, especially in the first quarter, we have seen that money does not follow the patient,” he said.

For his part, Vadym Zukin, Chief Operating Officer of the Leleka Multidisciplinary Medical Center, reminded that Leleka is the only medical center in Ukraine that has international JCI accreditation, and the clinic received its latest confirmation at the end of 2024.

“Literally two months before the full-scale invasion began, the Minister of Health and his deputy came to us and we discussed how these standards could be implemented for other market players. But now it seems that the state is sailing its own ship, and we are trying to catch up with the Ministry of Health and convince it of something,” he explained the situation.

Zukin emphasized that “the state should realize that it is more profitable for it to become a purchaser of medical services rather than a provider and not to invest in fixed assets, since private companies already have these funds.”

He also suggested that the NHSU should enter into longer-term contracts for participation in the PMG.

“Currently, certain PMG packages will have three-year contracts, which is better than one year, but it means nothing, because in Europe and the US they think in terms of seven years, 10 years, 15 years,” he said.

Zukin believes that “now the reform has started to move a little bit in the opposite direction from the notion that money follows patients, and I would like to bring it back in the right direction.”

For her part, Oleksandra Mashkevych, medical director of the Dobrobut medical network, noted that the network is a major taxpayer, employing 3,000 people, including 1,300 doctors. At the same time, 131 employees have been mobilized from Dobrobut and the clinic continues to pay their salaries.

“We are recognized by the Ministry of Health as critical infrastructure. In 2024, we invested almost UAH 0.5 billion in our development, most of which was spent on our energy efficiency. I would like to note that investments in energy efficiency in state and municipal institutions are not made at their own expense, but at the expense of the state or donors or sponsors. We do it on our own,” she said.

At the same time, Mashkevych emphasized that Dobrobut’s cooperation with the NHSU is “quite interesting.” In particular, the clinic has been contracted for a package of assisted reproductive technologies, under which 300 patients have completed treatment cycles and almost 45% of women have already confirmed pregnancy status.

“The tariff for this service was too low for us, we worked in the red, realizing that we were lending a hand to the state, in fact, we gave the state the opportunity to use our facilities to provide free medical services. We had long rounds of negotiations with the NHSU, the Ministry of Health, and the Ministry of Finance, and they heard us and increased the tariff. This tariff does not cover all our expenses, but we continue to work with it,” she said.

Commenting on the plans to work with the NHSU, Mashkevich noted that Dobrobut plans to expand its participation in the UHI-2025 and is waiting for the NHSU’s decision on contracting for new packages.

At the same time, Mashkevych called it a positive decision to allow private institutions to use the state unified portal of medical vacancies launched by the Ministry of Health.

The press conference was organized by the Interfax-Ukraine agency and the Association of Private Medical Institutions.

Afanasieva, Bereznitsky, CLINIC, MASHKEVYCH, MEDICINE, Ministry of Health, Skavronsky, URAKIN, Yeshchenko, Гавриченко, Зукін

The number of commercial flights in the European Union in 2024 amounted to 6.7 million, which is 5.8% higher than the previous year, according to the EU Statistical Office. However, their number remained below the 7 million mark recorded in the pre-pandemic year of 2019.

Irregular flights, such as charters, accounted for 8.7% of the total number of flights. The peak was in the summer months: in June, their share was 10.3%, in July – 10.7%, and in August – 10.1%.

Amsterdam Schiphol Airport handled the largest number of flights last year (484 thousand). This is followed by Paris Charles de Gaulle (463 thousand) and Frankfurt am Main Airport (437 thousand). The top ten airports in terms of traffic also include Madrid, Barcelona, Munich, Rome, Athens, Vienna, and Dublin.

Eurostat’s definition of commercial air travel includes passenger, cargo, and mail flights.