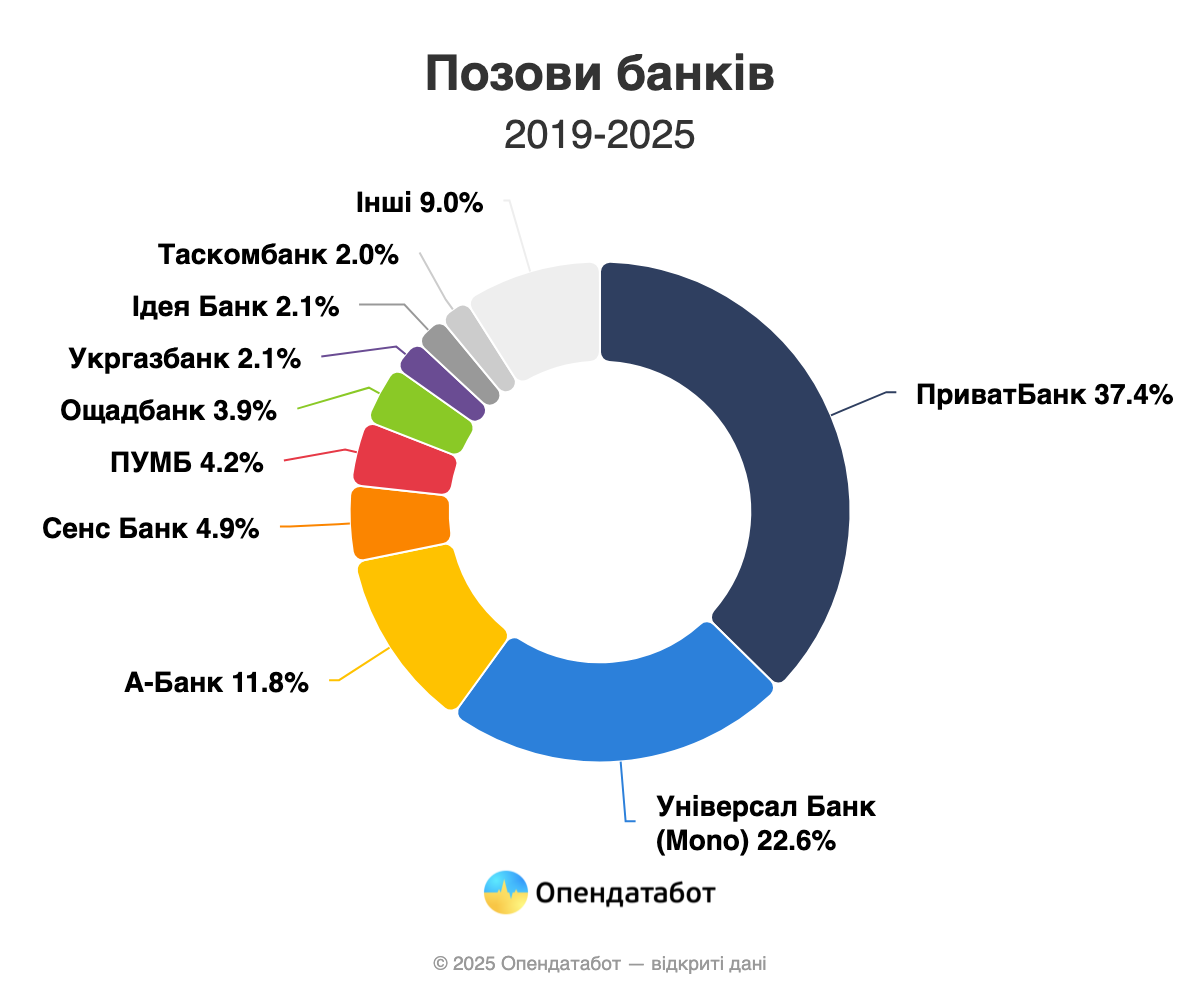

Banks are increasingly suing their debtors. According to the State Judicial Administration of Ukraine, a record 100,000 lawsuits were filed by Ukrainian banks this year. This is almost 1.5 times more than in the same period last year. In total, more than half a million lawsuits against debtors have been filed by banks over the past 7 years. Universal Bank (Mono), Privat and A-Bank account for 70% of the claims.

