Azerbaijan has suspended transport across the state border with Iran and closed its airspace at the border. Earlier, Azerbaijan accused Iran of launching drone strikes on the territory of the Nakhchivan Autonomous Republic and said it reserved the right to take appropriate measures. The Azerbaijani Foreign Ministry reported that one drone hit the Nakhchivan airport terminal, while another fell near a school building in the village of Shakarabad. Two civilians were injured in the attack, and the airport buildings were damaged.

The Azerbaijani Foreign Ministry demanded that Tehran provide an explanation as soon as possible, conduct an investigation, and take measures to prevent similar incidents from recurring. The Iranian ambassador was summoned to the ministry to receive a note of protest.

Against the backdrop of the incident, regional media and expert commentators are discussing the possibility of invoking the mechanisms provided for in the Shusha Declaration on Alliance Relations between Azerbaijan and Turkey. The document stipulates that in the event of a threat or act of aggression by a third state, the parties shall hold joint consultations and provide each other with the necessary assistance in accordance with the UN Charter.

At the time of publication, there was no official announcement of the start of formal consultations on the Shusha Declaration, but Ankara and Baku maintain constant coordination on regional security issues, including at the level of the foreign ministries.

Fuel prices in Ukraine on March 4, after yesterday’s increase amid the war in Iran, rose by another 2–3 UAH per liter per day, according to monitoring of offers from individual chains conducted by the Internet portal Energorforma.

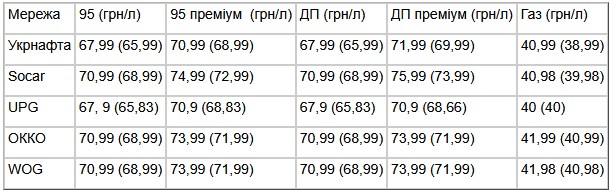

According to the monitoring, A-95 and DP are showing the following growth rates: their prices range from 67.99 UAH/liter to 70.99 UAH/liter. Premium gasoline brands cost from 70.99 UAH/liter to 74.99 UAH/liter, and diesel fuel costs from 71.99 UAH/liter to 75.99 UAH/liter.

As reported, fuel prices also jumped by 2-3 UAH/liter between March 2 and March 3.

For his part, the head of the parliamentary committee on finance, tax, and customs policy, Danylo Getmantsev, noted on his Telegram channel on Wednesday that the jump in fuel prices does not really depend on events in the Middle East, calling on gas station chains not to profit from consumer panic.

“I want to address the representatives of the fuel market… In a country where there is a war going on and half the country is running on generators, a powerful business like yours also has a certain social function that does not allow you to use panic to make super profits. Everyone understands that the jump in prices for the fuel you sell currently has a very limited causal link to the war in Iran, at least given the time lag,“ Getmantsev wrote.

”Come to your senses. Don’t force us to turn to the Antimonopoly Committee,” he added.

Fuel prices (average) as of the morning of March 4 compared to the morning of March 3 (based on the results of Energorforma’s monitoring of websites and network applications*).

It should be noted that not all networks publish prices on their websites and in their applications.

As reported, late in the evening on March 2, Sergey Kuyun, director of the consulting company A-95, predicted that fuel prices in Ukrainian networks could rise by 2-3 UAH per liter during the week amid the war in Iran, but there is no fuel shortage on the market, and none is expected in March.

Dmytro Petrenko, director of development at the UPG group of companies, also noted the absence of a shortage in a comment to Energorforma on Wednesday. According to him, the Ukrainian fuel market is capable of adapting to the most difficult conditions, which will allow it to avoid a shortage of resources amid the war in Iran, and it is too early to make predictions about prices.

The price of gold and other precious metals rose sharply on Monday due to the escalating conflict in the Middle East.

By 9:57 a.m. ET, April gold futures on the Comex exchange rose about 3.3% to $5,418 per ounce.

Silver futures rose 3.3% to $96.38 per ounce, and platinum futures rose 2% to $2,422 per ounce.

As reported, on Saturday, the US and Israel launched military action against Iran. They carried out more than a thousand missile strikes on Iranian cities, killing Iran’s supreme leader Ayatollah Ali Khamenei.

Iran launched retaliatory strikes against Israel and a number of Persian Gulf countries. In particular, residential areas of the capital of Bahrain were affected, and damage to a number of hotels and the airport in Dubai was reported.

Meanwhile, the price of aluminum on the London Metal Exchange jumped nearly 3% on Monday to $3,231 per ton. It is noted that Iran’s neighbors, including Saudi Arabia, the UAE, and Bahrain, are major aluminum producers. According to AZ China, the Middle East accounts for about 9% of global production of this metal.

Earlier, the Experts Club analytical center presented an analysis of the world’s leading gold-producing countries in its video on YouTube channel — https://youtube.com/shorts/DWbzJ1e2tJc?si=BywddHO-JFWFqUFA

EXPERTS CLUB, GOLD, IRAN, ISRAEL, USA

According to Fixygen, the escalation around Iran, including strikes by the US and Israel and Tehran’s subsequent response, has been a factor in increased volatility in the cryptocurrency market: Bitcoin fell below $64,000 on the news, while Ethereum fell even further.

At the same time, markets reassessed the risks to commodities and inflation expectations. In particular, Barclays allowed for Brent to rise to $80 per barrel in the event of significant supply disruptions amid tensions between the US and Iran. Against this backdrop, some investors shifted to defensive assets: some materials noted an increase in interest in tokenized gold amid a decline in BTC and ETH.

Possible scenarios: with further escalation and increased oil risks, the crypto market may remain in risk-off mode with increased volatility for longer; with de-escalation and a return of risk appetite, a rebound is likely; if sanctions and payment restrictions are expanded, demand for stablecoins may increase, but compliance risks for infrastructure will also grow.

The Ukrainian Foreign Ministry urges citizens to refrain from traveling to Israel and Iran due to the escalating security situation in the Middle East and the threat of missile attacks.

This was reported by the Consular Service Department of the Ukrainian Foreign Ministry on Facebook on Saturday.

Due to the escalating security situation in the Middle East and the threat of missile attacks, the Ukrainian Foreign Ministry recommends that Ukrainian citizens refrain from traveling to Israel until the situation stabilizes. It also reminds citizens of the current recommendation to leave Iran, which was announced in early January.

Citizens who are already in countries in the region are advised to remain vigilant, closely follow official reports, and always carry identification documents with them.

The US virtual embassy in Iran has urged US citizens to “leave Iran now” if possible and to have a plan to leave independently, without expecting assistance from the US government.

The published warning notes that heightened security measures continue in the country, with road closures, public transport disruptions, and internet blockages. It also points to communication restrictions, including access to mobile and landline networks, and that airlines continue to restrict or cancel flights to and from Iran.

US citizens are advised, if safe to do so, to consider leaving by land, including via Armenia or Turkey, and to make alternative communication arrangements in advance in light of possible internet shutdowns.

The US State Department maintains a Level 4 – Do Not Travel advisory for Iran and separately emphasizes that there is no US embassy in the country and consular assistance is limited; Switzerland acts as the protecting power.