As of October 17, 2024, prices for slaughter pigs decreased by 6.5% compared to a week earlier, according to the industry association Pig Producers of Ukraine.

“The negative price dynamics that began at the end of the first decade of October continued in the middle of the month. Thus, according to the results of last week’s auction, most commercial batches of live pigs were sold at 53-55 UAH/kg. Although in some places there were offers at both higher and lower prices by 1 UAH/kg, the weighted average market price was 55 UAH/kg. This is 3.8 UAH/kg, or 6.5%, lower than a week earlier,” analysts said.

One of the main factors that, according to some procurers, affected the price situation was seasonal fluctuations in supply and demand. Thus, traditionally, with the decrease in temperatures, the growth rate of live weight of pigs has recovered, and consumer activity is somewhat reduced with the seasonal reorientation to alternative types of protein (mushrooms, fish, poultry) and preparation for the heating season.

Other operators, on the other hand, state that trade is relatively stable and planned, so they see no prerequisites for lower prices, although most of them avoid predicting further price fluctuations until the active phase of trading begins.

Gold updated its record high on Thursday, with its price exceeding $2712 per ounce during trading.

The precious metal is rising amid a general increase in demand for the most reliable assets amid uncertainty surrounding the US presidential election, continued tensions in the Middle East, and pessimism about the prospects for the Chinese economy. Gold is also supported by monetary policy easing by the world’s largest central banks.

On Thursday, the European Central Bank (ECB) cut all three key interest rates by 25 basis points (bps), noting that “the disinflationary process in the euro area is proceeding in line with expectations.”

The cost of December gold futures on the Comex as of 19:50 Kyiv time on Thursday amounted to $2705.9 per ounce, which is 0.5% higher than at the close of the previous session. Earlier in the day, the price of the precious metal rose to $2712.7 per ounce.

Since the beginning of this year, December futures have risen by 25.2%.

