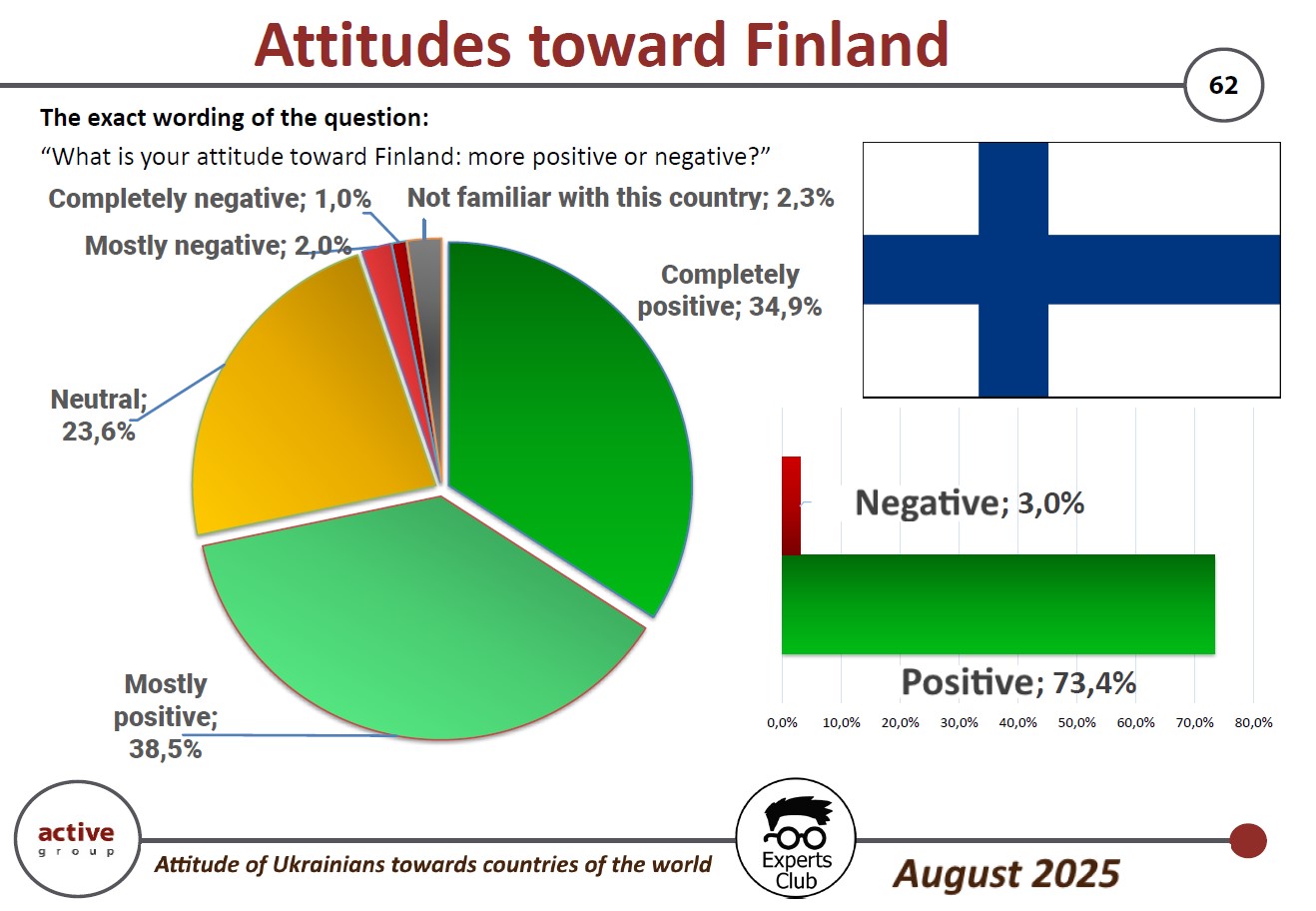

Most Ukrainians have a positive attitude toward Finland, according to the results of a sociological survey conducted by Active Group in collaboration with Experts Club in August 2025.

According to the published data, 73.4% of respondents have a positive attitude towards this country: 34.9% — completely positive, 38.5% — mostly positive. Only 3.0% of Ukrainians have a negative attitude (1.0% completely negative, 2.0% mostly negative). At the same time, 23.6% of citizens took a neutral position, and another 2.3% admitted that they were not familiar enough with Finland.

