Which companies go bankrupt most often in Ukraine?

780 companies began bankruptcy proceedings in 2025, according to data from the Supreme Court of Ukraine. This is about 10% of the total number of business closures. The turnover of the largest bankrupt companies ranges from UAH 3.4 to 7.7 billion. Most often, limited liability companies go bankrupt. Last year, companies engaged in wholesale trade and agriculture became insolvent. Kyiv leads in terms of the number of bankrupt businesses.

780 companies began bankruptcy proceedings in 2025. This is only 10% of the total number of business closures. Most companies in Ukraine go through the process of voluntary closure — this is 60% of cases. A total of 8,191 companies undergoing procedures related to the termination or change of business operations were recorded in Ukraine last year.

Most often, LLCs go bankrupt — 84% of cases in 2025.

Only in 48 cases do bankrupts try to stay afloat: to restore solvency and continue working through a reorganisation procedure. However, this is less than 1% of cases.

Currently, owners are increasingly opting for preventive restructuring: 8 cases in 6 companies were opened in 2025. These are cases where a business begins restructuring before it becomes insolvent, trying to avoid bankruptcy.

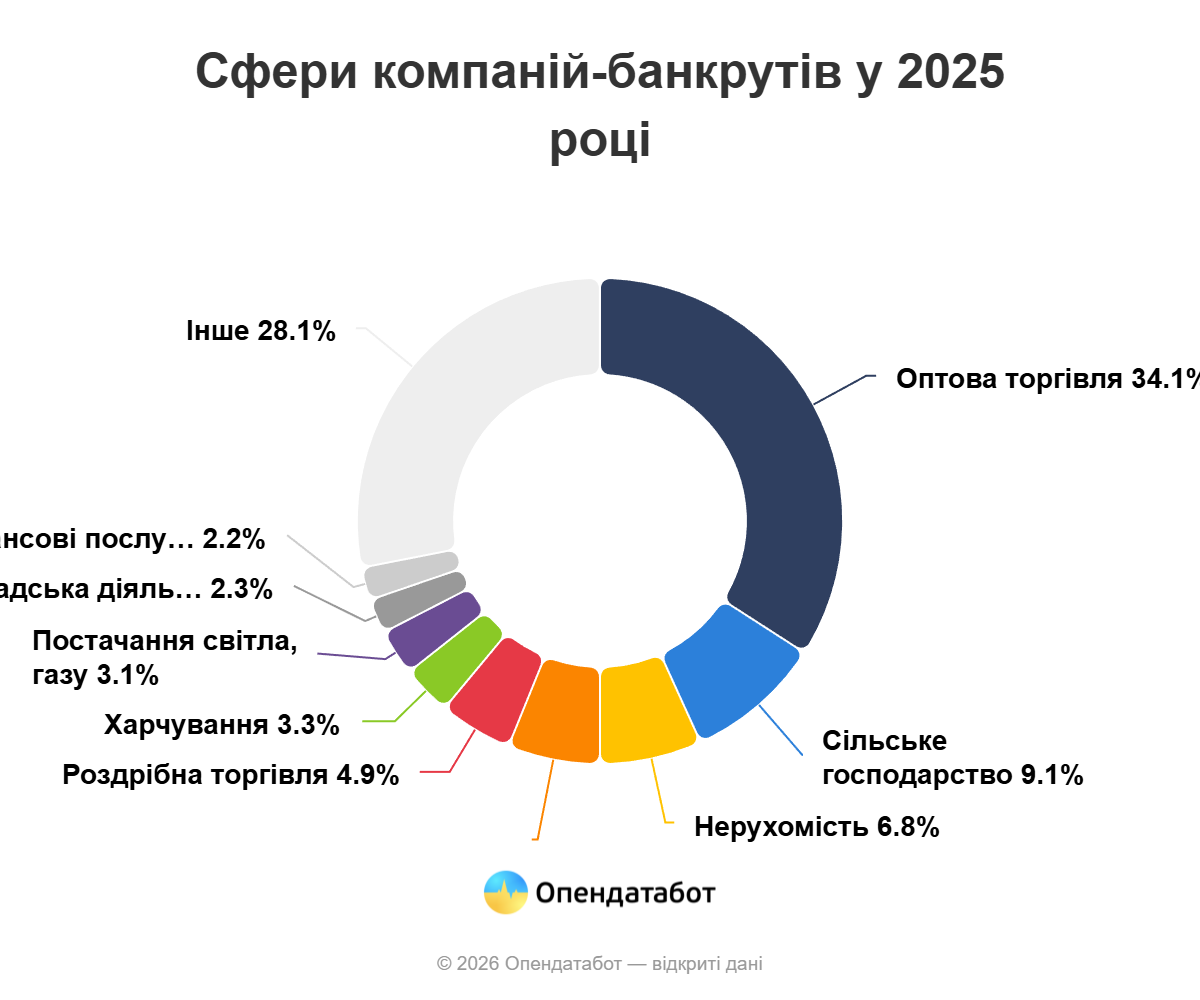

Most often, wholesale companies go bankrupt: 266 enterprises. In second place is agriculture: 71 companies. Next are real estate operations — 53 companies, construction — 48 companies, and retail trade — 38 companies.

