In 2025, the Dila medical laboratory increased the number of tests performed by 10.5%, the number of clients by 4%, and opened 26 new branches.

According to the laboratory’s press release summarizing the results of the past year, the development of online services remained the driver of sales growth in 2025. In particular, in 2025, the share of orders paid online increased by more than 10% to almost a third of orders.

The laboratory notes that in 2025, Dila opened 26 of its own and partner branches. In total, since February 2022, the laboratory has almost doubled its network, and as of the beginning of 2026, the company’s network consists of 276 points of presence.

In the fall of 2025, Dila launched a new clinical diagnostic laboratory in Kyiv with an area of over 2,000 square meters, with a capacity to perform over 15 million tests per year.

The largest amount of capital investment during 2022–2025—about UAH 40 million—was directed toward launching a new laboratory in Kyiv, comprehensively equipping the network of branches with generators and inverters with batteries, and installing additional power lines and uninterruptible power supplies.

“By the beginning of 2026, all of Dila’s own branches and clinical diagnostic laboratories will be operating in a completely autonomous mode,” the laboratory specifies.

They also note that 465 new employees joined the Dila team in 2025, bringing the total number of company personnel to over 2,100.

In addition, as part of corporate social responsibility projects, Dila, together with the Dila Foundation, allocated more than UAH 70.6 million in aid in 2025, and since 2022, over UAH 162.2 million, including UAH 49.3 million for social discounts, of which UAH 45 million was allocated to support the health of military personnel and veterans.

In 2025, Dila transferred UAH 593.2 million in taxes and fees to the state budget, which is 56% more than in 2024.

The claim that mushrooms help lower cholesterol is generally consistent with scientific logic, but requires important clarifications: the effect depends on the type of mushroom, overall diet, and individual tolerance, and the evidence base in humans is still limited.

The discussion was prompted by a comment from a gastroenterologist, who said that the chitin contained in mushrooms can lower cholesterol by binding dietary lipids and reducing their absorption in the intestine. In practice, the mechanisms are more often described in terms of the dietary fiber in mushrooms as a whole, including beta-glucans and chitin-like components: dietary fiber can bind bile acids and parts of lipids in the intestines, increasing their excretion, which causes the body to use more cholesterol to synthesize new bile acids.

The data on mushrooms indicate potential, but do not guarantee a strong effect in everyone. For example, a review in the journal Food & Function (RSC, 2024) notes that button mushrooms (A. bisporus) and some other mushrooms demonstrate the ability to bind bile acids in digestion models, but clinical data are limited and inconsistent. The same review mentions studies in which daily consumption of approximately 150-200 g of fresh champignons or oyster mushrooms was associated with a reduction in total and/or LDL cholesterol.

However, mushrooms are valuable not only for their potential effect on lipids. They usually provide dietary fiber and a number of micronutrients (B vitamins, selenium, copper, potassium), and vitamin D in mushrooms increases significantly with UV treatment.

The idea that mushrooms “should not be eaten” with potatoes, bread, or legumes has no strict scientific confirmation as a universal rule. The problem is more often something else: mushrooms contain mannitol (FODMAP group, polyols), which in some people, especially those with irritable bowel syndrome, can increase gas and bloating. If you add a large portion of starchy foods or legumes to mushrooms, the overall “burden” on digestion may increase, and discomfort becomes more likely, but this is a matter of individual tolerance and portion sizes, not a prohibition.

Practical conclusion: mushrooms can be considered a useful component of a balanced diet and a source of dietary fiber, but they should not be used to “treat cholesterol.” For high cholesterol, the key factors remain overall nutritional profile, physical activity, and doctor’s recommendations (including therapy, if necessary).

The Experts Club information and analytical center, with the assistance of the Ukrainian Cement Manufacturers Association (Ukrcement), has conducted an analysis of the Ukrainian cement industry.

Over the past five years, the Ukrainian cement industry has experienced a peak in production in 2021, a sharp decline in 2022, a gradual recovery in 2023, and stabilization in 2024. However, the current level is still far from pre-war indicators.

According to trade union and industry reviews, output was about 11 million tons in 2021, fell to 5.4 million tons in 2022, recovered to 7.43 million tons in 2023, and reached 7.93 million tons in 2024. In 2025, manufacturers are talking about an actual “ceiling” — approximately 8 million tons under current risks and logistics, which is likely to be the maximum figure.

The dynamics of domestic cement consumption show a similar trend of “decline and normalization.” In 2021, before the full-scale invasion, consumption was around ~10.6 million tons. In 2022, the cement market fell sharply to approximately 4.5 million tons, rose to 6.2 million tons in 2023, and stabilized at around 6.3 million tons in 2024. Thus, the country approached a stable level of “war” demand, which is almost half of the pre-war level, within the range of 6–6.5 million tons.

The structure of demand has changed: the share of traditional residential and commercial construction has given way to infrastructure and defense projects. The key short-term drivers are fortification works, shelters, emergency repairs of roads and bridges, as well as targeted housing programs such as “єОселя,” which supported demand in 2023–2024, although they did not return it to the 2021 level. The market expects demand to remain stable in 2025, sensitive to the volume of budgetary and international financing.

