The total state debt of Ukraine in January 2020, due to the weakening of the hryvnia exchange rate by 5.2%, in U.S. dollar terms decreased by 1.1%, or by $940 million, to $83.43 billion, the Finance Ministry has said.

According to its data, at the same time, this devaluation led to an increase in the national debt in hryvnias by 4%, or by UAH 80.72 billion, to UAH 2.079 trillion.

The Ministry of Finance noted that in January it held three auctions for the placement of government domestic loan bonds, at which it raised UAH 18.5 billion at the rates that by the end of the month fell below 10% per annum, and also placed eurobonds for EUR 1.25 billion at 4.375%.

State budget expenditures for the repayment of public debt in January 2020 amounted to UAH 31.6 billion, for servicing some UAH 4.4 billion.

In January, the share of obligations in dollars in the general structure of the state debt of Ukraine decreased from 38.9% to 38.5%, in hryvnias from 36.7% to 35.25%, while in euros it increased from 10.2% to 11.85%.

Ukraine’s gross foreign debt as of October 1, 2019 reached $119.95 billion, which is $4.44 billion or 3.8% more than in a quarter earlier, the National Bank of Ukraine (NBU) has reported. According to the central bank, as for GDP the debt fell from 83.5% to 82.3% of GDP.

The NBU recalled that at the beginning of this year, gross external debt amounted to $114.71 billion, or 87.8% of GDP.

“The growth of external debt [in the third quarter] was mainly due to an increase in the external liabilities of the private sector of the economy, which grew by $4.4 billion, to $69.7 billion, or 47.8% of GDP,” the regulator said.

The NBU said that the volume of public sector debt to nonresidents in July-September remained virtually unchanged and remained at the level of $50.2 billion (34.4% of GDP). In particular, the external liabilities of the general government sector increased by $0.4 billion, to $43.0 billion (29.5% of GDP). The main reason was the active purchase of government bonds by nonresidents, the obligations on which increased by $1.8 billion.

At the same time, $0.7 billion on 2015 eurobonds were repaid, and another $0.4 billion was the net repayment on direct government loans, including $0.33 billion under the Stand-By Arrangement and Extended Fund Facility (EFF) to the International Monetary Fund (IMF).

Due to exchange rate changes, the volume of external obligations on government loans decreased $0.3 billion, while on debt securities denominated in hryvnia, it grew by $0.1 billion, the NBU said.

According to the data, the external debt of the central bank decreased by $375 million as a result of planned depreciation of payments on Stand-By loans and as of September 30, 2019 the debt amounted to $7.2 billion.

The volume of external debt of banks decreased in the third quarter by $0.1 billion to $4.9 billion, while the volume of external debt of other sectors of the economy increased by $4.1 billion, to $54.7 billion. This was due to the placement of $1.8 billion eurobonds, an increase in obligations on non-guaranteed loans and borrowings by $0.5 billion and an increase in obligations on trade loans by $1.9 billion.

Intercompany debt of enterprises in direct investment relations increased by $ 0.4 billion to $ 10.2 billion.

Overdue debt on non-guaranteed loans in the real economic sector (including from direct investors) decreased $0.5 billion during the quarter and amounted to $21.5 billion (14.8% of GDP) at the end of the third quarter of 2019.

The National Bank said that as of the end of September, the U.S. dollar remained the main currency of external borrowing of Ukraine with the share of 68%, however its share decreased 1.6 percentage points.

The share of liabilities in SDRs to the IMF also decreased, from 10.3% to 9.3%, while the share of borrowings in euros increased from 14.9% to 16%, and in hryvnia – from 2.7% to 4.2% The volume of liabilities in Russian rubles during the quarter remained virtually unchanged and amounted to 1.7% of the volume of external liabilities.

The volume of short-term external debt with a residual maturity increased by $2.8 billion and amounted to $48.9 billion as of September 30, 2019, the regulator said. The NBU said that the liabilities of the public sector (government and central bank), which should be repaid over the next 12 months, increased by $1.1 billion, to $5.9 billion mainly due to future payments on debt securities, then short-term liabilities of banking sectors fell $0.1 billion, to $1.2 billion

The total volume of real economic sector liabilities to be repaid over the next 12 months (together with intercompany debt) increased $1.6 billion, to $40.3 billion as a result of an increase in debt on short-term trade loans by $2.1 billion, to $16.6 billion.

Canada’s Black Iron, implementing the investment project to create a new iron ore production facility in Kryvy Rih (Dnipropetrovsk region), has said that it received expressions of interest from European banks and export credit agencies to provide $250 to $300 million of debt.

The company said in a press release that Black Iron management continue to make sound progress arranging the financing for Shymanivske project construction.

Construction of phase one to produce four million tonnes per year of 68% iron content pellet feed is estimated to cost $436 million, as further detailed in Black Iron’s most recent Preliminary Economic Assessment. As is typical for financing the development of mining projects, based on discussions with potential investors and financiers, the company estimates that some $175 million (40%) will be equity and the balance around $261 million (60%) financed as debt, not including financing charges and working capital.