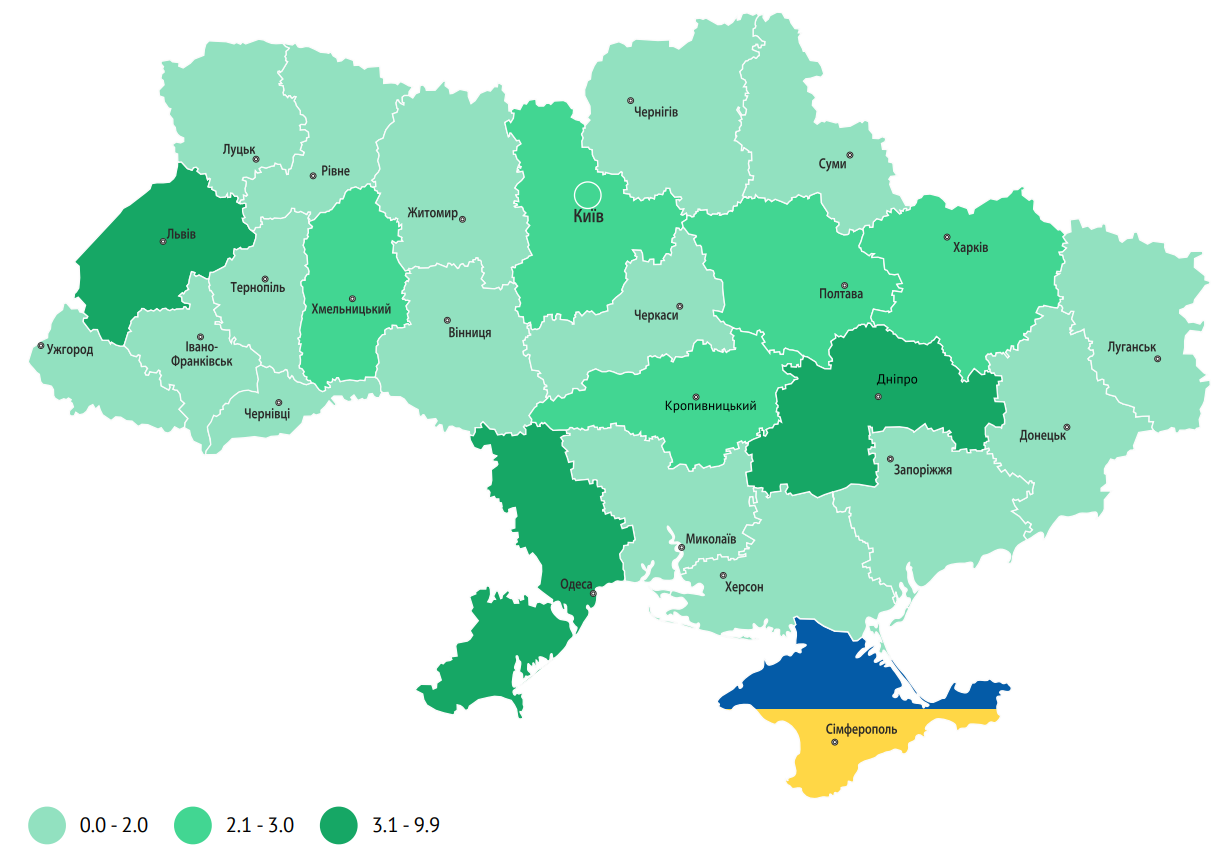

Number of vacancies as of 30.06.2024 (thousand units) according to the data of the state employment center

Open4Business.com.ua

Incumbent Moldovan President Maia Sandu is the favorite in the presidential race, while candidates Alexandru Stoianoglo and Renato Usatîi are fighting to reach the second round. These are the results of an opinion poll presented on Thursday, conducted by CBS-AXA and commissioned by the WatchDog.MD community. The presidential election in the country will be held next Sunday, October 20.

“Maia Sandu is the favorite in the race, with over 35% ready to vote for her. 9% are ready to vote for the candidate of the Socialist Party, Alexandru Stoianoglo, and 6.4% for the head of the Our Party, Renato Usatîi. The remaining eight candidates are gaining between 0.5 and 3% of the vote,” said Vasyl Kantarzhy, director of CBS-AXA, sociologist.

According to the poll, 85.7% of respondents said they would definitely go to the polls on October 20. Another 8.3% said they were likely to vote.

At the same time, 28.1% of respondents have not decided, 2.9% said they would not go to the polls, and 9.9% did not answer the question.

Vasyl Kantarzhy said that the polls of recent months show an “atypical trend”, namely that “as the election date approaches, the number of undecided voters is growing”.

He attributed this growth mainly to opposition candidates, in particular, Oleksandr Stoianoglo’s claims of Romanian citizenship, as well as the events surrounding the Shora group. “This forced supporters of a number of opposition candidates to reconsider their position and become undecided,” Kantarzy said.

There are 11 candidates registered to run in the presidential election, a record number of candidates for the entire period of national presidential elections in Moldova. In the period from 2000 to 2016, the president of Moldova was elected by the parliament.

The survey was conducted by telephone on October 11-16 with the participation of 1034 people. The margin of error is 3.05%.

Earlier, the Experts Club think tank presented an analytical material on the most important elections in the world in 2024, more detailed video analysis is available here – https://youtu.be/73DB0GbJy4M?si=eGb95W02MgF6KzXU

You can subscribe to the Experts Club YouTube channel here – https://www.youtube.com/@ExpertsClub

Due to heavy rains and floods in a number of settlements in the south of France, people had to be evacuated and transportation was disrupted, BFM TV reported on Thursday. In the Ardèche department, many highways were closed due to weather conditions. Children were evacuated from schools and kindergartens in Annonay due to flooding. Public transportation was suspended in the city.

In the Rhône department, rail service between Lyon and Saint-Etienne has been suspended until at least Friday morning.

Nice Côte d’Azur Airport warns of possible flight delays due to adverse weather conditions.

Currently, the highest level of weather danger has been declared in the Rhône, Loire, Haute-Loire and Ardèche departments, and the orange alert level has been set in 20 other departments.

