The Federal Ministry of Finance, the Federal Bank of Germany, German banks and the National Bank of Ukraine will launch a program for Ukrainian refugees to exchange cash hryvnia for euros on May 24, the press service of the German Ministry of Finance said.

According to the report, the Federal Ministry of Finance and the Federal Bank of Germany have signed an agreement with the National Bank of Ukraine on the initial volume of exchange of 1.5 billion UAH.

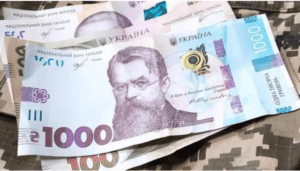

It is stated that refugees can exchange 100, 200, 500 and 1000 banknotes (up to 10 thousand hryvnias) for euros in German banks and savings banks participating in the program.

The conversion into euros takes place at the exchange rate published on the Bundesbank website (www.bundesbank.de/wechselkurse-ua), the report said.

The press service noted that the exchange will be registered in an online application submitted by the European Central Bank to ensure that the individual maximum amount of the exchange is not exceeded, for which the identity of each adult refugee wishing to participate in the exchange is recorded and verified.

It is specified that the exchange is initially possible within three months, and the losses resulting from the exchange are borne by the federal budget.

The Ministry of Finance of Ukraine at primary auctions on Tuesday, April 19, for the first time will offer buyers the full range of military bonds – both hryvnia and currency in dollars and euros.

According to the announcement of the Ministry of Finance, in particular, hryvnia military bonds with maturity in 6 months will be put up for auction. and 14 months, as well as 12 months. dollar bonds and 7-month. euro bonds.

Rates on these hryvnia bonds at the last auctions were respectively 10% and 11% per annum, on dollar bonds – 3.7%, and on euro bonds – 2.5% per annum.

As reported, the Ministry of Finance last week, at the seventh auctions for the placement of military bonds, was able to attract UAH 6.17 billion compared to UAH 0.96 billion a week earlier and UAH 3.33-4.88 billion in the previous three weeks. Currency notes were not offered last Tuesday.

The total volume of issuance of military bonds is up to UAH 400 billion. They can be bought by the National Bank, which has already purchased these securities under a separate procedure for UAH 40 billion.

At market auctions since March 1, their sales amounted to UAH 34.9 billion, $11.9 million and EUR143.4 million.

The European Commission (EC) put forward on Friday a proposal for the recommendation of the EU Council on the conversion of hryvnia banknotes into the currency of the member states hosting Ukrainian refugees. “This proposal complements the humanitarian assistance provided by the EU to those who flee Ukraine, in particular when they move through the territory of the union, and it is fully consistent with EU law on asylum and foreign policy,” the EC communique published in Brussels reads. The document says that since the beginning of Russia’s invasion of Ukraine, more than 3.8 million people have arrived in the European Union fleeing the fighting. One of the urgent needs of refugees is the conversion of their hryvnia banknotes into the currency of the host country. “Today’s proposal aims to promote a coordinated approach for all Member States to offer those fleeing Ukraine the same conditions for converting their hryvnia banknotes into local currency, regardless of the Member State they are in,” the statement said. European Commission. Brussels explains that this approach was necessary due to the fact that the National Bank of Ukraine was forced to suspend the exchange of hryvnia banknotes for foreign cash in order to protect Ukraine’s limited foreign exchange reserves. As a consequence, credit institutions in the EU Member States are reluctant to make the exchange due to the limited convertibility of hryvnia banknotes. Some EU Member States are considering introducing national schemes that support the conversion of a limited amount of hryvnia per person, and the aim of the Commission, as the communiqué suggests, is to consistently promote such schemes. These schemes should include a maximum limit of UAH 10,000 per person, and the duration of such schemes should be at least three months.

The hryvnia exchange rate on the interbank FX currency market weakened to UAH 28.005/$1 on Friday from UAH 27.860/$1 on the previous business day, dealers of commercial banks has told Interfax-Ukraine.

According to them, the quotes of the national currency at the close of trading amounted to UAH 27.995-UAH 28.015/$1.

According to the data of the National Bank of Ukraine, the hryvnia reference rate on the interbank FX market weakened to UAH 27.94/$1 on Friday from UAH 27.70/$1 on Thursday.

At the same time, the regulator weakened the exchange rate of the national currency for January 17 to UAH 27.9514/$1 from UAH 27.7372/$1 the day before.

Analysts at Bank of America (BofA) Global Research do not expect further nominal strengthening of the hryvnia, according to a June 14 BofA study.

The bank said that it is still constructive in relation to the International Monetary Fund (IMF), but the bank does not expect further nominal strengthening of the hryvnia, especially given the seasonality of the exchange rate in the third quarter, BofA said.

Ukrainian business has worsened expectations regarding a slowdown in inflation over the next 12 months to 7% from 5.1% in the middle of the year and the weakening of the hryvnia exchange rate to UAH 28.28/$1 from UAH 26.01/$1.

According to the results of a regular quarterly survey of business expectations of enterprises, conducted by the National Bank of Ukraine (NBU) from May 4 to June 4 this year, businesses more restrainedly expected an increase in production of goods and services in Ukraine in the next 12 months. Thus, almost 34.1% (10.4% a quarter earlier) of respondents expected a decrease in this indicator.

According to the survey, the business activity of Ukrainian enterprises decreased to the lowest index of business expectations since 2015 for the next 12 months, to 90.8% from 110.5% a quarter earlier.

It is noted that a decline in business activity is expected by enterprises of all types and areas of activity.

The poll shows that most companies do not expect changes in their financial and economic situation in the next 12 months, 22% of companies expect deterioration. The regulator noted that representatives of small and medium-sized businesses have more pessimistic assessments.

According to the report, the business expects a decrease in the total volume of sales of products, including in the external market. In general, growth in this indicator is predicted only by respondents from processing industry and trade, and the lowest estimates are in construction and mining enterprises.

According to the survey, for the third quarter in a row, the share of companies that predict a decrease in the number of employees at their enterprises has increased. In particular, the share of enterprises planning to cut staff in the next 12 months increased to 26.3% from 21% a quarter earlier. The respondents are pessimistic in all types of economic activity, except for construction, where the number of employees is predicted to remain unchanged.

At the same time, the number of companies planning to raise wages for their employees has significantly decreased over the next 12 months, to 36.5% from 63.4%.