As of December 6, Ukraine exported 18.855 mln tonnes of grains and pulses since the beginning of 2024-2025 marketing year, 480 thsd tonnes of which were shipped since the beginning of the month, the press service of the Ministry of Agrarian Policy and Food reported, citing the data of the State Customs Service.

According to the report, as of the same date last year, the total shipments amounted to 13.723 mln tons, including 626 thsd tonnes in December.

At the same time, in 2024-2025 marketing year, the exports of all major crops are significantly higher than last year. Thus, since the beginning of the current season, Ukraine has exported 9.078 mln tonnes of wheat (6.057 mln tonnes in 2023/24 MY), 1.865 mln tonnes of barley (889 thsd tonnes), 10.8 thsd tonnes of rye (0.9 thsd tonnes), and 7.6 mln tonnes of corn (6.642 mln tonnes).

The total export of Ukrainian flour since the beginning of the season as of December 6 is estimated at 32.8 thsd tonnes (in 2023/24 MY – 51.1 thsd tonnes), including 30 thsd tonnes of wheat (48.8 thsd tonnes).

On December 5, Ukrchemtransammonia (Kyiv) announced a tender for liability insurance for business entities that use high-risk facilities for damage that may be caused by emergencies.

According to the Prozorro electronic procurement system, the expected price of the tender is UAH 303,248 thousand.

The deadline for submitting an application is December 13.

A large-scale post-war program to rebuild Ukraine’s infrastructure should be based on FIDIC contracts, says Mykola Tymofeev, CEO of Ukraine’s largest infrastructure construction company, Avtomagistral-Pivden.

“International donors prefer FIDIC contracts because they provide for a clear division of responsibilities between the client and the contractor, prevention of corruption risks, transparent dispute resolution practices, and professional arbitration. The investor is confident that the financed contract will be implemented on time – there will be no legal conflicts or lengthy litigation,” he said during the FIDIC Users Conference in London.

FIDIC is the largest international organization in the field of construction consulting, which unites more than a million practicing consulting engineers in 104 countries. The main goal of FIDIC is to regulate the relationship between the client and the construction contractor through standard forms of contracts. Infrastructure construction contracts financed by the World Bank, the European Investment Bank (EIB) and the European Bank for Reconstruction and Development (EBRD) are executed under FIDIC model contracts.

The main topics of the conference in London included new practices for appointing dispute resolution boards, the use of AI technologies for tender preparation and project management, and reducing carbon emissions in construction projects. The event also included the awarding of the winners of the FIDIC Contract Users’ Awards 2024.

According to Mykola Tymofeev, Avtomagistral-Pivden is the only contractor from Ukraine invited to the conference. More than a decade ago, Avtomagistral-Pivden representatives became the first Ukrainian certified FIDIC consulting engineers. Currently, there are more than 20 such engineers in the company. FIDIC membership requires compliance with the FIDIC Charter on the norms of professional ethics and behavior of consulting engineers.

“The fact that we were invited to the conference is further evidence of the international recognition of our company, confirmation of the high professional level of our consulting engineers. “Avtomagistral-Pivden works under FIDIC contracts both in other countries and on international projects in Ukraine. But we are ready to implement all Ukrainian infrastructure projects under the same FIDIC rules to stop pressure and interference in our work from law enforcement agencies that do not exist in any other European country once and for all,” Tymofeev summarized.

He also noted that almost all of the experts with whom he spoke at the conference hope that next year our country will be able to launch a large-scale recovery program with international support. “Which, of course, should be based on FIDIC contracts,” Timofeev said.

Avtomagistral-Pivden LLC has been on the market since 2004. It designs and builds highways, bridges, interchanges, airfield complexes, and hydraulic structures. The company’s owner is listed in Opendatabot as Oleksandr Boyko. According to the financial results for 2023, the company’s net profit amounted to UAH 624.9 million, and revenue was UAH 8.215 billion.

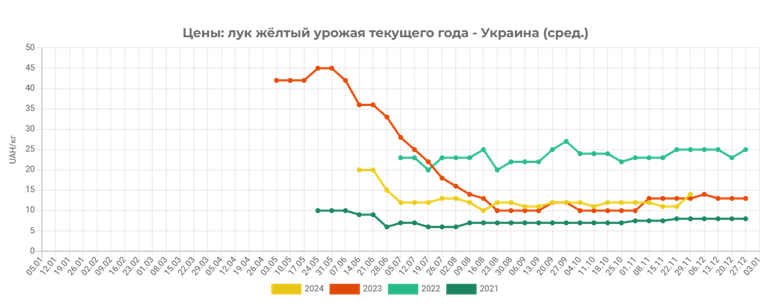

After the recent increase in price in Ukraine again decreased selling prices for onions, according to analysts of the project EastFruit. The main reason for the downward price trend was a decrease in demand in this segment, due to the fact that producers are increasingly offering for sale vegetables of medium and low quality.

Thus, today sales of onions are formed within the range of UAH 10-16/kg ($0.24-0.38/kg), which is on average 16% cheaper than at the end of the last working week. It should be noted that closer to the weekend wholesale batches of onions in Ukraine are already sold at prices inferior to the previous season.

Sellers are forced to reduce prices due to a noticeable decrease in demand in this segment. At the same time, the quality of onions in storage is rapidly deteriorating, so the owners are reducing prices in order to stimulate sales and sell out the available volumes of such products as soon as possible.

It is worth noting that most farmers today prefer to refrain from selling onions, citing extremely low prices. Recall that in early December 2023, Ukrainian producers shipped onions on average 20% more expensive than today.

You can get more detailed information on the development of the onion market and other horticultural products in Ukraine by subscribing to the operational analytical weekly – EastFruit Ukraine Weekly Pro. Detailed information about the product can be found here.

On Wednesday, the Board of Directors of the European Bank for Reconstruction and Development (EBRD) approved a loan of up to EUR80 million to Ukrnafta under state guarantees for the construction of about 100 MW of small gas-fired distributed power plants and cogeneration facilities. According to the bank’s website, the loan will help solve the problem of electricity shortages and ensure uninterrupted power supply to households and businesses.

The total cost of the project will be EUR103.8 million, and it will also be financed by a grant of up to EUR22 million expected to be provided by the Netherlands, the United States and other donors through the EBRD’s Special Crisis Response Fund, as well as a technical support grant of EUR1.8 million from other donors.

“Ukrnafta is Ukraine’s largest oil producer and operator of the national network of filling stations. In March 2024, the company took over the management of Glusco’s assets and operates 547 filling stations – 462 owned and 85 managed.

The company is implementing a comprehensive program to restore operations and update the format of its filling stations. Since February 2023, the company has been issuing its own fuel coupons and NAFTAKarta cards, which are sold to legal entities and individuals through Ukrnafta-Postach LLC.

“Ukrnafta holds 92 special permits for commercial development of fields. It has 1832 oil and 154 gas production wells on its balance sheet.

Ukrnafta’s largest shareholder is Naftogaz of Ukraine with a 50%+1 share. In November 2022, the Supreme Commander-in-Chief of the Armed Forces of Ukraine decided to transfer to the state a share of corporate rights of the company owned by private owners, which is now managed by the Ministry of Defense.

More than three quarters – 77.8% – of participants in the annual meeting of the American Chamber of Commerce in Ukraine (AmCham) expect a ceasefire in 2025.

In a short survey of more than 230 respondents, more than two-thirds – 67.9% – expect US President-elect Donald Trump to visit Kyiv next year, Interfax-Ukraine reports.

Almost two-thirds – 62.7% – expect international flights to resume in 2025.