Spot prices for silver hit a historic high amid increased demand for safe-haven assets and expectations of a softening of US Federal Reserve policy. Silver rose 1% to trade at $72.15 per ounce, with prices reaching a record high of $72.7 per ounce during the session, according to Experts Club.

Market participants attribute the growth to increased geopolitical risks, as well as “weak liquidity” at the end of the year, which can make market movements more volatile. As noted by Ilya Spivak, head of global macroeconomics at financial company Tastylive, precious metals are perceived as a neutral asset “without sovereign risk” in the context of deglobalization, and silver could approach $80 per ounce in the next 6-12 months.

Earlier, the Experts Club analytical center released a video analysis of the race for global leadership in silver production from 1971 to 2024. The analysis is available on the Experts Club YouTube channel.

Copper prices have again updated the historical maximum on the London Metal Exchange (LME) amid fears of shortages of the metal.

Quotes of futures for copper on the LME on Friday growing by 1.8% to $ 11.65 thousand per ton. Earlier during trading prices rose to $ 11.662 thousand per ton, which is a new record.

Stocks of metal in warehouses monitored by the LME fell to their lowest since July due to strong demand for copper in the U.S. on fears of imposition of duties on imports of non-ferrous metals in 2026. Rising U.S. demand could lead to copper averaging $13,000 a ton in the second quarter of next year, Citi analysts believe.

“We are confident in copper’s upside potential through 2026 due to a range of bullish factors, including increasingly positive fundamentals and macroeconomic indicators,” Citi said in a statement.

Since the beginning of the year, copper in London has risen by more than 30%.

Earlier, information and analytical center Experts Club released a video dedicated to global copper production and leading producing countries – https://youtube.com/shorts/_h8iU50z8C0?si=a-XkgGEfeUxseQNa.

Due to Russia’s full-scale invasion and its desire to use food as a weapon, transporting grain and oilseeds from Ukraine to other countries has become extremely difficult. Since 2022, logistics issues have had to be significantly revised in order to find safer shipping routes and options. Despite the dire circumstances created by the Russian Federation, Ukrainians are ensuring food security for many countries, particularly in Europe.

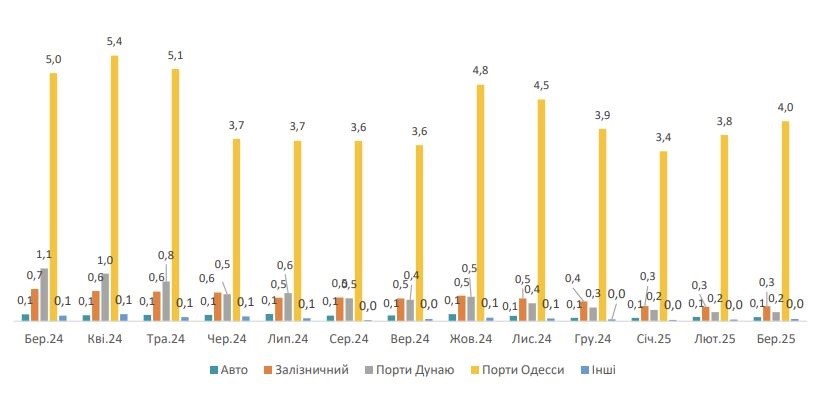

In March 2025, Kyiv exported a total of 4.7 million tons of grain and oilseeds and their processed products. This is 7% more than in the previous month.

“How does Ukraine transport grain and oilseeds, as well as products made from them? The lion’s share goes to the seaports of the Odesa region. This figure is 4 million tons. By rail – 300,000 tons, through the river ports of the Danube – 200,000 tons. It is also exported by road. The volume reaches 100,000 tons,” said grain market analyst Oleksandr Korenitsyn.

Exports of grain crops, oilseeds, and processed products, million tons

Let’s look at the prices of the main agricultural crops that Ukraine exports to world markets. In April 2025, the price of wheat (France, FOB) was 244 USD/ton. Note that this is 3 USD more than in March of this year and 29 USD more than in the same period of 2024. The price of wheat (Ukraine, 2nd class, CPT) in April 2025 was USD 211/t (central regions), which is USD 4 more than in March 2025 and USD 75 more expensive than a year ago. In ports, the price was 229 USD/t, which is 7 USD higher than in the previous month and 65 USD more expensive than in April 2024, according to the International Grains Council.

As for corn (USA, FOB), the price as of April 2025 was USD 211/t. This amount is USD 4 higher than in the previous month and USD 19 higher than in April 2024. The price of corn (Ukraine, CPT) in the central regions is 206 USD/t, thus increasing by 11 USD over the month and by 89 USD over the year; ports – 222 USD, which is 12 USD more than in March 2025 and 78 USD higher than in April 2024.

As noted by Oleksandr Korenitsyn, the price of barley (France, FOB) was 229 USD in April 2025, which is 1 USD less than in March of this year and 26 USD more than in the same period last year. The price of barley (Ukraine, CPT) was USD 195 in the central regions, which is USD 8 more than in March 2025 and USD 102 higher than in April 2024; in ports, it was USD 215 (the price rose by USD 5 per month and USD 85 over the year).

