The international reserves of Ukraine as of September 1, 2021, according to preliminary data, amounted to $31.614 billion (in equivalent), which is 9.2% more than at the beginning of August this year ($28.951 billion) according to the data of the National Bank of Ukraine (NBU).

“As of September 1, 2021, Ukraine’s international reserves, according to preliminary data, amounted to $31.614 billion (in equivalent). This volume of reserves is a record over the past nine years … In August, the reserves increased by 9.2% due to, first of all, the receipt of funds in the amount of 1.928 billion special drawing rights (SDR) within the general allocation from the IMF,” the report says.

As the National Bank notes, the dynamics of the August reserves was affected by the operations of managing the state debt: the total volume of payments for servicing and repaying the state and state-guaranteed debt in foreign currency amounted to $ 188 million (in equivalent).

It is specified that $ 33.7 million was spent on servicing and redeeming external bonds, $ 18.2 million – on servicing and redeeming government domestic loan bonds, the rest – for fulfilling other government obligations in foreign currency.

At the same time, in August, foreign exchange receipts in favor of the government amounted to $ 8.8 million (in equivalent).

The dynamics of reserves was also influenced by the operations of the NBU in the interbank market. In particular, the central bank replenished its reserves by $ 348.3 million due to the fact that for most of August supply on the market prevailed over demand.

In addition, the dynamics of the indicator was influenced by the revaluation of financial instruments: last month their value decreased by $ 31.6 million (in equivalent), according to the National Bank.

The regulator noted as of September 1, 2021 the volume of international reserves covers 4.4 months of future imports – this is enough to fulfill the obligations of Ukraine, the current operations of the government and the NBU.

In addition, the NBU clarified that Ukraine’s net international reserves in August increased by $ 2.836 billion, or 15.3%, to $ 21.364 billion.

The National Bank of Ukraine (NBU) in the updated Inflation Report published on the website again worsened the estimate of the growth of Ukraine’s gross domestic product (GDP) in the second quarter of 2021 (hereinafter compared to the same period in 2020), to 7.5% from 8.7% in April and from 11.3% in the January report.

The negative impact of last year’s low harvest on exports, the food industry and agriculture (in particular, livestock farming due to a decrease in profitability as a result of higher prices for feed) remained. The negative conditions influenced agriculture and a later start of the harvesting (one week later), the National Bank said, explaining the deterioration of the assessment.

The NBU also revised its forecast for GDP dynamics in the second half of this year. If in April he expected economic growth in the third and fourth quarters, respectively, by 4.2% and 3.6%, now – by 3.6% and 5.8%.

“The key risks to the macroeconomic forecast are the imposition of stricter quarantine measures in Ukraine and globally, and a longer and more pronounced than expected surge in global inflation,” the National Bank said.

As reported, in general, the NBU confirmed the forecast for GDP growth for 2021 at 3.8% and for 2022-2023 at 4%.

According to the report, the central bank expects the economy to expand by 6.7% in the first and second quarters of next year, slowing to 2.8% in the third and to 1% in the fourth quarters.

Travel services imports, which fell sharply in 2020 due to the pandemic, will grow by almost 1.5 times this year, to almost $7 billion, Deputy Governor of the National Bank of Ukraine (NBU) Yuriy Heletiy said in an interview with Interfax-Ukraine.

“Travel services imports will not reach pre-crisis levels this year, but there will be an increase compared to the last year, when international travel was restricted due to lockdowns. We forecast an increase this year to nearly $7 billion from $4.7 billion in 2020, and it will exceed the pre-crisis level in the next year,” he said.

Earlier, the National Bank estimated travel services imports in 2019 at $7.5 billion.

At the same time, Heletiy said that the growth of remittances of labor migrants continues, which did not stop even the last year, and following the five months of this year amounted to 11%.

“According to our forecast, remittances of labor migrants this year will increase by 11%, to about $13.3 billion due to the economic recovery of the countries of destination of labor migrants and simplification of border crossing conditions due to the acceleration of vaccination rates,” the NBU Deputy Governor said.

The number of banks expecting an increase in the volume of their loan portfolio over the next 12 months amounted to 88% for the corporate segment and 79% for lending to the population, according to the results of a survey conducted by the National Bank of Ukraine (NBU) on the conditions of bank lending.

“In the next 12 months, 79% of respondents predict an increase in the loan portfolio of households, 88% – corporate portfolios. The share of banks that expect an increase in the loan portfolio of enterprises is the largest in the entire history of observation. 67% of financial institutions predict an increase in funding due to an increase in funds of both population and corporations,” the central bank said in a review on its website on Friday.

In addition, in the second quarter, half of the respondents noted an increase in demand for both consumer lending and mortgages.

In the second quarter, survey participants noted a moderate increase in liquidity risk, credit and interest rate risks, while in the next three months banks expect further growth in credit risk, simultaneously with a decrease in interest rate risk and liquidity risk.

More than 80% of banks consider the total debt burden to be medium, in addition, for large enterprises it is higher when compared with SMEs.

In the next quarter, financial institutions forecast the largest easing of hryvnia business lending standards since 2013. In particular, in mortgage loans, due to positive expectations of the prospects for the real estate market, and in consumer loans due to positive expectations of consumer solvency and general economic activity, as well as competition with other banks and nonbank financial institutions.

The National Bank of Ukraine (NBU) has revised its 2021 inflation forecast from 8% (in its April forecast) to 9.6%, and expects that inflation will return to 5% in H2 2022.

“With global prices surging and demand recovering further, the NBU has revised its 2021 inflation forecast from 8% to 9.6%. After peaking in the fall of this year, inflation will begin to slow as the new harvest arrives and global energy prices adjust… inflation in H2 2022 will decline to its 5% target and remain there going forward,” the NBU said on its website on Thursday.

Inflation will soon rise to slightly above 10%, but it will weaken at the end of 2021 and return to its 5% ± 1 pp target range in H2 2022.

The rise in inflationary pressure, including its fundamental component, is also driven by the dynamic recovery of the economy, as evidenced by monthly and other high-frequency indicators. By tightening its monetary policy, in particular through raising its key policy rate and rolling back its emergency monetary measures, the NBU will also keep inflation expectations under control and gradually reduce underlying inflationary pressures.

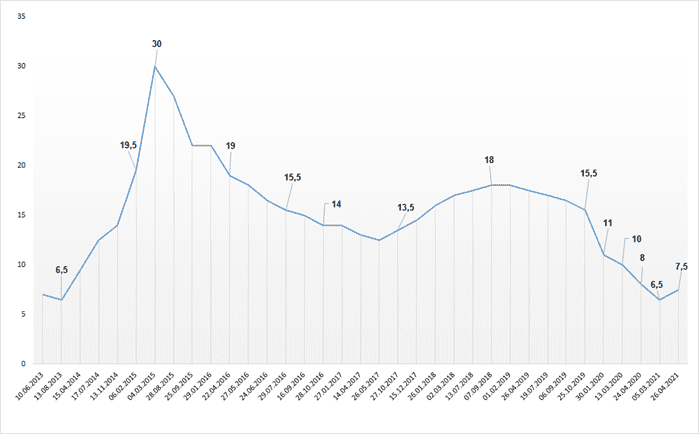

DYNAMICS OF CHANGES IN DISCOUNT RATE OF NBU