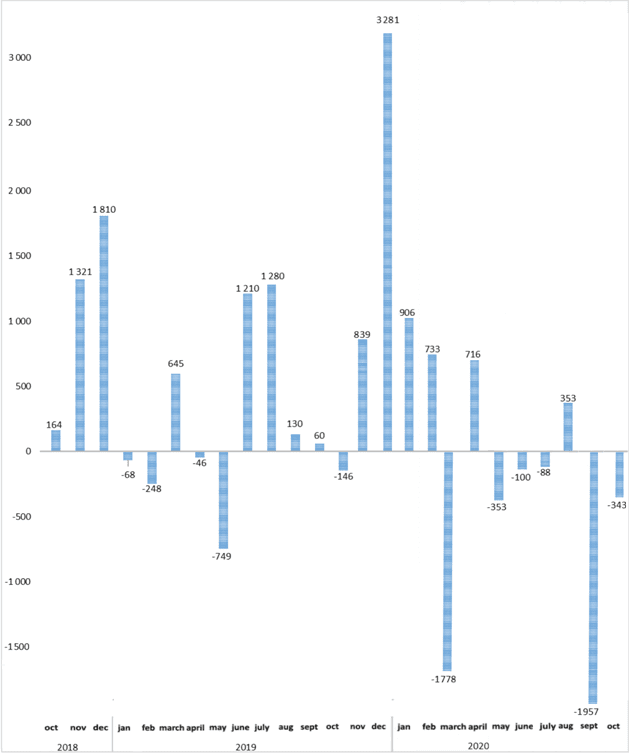

Dynamics of balance of payments of Ukraine (USD mln).

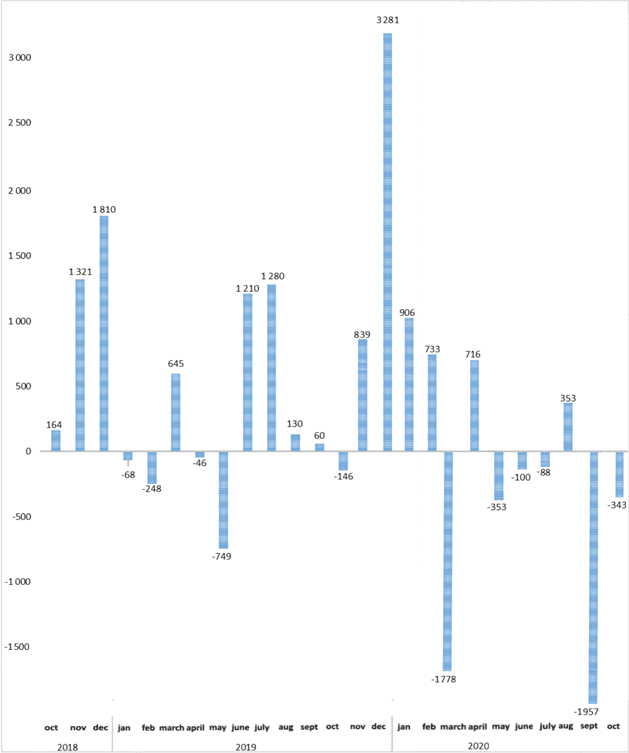

Dynamics of balance of payments of Ukraine (USD mln).

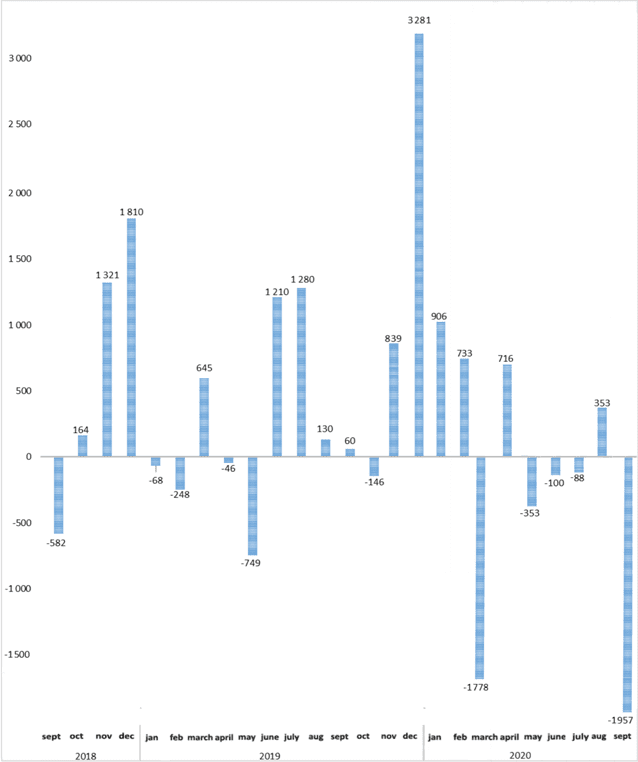

Dynamics of balance of payments of Ukraine (USD mln).

The National Bank of Ukraine (NBU) has improved the forecast for forex reserves as of late 2019 from $20.6 billion to $21.2 billion, from $21.4 billion to $21.9 billion as of late 2020 and from $21.4 billion to $21.8 billion as of late 2021. According to data released by the central bank on Thursday, the assessment of the deficit in the consolidated balance of payments for 2019 has also been improved from $1.1 billion to $0.3 billion, while for 2020-2021 it is confirmed at the level of $0.1 billion and $0.7 billion respectively.

At the same time, the NBU worsened the forecast of the current account deficit: for the current year – from $4.5 billion to $4.9 billion, for the next year – from $5.6 billion to $5.8 billion, and for 2021 – from $6.2 billion to $6.7 billion

In relation to GDP, the assessment of the current account deficit for 2019 is worsened from 3.1% of GDP to 3.3% of GDP, for 2020 it is confirmed at the level of 3.6% of GDP, and for 2021 it is worsened from 3.9% of GDP to 4% Of GDP.

As reported, at the end of 2018, Ukraine had forex reserves of $20.8 billion, a surplus of the consolidated balance of payments of $2.9 billion and a current account deficit of $4.5 billion or 3.4% of GDP.

The surplus of Ukraine’s balance of payment in February 2018 reached $252 million, while a deficit of $449 million was seen a month ago, according to preliminary data published on the official website of the National Bank of Ukraine (NBU).

In January-February 2018, the deficit of the balance of payment totaled $197 million, which is 13.97% less than a year ago.

The central bank said that the surplus of the current account in February fell by 92.4% compared with January, to $9 million. In January-February 2018, the surplus of the current account was $128 million, which is 15.79% less than a year ago.

The NBU pointed out deterioration in the export performance of a number of commodity groups, despite the maintenance of a favorable price environment for ferrous metals, ores and grains.

According to the central bank, the corresponding pace was due to a slowdown in the growth of production volumes in certain industries and the complication of transportation due to unfavorable weather conditions.

In turn, imports continued to grow, mainly thanks to energy and chemical products.

Revenue sent to the financial account in February amounted to $243 million compared with $568 million outflow a month earlier. According to the NBU, the inflow of funds is linked to the stepping up of purchase of hryvnia-pegged government domestic loan securities by nonresidents.

Foreign direct investment (FDI) in February totaled $111 million fully sent to the real economic sector to increase share capital.

Outflow on the financial account in January-February 2018 was $325 million, which is 15.8% less than a year ago, and net FDI inflow was $191 million (32.5% down year-over-year).