100,434 lawsuits against debtors were filed by Ukrainian banks. This is 1.5 times more than in the same period last year and a record for the last 7 years. A total of 511,865 lawsuits have been filed by banks since 2019.

Universal Bank/Mono (28,213 claims), A-Bank (22,221), and Privat (20,278) accounted for more than 70% of all claims this year. FUIB (9 , 225) and Sense Bank (6,831) are far behind.

In general, over the past 7 years, Privatbank has remained the unchanged leader in lawsuits against debtors – 191,353 lawsuits. It is followed by Universal Bank (115,702), A-Bank (60,421), Sense Bank (25,283) and FUIB (21,476).

TASKOMBANK saw the largest increase in the number of claims this year, up 3.5 times. PrivatBank (1.8 times), Kredobank (1.7 times), Accent Bank (1.6 times), and Sens Bank (1.6 times) also saw a significant increase.

At the same time, many banks have significantly reduced the number of court appeals. Unex Bank (4 times), Credit Agricole (2 times) and Ukrgasbank (2 times) showed the biggest drop.

It is worth noting that the ranking of the most “litigious” banks has been updated this year. New players entered the top – Radabank and Bank Alliance, which were not on the list last year. Instead, Accordbank and Unex Bank dropped out of the top twenty.

https://opendatabot.ua/analytics/banks-courts-2025

The number of banks in Ukraine in October 2025 has not changed and is 60, according to the website of the National Bank of Ukraine.

According to the regulator, the number of banking groups is also unchanged – 16. 15 payment systems created by residents, including state-owned ones, and 10 international payment systems continue to operate in the payment market.

Among payment service providers there are 16 payment institutions (17 a month earlier), 12 financial institutions authorized to provide payment services, one bank – issuer of electronic money, and one postal operator. Other payment market entities include 49 commercial agents and 32 technological payment service providers.

In October, the NBU received 243 requests for registration and licensing actions, including 41 requests for banks, 131 requests for financial companies, pawnshops and lessors, 55 requests for insurers, 14 requests for credit unions and collection companies, and 2 requests for payment institutions.

At the same time, banks’ profits increased by 22% Almost UAH 120 billion was earned by Ukrainian banks in 7 months of 2024, according to the NBU. Net profit after tax amounted to UAH 93 billion. Income tax is also growing along with earnings. Thus, this year, financial institutions have already paid 1.8 times more income tax than last year. Privat accounts for 40% of the profit of all banks, and the MTB has grown the most – by as much as 13 times.

Banks in Ukraine made a total of UAH 119.44 billion in profit. This is 22% more than in the same period last year: UAH 97.53 billion.

This year, the amount of income tax increased by 1.8 times to UAH 25.83 billion. Despite the tax increase, net profit is still 13% higher than last year: UAH 93.61 billion compared to UAH 83.18 billion last year.

Alpari Bank withdrew its license of its own free will in June, so there are now 62 banks operating in Ukraine. 8 of them suffered losses.

The top 10 banks in Ukraine currently account for 86% of the total profit: UAH 80.13 billion.

State-owned banks

State-owned banks account for 63% of the total profit of all banks. Privat is a stable leader: UAH 37.16 billion of profit after tax. This is 8% more than last year.

Privat accounts for 40% of the total profit of all banks in the country. The bank’s tax expenses increased 1.5 times and amounted to UAH 12.13 billion.

In total, 5 out of 6 state-owned banks earned a total profit of UAH 58.84 billion during this period, and tax expenses amounted to UAH 14.6 billion.

