The number of banks expecting an increase in the volume of their loan portfolio over the next 12 months amounted to 78% for the corporate segment and 82% for lending to the population, according to the results of a survey conducted by the National Bank of Ukraine (NBU) on the conditions of bank lending.

“The survey participants positively assess the prospects for lending in the next 12 months: 78% of respondents predict the growth of the loan portfolio of corporations, 82% of households. These are the highest estimates of the growth of the loan portfolio of the population since 2015, however, some large banks expect a certain deterioration in its quality,” the review says.

According to the report, the optimism of the respondents regarding the further increase in funding has grown, in particular, 77% of respondents expect an increase in household deposits, 78% – funds of enterprises.

The banks note that despite expectations of the introduction of new quarantine restrictions, the demand for loans increased from business and the population, in particular, the demand for mortgages was the highest in the entire history of observations.

It is indicated that in January-March 2021, the demand for business loans increased, primarily for loans to SMEs, in hryvnias and long-term loans.

The main factors behind the revival of demand are still cited by banks as a decrease in interest rates, the need of enterprises for capital investments and working capital, as well as debt restructuring.

The banks explain the softening of the creditworthiness for business by the high level of liquidity, increased competition with other banks, as well as improved expectations regarding the overall economic activity and the development of certain industries, primarily for SMEs.

According to the survey, almost a quarter of the surveyed respondents noted an increase in the level of approval of applications for business loans and easing requirements for the size of the loan.

It is indicated that 92% of financial institutions rated the debt burden of household borrowers as average, and more than 80% of financial institutions also rated the debt burden of corporate borrowers.

The survey was conducted from March 19 to April 9, 2021 among credit managers of 23 banks, whose share in the total assets of the banking system of Ukraine is 88%.

The single counterparty exposure limit (H7, should be no more than 25%) as of March 1, was violated by Prominvestbank (82.02%), Sberbank (50.23%) and Industrialbank (49.51%), according to the website of the National Bank of Ukraine (NBU).

According to the regulator, the related party transactions exposure limit (H9, should not exceed 25%) was violated by First Investment Bank (52.02%), Unex Bank (28.17%), Megabank (27.56%) and Land Capital Bank (26.75%).

The limit on bank total long open FX position (L13-1, should be no more than 10%) was violated by Oschadbank (129.99%), Prominvestbank (114.57%), PrivatBank (95.74%) and Industrialbank (12.35%).

The limit on bank total short open FX position (L13-2, should be no more than 10%) was violated by Prominvestbank (110.36%).

FIRST INVESTMENT BANK, INDUSTRIALBANK, LAND CAPITAL BANK, MEGABANK, NBU, OSCHADBANK, PRIVATBANK, PROMINVESTBANK, REQUIREMENTS, SBERBANK, UNEX BANK, VIOLATE

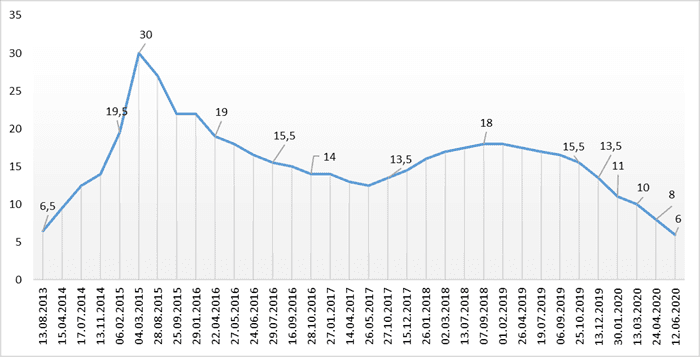

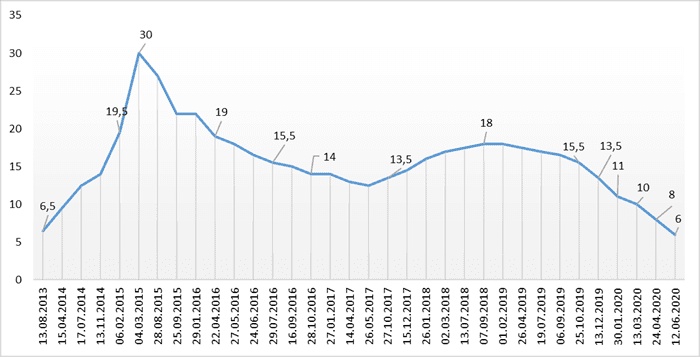

Dynamics of changes in discount rate of NBU.

NBU

The National Bank of Ukraine (NBU) on January 26 made a decision to revoke the banking license and liquidate Misto Bank (Odesa), according to the regulator’s website on Wednesday.

“The NBU, at the suggestion of the Deposit Guarantee Fund, made a decision dated January 26, 2021 No. 25-RSh to revoke the banking license and liquidate Misto Bank,” the message said.

As reported, on December 14, the NBU classified Misto Bank as insolvent due to a decrease in capital ratios by 50% or more from the minimum established level due to the loss of one of its main assets – a soybean processing plant in Kherson region, with a book value of over UAH 271 million, or almost 17% of all bank assets.

Misto Bank was founded in 1993. According to the NBU, as of January 1, 2020, the main shareholders of the financial institution were Fursin, who directly and indirectly owned 97.180668% of the bank’s shares, and Latvian citizen Igor Buimister with 1.811499%.

As of October 1, 2020, the bank ranked 53rd in terms of total assets (UAH 1.498 billion) among 74 banks operating in the country, the press service of the central bank said on Monday.

Dynamics of changes in discount rate of NBU.

NBU

The National Bank of Ukraine (NBU) has excluded from the State Register of Financial Institutions such companies as׃ Credit Institution Credit Commerce LLC, Financial Company Monopolium Finance LLC, Finance and Credit Group Chaika LLC on the basis of their applications.

As reported on the regulator’s website, the relevant decisions were made by the NBU Committee on Supervision and Regulation of Non-Bank Financial Services Markets at a meeting on December 11, 2020.

According to the NBU, Credit Commerce had one license to issue loans, financial loans as well. As of September 30, 2020, the volume of assets of this institution was UAH 10.7 million, or 0.006% of the total assets of financial companies.

Monopolium Finance had three licenses: for the provision of guarantees and sureties, loans, financial loans, as well as factoring services. The licenses were revoked at a committee meeting on November 20. The company’s assets amounted to UAH 403.9 million, or 0.2% of the total assets of financial companies.

Finance and Credit Group Chaika had one license for issuing loans, including financial ones. The license was revoked on July 30, the volume of assets is UAH 5.9 million, or 0.003% of the total assets of financial companies.