EU enlargement is a geopolitical decision, and changes need to be made to the process of accepting new members, but EU member states are not yet ready to name a specific date for Ukraine’s accession, as Ukrainian President Volodymyr Zelensky insists, said EU High Representative for Foreign Affairs and Security Policy Kaja Kallas.

“We really need to work on this. But I think I have the feeling that the member states are not ready to name a specific date,” she said in response to questions at the Munich Security Conference on Sunday, according to a correspondent from the Interfax-Ukraine agency.

Kallas recalled that, in addition to Ukraine, Montenegro and Albania have also been on the list of candidates for accession for a long time.

“I think that the priority, the urgent need to move forward and show that Ukraine is part of Europe, exists,” the head of European diplomacy noted.

Latvian President Edgars Rinkēvičs also agreed with the EU’s unwillingness to set a date for Ukraine’s accession today.

“When I spoke with many heads of state and government of the European Union, I got the impression that at this stage, as we speak here in Munich in February, there is no readiness to set a date,” he said.

In his opinion, there is a desire to see Ukraine become part of the EU as soon as possible.

“The EU has always been very creative when it was really necessary. And we can find a formula that will probably suit us,” the Latvian president believes.

According to him, two other issues need to be resolved as part of this decision: the admission of candidate countries from the Western Balkans, which have long been promised this, and Moldova.

“When talking about Ukraine, don’t forget about Moldova. If Ukraine joins, we cannot exclude Moldova from this. So it’s not just about Ukraine anymore. We are talking about perhaps the largest unifying expansion, but probably under different rules,” Rinkēvičs explained.

In his opinion, it will then be necessary to return to a very serious discussion of what the entire structure of European Union decision-making will look like.

The Latvian president also stressed that the date of Ukraine’s possible accession to the EU, whether we like it or not, is now very much linked to a peace agreement with Russia — will there be a peace agreement or not?

“To be honest, I don’t see Russia being ready for an agreement. And if Russia doesn’t move, we won’t have an agreement,” he explained.

According to Rinkevics, Zelensky’s appeal to set a date for accession should be heard at a meeting of the European Council.

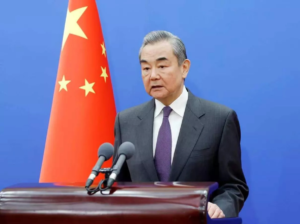

Chinese Foreign Minister Wang Yi, speaking on the sidelines of the Munich Security Conference, said that “the door to dialogue in Ukraine is open, and all parties should strive to reach a comprehensive and lasting peace agreement and eliminate the root causes of the conflict,” and called on Europe to be more active in peace efforts, according to a correspondent for Interfax-Ukraine.

“The doors to dialogue have finally opened on the ‘Ukrainian crisis’ (Russia’s full-scale war against Ukraine – IF-U). All interested parties should seize the opportunity to achieve a comprehensive, durable, and binding peace agreement, eliminate the root causes of the conflict, and ensure lasting peace and stability in Europe,” he said.

According to the Chinese foreign minister, Europe should not stand by and watch.

“Since the conflict broke out here in Europe, Europe has every right to participate in the negotiations at the appropriate time. Europe should not be on the menu, but at the negotiating table,” he said.

“Now we see that Europe has found the courage to negotiate with Russia. This is good, and we support it,” Wang Yi emphasized.

At the same time, in his opinion, dialogue should not be conducted for the sake of dialogue itself, and Europe should offer new ideas and new plans to resolve this issue.

” And in this process, we need to promote the creation of a more balanced, effective, and sustainable security architecture for Europe. Consequently, by doing so, we are addressing the root causes of the crisis and can prevent its recurrence. And to achieve sustainable and lasting peace, China, for its part, will fully support the peace process,” the foreign minister concluded.

He also clarified that China is not a party directly involved in the conflict, has no right to make a final decision, and is only facilitating peace talks.

Regarding relations between China and the EU, Wang Yi expressed his conviction that they should be partners, not systemic rivals or strategic competitors.

“But there are differences and disagreements between our two sides, for example, our social systems, our values, and our development models, but that is because we have different histories and cultures, and based on that, our peoples have different choices regarding the path of development. But that does not mean that we should become rivals or competitors,” the minister said.

He declared that it is more important for China and the EU to practice multilateralism, defend the authority of the UN, say “no” to unilateral practices, uphold free trade, and oppose bloc confrontation.

Information that China’s Foreign Minister Wang Yi said Ukraine is viewed as a “friend and partner” is confirmed by China’s official statements. The remark was made on February 15, 2025, during Wang Yi’s meeting with Ukraine’s Foreign Minister Andrii Sybiha on the sidelines of the Munich Security Conference, Xinhua reported.

According to Xinhua’s publication, Wang Yi noted that China and Ukraine maintain a “traditional friendship,” and that bilateral relations are based on the strategic partnership established in 2011. He also said Beijing is ready to work with Kyiv to advance bilateral relations and practical cooperation despite “unfavorable factors.”

In 2026, the topic of China–Ukraine contacts was again brought to the fore at this year’s Munich conference. Ukraine’s Foreign Minister Andrii Sybiha said on February 13, 2026, that he invited Wang Yi to visit Ukraine and stated that China could help achieve an end to the war.

Ukraine may face a critical shortage of seasonal workers for raspberry harvest in 2026, the head of the Ukrainian Fruit and Vegetable Association (UFOA) Taras Bashtannik said.

