The National Bank of Ukraine (NBU) has relaxed the harmonization procedures in the field of licensing banks, in particular, approaches to monitoring the financial condition of legal entities and the property status of individuals who are substantial owners of the bank, the regulator’s press service said on Tuesday.

The relevant changes were approved by NBU Board resolution No. 66 dated May 25, 2020 on approval of changes to the regulation on licensing banks, which was posted on the website of the central bank and comes into force on May 27, 2020.

According to the document, the National Bank has reduced the amount of information that the substantial owner of the bank must provide annually. In particular, from now until February 1, such individuals will have to submit a written assurance of the absence of grounds for the deterioration of their property status or signs of unsatisfactory financial condition, which must meet the requirements stipulated in the banks licensing regulations.

Thus, in 2020, substantial owners of banks will not submit documents stipulated in the regulation within their annual assessment of financial or property status, the NBU said.

According to the document, now, in order to recognize a satisfactory financial or property status, it is enough to have no signs of unsatisfactory financial condition for legal entities and to maintain solvency for individuals.

“The National Bank has also developed forms of documents for calculating the size of equity and analyzing the financial condition of a legal entity, conducted by an auditor or adviser. This approach will contribute to the implementation of common standards,” the central bank said.

The mentioned forms of documents will be posted on the NBU website.

In addition, the regulator clarified the coordination of bank leaders and informing about the opening of a separate division. “Innovations will help reduce technical procedures and carry out an in-depth analysis of processes,” the central bank said.

In addition, the National Bank updated the methodology for assessing the financial or property status of substantial owners, which, in the opinion of the regulator, will help improve the substantive analysis in the implementation of these procedures.

The NBU also clarified the procedure for coordination of bank managers and heads of internal audit units. So, the regulator will be able not to conduct testing of candidates, if during the year it already tested them for approval in equivalent positions in the same or another bank.

At the same time, if the candidate was refused approval for the position of the head of the bank or the head of the internal audit unit based on the results of the testing, re-appointment to the position in this or another bank is possible no earlier than six months later.

In addition, the National Bank clarified the procedure for informing the bank about the opening of a separate division and reduced the list of documents necessary for this. In particular, now banks need to submit only the economic justification for opening a separate division to the regulator. “This will help to reduce the workflow and speed up the process of registration of structural units,” the NBU said.

The net international reserves of the National Bank of Ukraine (NBU) in April increased by 4.7%, to $16.83 billion after a decrease of 9.4% in March, according to the regulator’s website. According to the report, in general for the four months of 2020, the National Bank’s net international reserves increased by 6.6%, or by $1.04 billion.

As reported, the net purchase of foreign currency by the central bank in the interbank foreign exchange market in April amounted to $678.8 million, while in March it spent $2.2 billion to support the hryvnia.

Net international reserves are calculated as the excess of foreign exchange reserves over the liabilities of the National Bank in foreign currency.

The National Bank of Ukraine (NBU) in April 2020 bought $723.3 million, while sold $44.5 million in the interbank foreign exchange market, while in March it spent $2.2 billion on supporting the hryvnia. According to the NBU, in the period from April 27 to April 30, the regulator bought $115.5 million at a single rate in the interbank market, which is four times more than a week earlier. This week, the central bank was only buying currency.

Most of all, in March the National Bank bought in the interbank market from April 6 to April 10 ($327.7 million), and only that week it sold foreign currency ($44.5 million).

In general, since the beginning of the year, the central bank bought $2.069 billion for reserves and sold $2.793 billion.

This week, the national currency rate in the interbank market strengthened and reached UAH 26.945/$1 on Wednesday, after which it slightly weakened on Thursday to UAH 26.955/$1. Starting from April 2, the hryvnia exchange rate did not fall below the level of UAH 27.5/$1, stabilizing after a rapid fall in March.

The Board of the National Bank of Ukraine has decided to cut the key policy rate from 10% to 8%, the NBU said in a statement on Thursday.

