The Cabinet of Ministers of Ukraine for the period of martial law has exempted from VAT operations on the supply of components for vehicles (including special and specialized), as well as fuel and lubricants for security and defense forces, said the Cabinet’s representative in the Verkhovna Rada Taras Melnychuk following a government meeting on Thursday.

The government’s decision is enshrined through amendments to the government resolution from March 2, 2022 N178 “Some issues of imposition of value added tax at a zero rate during martial law”.

“It is established that until the termination or abolition of martial law, operations on the supply of goods (spare parts, batteries, car tires, coolants, components, additional equipment, etc.) for vehicles (including special, specialized vehicles), as well as fuel and lubricants … are subject to value added tax at a zero rate,” Melnychuk wrote in Telegram.

The Ministry of Finance of Ukraine has supported the proposal of the Association “Insurance Business” (ASB) and the League of Insurance Organizations of Ukraine (LIOU) on the inadmissibility of VAT taxation of commission remuneration of insurance agents, according to the press release of the ASB.

It is specified that the norm on VAT taxation was contained in the draft law of Ukraine “On Amendments to the Tax Code of Ukraine to improve the taxation of insurance activities in Ukraine”.

As reported, both associations jointly appealed to the Ministry of Finance, the Ministry of Economy, the State Regulatory Service, the National Bank with a request not to worsen the tax conditions of insurance business and not to violate the requirements of the EU Directive.

“Ukraine is moving to the EU, so we must check all tax innovations both with common economic sense and with the principles and norms in force in the European Union,” says Vyacheslav Chernyakhovsky, general director of the Insurance Business Association.

At the same time, the press release specifies that the imposition of VAT on commissions of insurance agents directly contradicts the EU Council Directive No. 2006/112/EC of November 28, 2006 “On the Common System of Value Added Tax”. Article 135 “Exemption from taxation of other activities”, which expressly stipulate that “Member States shall exempt from taxation … insurance and reinsurance operations, including related services provided by insurance brokers and insurance agents.

The report also notes that to substantiate their position, insurance associations have analyzed the performance of insurers of Ukraine for the first nine months of 2023 and conducted a representative survey of market participants. According to the results of which it became clear that the state would not receive economic effect from this innovation, and on the contrary, there would be unpredictable additional costs for administration, control and monitoring of VAT operations in insurance activities.

“According to our estimates, our proposals, supported by the Ministry of Finance, saved each insurance company at least 40-50 thousand UAH monthly,” – said Chernyakhovsky.