Amid declining domestic demand, a natural step to support production capacity utilization was the gradual reorientation of part of the cement output to foreign markets. In 2021, cement exports amounted to about 971,000 tons (9% of production), and in 2024, about 1.7 million tons (21.3% of production). The main destinations remain neighboring countries—Poland, Romania, Hungary, and Moldova—as confirmed by both statistical data and industry estimates. The industry has repeatedly emphasized that as soon as domestic consumption begins to grow, the export share will decline in favor of Ukrainian construction sites.

Imports, on the contrary, have declined. After approximately 1 million tons in pre-crisis 2020, deliveries in 2024 decreased to ~40 thousand tons (including niche items such as white cement). This was also influenced by anti-dumping duties: against Turkey — 33–51% (in effect until September 2026), and against Russia/Belarus/Moldova, measures have been extended until 2030. Under the current conditions, when production capacities and logistics are adapted to the “military” level of consumption, demand is fully covered by domestic resources.

The market structure in 2024–2025 is highly concentrated. The key producers are PJSC Ivano-Frankivskcement, the CRH group (after the AMCU approved the deal to acquire CRH’s Dyckerhoff/Buzzi assets — PJSC VIPCEM, Podolsky Cement JSC, Mykolaivcement PJSC, Cement LLC) and Kryvyi Rih Cement PJSC. Despite market discussions, legal disputes, and attention from antitrust authorities—which is to be expected for transactions of this scale—the CRH deal creates potential for integration into global production and logistics chains, attracting new investments, modernizing production, and raising the standards of the competitive environment. In the context of the country’s future large-scale recovery, the agreement opens up opportunities to strengthen supply stability, improve product quality, and develop a competitive environment.

Who is currently driving domestic consumption? In peacetime, the main stabilizers of demand were mass housing construction and infrastructure. In 2023–2025, basic demand will be driven by roads and engineering structures (including fortifications and shelters), municipal and energy facilities, selective reconstruction projects, as well as the private sector — repairs and local construction.

Road construction is an important factor in economic and social development. The introduction of the latest technologies, the use of high-quality materials, and compliance with environmental requirements are key aspects of the successful development of this industry.

The development of the construction and repair of cement concrete roads based on cement mixtures can play a key role in stimulating stable cement consumption in conditions of war and reconstruction. This infrastructure direction makes it possible to maintain the production capacity of enterprises, jobs, and economic activity, despite a significant reduction in residential and commercial construction. Thanks to their durability and endurance, cement concrete pavements are the optimal solution for both military and civilian logistics. The implementation of such projects not only ensures constant demand in the industry, but also the development of related sectors, creating a multiplier effect for the economy even in crisis conditions. This issue will be the focus of a specialised seminar organised by NIRI and the Ukrcement Association on 15-16 October 2025, where the advantages and role of cement concrete solutions in the reconstruction of Ukraine will be discussed (details at ukrcement.com.ua).

In terms of sales channels, the market remains predominantly B2B: most of the cement is purchased by contractors, road and infrastructure companies, large developers, reinforced concrete manufacturers, and concrete plants. The B2C channel (retail chains of building materials, small contractors) continues to play a significant role in repairs and low-rise construction, but in terms of total volume, it is inferior to the project segment. Industry reviews of construction projects and reports on fortification works in 2024–2025 provide further confirmation of the “infrastructure” shift.

The geography of foreign sales shows a stable “corridor” and proximity to the EU. According to trade statistics for 2023, Romania accounted for the largest value of supplies, followed by Poland and Hungary; in 2024, Romania, Poland, and Hungary remained in the lead.

This reflects shortages in the EU border markets and the competitiveness of Ukrainian prices with close logistics.

What limits growth. Military risks and energy infrastructure (in particular, the availability of electricity), regional logistics, as well as regulatory and competitive issues. A large-scale jump in consumption (approximately 12–13 million tons) requires a steady inflow of investment resources for reconstruction of around $35 billion per year — the association considers such a scenario to be technically and operationally realistic. Predictable competition rules and price monitoring are important in the equation so that the “reconstruction” multiplier is not absorbed by costs.

Conclusion by Experts Club. The industry has found a “military balance”: production of about 8 million tons, domestic consumption of ~6.3 million tons, and exports as insurance at the level of 1.5–1.7 million tons. With the scaling up of energy restoration and strengthening programs, a shift from exports to the domestic market is logical. The key to acceleration is stable financing of infrastructure and housing, affordable energy, and maintaining fair competition between major players. In such a scenario, cement remains one of the first materials that quickly transforms the budget into employment and GDP — through concrete, reinforced concrete structures, roads, and fortifications.

Sources: Global Cement (production and consumption; import duties), Interfax-Ukraine/Ukrcement (exports in 2024; estimates of reconstruction needs), OEC (export destinations in 2023), CEMBUREAU (imports, exports, and consumption, in particular the benchmark for 2024), industry and business media regarding the CRH/Dyckerhoff deal and the competitive situation.