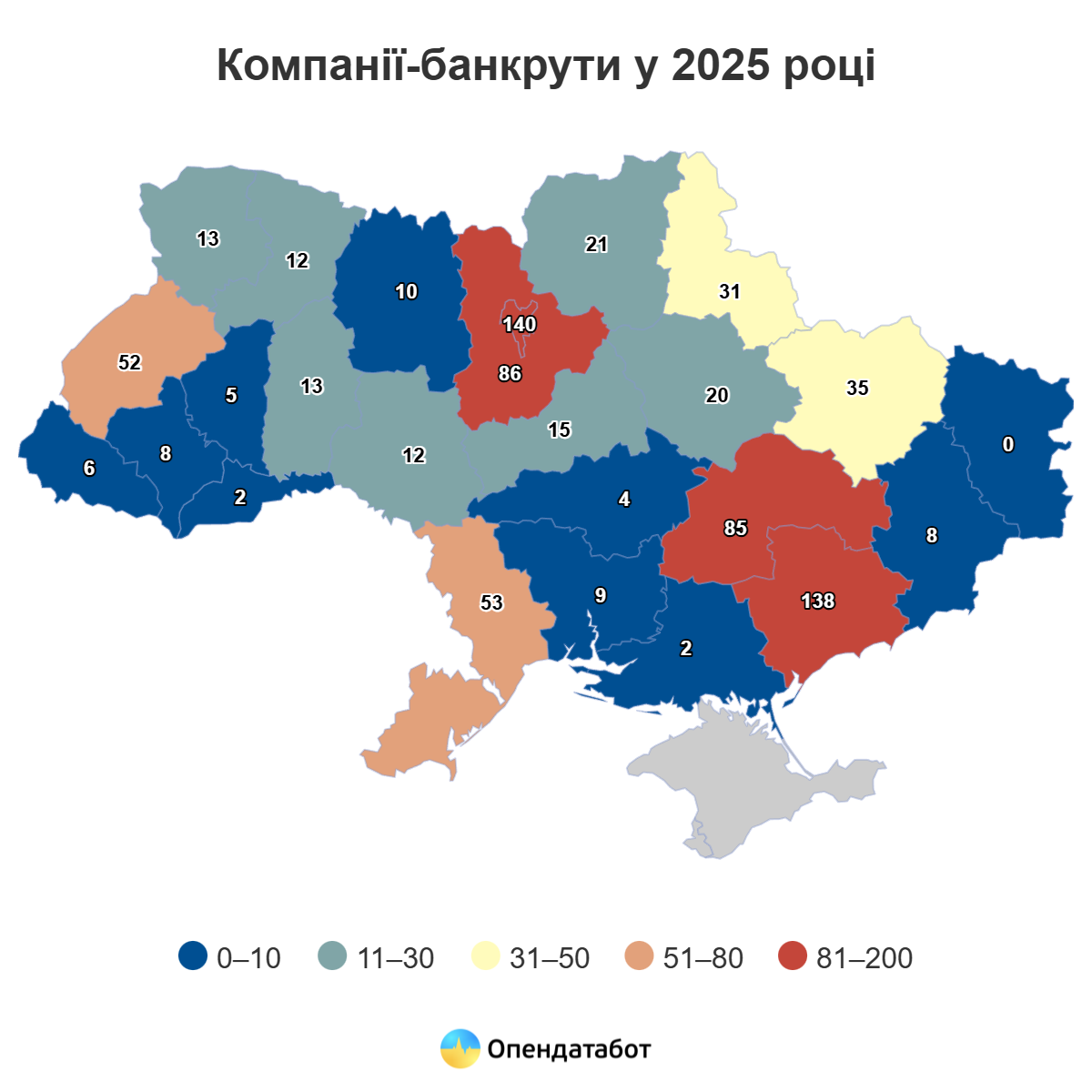

Most bankruptcy proceedings against businesses are opened in Kyiv — 140 companies (18%). Almost as many are in the frontline Zaporizhzhia region — 138 companies (17.7%). Next are Kyiv region — 86 companies (11%), Dnipropetrovsk region — 85 (10.9%) and Odesa region — 53 companies (6.8%).

The top 10 companies against which bankruptcy proceedings have been initiated include enterprises that until recently had revenues ranging from 3.4 to 7.7 billion hryvnia. The largest case concerns DEGS HOLDING, which was engaged in gas trading and had revenues of over 7.7 billion hryvnia in 2024. Next are PRIDE SOLUTIONS UKRAINE with revenues of UAH 6.08 billion and OPT-SYSTEMS with UAH 5.46 billion.