insurance agents, MINISTRY OF FINANCE, TAXATION, VAT, АСБ, ЛСОУ

Amounts to be refunded decreased by almost one and a half times

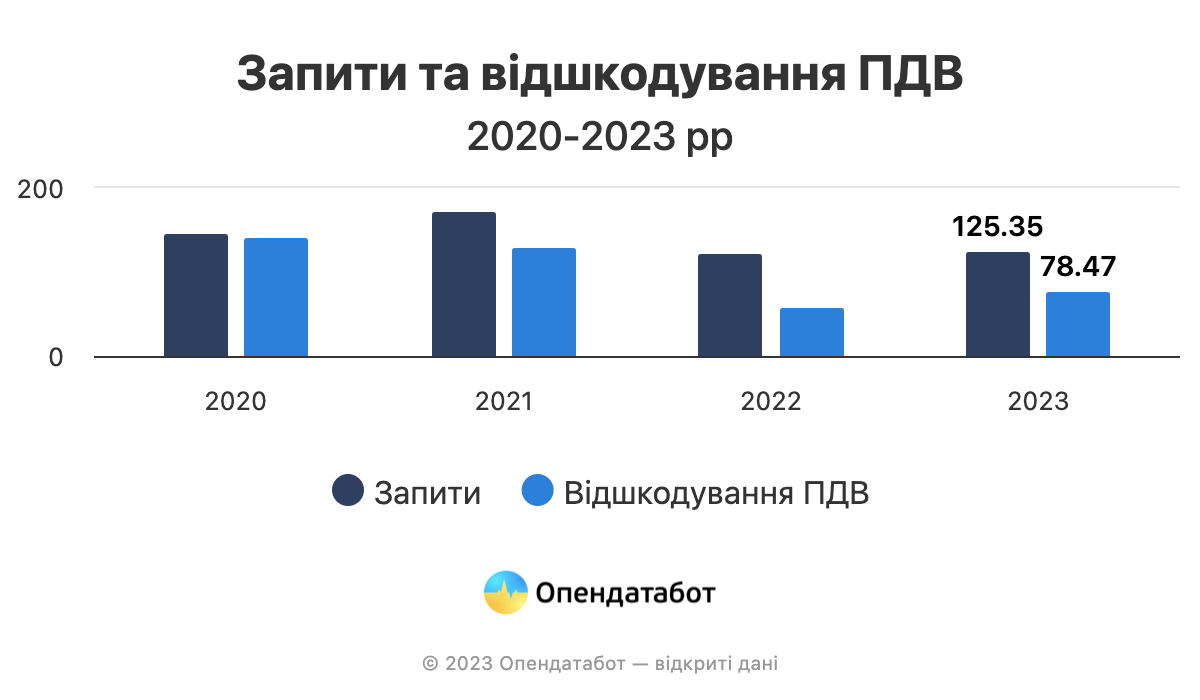

Value added tax (VAT) accounted for one fifth of all state budget revenues in 2023. All VAT payers are entitled to a VAT refund. However, only 63% of the requested VAT refunds were paid by the State Tax Service (STS) in 2023.

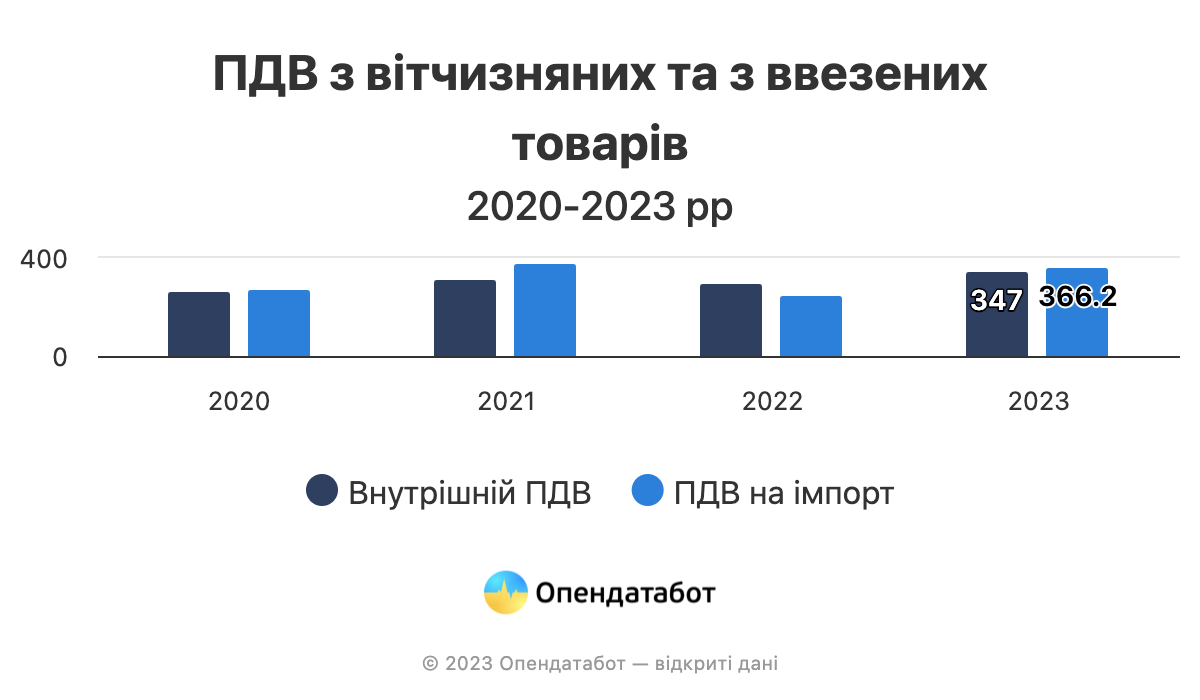

Last year, VAT on imported goods amounted to UAH 366.2 billion, a 1.4-fold increase compared to the first year of the full-scale war. This is almost the same as in 2021 – UAH 380.7 billion.

At the same time, domestic VAT – that is, the tax on goods produced in the country – increased by 10% by 2021.

The situation with VAT refunds in 2023 improved slightly, but still did not reach pre-war levels. Last year, the Tax Service refunded 63% of the amounts claimed for refund, almost UAH 78.5 billion. This is 1.6 times less than in 2021. It is worth noting that the amounts to be refunded decreased by 1.4 times compared to the same pre-war year.

In general, the worst VAT refund rates over the past 4 years were recorded in 2022 – only 48% of the requested amounts, and the best – in the covid 2020: 97% of the requested amount.

Last year, VAT on domestic goods, including refunds, amounted to 8.6% of the budget, and VAT on imported goods – 11.5%. VAT will account for 20% of all state budget revenues in 2023. For comparison, in 2022, VAT brought 25% of the state treasury.