Source: https://expertsclub.eu/rynok-czementu-ukrayiny-doslidzhennya-experts-club/

Ukrainian President Volodymyr Zelensky’s approval rating stands at 29.3%, while 56.1% of Ukrainians disapprove of his activity, according to a nationwide poll conducted by the Kyiv International Institute of Sociology between July 24 and August 1.

The sociologists noted a decline in the president’s approval rating, as 34.1% respondents approved of his activity and 52.7% said the opposite in June 2021.

Meanwhile, 43.2% of Ukrainians support an early presidential election, and 46% do not.

The respondents are more inclined to support early parliamentary elections, with 48.7% in favor and 38.3% against, the pollster said.

The institute interviewed 2,028 respondents older than 18 in 105 populated localities in all regions of Ukraine controlled by Kyiv.

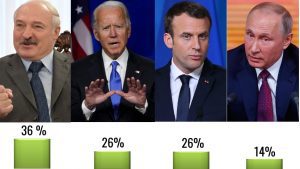

Some 36% of Ukrainians trust Alexander Lukashenko, 26.7% – Joe Biden, 26.2% – Emmanuel Macron and 14.4% – Vladimir Putin, according to the results of a poll conducted by the Kyiv International Institute of Sociology (KIIS) from January 27 to February 1.

According to the research, President of Belarus Alexander Lukashenko, whom the EU and the U.S. do not recognize as legally elected, is trusted by 36% of respondents, distrusted – by 53.6%,there are 7.6% of those who found it difficult to answer, and 2.7% do not know. The balance of trust in Lukashenko is (-17.6%).

U.S. President Joe Biden is trusted by 26.7% of respondents, 23.3% do not trust him, 25.4% found it difficult to answer, and 24.6% do not know. The balance of trust in Biden is (+ 3.4%).

Some 26.2% of respondents trust French President Emmanuel Macron, 23.2% do not trust him, 22.9% found it difficult to answer, and 27.6% do not know. The balance of trust in Macron is (+ 3%).

Some 14.4% of respondents trust Russian President Vladimir Putin, while 79.8% do not trust him, 5.6% found it difficult to answer, and 0.3% do not know. The balance of trust in Putin is (-65.4%).

The all-Ukrainian poll was conducted by personal interviews using tablets (CAPPE). Some 1,205 respondents living in 86 settlements of all regions of Ukraine (except for the Autonomous Republic of Crimea) were interviewed according to a 3-stage stochastic sample with a quota selection at the last stage, which is representative for the population of Ukraine aged 18 and over. In Luhansk and Donetsk regions, the survey was conducted only in the territory controlled by the Ukrainian authorities.

The statistical error of the sample (with a probability of 0.95 and excluding the design effect) does not exceed: 2.9% – for indicators close to 50%, 2.5% – for indicators close to 25%, 1.9% – for indicators close to 12%, and 1.3% – for indicators close to 5%.

The Ukrainian Chambers of Commerce and Industry and export organizations assess the opportunities for the export of Ukrainian products on a 10-point scale at 7.5, and note the need for state support for export activities, which should provide for financial, legal, communication and infrastructure direction.

According to the research “Analysis of institutional support for exports among organizations of the agrarian sector of Ukraine” of the Agritrade Ukraine project, the text of which is available to the Interfax-Ukraine agency, the average assessment of the opportunities for the export of Ukrainian products on a 10-point scale (where one is very poor opportunities, while ten is very good) by participants in the study was 7.5.

Among the main factors of such an assessment were named a high existing demand abroad, good qualifications and experience of industry employees, favorable agro-climatic conditions.

At the same time, the participants in the research noted that the implementation of the export potential is impossible in full due to a saturated competitive environment, insufficient level of harmonization of production and processing standards, the complexity and lack of information about the features of certification and the inertia of some domestic farmers.

More than three quarters of the organizations (77%) that that took part in the survey noted that they have established cooperation with companies from the EU countries. Among the main problems that arise in this process and become obstacles to cooperation, they named a small amount of quotas for certain types of agricultural products, non-compliance with quality standards and certification standards, a saturated competitive environment.

Assessing the compliance of domestic agricultural products and food products with European quality standards, almost three quarters of the respondents (72%) noted that they were more likely to comply, 12% of the survey participants were sure of absolute compliance.

Approximately one fifth of the organizations (22%) that took part in the survey can fully satisfy the requests of Ukrainian companies to establish trade relations with foreign companies and companies from the EU countries (that is, 90-100% of requests).

Among the main factors that affect the ability to satisfy the requests of Ukrainian companies to establish trade relations with foreign companies and companies from the EU countries, the survey participants most often named a lack of practical experience of employees, a lack of knowledge of business English and export-import legal framework, a limited access to market information (supply-demand), lack of analytical skills and tools, the volume of quotas for the export of certain types of agricultural products, limited and insufficient advertising and marketing budgets.