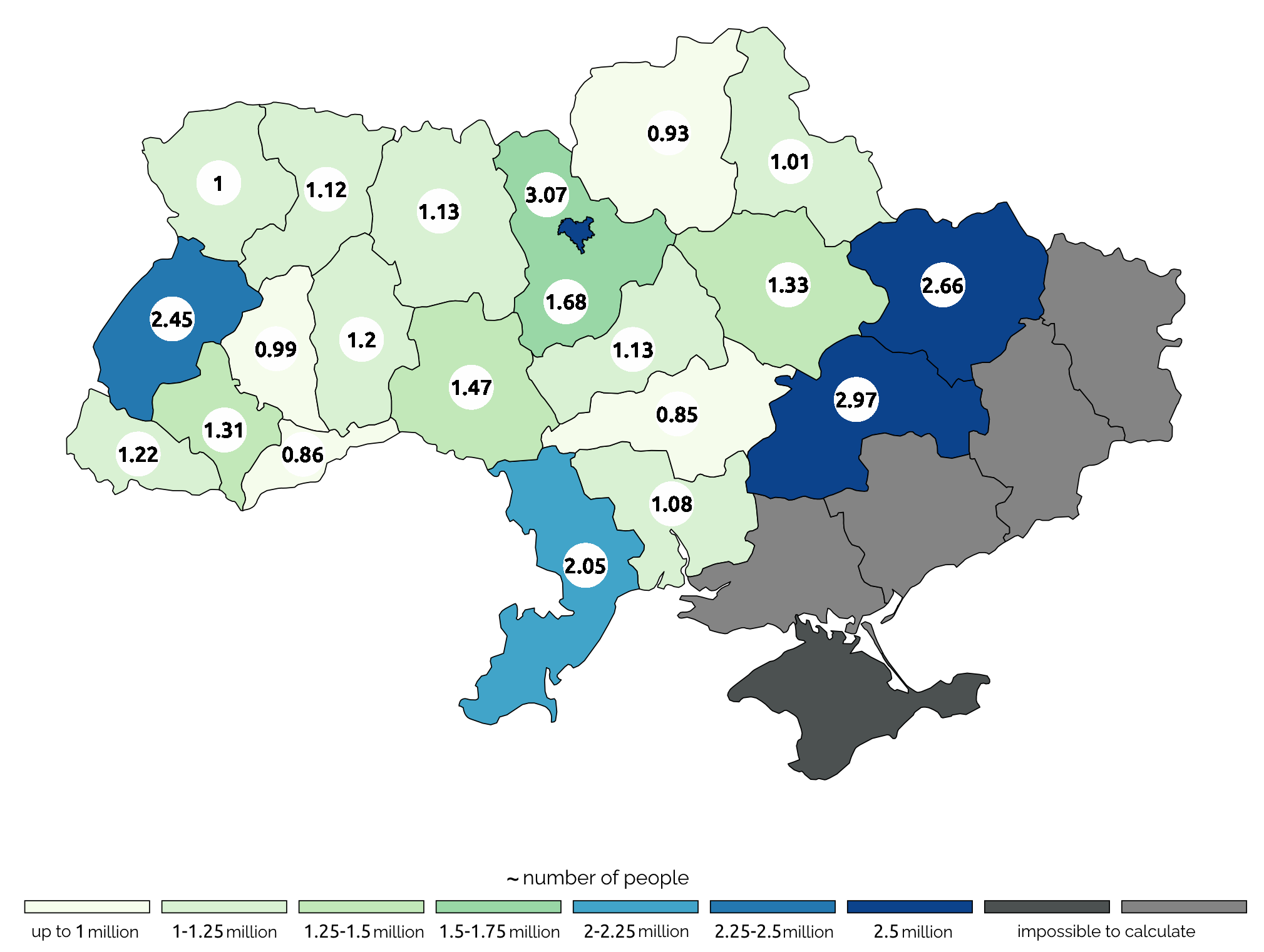

Estimated number of population in regions of Ukraine based on number of active mobile sim cards (mln)

Open4Business.com.ua

Ukraine processed about 861 thsd tonnes of sunflower in the first month of the new processing season-2024-2025, the lowest volume for September since 2014-2015 marketing year, APK-Inform news agency reported.

