The National Bank of Ukraine (NBU) will reduce the discount rate from 25% to 23-24% for the first time since June 1, 2022 at a meeting on July 27, bankers interviewed by Interfax-Ukraine predict.

“I am sure that the NBU will decide to lower the rate by 1-2%, because there are all prerequisites for this. First of all, significantly more lively rates of inflation reduction. (…) True, I do not think that the regulator will resort to drastic changes. Nevertheless, the risks and uncertainty remain very significant, and the system has a considerable liquidity overhang, which the NBU is trying to tie up in term deposits. And from the point of view of exchange rate stability, the National Bank should maintain a high level of attractiveness of hryvnia deposits for the population,” – said the board of Unex Bank Ivan Svitek.

He noted that the NBU back in April expected to slow inflation to 14.8% at the end of 2023, but already at the end of June inflation fell to 12.8%.

“So, military risks do not allow to be too optimistic in forecasts, including with regard to inflation. However, the NBU itself openly speaks about the preservation of the potential for its further slowdown,” the banker added.

Elena Dmitrieva, the first deputy head of the board of Globus Bank, shares a similar opinion.

“Now, more than ever, the issue of discount rate reduction is the most probable. At the same time, the “step” of reduction is unlikely to exceed 1-2 p.p., which will actually coincide with the previously announced plans of the NBU,” – said the expert.

According to her, such a decision became possible after a long and painstaking work of the regulator to establish a balance between supply and demand for currency, gradual popularization of the hryvnia as the most reliable currency for preserving and increasing the wealth of citizens.

In addition, thanks to strong macro-financial assistance from partner countries, Ukraine is able to cover a significant amount of state budget expenditures, which has a positive impact on the strength of the hryvnia, including since the beginning of the year the treasury has already received almost $23 billion, Dmitrieva added.

Low inflation, which according to the current macro forecast will not exceed 12.8% by the end of 2023, gradual development of the country’s economy, as well as the NBU strategy of gradual liberalization of the foreign exchange market, which is possible only in conditions of a strong national currency, she said.

According to the first deputy head of the board of Globus Bank, in the perspective of September – December the size of the discount rate may decrease to 20%, it is this that will encourage commercial banks to significantly change the terms of their own mortgage and deposit programs.

“In such conditions, for example, the rates on hryvnia deposits with placement up to 1 year may fall to 4%, and the mortgage ones, depending on the maturity, by 3.5-5%,” she expects.

In turn, the head of the analytical department of Sense Bank Alexey Blinov expects a decrease in the discount rate by 3 p.p. to 22% per annum.

“The improvement in short-term inflation expectations further increases the need for lowering the discount rate. As a first step on July 27, its reduction by 3 p.p. to 22% per annum seems optimal. Given the twofold disagreement between inflation and the discount rate, this would be a rather cautious step,” he pointed out

According to him, Sense Bank, maintains the forecast of the discount rate of 20% per annum at the end of 2023, which is in line with the NBU’s stated intentions to keep the discount rate at a markedly positive real level, even taking into account the risks of accelerating inflation in 2024.

Volodymyr Mudryy, Head of the Board of OTP Bank, Head of the Council of the Independent Association of Banks of Ukraine, also expects that the NBU may decide to lower the rate by 2-3% per annum.

“There are two prerequisites for this. First, it is necessary to stimulate lending to the economy. Despite the fact that business expectations have recently improved, we do not see demand for borrowed funds from business. The corporate loan portfolio, unlike the consumer loan portfolio, continues to shrink. And the price of resources has a big impact on this.

Second, deposit rates are already significantly higher than the inflation rate,” he said.

He noted that inflation was 12.8% in July, while the Ukrainian index of retail deposit rates was 14-15% per annum in hryvnia, depending on the term of deposits, and the NBU has always emphasized that deposit rates should be kept at a level that only compensates for inflation.

In addition, he believes that the NBU’s three-month deposit certificates at a fixed rate at the level of the discount rate will remain in effect for the time being.

Oleksiy Rudnev, Chairman of the Board of Accordbank, notes that in the current environment it is advisable to reduce the discount rate, in particular, to develop lending.

“Consumer inflation slowed to 12.8% year-on-year in June (from 15.3% in July), with the prospect of further decline during the summer months. The NBU’s foreign exchange reserves have reached a historic level of $39 billion, and the dollar has been relatively stable in recent months. (…) In our opinion, the regulator will cut rates, albeit slightly (perhaps by 1.5-3%), as it is important to set the market trend while maintaining the attractiveness of hryvnia deposits,” he said.

For his part, Pivdenny Bank’s strategic development analyst Konstantin Khvedchuk is more modest and expects the NBU discount rate to drop to 24% and the overnight deposit certificate rate to 19%.

“Inflationary pressures have significantly decreased over the past 5 months, and the NBU’s interest rates are now significantly higher than inflationary expectations, so there are grounds to start a cycle of rate cuts. However, given the high uncertainty during the war and the reaction of banks in the face of ultra-high liquidity, the NBU will act cautiously, cutting rates in small steps. By the end of the year, we expect the key policy rate to be close to 20%,” the analyst said.

Sergiy Kolodiy, Chief Macroeconomic Analysis Officer at Raiffeisen Bank, shares his forecast.