“The high level of positive attitudes toward Finland can be explained by both Ukraine’s support at the political level and assistance in the areas of defense, education, and humanitarian projects. Finland has long been perceived by Ukrainians as part of the European family and an ally in countering Russian aggression,” commented Active Group CEO Oleksandr Pozniy.

Experts Club co-founder Maksym Urakyn drew attention to economic indicators:

“In 2025, trade turnover between Ukraine and Finland amounted to more than $163.6 million. Exports from Ukraine amounted to only $21.6 million, while imports exceeded $141.9 million. The negative balance of $120.4 million indicates significant potential for export diversification, particularly in the fields of woodworking, agricultural products, and mechanical engineering,” he emphasized.

The study is part of a large-scale project by Active Group and Experts Club to analyze Ukrainians’ international sympathies and the prospects for foreign economic relations.

ACTIVE GROUP, EXPERTS CLUB, FINLAND, Pozniy, RELATIONS, SOCIOLOGY, TRADE, UKRAINE, URAKIN

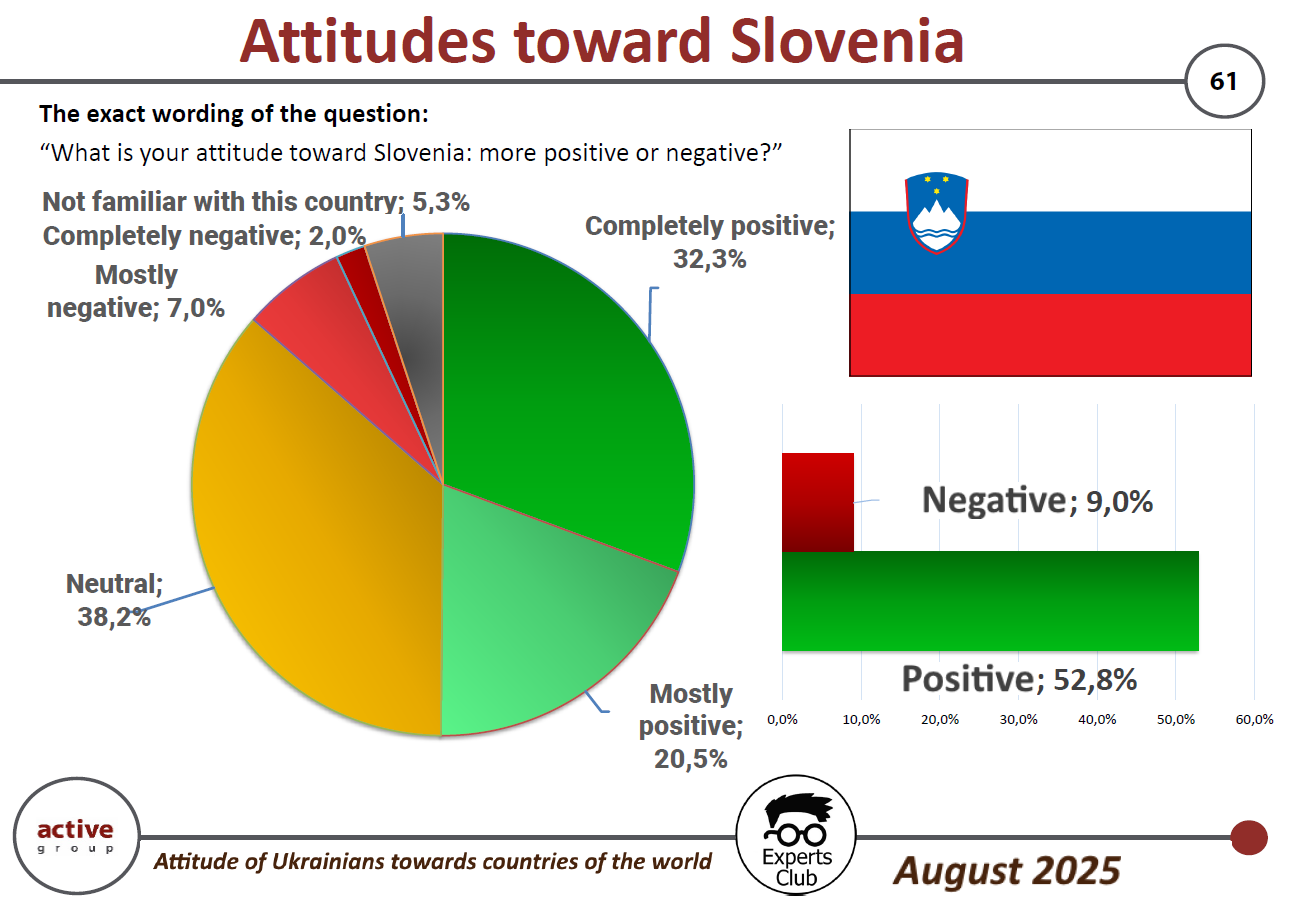

Most Ukrainians have a positive attitude toward Slovenia, according to the results of a survey conducted by Active Group and Experts Club in August 2025.

According to the data, 52.8% of respondents expressed a positive attitude towards this country (20.5% — mostly positive, 32.3% — completely positive). Only 9.0% of respondents had a negative attitude (7.0% — mostly negative, 2.0% — completely negative). At the same time, 38.2% of citizens expressed a neutral position, while another 5.3% admitted that they knew little about Slovenia.

“The survey results show that Ukrainians perceive Slovenia as a friendly European country that consistently supports Ukraine in international organizations and promotes European integration. The high level of positive attitudes reflects both cultural proximity and shared European values,” said Active Group CEO Oleksandr Pozniy.

In turn, co-founder of Experts Club Maksym Urakin emphasized the economic aspect:

“In 2025, the total trade volume between Ukraine and Slovenia reached $181.5 million. Ukrainian exports amounted to $45.3 million, while imports exceeded $136 million, resulting in a negative balance of $90.8 million. This indicates that there is significant potential for growth in Ukrainian exports to Slovenia, especially in the areas of agricultural products and mechanical engineering,” he said.

The study is part of a large-scale project by Active Group and Experts Club to study Ukrainians’ international sympathies and the dynamics of foreign economic relations.

ACTIVE GROUP, EXPERTS CLUB, Pozniy, RELATIONS, SLOVENIA, SOCIOLOGY, TRADE, UKRAINE, URAKIN

