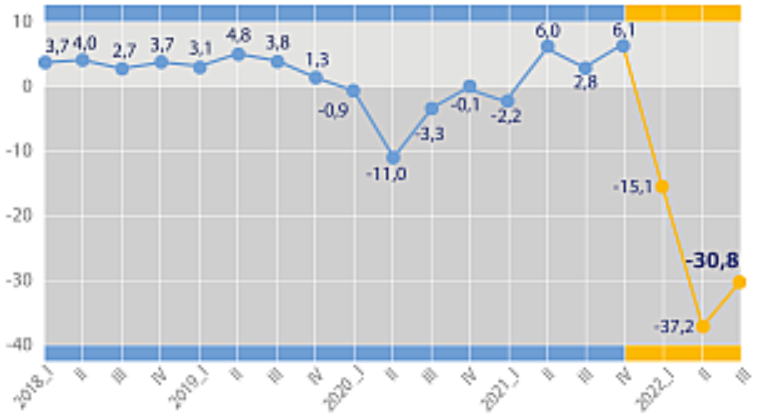

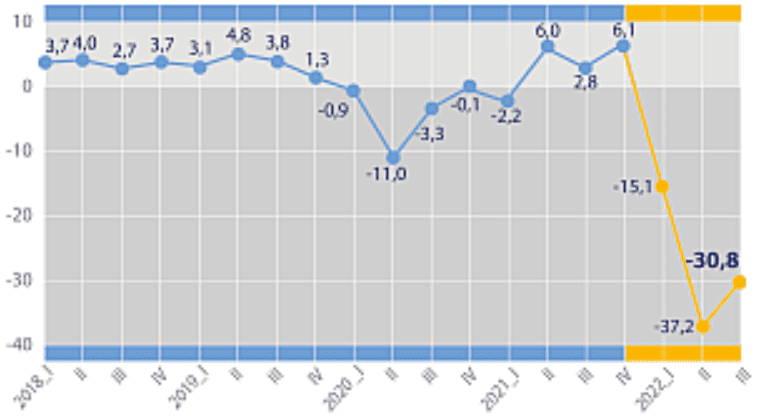

Real GDP percentage changes over previous period in 2018-2022

Source: Open4Business.com.ua and experts.news

Even after the end of the war, 860,000 to 2.7 million Ukrainian refugees may stay abroad, which will lead to a loss of GDP of 2.55 to 7.71%, according to a study of the Center for Economic Strategy (CES).

“According to our calculations, from 860 thousand to 2.7 million Ukrainians may stay abroad. More prone to return are the elderly, people with lower levels of education, as well as those who worked before the war, “- said the experts of the center.

They recalled that in total there were 3.8-4.7 million Ukrainian refugees abroad (except Russia and Belarus) by the end of 2022, and about 1.5 million more in Russia.

According to the survey conducted by Info Sapiens, the ratio of adults to children is 1:1.07. Among adults, women aged 35 to 49 are the most numerous – 42.2%, while men of that age make up 6.4%.

Women 25-34 years old make up 18.5%, men 3.2%, and those 18-24 years old 8.2% and 3.5%, respectively.

According to the survey, at the end of the year 11.3% of refugees aged 35-49 years definitely or rather did not plan to return to Ukraine, 13.1% of refugees aged 18-24 years, 8.2%-8.3% of refugees aged 25-34 years, and 50-65 years.

It is also stated that almost a quarter of the residents left the Zaporizhzhya region, and almost a fifth from Kiev and the Kiev region, while from the western regions – less than 10%.

Among the main reasons for refugees to settle in a new place outside of Ukraine the CEC named the prolongation of the war, the positive attitude of Europeans to Ukrainians, the prospects for children.

In addition, those who left abroad from the war zone may have nowhere to return, so their return depends on the rapid reconstruction of their regions or support to move to other regions of Ukraine.

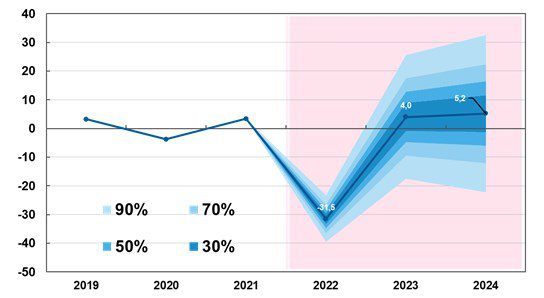

Forecast of dynamics of changes in GDP in % for 2022-2024 in relation to previous period

Source: Open4Business.com.ua and experts.news

Real GDP percentage changes over previous period in 2018-2022

Source: Open4Business.com.ua and experts.news

The decline in Ukraine’s real gross domestic product (GDP) in the first quarter of 2023 compared to the same period last year will slow to 19% from 35% and 30.8% respectively in the fourth and third quarters of 2022, the National Bank of Ukraine has published this forecast in an inflation report on its website.

According to him, in the second quarter of 2023 the economy will begin to recover and immediately 11.7%, given the low base of the second quarter of last year, when the decline was 37.2%.

In the third and fourth quarters of this year, the National Bank expects growth to slow to 1.5% and 8.2%, respectively, and real GDP will grow by 0.3% this year after a 30.3% decline last year.

The NBU’s updated estimates of the GDP dynamics are worse than last October, when it expected the economy to decline by 17.5% in the first quarter of this year and to grow by 13.9% in the second quarter, and by 4% for the year as a whole.

For next year, the National Bank has worsened its growth forecast from 5.2% to 4.1%, and expects growth to accelerate to 6.4% in 2025.