On average, three people a day ask to be declared insolvent

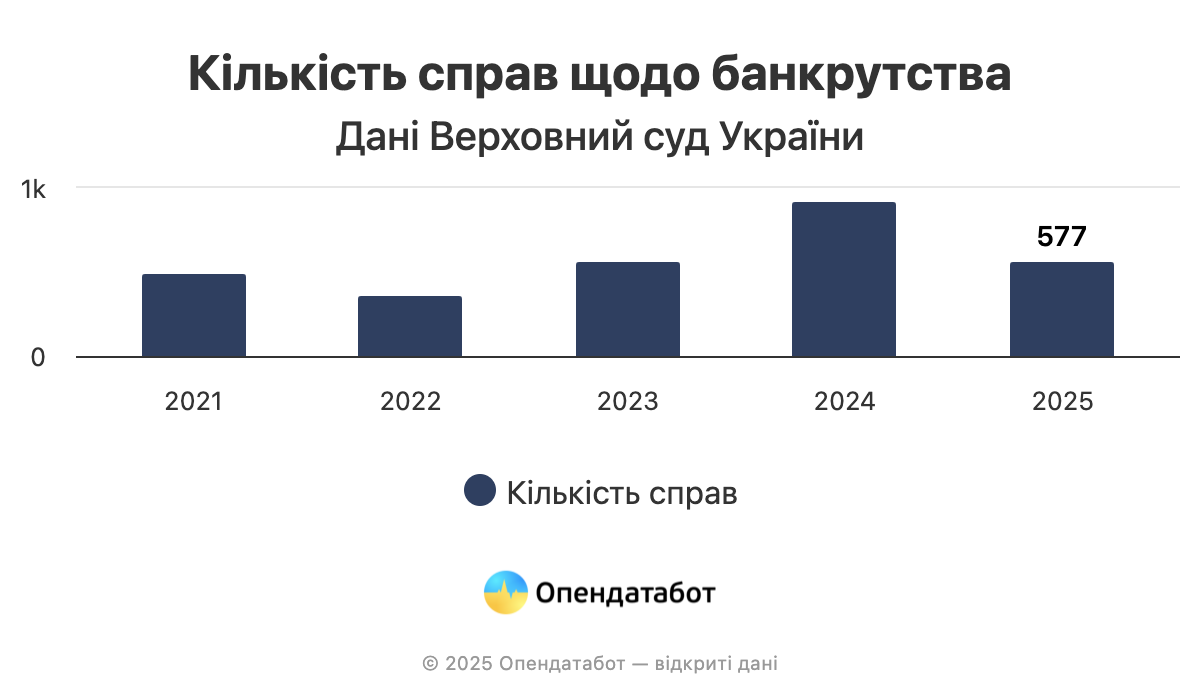

The number of people deciding to declare themselves bankrupt is growing in Ukraine. According to the Supreme Court, more than 2,900 Ukrainians have become bankrupt in the last five years. 577 Ukrainians have already filed for bankruptcy in the first six months of 2025. In 52% of cases, it is men who are asking to be declared insolvent. The highest number of bankruptcies this year is in Kyiv, Kyiv Oblast, and Lviv Oblast.