Lawyers, finance experts and attorneys have united to form the National Association of Lobbyists of Ukraine (NALU) to promote investments and protect business interests, said Oleksiy Shevchuk, a lawyer, chairman of the board of NALU, chairman of the Information Policy Committee of the National Association of Lawyers of Ukraine (NALU).

“Lobbyist is a new profession in Ukraine, now created by NALU. It means that a great profession is now open to everyone, it means that now a lot of businesses have support. A lobbyist performs business and investment support functions. Today it means that large companies that are going to enter the reconstruction of Ukraine have guides, have support and have managers who will develop these companies and accompany investments,” he said at a press conference at the Interfax-Ukraine agency.

Shevchuk said that NALU now includes 20 people, while the transparency register of lobbyists – the only official State register of lobbyists – includes more than 30 people, and the holder of the transparency register is the National Agency for the Prevention of Corruption (NAPC). At the same time, the NALU can unite only individual lobbyists.

“The NAPC checks the representatives of the lobbying profession to ensure that they meet the requirements of decency and good business integrity and that they do not violate lobbying laws. Lobbyists who are members of NALA meet the standards of quality and requirements of the lobbying profession. This means that these representatives can and should be chosen to accompany major investment projects. This means that today we are moving towards the creation of a civilized society,” he said.

Shevchuk also noted that “recently, law enforcement agencies have been abusing a lot when some investment projects were presented by a state body, when people’s deputies received bills that business needs.”

“Today no one will no longer say that this is a violation of law or abuse of influence. Lobbyists are official managers who represent business,” he said.

According to Shevchuk, Ukrainian lobbyists can be registered in the United States as individual members of the profession and will be able to have a corresponding contract with a European or U.S. organization.

“If today there will be an order either from some lobbyist from the US or from some separate organization – for example, it can be an investment bank, a fund, or a small business that needs to be promoted – a lobbying contract must be concluded and this contract must be registered in the appropriate registry in the US. On their own, no lobbyist has the right to act in the U.S., every lobbyist from Ukraine must interact with a U.S. company. It is the same as with lawyers: a lawyer from America cannot work independently in Ukraine, a lawyer from Ukraine cannot work independently in the U.S.,” he explained.