“Another important crop for Ukraine and the world that should be mentioned is sunflower. The price of its seeds in the EU (Rotterdam, FOB) in April this year was 730 USD/t. There has been an increase in price over the last month – by 7 dollars, as well as an increase over the year – by 273 dollars. Meanwhile, the cost of sunflower seeds (Ukraine, CPT) for the central regions was 537 USD/t. The price rose by 10 USD per month and 221 USD per year. For ports, the cost is $512 per ton, which is $6 more than last month and $194 more than last year,” said expert Oleksandr Korenitsyn.

We would like to add that the cost of sunflower oil (Ukraine, FOB) in April was $1,140 per ton. It should be noted that among the key factors that could destabilize further pricing on the world market and affect food security in Europe and the world are Russia’s military actions on the territory of Ukraine.

EUROPE, full-scale Russian invasion, grain exports, Korenitsyn, LOGISTICS, Odessa ports, OILSEEDS, PRICES, UKRAINE, VOLUME

Ministry of Economy and Trade has developed a draft resolution of the Cabinet of Ministers “On Amendments to the Annex to the Resolution of the Cabinet of Ministers of Ukraine No. 957 of October 30, 2008”, which provides for an increase in the minimum wholesale and retail prices for certain types of alcoholic beverages.

According to information on the website of the Ministry of Economy, the current size of the minimum wholesale and retail prices for alcoholic beverages was established by the relevant Cabinet of Ministers’ resolution No. 748 in September 2018, except for retail prices for sparkling wines and carbonated wine drinks.

“The changes that have occurred in the socio-economic and tax spheres, in particular, the growth of the expenditure component of prices (raw materials, components, energy, labor costs, etc.), as well as the change of excise tax rates for alcoholic beverages on March 1, 2022, have led to the fact that the size of minimum prices does not correspond to the real costs of economic entities for the production and sale of alcoholic beverages and requires adjustment,” – noted in the explanatory note to the document.

The new resolution proposes to increase the size of minimum wholesale and retail prices for certain types of alcoholic beverages depending on the code of products from the UKTVED, including retail prices for vodka and liquor products to increase by 13%, whiskey, rum and gin – by 25%, cognac (brandy) – by 11-12%.

The rates for wine products, in particular, ordinary (non-sparkling) wines will be increased by 62%; for cider, perry, wines, vermouth and other fermented beverages (including mixtures of fermented beverages and mixtures based on fermented beverages), the actual strength of which is higher than 1.2% of volumetric units of ethyl alcohol, but not higher than 22% of volumetric units of ethyl alcohol – by 61-71%; for sparkling wines and carbonated wine drinks – by 28%.

Notes to the Decree will be supplemented with a new paragraph, according to which the minimum retail price for wine products (except for cider and perry (without added alcohol), fermented drinks obtained exclusively as a result of natural fermentation of fruit, berry and fruit-berry juices, with alcohol content not exceeding 8.5% of volume units (without added alcohol) in Tetra-Pak and Bag in box packaging will be determined as a derivative of the approved minimum price for the corresponding products in glass containers with a capacity of 0.7 liters, in other containers with a capacity of 0.7 liters.

All changes in the descriptions of goods and their grouping by codes according to UKTVED will be harmonized with the Tax Code of Ukraine.

The number of requests to rent apartments in Kiev in December 2022 increased by 3% compared to the pre-war level, the press service of the portal of new buildings LUN told Interfax-Ukraine.

Reportedly, the team iOS-application to rent apartments in Kiev bird has prepared updated statistics on the situation of demand and prices in the capital market.

According to the study, the median rent price of one-bedroom apartment in the capital continues to fall – up to 8,5 thousand UAH, which is 10.5% lower than in November. At the end of February last year it was 13 thousand UAH per month.

The median price of rent of one-bedroom apartments at the end of December was UAH 12 thousand, which is 14.2% lower than in the previous month. In February it was UAH 21.6 thousand.

For three-room apartments median price decrease was 9%. Now you can rent such apartment for the price of 20 thousand UAH. This is much lower than before the war prices, because in February 24, 2022 such housing would cost 46.1 thousand UAH per month.

Oil prices ended August with a decline and continued to fall on the first day of September.

At the end of last month, Brent fell by 12.3%, WTI – by 9.2%, and negative dynamics were noted for the third month in a row, which is the longest such period since the first half of 2020.

The price of November Brent futures on the London exchange ICE Futures at 8:10 Moscow time on Thursday is $95.18 per barrel, which is $0.46 (0.48) below the closing price of the previous session. According to the results of trading on Wednesday, these contracts fell in price by $2.2 (2.3%), to $95.64 per barrel.

The price of WTI oil futures for October on the electronic trading of the New York Mercantile Exchange (NYMEX) is currently $89.08 per barrel, which is $0.47 (0.52%) lower than the final value of the previous session. By the close of the market the day before, the value of these contracts decreased by $2.09 (2.3%), to $89.55 per barrel.

Pressure on the market is caused by fears of a downturn in the world economy against the background of tightening of monetary policy by the world’s largest central banks, as well as coronavirus restrictions in effect in China, according to the Bloomberg agency.

“Concerns about the state of the economy are a key reason for the decline in the oil market,” said WTRG Economics energy markets analyst James Williams, quoted by Market Watch.

“OPEC expresses concerns about demand prospects, and sometimes representatives of the cartel raise the question of reducing quotas. The possibility of a recession now occupies an important place in OPEC’s thinking,” the expert notes.