In January-December 2025, Ukraine imported 138,410 tons of potatoes, which is 5.3 times (+431.3%) more than in 2024, when 26,050 tons were imported into the country, according to the State Customs Service.

According to published statistics, in monetary terms, potato imports increased 4.9 times (+391.9%) to $74.82 million compared to $15.21 million a year earlier. The main imports came from Poland (38.2%), Egypt (14.1%), and the Netherlands (10.8%).

Potato exports from Ukraine during the same period amounted to 2.38 thousand tons, which is 11.2% less than in 2024 (2.68 thousand tons). At the same time, despite the physical reduction in export volumes, in monetary terms, the sale of Ukrainian potatoes abroad was more profitable and brought in 3.1% ($584 thousand) more revenue than in 2024 ($566 thousand). The main buyers were Moldova (60.2% of all exports), Azerbaijan (35.4%), and Georgia (1.2%).

As reported, Ukraine had a poor potato harvest in the 2024 season due to drought, extremely high temperatures, and a lack of seed material.

Deputy Minister of Economy, Environment, and Agriculture Taras Vysotsky noted in a podcast by the Center for Economic Strategies that the 2025 vegetable harvest in Ukraine is sufficient and even larger than last year, so no shortage is expected in this sector.

Commenting on Ukraine’s potato imports in 2024-2025, Mykola Furdyga, director of the Potato Institute, explained that this record volume of imports was caused by the unusual weather conditions in 2024. Therefore, the state was forced to import potatoes to meet domestic food needs. European countries were eager to supply Ukraine with their products due to their attractive prices. At the same time, potatoes from Egypt did not dominate the market but occupied their traditional niche in the off-season (February-March – IF-U). In addition, Ukraine traditionally imports seed potatoes from leading breeding companies in the European Union.

Furdyga noted that since the beginning of the war, there has been a trend in Ukraine toward reducing potato cultivation in households and expanding production areas for this crop in farms and even in agricultural holdings. He explained this trend by the departure of the population from villages abroad and mobilization.

Ukraine increased tomato imports by 32.5% in 2025 compared to 2024, to 104,820 tons, according to the State Customs Service.

According to statistics, in monetary terms, tomato imports increased by 31.6% to $140.84 million.

The main imports of tomatoes in 2025 came from Turkey (82.3% of all supplies in monetary terms), Poland (7.3%), and the Netherlands (1.9%). A year earlier, Turkey accounted for 77.3%, Poland for 10.9%, and the Netherlands for 4.3%.

As reported, in July 2025, Ukraine introduced anti-dumping duties on imports of fresh tomatoes from Turkey at a rate of 26.9% for a period of five years.

US President Donald Trump announced his intention to raise tariffs on a number of goods from South Korea from 15% to 25%, linking this decision to the fact that, according to him, the country’s parliament had failed to fulfill its obligations under a previously agreed trade agreement. According to Reuters, Trump wrote on social media that the increased rates would apply to South Korean cars, lumber, pharmaceuticals, and other goods subject to “reciprocal tariffs.” However, the report did not specify when the increase would take effect.

The South Korean authorities were taken by surprise by the announcement and declared their commitment to implementing the agreements; emergency consultations were held in Seoul, and relevant officials are preparing to contact the American side.

Against the backdrop of the news, South Korea’s KOSPI index fell during trading, then reversed and closed higher, while the won weakened. Hyundai Motor and Kia shares ended the session lower after a more noticeable decline during the day.

We remind you that under the agreement reached in 2025, the tariff on imports of Korean cars and auto components to the US was previously reduced to 15% from 25% and came into effect on November 1

IMPORTS, SOUTH KOREA, TARIFFS, TRUMP, US

Uzbekistan has eliminated customs duties on imports of 82 types of raw materials and semi-finished products until January 1, 2027.

Zero rates for these types of products were first introduced in October 2021 and were valid until January 1, 2024.

The list includes, in particular: castor oil, asbestos, sodium hydroxide (caustic soda), dyes, artificial fur, artificial wax, ready-made adhesives, photo emulsion for textile printing, paper and cardboard, cotton fabrics, linen fabrics, fabrics made of artificial and synthetic fibers, glass fiber, glass fiber fabrics, loudspeakers, and others.

Measures to reduce customs duties were applied in order to support domestic manufacturing enterprises and increase exports of value-added products.

As a reminder, Uzbekistan previously extended zero customs duties for a number of food products and children’s clothing until January 1, 2027.

In addition, until January 1, 2031, special equipment, spare parts and components, raw materials and materials that are not produced in the country and are used in the technological processes of enterprises for the disposal of household, construction and medical waste, as well as the production of biodegradable polymer materials, are also exempt from customs duties.

Naftogaz Group increased electricity imports from Europe this week based on a government decision and with the aim of stabilizing the situation in the energy system, said Sergey Koretsky, chairman of the board of Naftogaz of Ukraine.

“The volume of imported electricity already covers more than 50% of the needs of all the Group’s enterprises, as provided for by the government’s resolution,” he said in a Facebook post on Saturday.

Koretsky explained that the corresponding amount of electricity has been allocated for the needs of domestic consumers.

“We are coordinating our actions with the government in order to stabilize the situation in the energy system as quickly as possible after the Russian shelling,” the chairman of the board of Naftogaz emphasized.

As reported, amid the deteriorating situation in Ukraine’s energy system due to massive Russian shelling of energy infrastructure, the government has instructed state-owned companies to increase electricity imports.

During the “Question Time to the Government” in the Verkhovna Rada on January 16, First Deputy Prime Minister of Energy Denys Shmyhal pointed out that, on behalf of the government, Naftogaz of Ukraine, Ukrzaliznytsia, and part of the industrial complex will import at least 50% of their electricity needs.

“This will make it possible to free up 1.5 MW for people’s needs. I hope this will happen in the coming days,” Shmyhal said at the time.

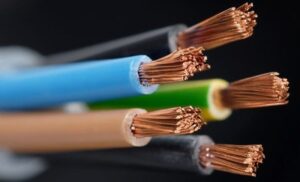

Imports of insulated wires and cables, including fiber optic cables, to Ukraine in 2025 increased by 24.3% compared to 2024, reaching $590.7 million, according to data from the State Customs Service.

The largest suppliers of wires and cables last year were Hungary ($153.4 million, or 26% of imports), China ($132.3 million, or 22.4%), and Poland ($94.4 million, or 16%). For comparison: in 2024, imports from Hungary amounted to $127.8 million, from Poland – $80 million, and from China – $75 million.

In December 2025, imports of these products decreased by 4.4% compared to December 2024, to $49.1 million.

According to the State Customs Service, in 2024, Ukraine increased imports of insulated wires and cables by 9.3% compared to 2023, to $475 million.