Black Iron CEO Matt Simpson said that strong interest from well known, highly regarded, providers of debt financing for project construction is seen.

“The indicative interest rates, grace period prior to starting repayment and loan duration in the expressions of interest received by the Company are very competitive. The recent announcement of the MOU between the Company and Ukraine’s government to transfer a critical parcel of land to the Company is an important milestone that both anchor offtake and debt investors have been waiting to see. The Company is currently negotiating binding terms for the land transfer, including the compensation amount, and expect this to conclude following a binding product sale (i.e. offtake) agreement as a portion of the funds invested by the offtake company will be used to cover the land transfer costs. Now that an MOU on land transfer has been reached, we look forward to commercial negotiations for project construction financing being accelerated,” he said.

Majority of the required equity for project construction is anticipated to come from offtake by a large trading company and/or steel mill that is interested to purchase Black Iron’s pellet feed on a long-term contract at a slight discount to market price in exchange for making both a prepayment and acquiring ownership in the Shymanivske project. Several multi-billion companies, including Glencore, as previously announced, are currently conducting due diligence to consider such an investment.

Additionally, there are two Asia based construction companies that have conducted site visits and expressed serious interest to invest up to $50 million of equity in kind in exchange for being awarded the construction contract.

From a sequence standpoint, discussions are being held simultaneously with equity and debt investors as both are ultimately required to fund project construction. It is likely the anchor equity and offtake investor will be announced first followed by completion of an updated feasibility study and environmental impact assessment upon which the debt financing can be secured to allow for construction start around the end of next year, the company said.

The total debt of insolvent VAB Bank and bank Financial Initiative of Oleh Bakhmatiuk to the state is UAH 29.3 billion, including a UAH 11 billion debt to the Deposit Guarantee Fund, a UAH 10.6 billion debt to the National Bank of Ukraine (NBU) and a UAH 7.7 billion debt to three state-run banks. According to a posting of the NBU press service on Facebook on Friday, the debt of the former owner of VAB Bank and Financial Initiative Bank to the central bank was secured by his personal guarantee to repay a total amount of UAH 8.6 billion and property guarantees of Bakhmatiuk’s companies.

“In order for these guarantees to turn into a real refund, the NBU filed more than 50 lawsuits against him and his companies,” the regulator said.

The central bank said that as of October 15, 19 court decisions on Bakhmatiuk’s guarantee agreements regarding the bank Financial Initiative were made in favor of the National Bank and entered into legal force, while there are no decisions regarding the VAB bank.

“Nineteen victories have not yet allowed for the repayment of debts: the sale of property by the State Enforcement Service is surprisingly sluggish,” the regulator said.

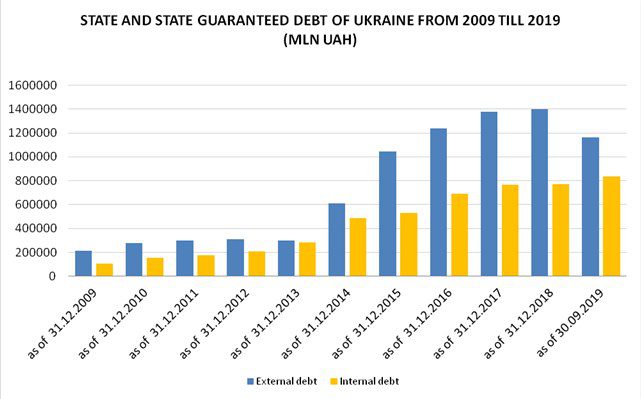

State and state guaranteed debt of Ukraine from 2009 till 2019 (mln UAH)

The total state (direct) and state-guaranteed debt of Ukraine in September 2019 increased by 1.26%, or by $1.03 billion, to $82.95 billion, according to data on Finance Ministry’s website.

According to the ministry, the state debt in the national currency decreased by 3.36%, to UAH 1.997 trillion.

In September, direct government debt in U.S. dollars rose by 1.77%, to $72.99 billion (in hryvnias it fell by 2.86%, to UAH 1.758 trillion), in particular external debt decreased by 2.88%, to $38.66 billion.

The state-guaranteed debt last month decreased by 2.36%, to $9.95 billion (in hryvnias decreased by 6.81%, to UAH 239.73 billion), in particular external one fell by 2.72%, to $9.49 billion.

In general, since the beginning of the year, the aggregate public debt of Ukraine increased by 5.91%, or by $4.63 billion, however, in hryvnia equivalent, due to the strengthening of the national currency, it decreased by 6.72%, or by UAH 143.92 billion.

According to the Finance Ministry, the share of liabilities in U.S. dollars of the overall structure of Ukraine’s public debt fell to 39.58% in September, in euros it decreased to 9.93%, in Canadian dollars to 0.18%, in special borrowing rights to 13.46%, in yen to 0.69%, while in hryvnias it increased to 36.15%.

The official hryvnia exchange rate, according to which the Finance Ministry calculates the national debt, strengthened in September to UAH 24.08/$1 compared to UAH 27.688/$1 at the beginning of the year.