This was discussed at a meeting of the Head of the State Agency on Energy Efficiency and Energy Saving of Ukraine Hanna Zamazieieva with representatives of the Czech RSJ Investments Foundation and their partner company.

The Czech partners assured of their desire to help Ukraine and Ukrainian communities become less energy dependent through bioenergy projects.

The Czech Fund is considering installing biomass boilers in Ukraine. The scale of the plans is impressive: the total capacity of the boiler houses is 80 MW, and the amount of investment is more than €12 million. The ultimate goal is to ensure uninterrupted heat supply in Ukrainian hospitals and other institutions.

“Such projects as alternative fuel boiler houses are one of the most relevant solutions for Ukrainian communities. It is an opportunity to provide heat, first of all, to critical infrastructure facilities, even during energy challenges,” emphasized Hanna Zamazeyeva.

The Chairman presented the significant potential of Ukrainian bioenergy, the legislative framework and the initiatives that the Agency’s team is working on to stimulate investment in this area.

The parties went through all the obstacles faced by market participants and discussed various ways to overcome them.

As a result of the meeting, the participants agreed to consolidate efforts to develop heat production from alternative fuels and the cultivation of energy crops.

The largest private railway passenger carrier in Central Europe Czech RegioJet in partnership with Ukrzaliznytsia plans to launch in 2023 a flight Prague-Chop, and in 2024 two flights to Germany – Kiev-Berlin and Kiev-Hanover via Leipzig and Dresden, said the owner of RegioJet Radim Jančura in an interview for “Forbes Ukraine”.

“Historically, the train from Kiev to Berlin ran until 2012 and was very successful. But the German railroad at one time imposed commercial conditions that increased the cost of the train on the territory of Germany. It made the route unprofitable and the trip was closed,” – he said.

The RegioJet head said the company has optimistic expectations for this project, as many more Ukrainians travel to Germany than to the Czech Republic.

Yanchura also underlined that RegioJet has a different business model from the state operators, so UZ will not have to share the revenues with the Polish and German railroads.

Speaking about the flight to Chop, the RegioJet head noted that the company has the largest share of transportation on the popular route Prague-Kosice.

“We would like to continue this route to the Ukrainian city of Chop in Transcarpathian region, and in the future to Mukachevo,” Jančura said.

According to him, the company now agrees with “Ukrzaliznytsia” schedules and conditions, so we plan to run a new train to Chop during 2023.

Yanchura added that launching a train to Mukachevo is more difficult.

“The main obstacle is the Chop-Mukachevo track section is not electrified: it used to have a contact network, but later part of it was dismantled,” the RegioJet owner noted and added: – We are ready to electrify this section at our own expense.

The head of RegioJet did not name the cost and timing of the project. According to him, they will be known after the Ukrainian authorities and UZ will approve the technical audit and determine the scope of work.

According to him, after Ukraine joins the EU, RegioJet will be able to operate trains itself in Ukraine, having received a license.

“This is how we work in all countries of the European Union. In the EU, anyone can get access to the railway infrastructure by paying a fixed tariff,” Yanchura explained.

The RegioJet owner noted that the company relies on residents of small towns rather than the population of large cities with well-developed airports.

In addition, according to Yanchura, the company is working on the possibility of RegioJet trains, still following only to the Polish Peremyshl, to the Ukrainian border station “Mostiska-2” and plans to implement this project by the end of 2023.

“For this purpose it is necessary to complete the passenger platform and the pedestrian bridge. We are ready to build it at our own expense, “- said the owner of the company.

He also said that he is ready to buy in Ukraine passenger railway cars in large quantities, but their price should be up to $ 1 million per piece.

RegioJet is the second biggest bus carrier in Europe after Flixbus and the biggest private railway passenger carrier in Central Europe. The company has licenses to operate in the Czech Republic, Slovakia, Germany, Austria and Poland. Last year, RegioJet carried 11 million passengers.

According to the České noviny news agency, it would also be advisable to consider transferring the Czech L-159 fighter jets to Ukraine. He stressed that the Czech Republic has already provided Ukraine with about a hundred tanks and the same number of armored personnel carriers.

“It is worth considering maybe we could provide Ukraine with our L-159 planes with a certain look and prospect of rearming, because even as direct air support planes, they could significantly help Ukraine in a counterattack,” he added.

The Czech president stressed that Western countries have so far refrained from providing modern fighters to Ukraine because it takes a relatively long time to prepare for their use and because the machines contain secret systems. According to him, the allied countries do not want these devices to fall into Russia’s hands.

The KUB SAMs will replace the SPYDER missile systems made by Israel in the Czech army’s arsenal.

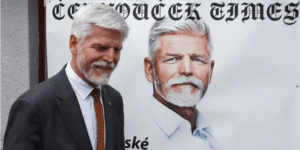

The Czech Republic intends to open its consulate general in Dnipro, Czech President Petr Pavel said.

“We seek to strengthen our presence and deepen cooperation in Ukraine. To this end, we will delegate two persons who will work in Dnipro. We will open a consulate general there,” he said Friday at a joint press conference with the presidents of Ukraine and Slovakia in Kiev.

In particular, the work of the consulate will be connected with facilitation of projects of mutual cooperation of the Czech Republic in energy, economy, transport and housing in the reconstruction of Dnipropetrovsk region.

The timing of the opening was not reported.

Czech President Petr Pavel together with Slovak President Zuzana Chaputova arrived in Ukraine on a visit.

“With Zuzana Chaputova, we both understand the value of freedom and justice. It is hard to see with our own eyes that Ukrainians are paying the highest price for it. With the blood and lives of its citizens. In fighting the aggressor, he defends what we have in common. That’s why we will support them,” Pavel wrote on Twitter, showing a picture with the president of Slovakia in front of the destroyed building.

For its part, the Czech media outlet Denikn reported that the Slovak president and her Czech counterpart Petr Pavel arrived in Kiev early this morning.

This is the first visit of the Czech head of state to Ukraine since 2013.

Pavel and Chaputova will meet with Ukrainian President Volodymyr Zelensky and Prime Minister Denys Shmygal, and will also visit cities liberated from Russian occupation near the capital.

A meeting with Crimean Tatar representatives Mustafa Dzhemiliev and Refat Chubarov is also scheduled.

Chaputova also later tweeted about the joint visit to Ukraine.

“Our first joint visit abroad with Peter Paul to Ukraine with a message of friendship, solidarity and support. Slovakia, the Czech Republic and Ukraine share parts of a common history – and we also share our common future,” she stressed.

The Czech TV channel ČT24 reported that the Czech and Slovak presidents visited Irpen, then went to Borodyanka. In addition, the Czech president then headed to Bucha.

Ukrainian President Vladimir Zelensky congratulated Petr Pavel on his victory in the Czech presidential election and invited him to visit Ukraine.

“Congratulated Petr Pavel on his victory in the Czech presidential election. Thanked him and the Czech people for their unwavering support. Invited him to visit Ukraine,” Zelensky wrote in his Telegram channel on Sunday.

Earlier it was reported that the former chairman of the NATO Military Committee Petr Pavel on Saturday won the second round of the presidential elections in the Czech Republic. After all ballots were counted, he received more than 58.3 percent of the vote. The inauguration is scheduled for March 9.