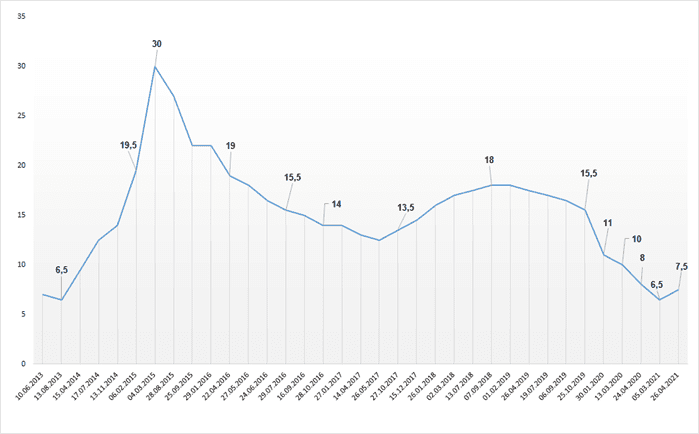

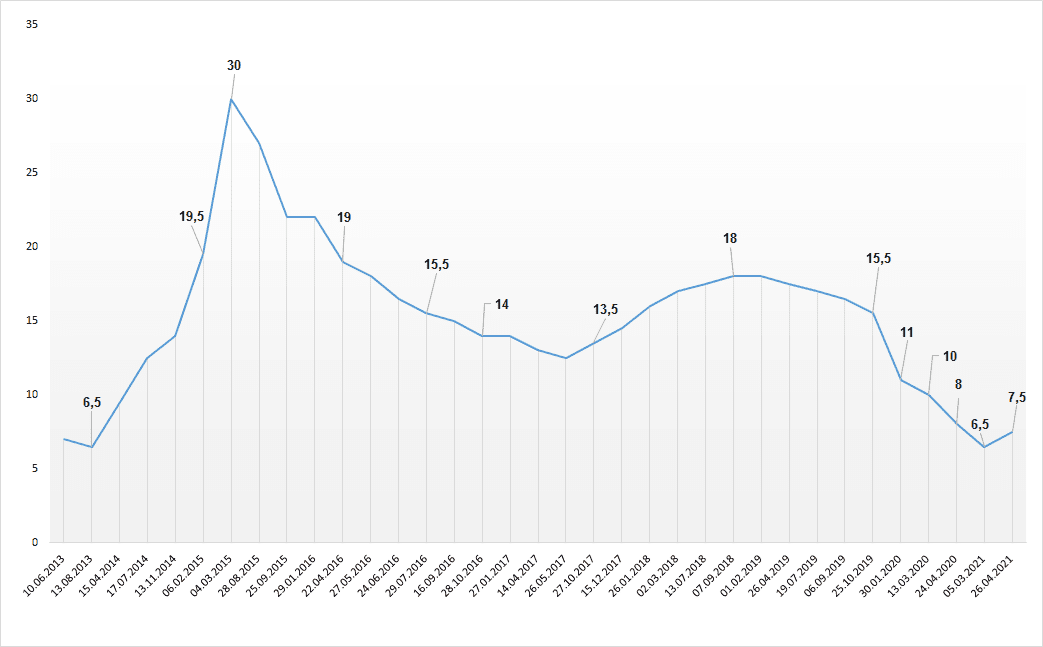

DYNAMICS OF CHANGES IN DISCOUNT RATE OF NBU

The net supply of foreign currency from the Ukrainian population since the beginning of the year amounted to $1.6 billion, Head of the Council of the National Bank of Ukraine (NBU) Bohdan Danylyshyn has said.

“In the segment of foreign exchange transactions of individuals, the supply of foreign currency continues to prevail over demand. In particular, since the beginning of June, the net sale of foreign currency by individuals (in cash and non-cash form) has exceeded $300 million, and since the beginning of the year amounted to almost $1.6 billion,” he wrote on Facebook.

As reported, the net supply of foreign currency by the population of Ukraine in March amounted to $182 million, and in April – $422 million.

The Council of the National Bank of Ukraine (NBU) at a meeting on June 23 called on the NBU Board and the Cabinet of Ministers to speed up the drafting of bills on the regulation of cryptocurrencies, NBU Council Head Bohdan Danylyshyn has said.

“The NBU Council, in particular, decided to approve the recommendations […] to the NBU Board and the Cabinet of Ministers in order to minimize the risks of macro-financial stability in connection with the spread of transactions with virtual assets, and to accelerate the preparation of legislative acts on the regulation of the market of virtual assets and transactions with them,” the head of the Council wrote on Facebook on Wednesday.