“This figure is almost at the level of the last year’s September volumes (-1%), however, the difference is that at the beginning of the season-2023/24 Ukrainian companies faced the difficulties in exporting due to the shutdown of Odesa ports, which restrained the more active increase of processing, while in the current season the main problem is the formation of the raw material base,” the analysts explained.

Experts noted that most farmers are not in a hurry to sell their products due to expectations of lower sunflower harvest in 2024. As a result, during September, the purchase prices for the oilseed increased and in early October reached the highest level since February 2022 – 22 thsdn/MT – 23.8 thsdn/MT.

At the same time, the price increase did not help to accelerate the sales of sunflower by farmers – the excitement created by the processors provoked the oilseed owners to slow down the sales in anticipation of new price records. At the same time, the increase in prices for raw materials is supported by the growth of prices on the export market of sunflower oil.

APK-Inform predicts that in 2024-2025 marketing year Ukraine can process the minimum amount of sunflower for the last three seasons – about 13-13.4 mln tonnes, which will be 11% lower than a year earlier.

“In connection with the opening of the office, we also created a Ukrainian business department at JETRO headquarters, which decided to invite a business support team between Ukraine and Japan. We came with 10 major Japanese companies and startups equipped with advanced technology and a strong commitment to support Ukraine’s reconstruction,” Jetro head Norihiko Ishigura said at the office opening in Kiev on Thursday.

Ukrainian Prime Minister Denis Shmygal also attended the ceremony.

Among the companies that have decided to interact with Ukrainian business are Itochu Corporation (represents investment products, but in Ukraine is interested in engineering projects, food/chemicals/metals trade and automotive business), Taichi holding Limited (develops air conditioning systems, sells construction equipment), Nippon express holding Inc (freight forwarder), Green (develops “clean” solutions for agribusiness), NTC International Co (consulting firm in the field of agriculture), Spec Company Limited (develops soil reinforcing agents), and NTC International Co (agricultural consulting firm).

According to him, JETRO will continue to bring Japanese business initiatives to Ukraine and create as many opportunities as possible for companies from both countries.

He also hopes that Ukraine and Japanese companies will take advantage of these opportunities and develop business relations.

The members of the JETRO Kyiv office are Shibata Tetsuo – he has been appointed CEO of JETRO Kyiv, Sagakuchi Ryohai – coordinator of Jetro in Ukraine, Yoden Tomohiro – deputy CEO, and Diana Nazarova – JETRO Ukraine project coordinator.

“I look forward to building strong ties with Ukrainian communities as a true friend. Dear Kiev, I love you,” Tomohiro stated.

In turn, First Deputy Prime Minister and Minister of Economy of Ukraine Yulia Sviridenko said that the opening of JETRO office in Kiev marks the beginning of strategic partnership between Japan and Ukraine.

JETRO (Japan External Trade Organization) – Japan External Trade Organization Office, an independent administrative body under the auspices of the Ministry of Economy, Trade and Industry of Japan, established to promote trade and economic cooperation with other countries of the world.

Since the beginning of the year, Ukrzaliznytsia JSC (UZ) has increased its cargo transportation by almost a quarter, reducing it in September compared to August, according to an analytical note prepared for a meeting of the Exporters’ Office on Wednesday.

In January-September, the volume of cargo transportation increased by 23.3% compared to the same period last year, to 131.88 million tons. At the same time, in September, 2.4% less cargo was transported than in August – 13.84 million tons, the document says.

“Massive rocket attacks have significantly affected the state of the energy sector, certain industries, and transport infrastructure, which affects the dynamics of cargo transportation,” it says.

The volume of transportation in export traffic for 9 months increased by 66.4% to 63.92 million tons.

According to the results of 9 months, the largest exports were of grain cargo – 25.78 million tons (40.3%), iron and manganese ore – 25.19 million tons (39.4%), and ferrous metals – 4 million tons (6.2%). The fourth position is occupied by construction materials – 3 million tons (4.7%). At the same time, in September 2024, the volume of cargo exports decreased by 6% to 6.18 million tons compared to August.

