The spot price of gold hit a new record high on Monday. As of 9:34 a.m., it stands at $4068.74 per ounce, which is 1.3% higher than the previous session’s close. Earlier in trading, the spot price of gold rose to $4078.24 per ounce, marking an all-time high. Gold futures on the Comex exchange are up 2.2%, reaching $4087.4 per ounce.

The precious metal is supported by rising tensions between the United States and China, as well as expectations of further interest rate cuts by the Federal Reserve.

On Friday, U.S. President Donald Trump announced the possibility of significantly increasing import tariffs on Chinese goods in response to Beijing’s tightened export controls on rare earth metals. He also said he saw no point in meeting with Chinese President Xi Jinping. However, on Sunday, Trump stated that Washington wants to help Beijing rather than harm it and suggested that he might still meet with Xi later this fall.

In addition, traders expect two more rate cuts by the Fed before the end of the year. According to futures market pricing, the probability of a 25-basis-point rate cut by the U.S. central bank at its next meeting on October 28–29 is estimated at 95.7%. Investors in the derivatives market also expect another similar cut in December.

Earlier, the analytical center Experts Club released an analysis of the world’s leading gold-producing countries in a video on its YouTube channel — https://youtube.com/shorts/DWbzJ1e2tJc?si=9YBue5CS6dz-tA6_

The rapid growth in the price of gold continues on global markets: December futures prices on the Comex exchange rose to $3,965 per troy ounce on Monday

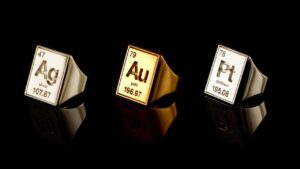

Against the backdrop of rising gold prices, other precious metals are also becoming more expensive.

Platinum added about 0.8%, rising to $1,085 per ounce, on expectations of reduced supply from South Africa.

Silver strengthened by 1.2%, reaching $32.7 per ounce, following the general increase in interest in precious metals.

According to experts, if political uncertainty in the US and the EU persists, gold could consolidate above the $4,000 mark, with silver and platinum continuing to rise moderately in its wake.

Earlier, the Experts Club analytical center presented an analysis of the world’s leading gold-producing countries in its video on YouTube channel – https://youtube.com/shorts/DWbzJ1e2tJc?si=9YBue5CS6dz-tA6_

The price of gold continues to rise rapidly on global markets: December futures on the Comex exchange rose to $3,965 per troy ounce on Monday, a new historic high. Since the beginning of the year, gold has risen in price by almost one and a half times.

The main drivers of growth were increased demand for safe-haven assets and political instability in the US and Europe.

In Washington, federal agencies have been shut down for six days now, as Congress has been unable to approve a temporary budget. Against this backdrop, investors are pulling their money out of stocks and bonds and putting it into gold, which they see as a safer bet in times of crisis.

Adding to the nervousness is the political crisis in France: Prime Minister Sébastien Lecornu resigned after criticism of the composition of the new cabinet, causing another surge of volatility in European markets.

“We see both fundamental and situational factors for a further rally in gold. If current conditions persist, the price could reach $4,200 per ounce by the end of the year,” UBS analysts predict.

According to experts, if political uncertainty in the US and the EU persists, gold could consolidate above the $4,000 mark.

Earlier, the Experts Club analytical center presented an analysis of the world’s leading gold-producing countries in its video on YouTube — https://youtube.com/shorts/DWbzJ1e2tJc?si=9YBue5CS6dz-tA6_

Experts Club has released a video analysis dedicated to the dynamics of gold production in the world by leading countries. Over the past half-century, the structure of global gold production has changed significantly: while South Africa and the USSR were the leaders in the 1970s, by the 2020s, China, Australia, and Russia had taken the lead.

China is now the largest gold producer in the world, having led the field by a significant margin for almost 20 years. Russia is in second place, Australia in third.

Further down the top ten are Canada, the US, Ghana, Mexico, Indonesia, Peru, and Uzbekistan.

In the 1970s and 1990s, South Africa dominated, accounting for up to two-thirds of global gold production. The gradual depletion of deposits and rising costs led to a decline in its share. South Africa has now fallen out of the top ten countries in terms of gold production.

In the 1990s, Russia took the lead, and in the last two decades, there has been significant growth in gold production in Australia, Canada, and African countries (Ghana, Mali).

Total global gold production has more than doubled since 1975, exceeding 3,600 tons per year by 2023–2024.

Since the early 2020s, gold has been steadily updating its historical highs amid geopolitical instability and inflationary risks. As of September 2025, the price of gold reached about $3,710-$3,730/ounce. This rapid rise in price is supported by increased demand from central banks, investment flows into ETFs, and expectations of lower interest rates in the US.

For more details on the struggle between countries for global leadership in gold production, see the video from Experts Club – https://www.youtube.com/shorts/DWbzJ1e2tJc

“Gold is not only used in the jewelry industry and finance, but also in electronics (coating contacts and connectors, where high conductivity and corrosion resistance are important), modern computers and smartphones are impossible without the use of gold. Gold is used in aviation and space technology, medicine, and lasers. Gold is also used as a catalyst in chemical reactions (for example, in the production of certain types of fuel),” commented Maxim Urakin, candidate of economic sciences and co-founder of the Experts Club information and analytical center, in the video.

The rise in prices confirms the importance of gold as a “safe haven” in times of global turbulence.

Gold traded at a four-month high on Monday amid growing demand for safe-haven assets and uncertainty surrounding US monetary policy.

The price of gold on the spot market rose 0.9% to $3,475.94 per ounce, its highest level since April 22. December futures for the precious metal on Comex rose 0.8% to $3,542.6 per ounce, according to trading data.

Analysts attribute the rise in gold prices to investor concerns about the independence of the Federal Reserve (Fed), uncertainty over US tariffs, and the upcoming release of the August US employment report.

Gold prices rose to a record high on news that the US would impose tariffs on 1-kilogram gold bars imported from Switzerland. During Friday trading on the Comex exchange, December futures for the precious metal reached $3,534.1 per ounce, a historic high. They are currently trading at $3,484.5 per ounce, up 0.9% from the previous close.

The US Customs and Border Protection agency said that gold bars weighing 1 kg and 100 ounces (2.8 kg) should be classified under a customs code that is subject to import duties, according to a July 31 ruling seen by the Financial Times.

The customs decision came as a surprise to the industry. Experts had assumed that these types of gold bars would be classified under a different customs code that would not be subject to the new duties imposed by US President Donald Trump.

Kilogram bars are the most common form of trade on Comex, the world’s largest gold futures market, and account for the bulk of gold bar exports from Switzerland to the US.

Relations between Washington and Bern deteriorated after the US announced last week that it would impose 39% import duties on products from that country. According to customs data, gold is one of Switzerland’s main exports to the US.

“The prevailing opinion was that precious metals remelted by Swiss refineries and exported to the US could be shipped without paying duties,” said Christoph Wild, president of the Swiss Precious Metals Association. The decision to impose the duty is “another blow” to gold trading between Switzerland and the US, he believes.