In December 2024, the general fund of the state budget of Ukraine received UAH 13.1 million of excise tax on manufactured and imported excisable goods, which is 45% (UAH 4.1 billion) more than a year earlier, the press service of the State Tax Service of Ukraine (STS) reports.

The State Tax Service noted that the revenue target was met by 104.1%, with an additional UAH 0.5 billion going to the budget.

In December 2024, the State Tax Service also exceeded the plan for revenues from alcoholic beverages and tobacco products by 109% (an additional UAH 80.4 million). The state budget received almost UAH 1 billion from alcoholic beverages produced and imported into the customs territory of Ukraine.

In addition, the state budget received almost UAH 9 billion from manufactured and imported tobacco products, which amounted to 100.1% of the revenue indicator, the state received an additional UAH 9.3 million, the State Tax Service summarized.

At the end of 2024, the Serbian labor market showed stability with a gradual increase in employment. The unemployment rate decreased to 9.2%, down from 10.1% in 2023. Economic recovery from the pandemic and the inflow of investments in key sectors are contributing to job creation, but the country still faces a shortage of skilled labor.

The key characteristics of the labor market in Serbia are:

1) The employed population is about 2.9 million.

2) The main employment sectors are:

3)Average salary level:

4) The most demanded professions are:

IT specialists;

Engineers;

Medical personnel;

Workers in the construction and agricultural sectors.

The role of migrants in the Serbian labor market

Migrants play an important role in the Serbian economy, especially in sectors where there is a labor shortage. In 2024, the number of registered foreign workers exceeded 120,000, including citizens of Ukraine, Bosnia and Herzegovina, North Macedonia, Russia and China.

Main migrant groups and their roles:

Regularities:

Challenges of the labor market with regard to migration

Experts predict that Serbia will maintain a high share of migrant workers in the labor market, especially in construction, agriculture, and IT. Key factors:

Serbia’s labor market in 2024 is developing against the backdrop of an influx of foreign workers, including a significant share of Ukrainians. This allows the country to address the problem of staff shortages in key sectors. However, Serbia’s further growth will require not only attracting migrants, but also improving working conditions and incentivizing local workers.

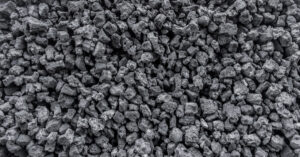

In 2024, Ukraine increased imports of coke and semi-coke in physical terms by 2.01 times compared to 2023, up to 661.487 thousand tons.

According to statistics released by the State Customs Service (SCS), coke imports in monetary terms increased by 81.9% to $235.475 million during this period.

Imports were mainly from Poland (84.76% of supplies in monetary terms), Colombia (7.74%) and Hungary (2.69%).

Last year, the country exported 1,601 thousand tons of 84.76% coke for $368 thousand to Moldova (99.18%) and Latvia (0.82%), while in January, March, October and November 2024, there were no exports, while in 2023, exports amounted to 3,383 thousand tons for $787 thousand.

As reported, in 2023, Ukraine reduced imports of coke and semi-coke in physical terms by 8.5% compared to 2022 – to 328.697 thousand tons, while imports in monetary terms decreased by 25.8% to $129.472 million.

In 2023, Ukraine exported 3,383 thousand tons of coke, down 12.3% compared to 2022. In monetary terms, it decreased by 22.2% to $787 thousand.

Exports were carried out to Moldova (100% of supplies in monetary terms), while imports were mainly from Poland (88.47%), Colombia (7.72%) and the Czech Republic (3.15%).

In 2024, imports of tin and tin products increased by 16.9% to $3.188 million (in December – $338 thousand). Exports of tin amounted to $389 thousand, compared to $159 thousand in 2023, with no exports in December.

Tin is used mainly as a safe, non-toxic, corrosion-resistant coating in its pure form or in alloys with other metals. The main industrial applications of tin are in white tinplate (tinned iron) for food containers, in solders for electronics, in house pipelines, in bearing alloys, and in coatings made of tin and its alloys. The most important tin alloy is bronze (with copper).

In 2024, Ukraine reduced exports of processed pig iron in physical terms by 3.4% compared to 2023, to 1 million 290.622 thousand tons.

According to statistics released by the State Customs Service (SCS), pig iron exports in monetary terms decreased by 6.1% to $500.341 million during the period under review.

At the same time, exports were carried out mainly to the United States (72.64% of supplies in monetary terms), Turkey (8.03%) and Italy (7.30%).

For the whole of 2024, the country imported 38 tons of pig iron worth $90 thousand from Germany (in January, March, May, June, July, August, October and November, there were no imports), while in the same period in 2023, it imported 154 tons of pig iron worth $156 thousand.

As reported, in 2023, Ukraine decreased exports of processed pig iron in physical terms by 5.8% compared to 2022 – to 1 million 248.512 thousand tons, while exports in monetary terms decreased by 26.2% to $471.467 million. Deliveries were made mainly to Poland (51.91% of supplies in monetary terms), Spain (21.41%) and the United States (13.15%).

In 2023, Ukraine imported 154 tons of pig iron worth $156 thousand from Germany (42.31%), Brazil (41.67%) and Poland (16.03%), compared to 40 tons of pig iron worth $23 thousand in 2022.

“DTEK Renewables has launched the issuance of carbon credits that can be purchased by businesses to reduce their carbon footprint in the production of products.

According to the company’s website, one of DTEK Renewables’ enterprises has been certified to issue carbon credits by the International Carbon Registry (Iceland). According to the registry’s methodology, one carbon credit in Ukraine corresponds to a reduction of 1 ton of CO2 emissions due to the production of 1.56 MWh of renewable energy.

Thus, the “clean” electricity produced by the company in 2019-2023 helped to avoid CO2 emissions of 880 thousand tons.

“We recently issued the first guarantees of origin that can be purchased by Ukrainian businesses. Now, by issuing carbon credits, we are entering the international level and calling on foreign businesses to support the renewal of Ukraine’s energy sector. After all, the proceeds from the sale of carbon credits go directly to the development of renewable energy capacities,” said Oleksandr Selishchev, CEO of DTEK Renewables.

The company reminded that carbon credits can be used by international companies to obtain the right to emit greenhouse gases or compensate for previously produced emissions as a result of their activities. This tool is used to comply with environmental requirements and achieve sustainable development, including carbon neutrality.