For her part, NALU executive director Vitalia Globa noted that among the key areas of the association’s activities are the development of lobbyism as an important component of a democratic society, the creation of a system of self-regulation and professional standards for lobbyists, as well as the protection of the rights of association members.

“Any lobbyist in our country can become a member of our association of lobbyists by submitting a free-form application with certain documents, which are specified on the official website of our organization,” she said.

In turn, NALU board member, managing partner of the Leshchenko and Partners law firm Oleksandr Leshchenko said that experts are preparing a large report on the status, system and procedure of lobbying in Ukraine. It will be presented in the European Parliament, as well as in the United States, where a round table with international participation with lobbyists from the US is planned.

“Lobbyism is an activity that in the civilized world is legally regulated. Unfortunately, in most cases, including among elites, journalists, there is a negative attitude to the activities of lobbyists. This opinion is erroneous, because, since 1946, in the United States for the first time an act regulating the activities of lobbyists has been in force. Today Ukraine has created such a legislative act at the legislative level and now there is a process of establishing legal regulation of lobbyist activity”, – he said.

As the vice-president of NALU, head of the representation of the Ukrainian Bar in the UK Oleksandr Chernykh noted, what is now happening very often around draft laws in Ukraine cannot be called professional activity not by the level of preparation, not by the level of analysis.

“Absolutely wrong thing in Ukraine, when public activists spend millions on youtubes and social networks, actually putting pressure on state bodies to make decisions, while they do not report. If we look at the tax and public reporting, it is really millions of dollars, which then disappear on some FOPs, for some incomprehensible services. And it is not clear where these millions of dollars come from, who is the customer and what the end result of this actual lobbying activity is. I very sincerely welcome the adoption of this law, because now we can talk about legitimate legal lobbying activities,” he said.

For his part, NALU representative in Brussels, President of European Facilitation Platform Oleksandr Kamenets emphasized the need to research the lobbying field in Ukraine.

“This is a necessary condition for both in Ukraine and abroad, in Europe and in the world to understand who is now on this market, on this field in Ukraine,” he said.

Chernykh, Kamenets, Leshchenko, lobbyists, UKRAINE, Глоба, НАЛУ, ШЕВЧУК

Ukraine ranked 66th in the 2025 Global Innovation Index (GII) published by the World Intellectual Property Organization (WIPO).

According to the study, Ukraine remains in the group of “innovation overperformers,” demonstrating results above expectations for its level of economic development. It has maintained this status for 13 consecutive years, starting in 2012.

Switzerland has topped the global ranking for the 15th consecutive time. Sweden and the United States took second and third place. The top ten also included the Republic of Korea (4th place), Singapore (5th), Finland (7th), the Netherlands (8th), Denmark (9th), and China, which entered the top ten for the first time.

The GII methodology is based on an analysis of more than 78 indicators grouped into seven “pillars” — from human capital and research to business sophistication and creative outputs. The index is divided into two equal parts: “input resources for innovation” (institutions, education, infrastructure, market, and business) and “output results” (technological and creative products). According to the compilers of the ranking, the index is a key tool for governments and businesses: it allows them to assess the strengths and weaknesses of a country’s innovation system and to formulate long-term development strategies.

Ukraine has announced a tender to conclude a production sharing agreement (PSA) for the Dobra lithium deposit (Kirovohrad region) to prospect, extract and enrich lithium, niobium, rubidium, tantalum, cesium, beryllium, tungsten and gold for a period of 50 years.

According to a report in the Uriadovyi Kurier newspaper and on the website of the Ministry of Economy, the minimum investment for exploration is the equivalent of $12 million, and for the organization of mining and processing of lithium-containing minerals and other metallic minerals – $167 million, but the final obligations are determined by the results of the tender. The total area of the site is 17.07 square kilometers, the deadline for submitting applications for participation in the tender is December 12, 2025, and the participation fee is UAH 0.5 million.

According to the terms, the maximum share of compensation products that will reimburse the investor for its costs is 70% of the total output until the investor’s costs are fully reimbursed, while the state’s share in profitable products should be at least 4-6%.

The Ministry of Economy clarified to Interfax-Ukraine that comparing such a share of the state in profitable products with a similar indicator for oil and gas PSAs, where it is significantly higher, is not correct, as this is the first PSA in the history of Ukraine for metal ores.