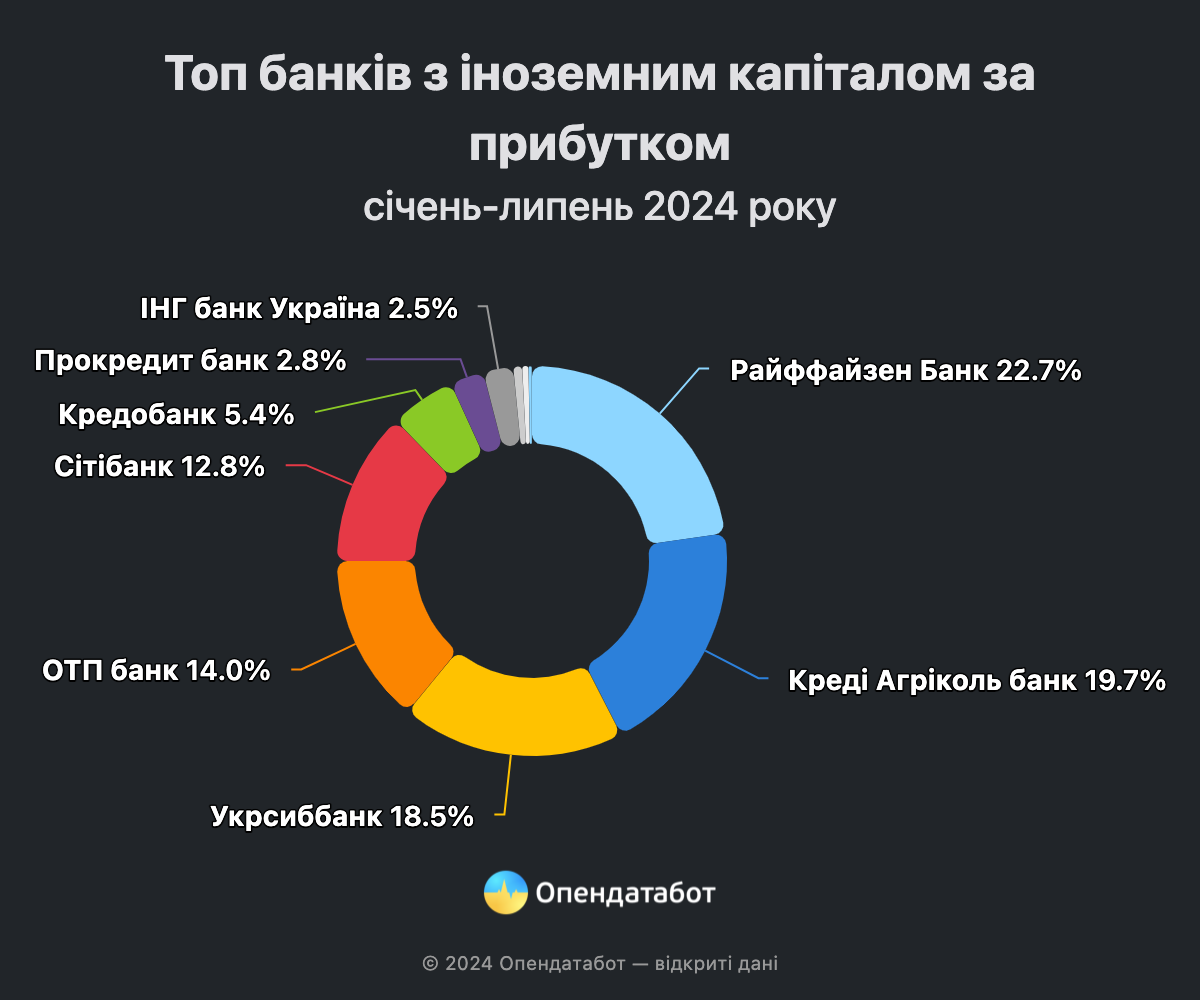

Banks with foreign capital

Banks with foreign capital earned UAH 21.5 billion. This is 9% more than in the same period last year. The profit tax of banks in this group increased 1.7 times this year and reached UAH 7.26 billion. They currently account for 23% of the total profit of all banks.

Raiffeisen Bank remained the leader of this group: UAH 4.87 billion. This is 28% more than in the same period last year. Raiffeisen Bank’s tax expenses doubled to UAH 1.63 billion.

Banks with private capital

The total profit of banks with private capital increased by 29% to UAH 13.39 billion. Accordingly, taxes doubled to UAH 3.95 billion. Currently, this group of banks accounts for 14% of the total profit.

FUIB is the leader of the group with UAH 4.24 billion. At the same time, MTB Bank showed the largest increase among all banks in the country: by 13 times, up to UAH 539.8 million.

As a reminder, the Verkhovna Rada is currently considering draft law No. 11416-d, which proposes to introduce a 50% income tax for banks in 2024.

Cardholders of the international financial service NovaPay can receive salaries from any Ukrainian employer on their cards, the NovaPay press service said on Tuesday.

“You can do this in the application – create a paper or electronic application for receiving a salary on a NovaPay card and send it to the company’s accountant,” the company said in a statement.

