The international rating agency Fitch Ratings has downgraded its global economic growth forecast for 2022 to 2.4% from 2.9% expected in June.

“The European gas crisis, high inflation and a sharp acceleration in the pace of tightening of monetary policy in the world entail serious consequences for the economic outlook,” the updated Global Economic Outlook (GEO) said.

The global GDP growth forecast for 2023 has been lowered to 1.7% from 2.7%.

The eurozone and UK economies will fall into recession as early as this year, while the US will face a mild recession in mid-2023, Fitch predicts.

Eurozone GDP, according to the agency’s new forecast, will decrease by 0.1% in 2023 due to the consequences of the gas crisis (in June, an increase of 2.1% was expected).

The new forecast takes into account the complete or almost complete cessation of pipeline gas supplies from Russia to Europe. Fitch experts note that, despite the EU’s attempts to find alternative sources of supply, the supply of gas in the region will be significantly reduced in the near term, which will affect the industrial sector.

The growth forecast for the US economy for the current year has been worsened to 1.7% from 2.9%, for 2023 – to 0.5% from 1.5%.

“The recovery of the Chinese economy is constrained by quarantine restrictions and a downturn in the real estate market, and therefore we expect China’s GDP to increase by 2.8% in 2022 and grow by 4.5% next year,” Fitch said in a review. In July, the growth of the Chinese economy was predicted by 3.7% and 5.3%, respectively.

High and persistent inflation and rising inflationary expectations are forcing the Federal Reserve (Fed), the Bank of England and the European Central Bank (ECB) to become more hawkish in recent months, Fitch said. The base interest rates of the world’s leading central banks are rising at a much faster rate than one might expect.

According to Fitch’s forecast, the Fed will raise the rate to 4% by the end of this year and keep it at this level throughout 2023, while the ECB will bring the lending rate to 2% by December of this year. The base rate of the Bank of England will reach 3.25% by February 2023, agency experts believe.

A decline in real gross domestic product (GDP) of Ukraine amounted to approximately 35% in August 2022 compared to August 2021, this estimate was given by the Ministry of Economy on Thursday.

“As you can see, the GDP decline rate is slowing down. This is confirmed by the trends that were observed in the second quarter and August of this year,” the ministry points out, commenting on the data released by the State Statistics Service on a GDP decline in the second quarter of 2022 by 37.2% compared to the second quarter of 2021, which is less than the previous estimates of the Ministry of Economy (40.6%).

“Over 2022, we expect a slowdown in a GDP fall to 33.2%. When forming the state budget for 2023, we will proceed from a conservative scenario for the development of events, which will allow the state to reduce budget risks and fully fulfill all its obligations to citizens,” the message quotes Deputy Prime Minister and Minister of Economy Yulia Svyrydenko.

The ministry indicates that August macro indicators were positively influenced by the partial unblocking of grain exports from the ports of Great Odesa to the EU countries, as well as the acceleration of a pace and volume of grain harvesting in the territory controlled by Ukraine. As of the end of August, 25.3 million tonnes had been harvested.

“In the future, a pace of recovery will depend on a situation at the front, a scale and speed of obtaining donor assistance, an availability of ports for export, a return of Ukrainians from abroad and a growth of labor productivity. Today there are grounds for restrained optimism,” Svyrydenko said.

The Ministry of Economy pointed to an observed improvement in business expectations about the prospects for their economic activity: the business activity expectations index in August amounted to 44.1 versus 43.6 in July.

Establishing import logistics chains and diversifying suppliers stabilized fuel prices, which reduced inflationary pressure on the economy amid falling external prices, especially for energy and food, the release notes.

In addition, in August Ukraine received a significant amount of international assistance – $4.6 billion, including $3 billion in grant funds from the United States through the World Bank. “In the foreseeable future, this makes it possible to ensure macroeconomic stability, cover military spending and reduce the budget deficit,” the Ministry of Economy believes.

