The National Bank of Ukraine (NBU) plans to reduce the number of coins to six and the number of banknotes also to six by autumn 2023, Deputy NBU Governor Oleksiy Shaban has said.

“We see that in two years there will be six coins and six bills,” he said during a press briefing in Kyiv on Wednesday.

Currently, there are banknotes in circulation in Ukraine in denominations of UAH 1, UAH 2, UAH 5, UAH 10, UAH 20, UAH 50, UAH 100, UAH 200, UAH 500 and UAH 1000 and coins in denominations of 10, 25 (until October 1, 2020) and 50 kopecks and UAH 1, UAH 2, UAH 5 and UAH 10.

State-controlled bank PrivatBank in January-July 2020 continues to top the list of profitable Ukrainian banks with a financial result of UAH 16.2 billion, while the largest loss since April 2020 has been recorded by state-owned Ukreximbank (UAH 2.24 billion), according to data posted on the website of the National Bank of Ukraine (NBU).

According to the report, the second position in the list of the most profitable Ukrainian banks continued to be occupied by Oschadbank (UAH 4.32 billion), the third by Raiffeisen Bank Aval (UAH 2.46 billion). The fourth is still FUIB (UAH 1.5 billion), the fifth is OTP Bank (UAH 908.94 million), which climbed two steps, having received UAH 319.78 million of net profit in July.

In terms of losses in July, the list did not change: in the seven months of 2020, Prominvestbank ranked second (PIB, UAH 330.93 million), Credit Dnipro Bank ranked third (UAH 184.42 million), Pravex Bank ranked fourth (UAH 99.86 million), BTA Bank ranked fifth (UAH 67.17 million), according to the central bank’s statements.

In the seven months of 2020, solvent banks in Ukraine received UAH 28.39 billion of net profit, which is 23% less than in the same period of 2019 (UAH 36.73 billion).

During this period, 58 out of 75 banks operating in Ukraine were profitable, according to the NBU data.

According to the regulator’s statistics, in the seven months of 2020 in terms of total assets PrivatBank retained the first place in the rating (UAH 585.21 billion), Oschadbank ranked second (UAH 275.82 billion), Ukreximbank ranked third (UAH 239.05 billion), Ukrgasbank ranked fourth (UAH 163.13 billion), and Raiffeisen Bank Aval ranked fifth (UAH 104.17 billion).

The National Bank of Ukraine (NBU) maintains its forecast for the grain harvest in 2020 at 72 million tonnes, Deputy Governor of the NBU Dmytro Sologub has said.

“The harvest is basically at the level of last year, the area planted with early crops was slightly less than last year, because more corn was sown, but the yield is almost in line with last year … We keep the estimate for this year’s harvest, respectively, at the level of 72 million tonnes,” he said during a press briefing of the National Bank.

He noted that the NBU also does not see a significant decrease in grain exports in comparison with the forecast.

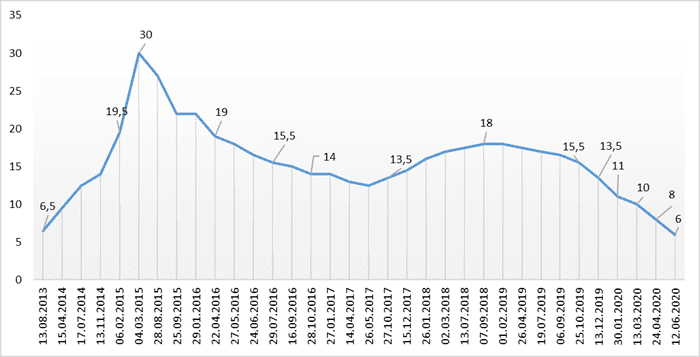

Dynamics of changes in discount rate of NBU

NBU

Ukrainian President Volodymyr Zelensky has held a phone conversation with Managing Director of the International Monetary Fund (IMF) Kristalina Georgieva to inform her about his plans to nominate a candidate for governor of the National Bank of Ukraine (NBU) by the end of the week.

“Informed Kristalina Georgieva that by the end of the week I will have a new candidate for Head of the NBU for Parliament’s approval. It will be an independent technocrat, who will continue the Bank’s independent course. I make all my decisions only in the interests of the Ukrainian people,” the head of state said on Twitter on Tuesday.

The Financial Stress Index (FSI) in April fell and reached 0.2 points by the end of the month after a bounce to 0.3 in March, the National Bank of Ukraine (NBU) said in a weekly bank survey posted on its website on Wednesday.

According to the document, corporate and banking sub-indices are declining, and the latter, in particular, due to a drop in the yield of securities.

The National Bank said that at the end of April the outflow of hryvnia-pegged time deposits and foreign currency funds of the population stopped. The regulator added that the hryvnia funds of Ukrainians have been at maximum levels for the second week since the beginning of March, and only foreign currency time deposits of the population are still declining.

According to the report based on the data from 22 largest banks, from April 27 through April 30, the hryvnia funds of individuals maintained stable growth of 0.3%, and that of business entities of 0.9%. Foreign currency funds of individuals for the same period increased by 0.2%, and business entities’ decreased by 0.1%, compared with the previous week.

The regulator said that the portfolio of foreign currency loans issued to small and medium-sized enterprises in April markedly worsened, in particular, from the beginning of April, the share of hryvnia loans overdue over a week in the portfolios of banks increased from 25.8% to 30.9%, and foreign currency loans – from 30.7% up to 38.3%.

The National Bank also said that at the beginning of May the share of working bank branches increased from 75.5% to 77.3%, and that of ATMs – from 95.8% to 96.3%.