577 Ukrainians went bankrupt in the first half of 2025 in Ukraine. Such cases increased by 33% compared to the same period in 2024. In general, the largest number of people went bankrupt last year: 926 cases, but this year risks catching up with these figures.

On average, three new bankruptcy cases are opened every day this year.

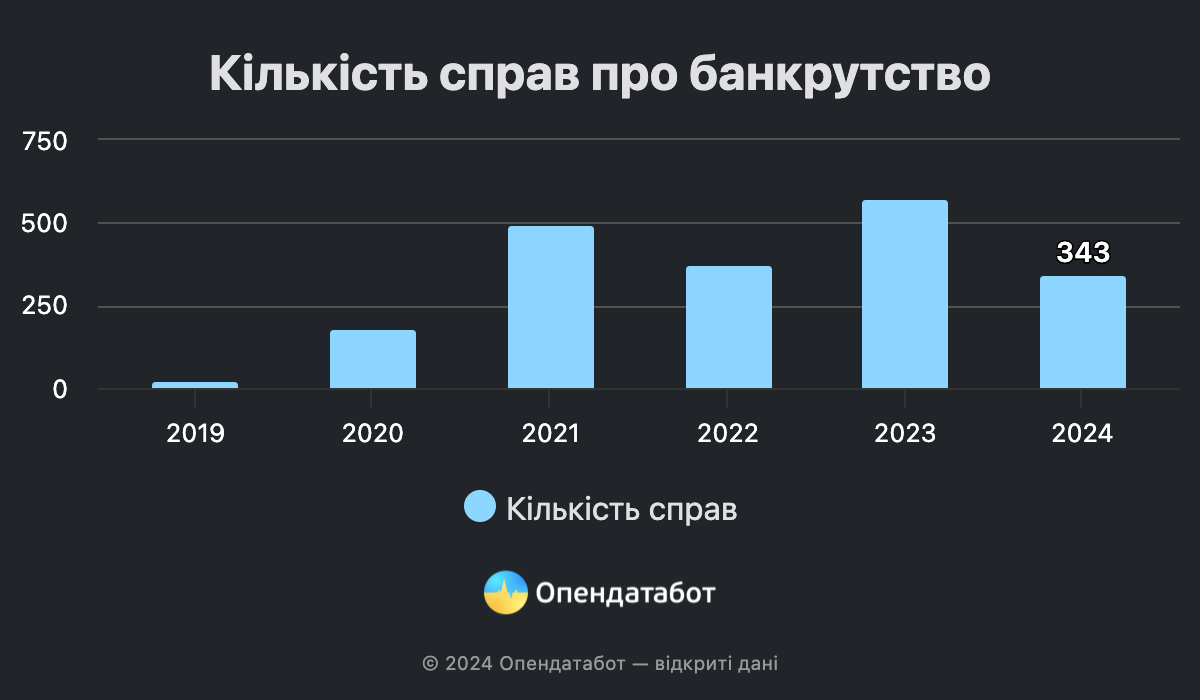

A total of 2,948 bankruptcy cases involving citizens have been opened in the last five years. Although the bankruptcy procedure was officially introduced in 2019, Ukrainians only began to actively use it in 2021.

