The results of a sociological survey conducted by Active Group in collaboration with Experts Club show that Ukrainians’ attitude toward Paraguay is mostly neutral or uncertain.

According to the study, 73.5% of respondents hold a neutral position, while another 10.3% were unable to give a clear answer. Together, this accounts for over 83% of those surveyed, indicating an almost complete lack of knowledge about the country.

Only 10.1% of Ukrainians have a positive attitude toward Paraguay, of which 7.3% chose “mostly positive” and 2.8% “completely positive.” A negative attitude is held by 6.2% — 5.8% “mostly negative” and 0.4% “completely negative.”

“Paraguay is a country that is rarely mentioned in the news or public discourse. As a result, most Ukrainians have no emotional or informational connection to it,” explains Maksim Urakin, candidate of economic sciences and founder of the Experts Club information and analytical center.

Ukrainians know almost nothing about Paraguay. This attitude is the result of an information vacuum, not established prejudices or sympathies.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

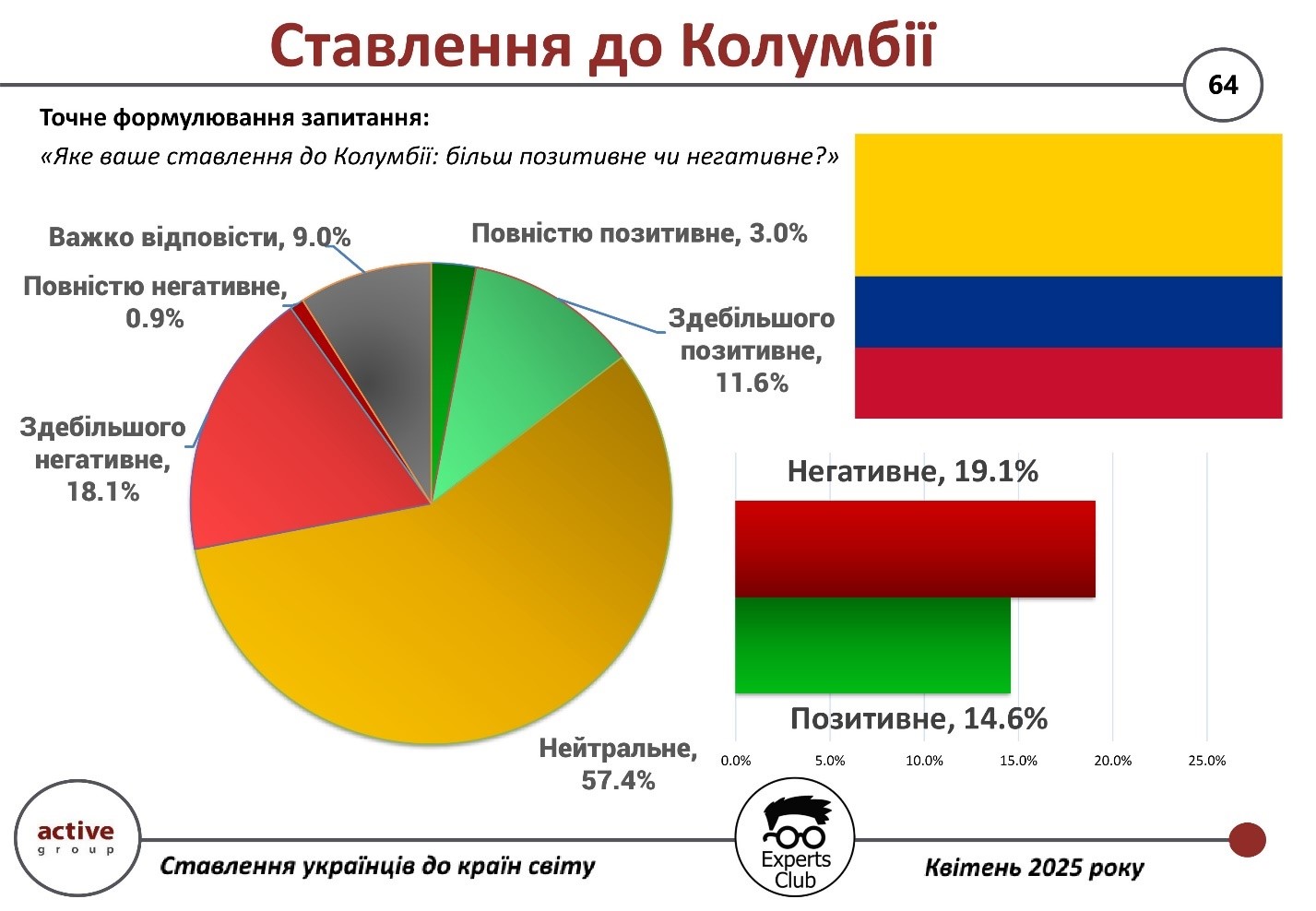

According to a survey conducted by Active Group in collaboration with the information and analytical center Experts Club, Ukrainians’ attitudes toward Colombia remain mostly neutral or negative.

According to the results, 57.4% of respondents hold a neutral position, while 19.1% expressed a negative attitude. Of these, 18.1% said their attitude was “mostly negative” and another 0.9% said it was “completely negative.”

A positive attitude is held by 14.6% of Ukrainians — 11.6% chose “mostly positive” and 3% “completely positive.” Nine percent of respondents were unable to decide on an answer.