In particular, in the east of the Upper Loire, about 10 cm of precipitation is expected, which could cause rivers to burst their banks.

Source: http://relocation.com.ua/

Associations of industrial, mining, building materials and cement producers are demanding the resumption of employee reservations, which have effectively stopped after the government suspended the process of assigning critical infrastructure status to enterprises.

“After the President drew attention to the fact that the number of reservations had tripled, the Cabinet of Ministers made a protocol decision to suspend the recognition of enterprises as critical. I emphasize that we are talking about new enterprises, not those that have been recognized as critical to the country’s economy for a long time and only need to confirm this status. But in fact, the entire reservation process has been put on hold at the level of the Ministry of Economy. We do not receive confirmations for enterprises previously recognized as critical and cannot book employees,” said Oleksandr Kalenkov, president of Ukrmetallurgprom, at a press briefing at Interfax-Ukraine.

Industrial companies are facing a serious staffing crisis. According to Kalenkov, booking 50% of employees is not enough for manufacturing companies, as the staff at the enterprises is already maximally optimized. Working in complex production requires certain qualifications, and it is impossible to quickly replace mobilized employees.

“People don’t come to work for us because we are transparent. Representatives of the TCC simply go to our checkpoint at the beginning of the day, where a thousand people pass through every day, hand out summonses and fulfill the work plan for the month ahead. This leads to the fact that people do not come to work for us because they are afraid that we will not have time to book them and they will be taken away the next day. This has actually happened, because we don’t even have time to go through this procedure,” he explained.

The situation is even more complicated with hiring employees at companies in regions close to the war zone, said Sergiy Kudryavtsev, executive director of the Ukrainian Ferroalloy Producers Association (UkrFA).

“We would like to increase the percentage of booked employees. A company located in the war zone has no way to replace a mobilized employee. We have repeatedly raised the issue with the Ministry of Defense to increase the reservation rate to at least 70%,” he said.

It is also important to allow companies to manage the reservation process independently in terms of changing the distribution of reservations among employees and refining the lists depending on the needs of the companies, Kudryavtsev said.

Changes should also be made to the process of recognizing an enterprise as critical, said Pavlo Kachur, chairman of the Ukrainian Cement Producers Association Ukrcement. According to him, the process of confirming the criticality status should be automatic based on established criteria.

One of the fundamental problems with the reservation mechanism is the lack of systematic information on the number of companies and their staff in Ukraine, said Konstantin Saliy, president of the All-Ukrainian Union of Construction Materials Manufacturers.

“In three years, we could have created a system where the Prime Minister and relevant ministries could see their industries and which enterprises are critical, and could automatically notify managers of their plans. No one knows how many mid-sized enterprises we have that are really critical. But there are no responsible persons in the government who would communicate and monitor the situation. We have a whole ministry for digitalization, so digitalize these processes,” the expert said.

In addition, the processes of booking employees in the mining, metallurgical and related industries require a specialized approach, taking into account the specifics of their work, said Georgiy Popov, representative of the National Association of the Extractive Industry of Ukraine (NADPU). According to him, the current booking periods are often insufficient, as some projects in these areas take up to five years and require the participation of highly qualified specialists.

“I support the proposals of my colleagues: we need a proper digitalization process, a specialized approach to the industry, taking into account its specifics and differences from other businesses. At the beginning of the full-scale war, there was a lot of talk about booking IT specialists. However, we should not forget that the mining business and the mining and metallurgical complex are responsible for the lion’s share of tax revenues, white-collar employment and foreign exchange earnings,” he emphasized.

Representatives of the associations called on the government, the President’s Office and relevant ministries to resume actual booking, to audit critical enterprises as soon as possible to avoid stopping the work of many companies and plants that provide significant tax revenues and materials important for the country’s defense capability.

“While we support the President’s decision to clean up the booking process, we appeal to the Cabinet of Ministers to solve the problems in this area. Not to stop the processes, but to conduct an audit and find out how so many reservations were made in six months. If the current situation drags on for days and weeks, it will lead to a halt in our work,” Kalenkov summarized.