Fifty-two percent of cases since 2021 involve men, and 48% involve women. The gender gap is not critical and remains almost the same every year. For example, in 2021, men dominated (57.9%), while in 2022 and 2025, women slightly outnumbered men.

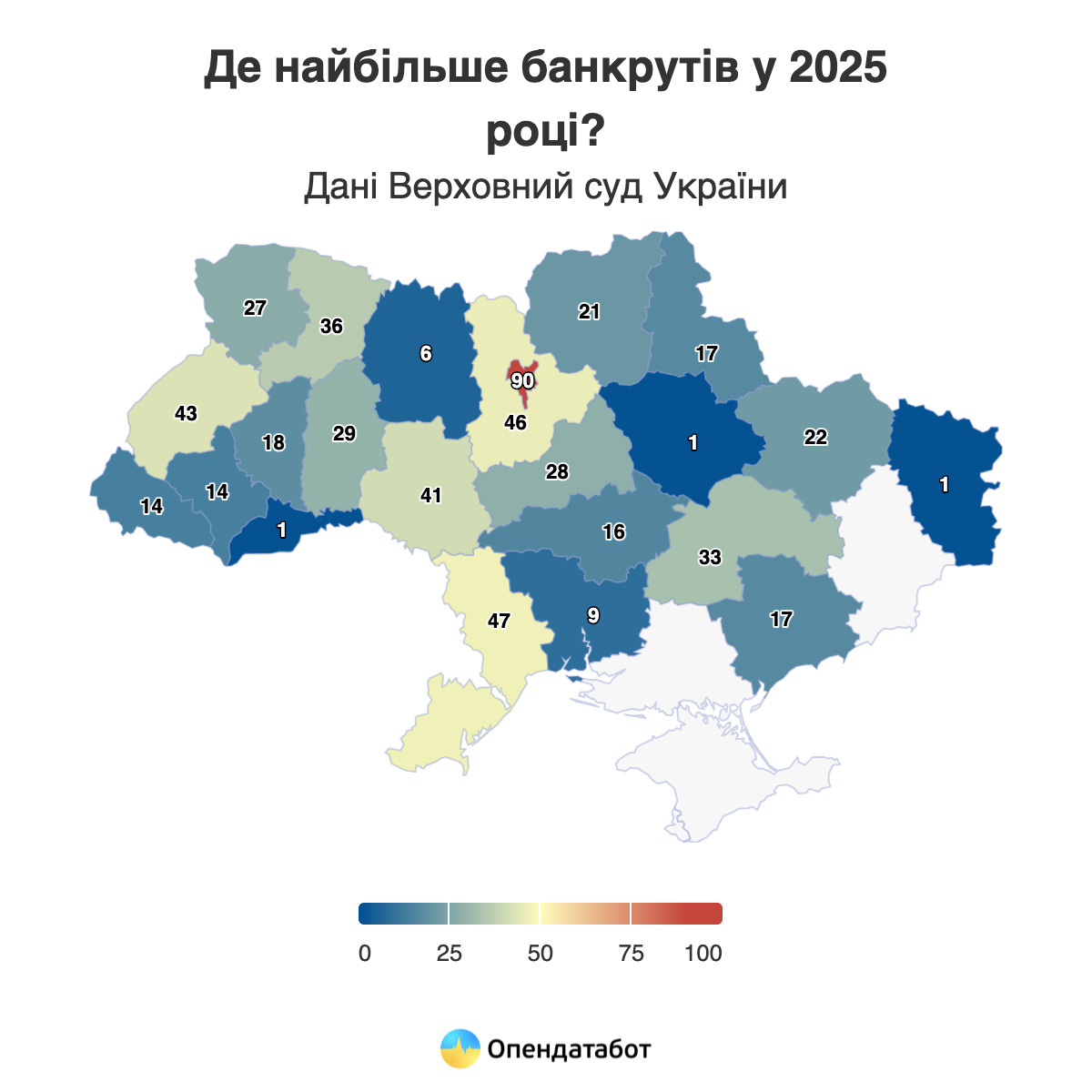

The largest number of bankruptcy cases in 2025 were opened in Kyiv — 128. Kyiv region is in second place with 83 cases, followed by Lviv, where 73 applications were filed.

You can check whether a person is bankrupt in OpenDataBot — just enter their TIN and you will receive complete information in a matter of seconds.

“The current increase in the number of bankruptcy cases is part of a steady trend that has been going on for several years. The procedure is gradually becoming more predictable: judicial practice is being developed, participants in the process are gaining experience, and the mechanism itself is working more smoothly. At the same time, creditors — banks and financial institutions — are becoming more demanding in terms of debt write-off or restructuring conditions. It is important to understand that bankruptcy is not a panacea for easy and painless “debt write-offs.” The consequences of insolvency will affect a person for at least several years,” comments Denys Pavlovych Lykhopok, lawyer, arbitration manager, member of the Qualification Commission of Arbitration Managers, and bankruptcy specialist.

According to him, there are still gaps in the procedure that need to be addressed. In particular, these relate to the tax consequences of restructuring and debt write-offs, as well as interaction with enforcement proceedings and other related court cases, which often remain outside the scope of insolvency cases.

https://opendatabot.ua/analytics/bankrupts-2025-6

American Tupperware Brands Corp., known for its plastic food storage containers, has filed for bankruptcy.

“Over the past few years, the company’s financial position has been severely impacted by the challenging macroeconomic environment,” said Tupperware CEO Lori Ann Goldman.