According to Danylyshyn, the Council also recommended the NBU Board to analyze the impact of the spread of transactions with virtual assets on the activities of central banks, in particular, on the monetary and financial stability polices, the development of payment technologies and the emergence of new regulatory processes (RegTech).

The cost of housing in Kiev and the purchasing power of the population are growing at a commensurate pace, and the ratio of price to annual income is at the lowest level over the past 10 years, according to the Financial Stability Report of the National Bank of Ukraine (NBU).

“Although the cost of housing is growing, it still remains affordable in terms of relative indicators. Prices and incomes of the population are growing commensurately. In the first quarter of 2021, purchasing activity in the housing market was almost a tenth higher than the five-year average for the first quarter,” the NBU said in the report.

According to the forecast, the growth of household incomes, the gradual recovery of mortgages and a decrease in the profitability of deposits will stimulate the growth of demand for housing. At the same time, the long-term implementation of the reform of urban planning control can reduce the number of new supply, which, in turn, affects the rise in prices: in April 2021, the growth of prices in Kiev exceeded 10% per year.

According to the NBU, in January-May 2021, Ukraine issued 213 building permits and 253 certificates for the commissioning of new apartment buildings. In addition, over the past year, only half of the permit applications have been approved.

“The average annual ratio between permits and certificates is about 3 to 4, which is a rather low indicator in comparison with the international level and may indicate a slow pace of new housing construction in the future,” the National Bank said.

DYNAMICS OF CHANGES IN DISCOUNT RATE OF NBU

All ten members of the the Monetary Policy Committee (MPC) of the National Bank of Ukraine (NBU) following the meeting on April 14, spoke in favor of raising the discount rate by 1 percentage point (p.p.), to 7.5% per annum in order to bring inflation to the target.

“The MPC members unanimously supported the increase in the discount rate to 7.5%, which is necessary for a gradual slowdown in inflation and its return to the target of 5% in the first half of 2022,” the NBU said in a statement.

According to the document, the participants in the discussion agreed that the forecast trajectory of inflation exceeding expectations, high inflationary expectations, as well as increased inflationary risks on the horizon of monetary policy require a decisive response from the National Bank.

The MPC several members said that temporary shocks related to the rise in fuel and food prices have largely been implemented, and therefore their impact will gradually weaken.

It is noted that the market’s reaction to the increase in the discount rate in March indicates its readiness of the market to perceive the signals of the National Bank, in particular, since the beginning of April, most rates on deposits of various maturities have stopped decreasing, and some of them have slightly increased.

The committee’s members expect that the current increase in the key rate will strengthen the transmission momentum through the interest rate channel, which will first affect interbank rates and rates on corporate deposits of banks, and from the middle of the year – on the profitability of deposits for the population, which will affect the reorientation of part of consumer demand in favor of deposits in banks and, accordingly, will contain its pressure on inflation.

One of the participants in the discussion noted the growth of bank savings of citizens due to the decrease in spending on tourism and certain types of services, access to which was complicated by lockdown.

According to this member, the high liquidity surplus in the banking system weakens the effectiveness of the monetary transmission mechanism: there is no urgent need for banks to strengthen the price competition of deposit resources.

At the same time, another participant in the discussion said that despite the increase in the discount rate, the NBU monetary policy remains soft, since, given the increased inflationary expectations, the level of the neutral discount rate is now from 9% to 9.5%.

He said that if the situation develops according to the basic scenario of the macro forecast, the transition of the National Bank to a neutral monetary policy will take place only in late 2021 or early 2022.

At the same time, he said that the baseline scenario provides for the resumption of cooperation with the IMF in the summer and does not imply an aggravation of the military conflict.

Most of the participants in the discussion believe that the decisions to increase the discount rate in March and April are sufficient to bring inflation to the 5% target in the first half of 2022. At the same time, several participants in the discussion said that inflationary pressures may be underestimated due to the high level of uncertainty, so they did not rule out the need to continue the cycle of increasing the discount rate.

The NBU press service said that the meeting was attended by all ten members of the MPC, including NBU Governor Kyrylo Shevchenko; First Deputy Governor Kateryna Rozhkova; Deputies: Yuriy Helety, Yaroslav Matuzka, Dmytro Solohub and Oleksiy Shaban, as well as department directors: Vitaliy Vavryschuk (financial stability); Volodymyr Lepushynsky (monetary policy and economic analysis); Oleksiy Lupin (open markets) and Yuriy Polovniov (statistics and reporting).