“Together with other measures taken by the NBU, such as expanding its set of liquidity support tools and the introduction of preferential terms for borrowers by banks, this will provide the economy with the impetus required to provide support for households and businesses in these difficult times, and to ensure that business activity picks up quickly once the quarantine is lifted,” the NBU said.

The NBU expects that the key policy rate to be reduced further, to 7% in the current year.

“In deciding how quickly the key policy rate can be decreased to that level, the NBU will take into account how talks with the IMF progress, how the coronavirus pandemic develops, how quickly quarantine measures are lifted, and what anti-crisis measures other governments and central banks adopt,” the central bank said.

The NBU leaves open the possibility of a greater easing in monetary policy if a fall in consumer demand due to quarantine measures and weaker business activity put stronger downward pressure on inflation than is currently expected.

The National Bank of Ukraine (NBU) reduced its property portfolio by 7.7%, to 455,700 square meters in 2019, which allowed saving more than UAH 10 million, according to the NBU’s annual report.

According to the report, to achieve the goals of the NBU’s property management strategy for 2019-2025, it is necessary to reduce the real estate package by another 12.2%, to 400,000 square meters by 21 facilities selling at auction, via privatization and free transfer to other government agencies.

The NBU said that the portfolio was reduced by 34 buildings and structures and six land plots in 2019, at the end of the year it included 409 facilities, namely, some 75 land plots, some 334 buildings and engineering structures.

The National Bank received repayment of debt on non-performing loans of banks and manages 36 land plots with a total area of 112.5 hectares received as debt payment and seven real estate facilities with a total area of 44,700 square meters.

According to the report, the central bank received such property worth UAH 218 million in its ownership in 2019 compared to UAH 85 million in 2018, while its sale as collateral amounted to UAH 181 million and UAH 6 million, respectively.

As reported, in 2019, the National Bank approved the NBU’s property management strategy for 2019-2025, which aims at optimizing the property of the regulator and ensure its effective use.

The NBU’s press service told Interfax-Ukraine that the regulator since 2015 has been disposing property that is not used. Within this period, the central bank transferred 50% of the property to the control of other bodies and ensured its disposal by sale and via privatization, including eight complexes of administrative buildings in the regions, seven social facilities, five garage complexes and a fire station.

“This has saved millions of public funds on the maintenance of property,” the NBU said.

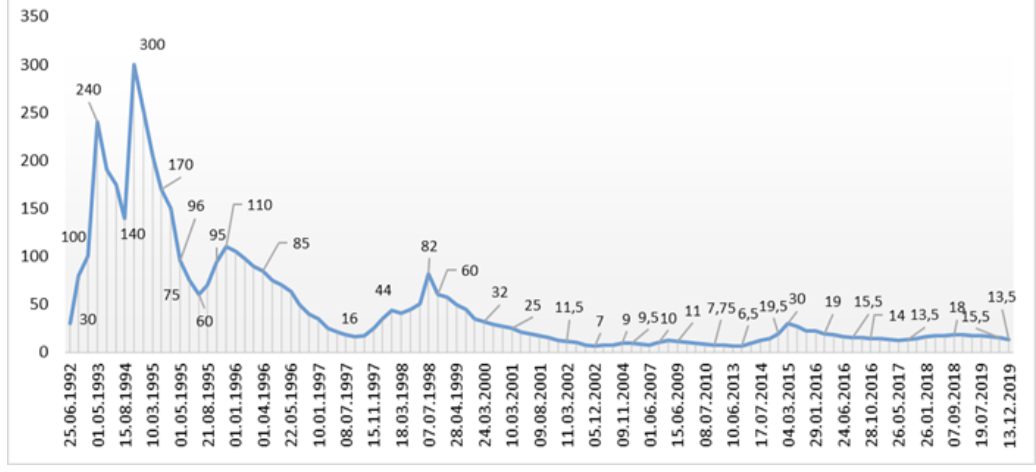

Dynamics of changes in discount rate of National bank of Ukraine