The company’s shares have fallen by 75% since the beginning of 2024.

Tupperware initiated bankruptcy proceedings in accordance with Article 11 of the US Bankruptcy Code. The company needs court approval to continue operations and speed up the process of selling the business while protecting its brand.

Tupperware was founded in 1946 by chemist Earl Tupper, who developed airtight plastic containers to help American families preserve food and save on costs. The company’s products are distributed through direct sales by Tupperware consultants around the world. The so-called “Tupperware parties” – events for cooking together using the company’s products – have also gained popularity.

In recent years, however, Tupperware has been experiencing serious difficulties, facing a decline in demand for its core products, increased competition, and a lack of liquidity, the WSJ notes.

Recently, the Experts Club information and analytical center released a video on the history of defaults and a table of countries that may face the risk of default in the medium term.

Watch the video on the Experts Club YouTube channel for more details: https://youtu.be/gq7twYrWuqE?si=KneYUbl2rNOUIGTM

The number of bankrupts since the beginning of the year

343 Ukrainians filed for bankruptcy in the first 5 months of 2024, according to the Supreme Court. This is 2.2 times more than last year. In total, almost 2,000 bankruptcy cases have been opened in Ukraine over the past 5 years.

Since the beginning of the year, 343 Ukrainians have filed for insolvency. The number of bankruptcy cases increased by 2.2 times compared to the same period last year. By the way, 575 people received this status last year.

The fewest bankruptcy cases were opened in 2019. It was the first year when the law allowed citizens to declare themselves insolvent in court. Back then, 22 bankruptcy cases were opened. Since then, the number of people who wanted to declare themselves insolvent has been steadily increasing: 8.3 times in 2020 and 2.7 times in 2021.