“We expect the NBU to start a cycle of monetary policy easing at its next meeting on July 27 after more than a year of unchanged key policy rate at 25%. In our opinion, the first step at the beginning of the rate cut cycle will be cautious (a 100 pp cut to 24%), as the regulator would like to see the market reaction to its decision and calibrate further steps,” the banker said.

Raiffeisen Bank also expects a similar downward correction of rates on standing facilities: certificates of deposit and overnight refinancing loans.

Kolodiy notes that the NBU is likely to maintain the asymmetry in the range of rates on them at the discount rate: “minus” 500 pp for overnight DS and “plus” 200 bp for overnight loans.

“However, the analysis of statistical data shows that since November 2022, overnight loans have not been used as simple access operations,” he added.

“By introducing three-month certificates of deposit at the discount rate and simultaneously reducing the rate on overnight certificates of deposit to the level of “discount rate minus 500 pp”, the NBU managed to change the structure of deposits in favor of longer-term deposits. Banks also gradually raised deposit rates, and now, taking into account the current inflation rate for June (12.8%), real deposit rates (i.e., adjusted for inflation) have returned to positive territory for the first time since the beginning of the war,” Kolodiy said.

Thus, Raiffeisen Bank believes that the NBU has already achieved its goals of increasing the interest of the population in hryvnia instruments, the main of which are deposits.

“Since the situation is developing according to a more positive scenario and we are seeing a permanent slowdown in inflation, in July – 12.8%, while the forecast at the beginning of the year was above 18.7% (the forecast was revised in April to 14.8% at the end of the year), a reduction in the discount rate is quite likely in the near future,” expects Oksana Shveda, Deputy Chairman of the Board of Credit Dnipro Bank.

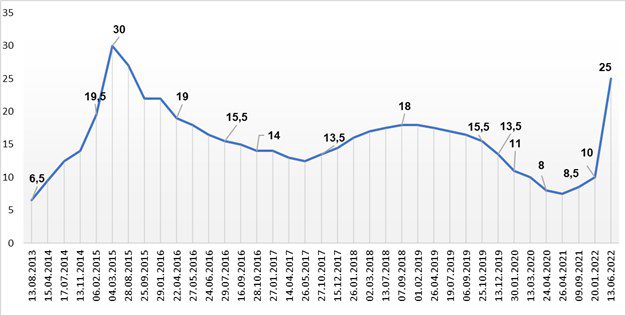

Dynamics of changes in discount rate of NBU

NBU

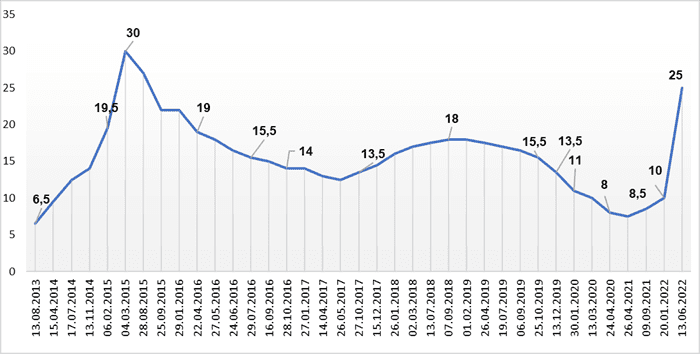

Dynamics of changes in discount rate of NBU

NBU

The National Bank of Ukraine (NBU), in line with market expectations, raised the discount rate by 1,500 basis points to 25% per annum from the current 10%, which is the highest level since the end of August 2015, according to the NBU website.

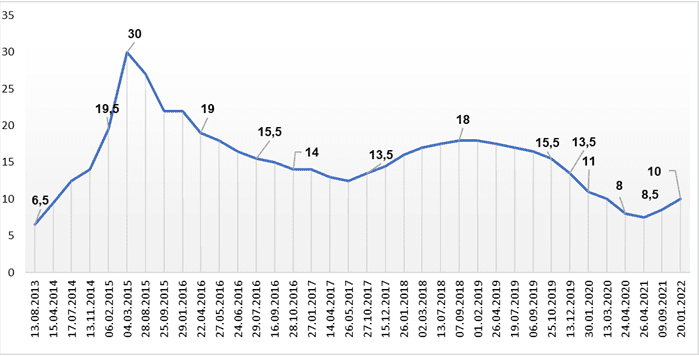

Dynamics of changes in discount rate of NBU

NBU

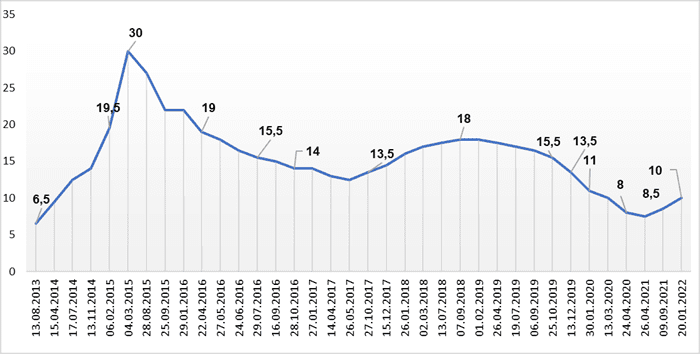

Dynamics of changes in discount rate of NBU

NBU