“The image of Colombia in popular culture as a country with high crime rates, drug cartels, and political instability influences perceptions. Even with minimal news coverage, this associative framework remains,” comments Maxim Urakin, candidate of economic sciences and founder of the Experts Club information and analytical center.

Colombia has one of the highest levels of negative perception among Latin American countries. This demonstrates the power of stereotypes in shaping public opinion, even with a small amount of relevant information.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

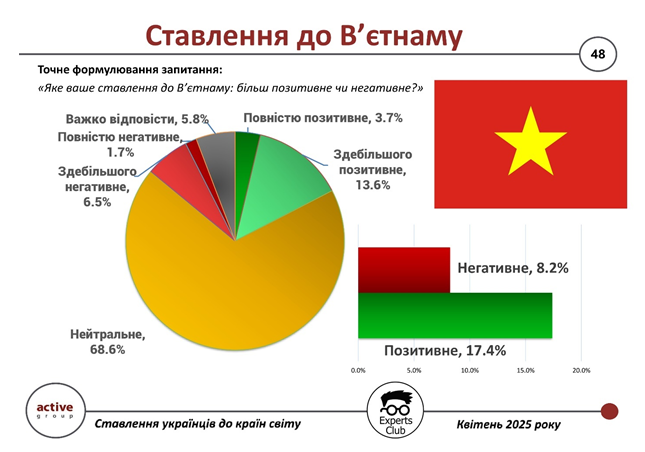

According to a survey conducted by Active Group in partnership with the Experts Club think tank in April 2025, more than two-thirds of Ukrainians (68.6%) have a neutral attitude towards Vietnam. At the same time, 17.4% of respondents express a positive attitude, of which 13.6% are mostly positive and 3.7% are completely positive.

In contrast, 8.2% of respondents expressed a negative attitude (in particular, 6.5% mostly negative and 1.7% completely negative), while another 5.8% of respondents were undecided.

“Historically, Vietnam has been perceived as a country with a rich culture and heroic struggle, but its geographical remoteness and lack of modern ties with Ukraine account for a large share of neutral assessments,” comments Maxim Urakin, PhD in Economics and founder of the Experts Club information and analytical center.

Attitudes toward Vietnam among Ukrainians are mostly positive, but a noticeable share of respondents were unable to give an assessment, indicating potential for shaping a stable image of the country in the public consciousness.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