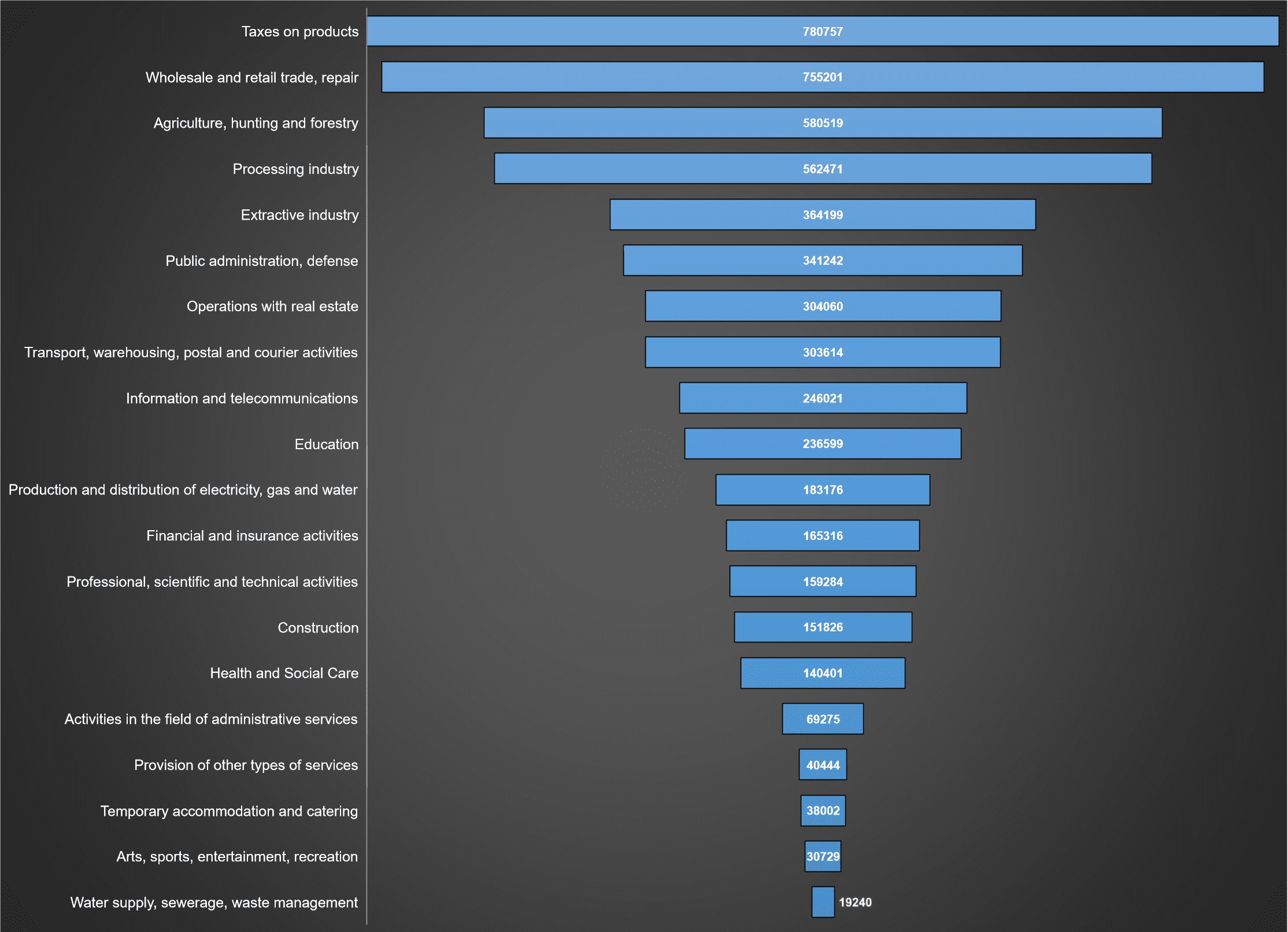

Structure of Ukraine’s GDP in 2021 (production method, graphically)

SSC of Ukraine

The volume of the German economy in the second quarter did not change compared to the previous three months, according to preliminary data from the German Federal Statistical Agency (Destatis).