As of September, exports accounted for 49% of total transportation, while in the same period last year – 36%.

The volume of grain cargo transportation for 9 months increased by 62.9% to 25.78 mln tons. The company transported 21.8 mln tons to ports, which is 2.3 times higher than the same period last year. Exports through land crossings, on the contrary, decreased by 38.5% to 3.89 million tons.

In September, compared to August, the volume of grain exports fell by 13.2% to 2.28 million tons. In the direction of ports, grain transportation decreased by 15.8% to 1.9 million tons, while in the direction of land crossings it increased by 3% to 378.74 thousand tons.

Export transportation volumes of iron and manganese ore doubled to 25.18 million tons over 9 months.

Over 9 months, the company transported 11 times more ore to ports than in the same period last year, 13.88 million tons, while transportation by land crossings decreased by 2.8% to 11.3 million tons.

In September, ore exports increased by 1.7% to 2.36 million tons compared to August. Ore was transported to ports by 18.4% more, to 1.31 million tons. The volume of transportation through land crossings decreased by 13.6% to 1.04 million tons.

Earlier it was reported that in January-August 2024, UZ increased the volume of cargo transportation by 24.3% compared to the same period last year – up to 118.04 million tons.

The deficit in the sunflower market in Ukraine continues to push prices up, due to the decrease in production of this oilseed compared to last year, Ukrainian plants are experiencing a shortage of raw materials, according to the analytical cooperative “Start”, created within the framework of the All-Ukrainian Agrarian Council (AAC).

“The price of sunflower has already exceeded 23 thousand UAH/t, and according to the seasonal model, the average price may reach 24 thousand-24.5 thousand UAH/t at the end of October. This is due to the large number of contracts for oil due to the shortage of raw materials,” the analysts said, adding that the crushing plants failed to accumulate stocks, as it was before.

According to the experts, most of the oil processing plants buy sunflower and immediately send it for processing. Previously, processors had stocks for October-November, but now many companies do not have enough to cover even the current month. This leads to higher prices and fierce competition between plants trying to buy the required amount of sunflower.

Pusk predicts that given the current trends and seasonality in the market, we can expect new record prices that may exceed the historical highs recorded in 2020.

About 7.7% of Ukrainians use the services of private medical laboratories five to 10 times a year, while 32.7% of Ukrainians use private laboratories less than five times a year.

This is according to a study conducted by the sociological company Active Group together with the Experts Club think tank.

According to the study, 34.8% of respondents visit private laboratories less than once a year, while 22.5% of Ukrainians do not visit them at all.

The top 10 most visited laboratories in Ukraine over the past two years include Synevo, which was visited by 39.5% of respondents, Dila (15.5%), Aesculab (9.3%), Invivo (6.1%), DniproLab (4.8%), Median (2.5%), Medlab (4.5%), DNA Laboratory (2.3%), Unimed (2.3%), and Nova Diagnostika (2%).

At the same time, 51.4% of respondents did not visit private medical laboratories at all.

When asked what aspects of private laboratories need to be improved, 69.8% of respondents said that it was the cost of services, 31.8% – the accuracy of results, 15.2% – the speed of service, 12.5% – the conditions in the laboratory, 11.8% – the politeness of the staff.

The survey was conducted in July by individual interviews. The study involved 600 respondents.

According to Andriy Yeremenko, founder of Active Group research company, the increase in the number of private medical laboratories in Ukraine indicates a systematic increase in demand for their services. At the same time, competition between laboratories has a positive impact on the quality and cost of analysis.

He predicts that the market will continue to develop in the future, making it easier to open new laboratories and improve existing ones. This, in turn, will increase competition, which will further reduce prices and improve the quality of medical services.

For his part, Maksim Urakin, founder of the Experts Club information and analytical center, emphasized that the study confirms the trend of increasing demand for private medical laboratories among Ukrainians.

“The survey data indicate an increase in confidence in the private medical sector and its capabilities. At the same time, the high level of competition in the market encourages laboratories to innovate, improve diagnostic accuracy and customer service. This trend is a positive signal for all market participants, as improving the quality of medical services and making them accessible to more people contributes to the overall improvement of the health of the Ukrainian population,” said the founder of Experts Club.