“The baseline scenario is based on the assumptions of launching a new cooperation program with the IMF, conducting a coordinated monetary and fiscal policy, the gradual leveling of quasi-fiscal imbalances, in particular in the energy sector. Also, the baseline scenario assumes a tangible reduction of security risks from the beginning of 2024, which will contribute to the full unblocking of seaports, reduction of the sovereign risk premium and the return of forced migrants to Ukraine,” the report notes.

It also provides for the absence of new critical damage from shelling, as well as the successful work of the government to attract international aid for the energy sector and the intensive restoration or replacement of damaged infrastructure.

The NBU specifies that the baseline scenario assumes a reduction in net outflows from Ukraine this year to 0.8 million from 8 million last year and a gradual return of 1.5-1.4 million in 2024-2025.

The central bank adds that this forecast also assumes continued active international financial support for Ukraine of $38.6 billion in 2023, $20 billion in 2024 and $8 billion in 2025, up from $32.5 billion last year.

The strongest risk for this scenario, the National Bank calls the prolongation of the war and its escalation, estimating its probability from 25% to 50%.

With 15-25% probability the National Bank considers such risks as increased emigration and growing energy shortages due to damaged infrastructure and unbalanced state finances (freezing of utility rates, cuts in international aid, emission deficit financing).

The NBU also names among the moderate risks of the baseline scenario a delay in the program with the IMF and the termination of the “grain corridor”, but their probability is lower – less than 15%.

The report also mentions such factor as “Marshall Plan”, which can strongly influence and improve macro-forecast, but its probability is estimated by the central bank below 15%.

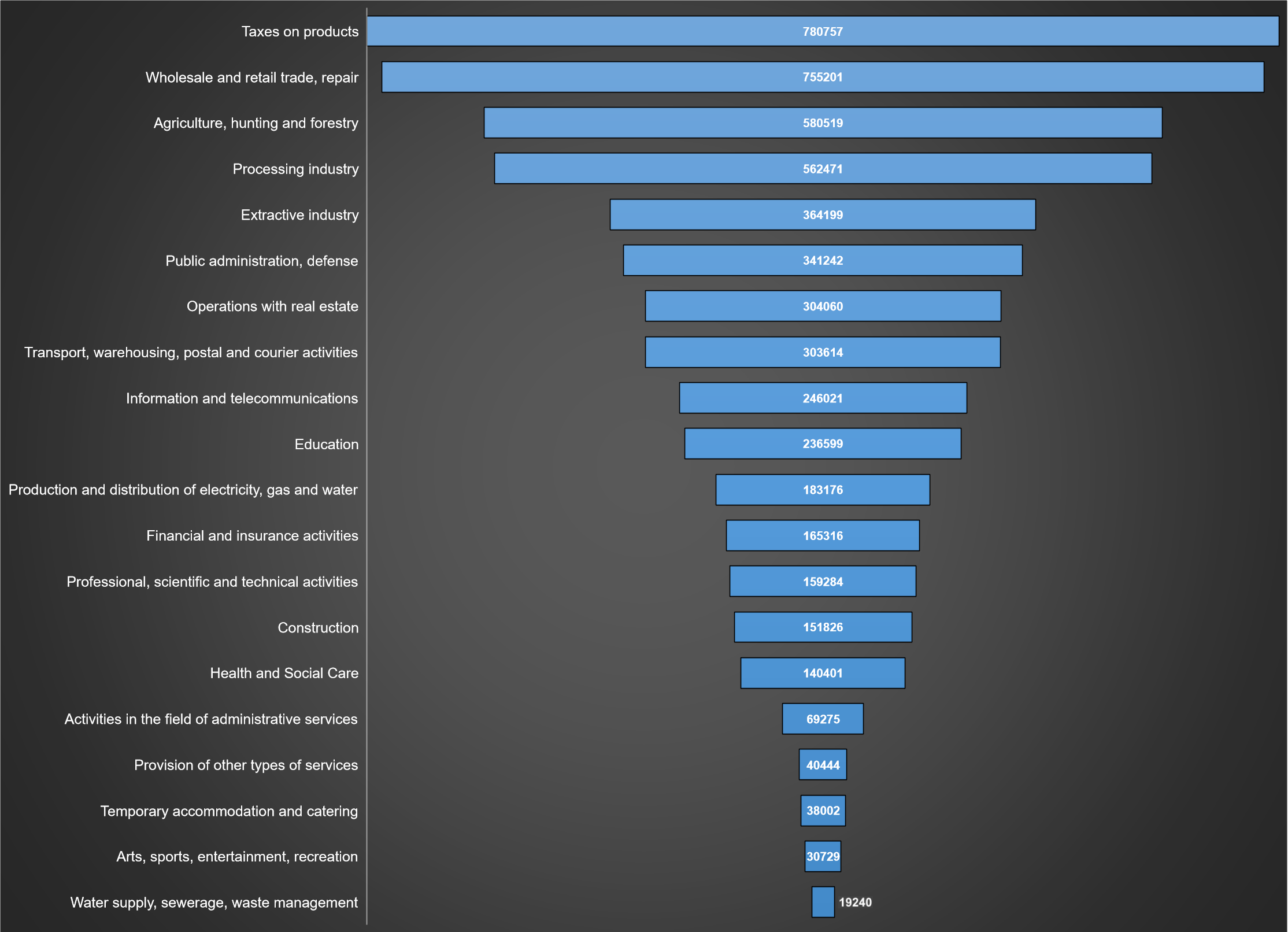

Structure of Ukraine’s GDP in 2021 (production method, graphically)

Source: Open4Business.com.ua and experts.news