In annual terms, GDP growth, adjusted for the number of working days, was 1.4%.

Analysts on average expected the first indicator to rise by 0.1% and the second by 1.7%, according to Trading Economics.

In the first quarter, GDP grew by 0.2% qoq and increased by 3.8% yoy.

The volume of the German economy is still 0.2% lower than in the fourth quarter of 2019 – that is, in the last quarter before the onset of the coronavirus pandemic, Destatis said.

Destatis will publish final data on the dynamics of the country’s economy in the second quarter on August 25.

At the same time, the statement of the statistical office notes that due to the ongoing COVID-19 crisis and the Russian invasion of Ukraine, the data is subject to more uncertainty than usual. This indicates the possibility of a stronger revision of the figures compared to those originally announced.

The real GDP of Ukraine in 2022 will decrease by more than a third, inflation accelerated to 20% in the first half of the year, according to bankers surveyed by the Interfax-Ukraine agency.

“We maintain our forecast for a 33% decline in Ukraine’s real GDP by the end of 2022. The reduction in investment and private consumption will be partially mitigated by an increase in government consumption and inventories,” Alfa-Bank Ukraine’s head of analytical department Oleksiy Blinov expects.

According to him, in June, the growth of the Consumer Price Index (CPI) is expected to accelerate to almost 20% in annual terms after 18% in May.

“We expect inflation to stabilize in the second half of 2022, but will remain above 20% until the end of 2022,” the expert added.

His opinion is shared by the head of the board of Unex Bank, Ivan Svitek, according to whom, according to the most conservative estimates, Ukraine’s GDP in the first half of the year fell by a third.

“But in fact, the fall could be even deeper. Moreover, the situation is constantly changing: household incomes continue to decline, consumer demand is declining. (…) Russia still wants to destroy the Ukrainian economy, but it does not quite succeed” , said the banker.

Konstantin Khvedchuk, strategic development analyst at Pivdenny Bank, in turn, notes that the peak of the decline in business activity occurred in March, when production was halved, and later the business adapted to the conditions of the war and gradually resumed its activities.

“In May, the decline in business activity is already estimated at 40% compared to the pre-war level. Domestic consumption and production are also supported by an increase in government spending. In general, the fall in GDP in the second quarter will be 40-45% y/y. In the third quarter, seasonal GDP growth will take place , including due to the harvest,” the expert explained.

According to his forecasts, if active hostilities continue until the end of the year, economic activity will remain at the level of 60-65% compared to the pre-war level.

Khvedchuk notes that inflation was accelerating even before the full-scale war both in Ukraine and in the world as a result of economic recovery after the pandemic, and the war further exacerbated these trends because now inflation has reached 18% y / y and is likely to grow before the end of the year .

He expects inflation to continue to be fueled by disruptions in supply chains, higher transport costs, including due to rising fuel prices, situational shortages of certain groups of goods and an increase in the money supply as a result of a growing budget deficit.

A significant factor in price dynamics will also be the receipt of external financial assistance and, accordingly, the ability of the NBU to ensure exchange rate stability, the banker points out.

“According to our forecasts, consumer price growth will reach 30% y/y at the end of the year and will continue to slow down,” he said.

The head of the board of Unex Bank, Ivan Svitek, also expects that the inflation rate for the first six months of the year will approach 19-20% on an annualized basis, and, taking into account the abolition of tax incentives for imports, in the next month or two, they may go beyond the specified corridor.

“It is almost impossible to predict how these figures will change in the second half of the year, because the situation is too unpredictable. The end of the war and the return of Ukrainians to their homeland is one scenario. The continuation or even escalation of hostilities is another,” Svitek said.

In addition, according to him, the gas war against Europe, the G7 negotiations on the introduction of a price ceiling for Russian oil, and many other events can have a global impact on inflationary processes in the world and in Ukraine, in particular, so it is difficult to make forecasts in such conditions.

Structure of Ukraine’s GDP in 2021 (production method, graphically)

SSC of Ukraine