“In my opinion, court statistics do not reflect the real number of debtors in difficulty who could benefit from bankruptcy proceedings. However, this procedure is not well-known and widespread among Ukrainians, and there are several reasons for this: it is expensive, complicated and incomprehensible without the help of a lawyer, for whom the debtor may simply not have the funds. In addition, creditors and financial institutions are not very willing to file their claims in such court cases, hoping to collect the debt after the person’s solvency is restored and save on legal fees, or vice versa, trying to torpedo the procedure by discrediting the debtor. On the other hand, citizens also need to realize that this procedure is not about writing off debts, but about trying to find an agreement with creditors through the court procedure and the insolvency officer,” comments Denys Likhopiok, attorney at law, insolvency officer, member of the Qualification Commission of Insolvency Officers, bankruptcy specialist.

In total, 1,993 bankruptcy cases have been opened against Ukrainians. Every second bankrupt is between the ages of 25 and 45: 58% or more than 1.1 thousand. A third of bankrupts are over 45 years old – 38.3% or 764 people. The lowest number of bankrupts is among young people under 25 – only 3.7%.

The gender distribution was almost equal. 54% of all bankrupts are men, and 46% are women.

Context.

The Verkhovna Rada allowed individuals to become bankrupt in October 2018. The procedure became fully operational in 2019. Since then, a person in a difficult financial situation can initiate bankruptcy and, after going through the entire procedure, get rid of debts.

https://opendatabot.ua/analytics/people-bankrupts-2024

The Verkhovna Rada on March 20 passed a law “On Amendments to the Code of Ukraine on Bankruptcy Procedures” (No. 4409), under which bankruptcy filings will now be considered in simplified proceedings without summoning the parties, the Ministry of Justice said.

“The bill also simplifies the work of bankruptcy trustees. It provides for the creation of an automated information system “Bankruptcy and insolvency,” uniting the necessary registries and databases and which will include an electronic office of the trustee in bankruptcy,” the Ministry of Justice said in a press release on Wednesday.

The department reminded that the bill number 4409 was adopted as a basis back in June 2021. In preparation for the bill for the second reading of 248 amendments were filed, of which 112 were proposed to take into account.

Deputy Minister of Justice Valeriy Kolomiets thanked the head of the profile subcommittee of the Rada Oleksiy Movchan “for persistence and for being in crime” in the difficult process of adopting the document and wished a little more patience, because the adoption of the bill on “military bankruptcies” and the implementation of EU Directive 2019/1023 until September this year.

Eurogroup finance ministers believe the collapse of U.S.-based Silicon Valley Bank (SVB) will not have a direct impact on Europe’s financial system, but is a signal of the importance of ensuring the stability of the EU banking system amid ongoing uncertainty.

“Since this bank’s presence in the EU is very, very limited, we do not see direct consequences, but we are closely monitoring developments and we take note of the strong reaction of the U.S. authorities,” EU Economy Commissioner Paolo Gentiloni said after the Eurogroup meeting in Brussels.

He noted that the eurozone economy has entered this year in slightly better shape than expected a few months ago, but turmoil in the banking system amid general volatility could arise at any time.

“Uncertainty remains very high,” the European commissioner stressed.

Eurogroup Chairman Pascal Donohue said the SVB collapse, which shook up the U.S. financial system, was one of the topics of discussion among European ministers.

“The problems (in America) arose because of the specific business model of the bank (…) and the picture here in Europe is very different. Our banks are generally in good shape,” Donohue assured.

The Eurogroup’s statement from the meeting notes that the eurozone economy has recovered significantly from the pandemic and has weathered the effects of rising energy prices. Nevertheless, economic growth is expected to “remain modest in 2023 and gradually accelerate in 2024.”

“While uncertainty about the outlook, especially geopolitical and energy factors, remains elevated, the risks to growth appear more balanced than before. This reinforces the need for fiscal policy to remain flexible,” the statement said.

The Eurogroup gave forward-looking guidelines for fiscal policy in the euro zone. Between 2023 and 2024, it should focus on debt sustainability over the medium term as well as sustained improvements in economic growth and addressing the transition to green and digital technologies through investment and reforms.