It is noted that the application fills in the necessary fields, including information about the employer, while other personal data is automatically pulled into the application, after which it remains to form an electronic application and sign it using “Diya. Signature”.

Among the advantages of the NovaPay card, the company calls a 20% discount on Nova Poshta delivery services, transfers without restrictions up to UAH 50 thousand and the possibility of buying NovaPay bonds.

As reported, at the end of 2023, NovaPay was the first non-bank financial institution in Ukraine to receive an extended NBU license, which allowed it to open accounts and issue cards. In January-February of this year, the company increased the number of payment cards sixfold to 78 thousand, including a fivefold increase in the number of active cards to 43.8 thousand.

The total number of transfers and transactions through NovaPay in Q1 2014 increased by 18% and 24% to 96 million and 66.1 billion, respectively.

Founded in 2001, NovaPay is an international financial service that is part of the Nova group and provides online and offline financial services at Nova Poshta offices. According to its website, the company employs about 13 thousand people in more than 3.6 thousand Nova Poshta offices across Ukraine. According to the National Bank of Ukraine, the company accounts for 35% of the total volume of domestic money transfers.

The Parliamentary Committee on Finance, Taxation and Customs Policy is preparing a draft law on additional taxation of net interest income or excess profits of banks, which is likely to come into force in 2024 and bring UAH 10 billion to the budget annually, Committee Chairman Danylo Hetmantsev told Forbes Ukraine.

“It’s not an easy question, we are still evaluating it,” Deputy Governor of the National Bank Serhiy Nikolaychuk commented on the proposal on Facebook.

It is noted that parliamentarians are considering two options for taxation: a tax on all net interest income received for the year at a relatively small or medium rate, or a tax on the difference between net interest income in the reporting year and the average value for the last three to four years.

“For example, in Spain, it is 4.8%,” Mr. Hetmantsev said, referring to the first option.

He clarified that in this country, net commission income of banks is also taxed. “But this is not our story: banks have not yet reached the pre-war level in this regard,” the head of the Financial Committee said.

Commenting on the second option, Mr. Hetmantsev noted that the rate should be high. “For example, in Lithuania, 50% of the difference between net interest income in the base year and its average value over the previous four years is taxed at 60%,” he explained.

According to the committee chairman, the option of taxing all net interest income earned during the year is more optimal.

Mr. Hetmantsev added that he proposes to introduce this tax temporarily: from January 1, 2024, for two years.

He noted that the main motivation for the innovation is the need for additional funding for defense spending.

According to the head of the Finance Committee, the draft law is ready, and after consultations with the Ministry of Finance, the National Bank, specialized associations and the President’s Office, it will be submitted to the Verkhovna Rada.

Mr. Hetmantsev added that there have been no consultations with the market yet. “Although it is not difficult to predict the position of banks,” he said.

As reported, the profit of operating Ukrainian banks in January-June 2023 amounted to UAH 67.65 billion, while the banks ended the same period last year with a net loss of UAH 4.65 billion. This figure is a record high for the first half of the year: the previous highest net profit for the first half of the year was in 2019 – UAH 31.04 billion, compared to UAH 23.79 billion in 2020 and UAH 30.08 billion in pre-war 2021.

According to the NBU, net interest income increased by 40.8% to UAH 93.62 billion in the first half of 2023, commission income by 22.3% to UAH 25.60 billion, and the result from revaluation and purchase and sale transactions increased by 35.8% to UAH 16.30 billion.

Record profits also allowed banks to pay a record corporate income tax in the first half of this year – UAH 12.44 billion, compared to UAH 1.21 billion in the first half of last year and UAH 2.5 billion in pre-war 2021.

In an op-ed in NV on Friday, National Bank Deputy Governor Sergiy Nikolaychuk reiterated the regulator’s position that accusations of overpayment on certificates of deposit are “fundamentally false, manipulative, and dangerous.” He emphasized that the main goal is to achieve price stability and tie up the high liquidity of the banking system caused by the war.

According to him, in the first 7 months of this year, the NBU paid UAH 48.6 billion on certificates of deposit, compared to UAH 40.3 billion last year and UAH 6.3-10.7 billion annually in 2015-2021, but the average daily balance on certificates of deposit increased to UAH 411.4 billion by August this year, from UAH 215.7 billion at the end of 2022 and UAH 145.4 billion at the end of 2021.