According to him, without attracting foreign labor, the country will not be able to harvest raspberries and maintain its position as an exporter of this berry.

As noted in the publication, the area of raspberries in Ukraine in 2024 was about 5 thousand hectares, and the need for labor is estimated at about 15 pickers per 1 hectare. Thus, the season requires more than 70 thousand workers only for raspberries. Labor shortages are also affecting blueberry and strawberry farms, as well as apple orchards.

Volodymyr Gurzhyi, the head of USPA Fruit gardening company, said that in 2026 Ukrainian companies plan to import workers to orchards, including from Bangladesh and Nepal, similar to the practice in Serbia. At the same time, taking into account the growth of orchard areas, the additional need may amount to at least 100 thousand pickers.

February 13, 2026, 11:00

Kyiv City State Administration (KCSA), Column Hall

(Kyiv, 26 Khreshchatyk St.)

Competition organizers:

The National Industry Partnership in Ukraine’s Light Industry “Fashion Globus Ukraine” and the Italian association VITAWORLD

On February 13, 2026, the Column Hall of the Kyiv City State Administration will host the ceremonial final of the 8th All-Ukrainian Professional Skills Competition “Fashion PRORYV for Freedom and Peace” https://fashionglobusukraine.com/konkurs/ua/fashion-proryv-2026 — a large-scale event that brings together fashion, education, culture, and international partnership between Ukraine and Italy. The final in Kyiv will take place in the format of a runway show featuring collections of sportswear and adaptive clothing, as well as an awards ceremony for the winners.

The Fashion PRORYV competition, launched in 2016, has become a unique platform for cooperation among educators, manufacturers, young designers, and sewing professionals. The project, initiated by Fashion Globus Ukraine, has created an effective model of interaction between education, business, and creativity.

“Over the years of the war with the Russian Federation, we have created a platform of peacebuilding cultural diplomacy, where Ukraine speaks to the world not in the language of pity, but in the language of dignity, creativity, and culture. We have created a precedent: when a competition in the fashion industry became a narrative about humanity, strength, resilience, and hope,” says the competition’s President, Golda Vynohradska.

Over the years, the competition has been held under the patronage of the city halls of Lviv, Kharkiv, Khmelnytskyi, and Kryvyi Rih. In 2025, the project received support from the U.S. Embassy in Ukraine, and in 2026—from the City of Milan.

Fashion as cultural diplomacy

During wartime, Fashion PRORYV has taken on special significance, turning into a platform for cultural diplomacy and international dialogue. Each year, between 60 and 100 educational institutions from all regions of Ukraine take part in the competition. In 2025, the winners’ collections were presented in Paris, Oslo, Milan, and Luxembourg.

This year’s competition is dedicated to cooperation with Italy and the theme of sports. It features students from 52 Ukrainian fashion-industry educational institutions and 4 Italian universities (Venice, Salerno, Milan, Rome).

International finals in Kyiv and Milan

A ceremonial international presentation will take place on February 28, 2026, in Milan (Milan San Siro Hotel) as part of the Milano-Cortina 2026 events and Milan Fashion Week.

Such projects demonstrate Ukraine’s innovative potential, young people’s prospects, and the value of human capital.

Distinguished guests and professional jury

The event will be attended by:

• representatives of the diplomatic corps,

• Olympic champions,

• cultural and sports figures,

• leaders of the fashion industry of Ukraine and Italy.

The jury includes leading experts in fashion, education, and creative industries of Ukraine and Italy: Ivan Frolov, Katya Silchenko, Olena Holets, Taras Prytula, Kateryna Myroshnychenko, Halyna Yerko, Emilia Ametrano, Walter Togni, Elena Kalencani.

General partner of the competition: SOFTORG

Invitation

The organizers invite journalists and media representatives to share in the celebration of Fashion PRORYV—an event about courage, talent, and the power to create the future even in the most difficult times. Such projects demonstrate Ukraine’s breakthrough, prospects for youth, and above all the value of human capital!

Media accreditation

For accreditation and additional information:

+38 067 220 86 37

Goldafashion.ua@gmail.com

www.fashionglobusukraine.com

Interfax Ukraine is the official information partner of the event.

As of December 31, 2025, 1,131,197 foreigners were registered in the Czech Republic – 37,108 more than the previous year (+3.4%), according to data from the Ministry of the Interior and the statistical unit of the Czech Statistical Office, as cited by the information and analytical center Experts Club.

According to the Ministry of the Interior’s estimate, foreigners account for 10.38% of the country’s population (the calculation used a population figure of 10,897,178 as of September 30, 2025). This means that the “native population” (residents without foreign citizenship) amounts to about 9.766 million people (an estimate based on the difference between the figures).

The structure of legal residence at the end of 2025 included 343,876 people with temporary residence, 394,265 with permanent residence, and 393,056 registered under the temporary protection regime. The highest concentration of foreigners is recorded in Prague (32.4% of all registered foreigners) and in the Central Bohemian Region (14.5%).

Ranking: Top 10 nationalities among foreigners in the Czech Republic (31.12.2025)

| Rank | Country | Number of people |

|---|---|---|

| 1 | Ukraine | 612,953 |

| 2 | Slovakia | 125,280 |

| 3 | Vietnam | 69,685 |

| 4 | Russia | 37,524 |

| 5 | Romania | 21,287 |

| 6 | Poland | 17,631 |

| 7 | Bulgaria | 17,562 |

| 8 | Mongolia | 14,908 |

| 9 | Philippines | 14,530 |

| 10 | Hungary | 12,111 |