It is noted that the reserves and resources of lithium ores at the site were approved by decisions at the end of 2017 and in 2018 in the amount of C2 and P1 categories – 1 million 218.14 thousand tons (average Li2O content of 1.37%) and P2 – 70.6 thousand tons (average Li2O content of 1.43%).

Separately, the State Commission of Ukraine for Mineral Resources (SCR) noted the presence of prospective and inferred resources of associated mineral components (P1+P2) in lithium ores at Dobra: Ta2O5 – 4.75 thousand tons; Nb2O5 – 8.24 thousand tons; Rb2O5 – 104.07 thousand tons; BeO – 22.08 thousand tons; SnO2 – 4.46 thousand tons and Cs2O – 7.97 thousand tons.

“In addition, by the protocol dated 31.07.2002 No. 35, the resources of cat. P2 for the Novostankuvatske manifestation were estimated: Ta2O5 – 1414.22 tons (0.0127-0.0134%); Nb2O5 – 1734.5 tons (0.0163%); Li2O – 85196.1 tons (0.7541%); Rb2O5 – 9859.3 tons; Cs2O – 1493.6 tons; BeO – 3588.9 tons; SnO2 – 447.9 tons; WO3 – 8862.3 tons (cat. P3; 0.177%); at the Tashlykskoye ore occurrence: Ta2O5 – 480.32 tons (0.0106-0.0854%); Li2O – 13,596.4 tons (0.6291%); Rb2O5 – 1371.9 tons; Cs2O – 345.4 tons; BeO – 447.4 tons; SnO2 – 106.9 tons; Nb2O5 – 903.0 tons (0.0244%); Lutkivske deposit: WO3 – 2292.4 t (cat. P3; 0.101-0.378%); Kontaktovoye ore occurrence: Au – 2.05 t (4.08 g/ton); on the Stankuvatskoye ore occurrence: Au – 1.78 tons (1.3-2.5 g/t). For the Severostankuvatskoye ore occurrence, the operationally estimated Li2O resources are: cat. P1 – 269.93 thousand tons and cat. P2 – 140.82 thousand tons with an average Li2O grade of 1.3548%,” the announcement reads.

The winner of the tender must ensure geological exploration of the subsoil and international audit of reserves at the site within two and a half years and submit materials on the assessment of lithium and other metal minerals reserves to the State Committee for the approval of such reserves.

After the conclusion of the PSA, the investor is obliged, among other things, to prospect, extract and enrich (primary processing) lithium and possibly other metal minerals, and to ensure the comprehensive development and mining of the metal mineral deposit.

In addition, the PSA tender documentation for the first time includes obligations for the investor related to the agreement signed at the end of April this year to establish the US-Ukraine Reconstruction Investment Fund, which has the priority right to invest in new projects for the extraction of rare earth materials and purchase their products.

In mid-June, the head of the President’s Office, Andriy Yermak, said that the development of the Dobra lithium deposit could become the first pilot project in cooperation with the United States.

In early July, the mining investment company TechMet (Dublin), one of the largest investors of which is the US government through DFC, announced its interest in participating in the first PSA tender for lithium mining in Ukraine and, if it wins, building processing facilities with investments of more than $0.5 billion. Recently, a delegation of DFC accompanied by the heads of the Ministry of Economy of Ukraine visited Kirovohrad region.

At the same time, the US-based Critical Metals Corp also claims its rights to the Dobra site, linking them to the transfer of assets from Australia’s European Lithium, which, in turn, received these rights from Ukraine’s Petro-Consulting LLC.

The Moldovan government is preparing to build a high-speed highway that will connect the border with Romania and run to Odesa. Doina Nistor, Deputy Prime Minister and Head of the Ministry of Economy of Moldova, said this at the opening of Moldova Business Week.

Currently, a feasibility study is being prepared to determine the possible route of the road and whether parts of the new route will use existing roads.

In addition, Moldova is modernizing both rail and road corridors. The feasibility study for the Ungheni-Chisinau-Odesa corridor is scheduled to be completed by the end of 2025.

The road will be of particular importance for Ukraine’s reconstruction, as it will help shorten routes, reduce logistics costs and increase the resilience of supply routes.

Once the feasibility study is completed, a final decision on the route and construction details will be made. The project will depend on funding, international support, and cooperation between the governments of Moldova and Ukraine (and possibly Romania).