Naftogaz Group increased electricity imports from Europe this week based on a government decision and with the aim of stabilizing the situation in the energy system, said Sergey Koretsky, chairman of the board of Naftogaz of Ukraine.

“The volume of imported electricity already covers more than 50% of the needs of all the Group’s enterprises, as provided for by the government’s resolution,” he said in a Facebook post on Saturday.

Koretsky explained that the corresponding amount of electricity has been allocated for the needs of domestic consumers.

“We are coordinating our actions with the government in order to stabilize the situation in the energy system as quickly as possible after the Russian shelling,” the chairman of the board of Naftogaz emphasized.

As reported, amid the deteriorating situation in Ukraine’s energy system due to massive Russian shelling of energy infrastructure, the government has instructed state-owned companies to increase electricity imports.

During the “Question Time to the Government” in the Verkhovna Rada on January 16, First Deputy Prime Minister of Energy Denys Shmyhal pointed out that, on behalf of the government, Naftogaz of Ukraine, Ukrzaliznytsia, and part of the industrial complex will import at least 50% of their electricity needs.

“This will make it possible to free up 1.5 MW for people’s needs. I hope this will happen in the coming days,” Shmyhal said at the time.

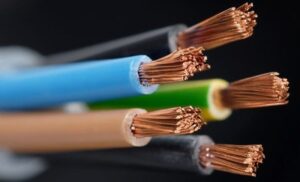

Imports of insulated wires and cables, including fiber optic cables, to Ukraine in 2025 increased by 24.3% compared to 2024, reaching $590.7 million, according to data from the State Customs Service.

The largest suppliers of wires and cables last year were Hungary ($153.4 million, or 26% of imports), China ($132.3 million, or 22.4%), and Poland ($94.4 million, or 16%). For comparison: in 2024, imports from Hungary amounted to $127.8 million, from Poland – $80 million, and from China – $75 million.

In December 2025, imports of these products decreased by 4.4% compared to December 2024, to $49.1 million.

According to the State Customs Service, in 2024, Ukraine increased imports of insulated wires and cables by 9.3% compared to 2023, to $475 million.

Imports of tin and tin products to Ukraine increased by 36.5% in 2025, reaching $4.352 million.

Tin exports, on the contrary, fell to $241,000 (compared to $389,000 in 2024).

In December, imports amounted to $290,000, exports — $89,000. Import growth was also observed in 2024 (+16.9%).

Tin is mainly used as a safe, non-toxic, corrosion-resistant coating in its pure form or in alloys with other metals. The main industrial applications of tin are in white tinplate (tinned iron) for the manufacture of food containers, in solders for electronics, in domestic piping, in bearing alloys, and in coatings of tin and its alloys. The most important tin alloy is bronze (with copper).

Tractor imports to Ukraine in 2025 amounted to $845.7 million, which is 7.9% more than in 2024 ($784 million), according to statistics from the State Customs Service.

According to the published statistics, tractors were mainly imported from the United States (21.2% of total imports of this equipment, or $179.7 million), Germany (17.1%, or $145 million), and China (16.9%, or $142.8 million), while last year Germany was the leader ($120.4 million), China was second ($105.3 million), and the Netherlands was third ($100.5 million).

At the same time, imports from other countries decreased by 17.4% last year to $378.3 million.

At the same time, in December 2025, tractor imports to Ukraine increased by 36.2% compared to December 2024, to $83.1 million, which is also 39.7% more than in November 2025.

Since the beginning of this year, as reported, tractor imports to Ukraine have shown negative dynamics: in January, they were one-third lower than in January 2024, and at the end of the first half of the year, the figures were almost equal to last year’s and continued to show positive dynamics.

According to statistics from the State Customs Service, last year, tractors worth almost $6.6 million were exported, mainly to Romania (20.4%), Belgium, and Germany, while the year before, exports amounted to $5.4 million, mainly to Moldova (26.5%), Kazakhstan, and the Czech Republic.

As reported, the volume of tractor imports to Ukraine in 2024 amounted to almost $784 million, 5.6% less than a year earlier, while exports amounted to $5.44 million compared to $5.74 million.

Ukraine reduced imports of nickel and nickel products by 2.7% in 2025, to $26.011 million.

Nickel exports more than doubled to $1.420 million (compared to $602,000 in 2024).

In December, imports amounted to $2.419 million, while exports amounted to $175,000. This decline in imports followed a sharp increase of 73.7% in 2024.

Nickel is used in the production of stainless steel and for nickel plating. Nickel is also used in the production of batteries, in powder metallurgy, and in chemical reagents.

Imports of electric generators and rotating electrical converters to Ukraine in 2025 increased 2.3 times compared to 2024, reaching $1.691 billion, according to data from the State Customs Service.

According to statistics, the largest suppliers of these products in 2025 were Romania (21.8%, or $369.2 million), the Czech Republic (17.9%, $301.8 million), and Poland (11%, $191.4 million). In 2024, China (17.7%, or $130 million), the Czech Republic (16.6%, $121.5 million), and Turkey (13.5%, $99 million) were the leaders.

In December 2025, imports of electric generators and converters fell by 30.6% compared to December 2024, to $177.5 million.

The State Customs Service also recorded a slowdown in growth rates during the year: in January 2025, imports exceeded the January 2024 figure by 8 times, and the high rate (about 7-7.5 times) continued until July, after which it began to decline.

Exports of electric generators from Ukraine in 2025 remained insignificant and amounted to $3.6 million (in 2024 – $1.7 million). The main destinations for supplies were the Czech Republic, Latvia, and Bulgaria; there were no exports in December.

As reported, at the end of July 2024, Ukraine exempted the import of electric generator equipment and batteries from customs duties and VAT. According to the State Customs Service, in 2024, imports of electric generators and converters amounted to $732.5 million, which is 3.7% more than in 2023.