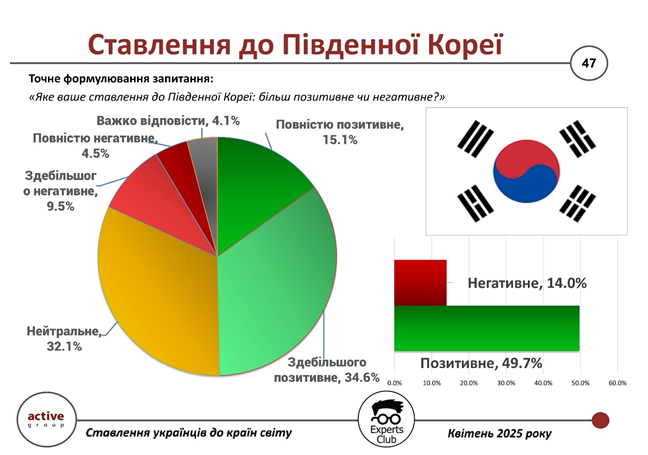

According to the results of a survey conducted by Active Group in collaboration with the Experts Club think tank in April 2025, almost half of Ukrainians (49.7%) express a positive attitude toward South Korea. Of these, 34.6% are mostly positive, and 15.1% are completely positive.

At the same time, 32.1% of Ukrainians remain neutral, 14% express a negative attitude (of which 9.5% are mostly negative and 4.5% are completely negative), and 4.1% of respondents were unable to answer.

“South Korea is perceived as a country of technology, education, and innovation. Its economic breakthrough and successful reforms are respected by Ukrainian society,“ said Maxim Urakin, PhD in Economics and founder of the Experts Club information and analytical center.

“It is also important that Seoul supports Ukraine in international formats,” said Alexander Pozniy, co-founder of Active Group.

South Korea is among the ten countries with the highest level of positive perception among Ukrainians, although the share of neutral attitudes remains significant.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

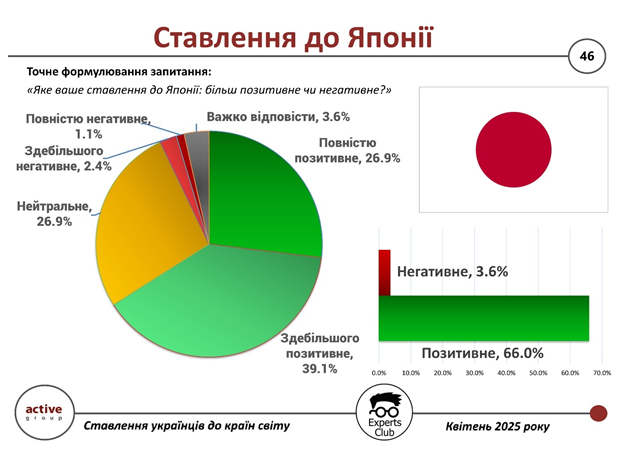

According to a survey conducted by Active Group and the Experts Club analytical center in April 2025, Japan was included in the list of countries with the highest level of positive perception among Ukrainians.

The majority of respondents — 66.0% — expressed a positive attitude toward Japan: 39.1% — mostly positive, and 26.9% — completely positive. Neutral attitudes toward the country were expressed by 26.9% of respondents, another 3.6% were undecided, and only 3.6% expressed negative attitudes (of which 2.4% were mostly negative and 1.1% were completely negative).

“Ukrainians traditionally have great respect for Japan. It is a country of high technology, a stable economy, a culture of discipline and solidarity,” said Maxim Urakin, candidate of economic sciences and founder of the Experts Club information and analytical center.

Japan is perceived as a country with a high cultural reputation and technological leadership and is among the leaders in terms of positive attitudes among Ukrainians, while the level of negativity is one of the lowest among all countries.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN

Yemen remains a little-known country for most Ukrainians, which explains the high level of neutrality. This is evidenced by the results of a survey conducted by Active Group in cooperation with the Experts Club think tank in April 2025.

According to the survey, 64.1% of respondents took a neutral position on Yemen. At the same time, 17.0% of respondents have a negative attitude (12.0% — mostly negative, 5.0% — completely negative), while only 6.9% expressed a positive attitude (4.5% — mostly positive, 2.4% — completely positive). Another 12.0% of respondents were unable to give a clear answer.

According to analysts, this pattern of responses indicates a lack of established associations with the country, except for possible mentions in the context of news about armed conflicts and the Houthi government’s aggressive policy towards shipping in the Gulf of Aden and the Red Sea.

The presentation of the study is available at the link.

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Pozniy, SOCIOLOGY, URAKIN