The Verkhovna Rada has exempted from value added tax (VAT) a number of goods imported to Ukraine for security and defense needs.

A total of 294 people’s deputies voted for the relevant draft law No. 9467 on amendments to the transitional provisions of the Tax Code on the peculiarities of importing into the customs territory of Ukraine goods for security and defense needs at the plenary session on Friday, a member of the faction “Golos” Yaroslav Zheleznyak said in his Telegram channel.

The bill exempts from VAT thermal imaging binoculars, monoculars and binoculars, night vision devices and rangefinders that are imported into the customs territory of Ukraine.

President of Ukraine Volodymyr Zelenskiy has signed laws on VAT and duty exemption for imports of copters, thermal imagers, collimators, radios and night vision devices.

As noted in the cards of the corresponding bills № 8360 and № 8361-d, posted on the website of the Verkhovna Rada, both documents were returned to Parliament with the signature of the head of state on February 22.

At the same time, a member of the faction “Golos” Yaroslav Zheleznyak in his telegram channel reminded that the possibility of preferential imports will also apply to express shipments.

“The laws come into force from the day following the day of its publication. That is, in a couple of days will already work, “- added the parliamentarian.

As it was reported, the Verkhovna Rada on February 6, adopted as a basis and as a whole the draft law № 8360 and № 8361-d on exemption from VAT and import duties of copters, thermal imagers, collimators, radios and night vision devices. On February 13, they were submitted to the president for signature.

The state’s debt for value added tax (VAT) reimbursement to grain trader Prometey for part of last year and this year reaches hundreds of millions of hryvnias, with its reimbursement now being spotty and according to non-transparent criteria, Rafael Goroyan, owner of the grain trading holding Prometey, said.

“The state owes Prometey a big VAT refund for more than a year, since before the war. We are patiently waiting for the VAT refund, but our patience may come to an end. Now it is reimbursed in a pinpoint manner, according to unclear criteria, as in the times of Yanukovych (ex-President of Ukraine – IF), when the tax was “discounted,” suitcases were carried, etc. But Prometey Company has its own principles. We never gave any bribes for VAT refunds because it deprived us of competitiveness,” he told Interfax-Ukraine.

“They (tax authorities – IF) want to “negotiate” and we always quarrel – we do not want to “be friends and communicate” with anyone. We do not create an ‘intimate environment,’ so we have conflict all the time,” the head of Prometey stressed in an interview.

“Our principles are much more important than money. Thank God, Prometey is developing, employees’ salaries are being paid, but if we get dirty in the mud of corruption, we won’t be able to wash off,” he added.

According to him, an effective way of dealing with government agencies is to ask for help from the media and hold actions with the participation of Prometey employees and their families.

“If we had to say something loudly, we held large pickets near the tax inspection. When Poroshenko (ex-President of Ukraine Petro Poroshenko – IF) was in power, 3500 people from Prometey employees and their family members used to picket when Nasirov (former head of the State Fiscal Service of Ukraine Roman Nasirov – IF) was the chief tax collector. It was a whole revolution. In my opinion, a month after that he was kicked out and now he seems to be under investigation,” stressed the owner of the holding.

“When the average business gets angry en masse, everything ends badly. We shouldn’t see the situation when VAT is reimbursed to someone point by point, for some unknown good,” Goroyan concluded.

The grain trader stressed that the issue of actual VAT refund is not just a positive thing for the Ukrainian AIC companies but a necessary condition for their survival in the market.

As reported, the head of the specialized parliamentary committee of the Rada Daniil Getmantsev earlier said that the volume of VAT refund to business in November increased by 20% compared to October and amounted to 13.6 billion UAH, this year such volumes were achieved only in February.

VAT refunds were almost completely stopped after the full-scale invasion of Ukraine by the Russian Federation on February 24 this year. If it was 18.52 billion UAH in January and 12.07 billion UAH in February, in March – 0.82 billion UAH, and in April and May it was completely absent and resumed only in June, when 9.5 billion UAH were paid, in July it almost stopped again – 0.6 million UAH. However, in August the amount of payments was 9,4 billion UAH, in September – 1,6 billion UAH and in October – 10,9 billion UAH.

Prometey Group provides services in the storage, processing and logistics of crops. Before the Russian aggression the holding owned 33 elevators in the regions of Nikolaev, Kirovograd, Kiev, Khmelnytsky, Zaporozhye, Sumy, Odessa, Kherson and Dnepropetrovsk, during the war the holding purchased one more.

By the end of 2021, the group planned to receive $45 million EBITDA, while in 2020 this figure reached $32.6 million and in 2019 – $30.5 million.