In July-September 2022 insurance companies – members of the Motor (Transport) Insurance Bureau of Ukraine (MTIBU) settled 51.1% of claims for property damage within 60 days from the date of the accident, up 43.1% compared to Q2 this year (35.7%) .

According to the report on the website of the IASBU, the percentage of claims settled within 90 days in the 3rd quarter of 2022 increased from 46% to 62.2%, up to 120 days increased from 60.2% to 67.4%, for 365 days decreased from 96.3% to 95.9% compared with the 2nd quarter of 2022.

IASBU reports that the greatest number of payments within 60 days performs insurance companies “Universalna” -79,6% (for the 2nd quarter. 61,7%), “Unique” – 77,6% (61.1%), IC “VUSO” -76,2% (57.3%), SG “TAS” -75,5% (62,3%), “ARCS” -75,4% (62,7%), “Knyazha VIG” – 74,3% (62,6%), “ROM Ukraine” -70% (64,1%), “USG” -69% (47,7%), Alfa Insurance -67.6% (56.8%), Arsenal Insurance -66.8%, Providna -66%, Brokbusiness -65.4%, INGO – 63% (45.5%), Oranta -62.1% (38.3%), Express Strakhovanie -60.8%.

The smallest proportion of claims on MTPL within 60 days in January-September 2022 at “Oranta-Sich” -%, “UTSSK” -0,6%, “Omega” -0,9% and “Etalon” -4%.

MLSBU also reported that for the third quarter of 2022 the bureau received 294 complaints against its members, which is 19,1% less than during the quarter before (363).

MTSBU is the only association of insurers, which performs compulsory insurance of civil liability of ground transport owners for damage, caused to third parties.

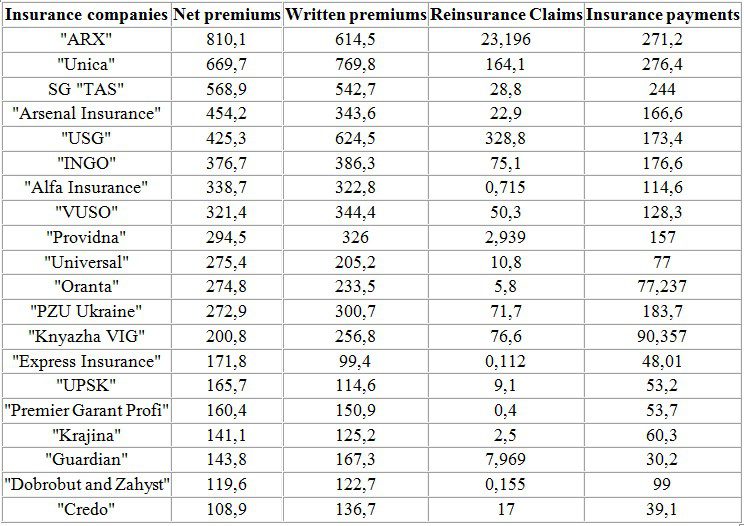

The leaders of the insurance market of Ukraine in terms of net insurance premiums collected in January-September 2022 were insurance companies ARX (UAH 2.228 billion), “Unica” (UAH 1.813 billion) and SG “TAS” (UAH 1.685 billion, all – Kyiv).

As reported in the main indicators of insurance companies in Ukraine for 8M2012, published on the NBU web site. 2022, the leaders in insurance payments in this period were Unica (980 mln UAH), ARX (775,7mn UAH) and SG TAS (675,6 mln UAH).

Data: NBU, mln UAH

In January-September 2022, insurance companies – members of the Motor (Transport) Insurance Bureau of Ukraine (MTIBU) concluded 5.228 million contracts of compulsory civil liability insurance of motor vehicles owners (CMTPL), which is 22.9% less than during the same period of 2021.

According to data released on the website of MTSBU, 3.184 million of the total number of contracts were concluded electronically – 3.86% less than for the same period last year.

During nine months of 2022 the Bureau members reduced the amount of insurance payments on CMTPL policy by 5,8% compared to the same period of 2021 – up to UAH 4,962 billion, including UAH 3,346 billion (+17%) on electronic contracts.

The total of accrued insurance reimbursements under domestic insurance contracts in January-September reduced by 22,77% – up to UAH 2,015 bn. Including UAH 414,562 mln. was paid out using the “Europrotocol (-14,54%).

The Bureau has also reduced the number of settled claims for insurance compensation by 34.2% – to 82.795 thsd. – up to 32,583 thousand (-28,23%).

MLIBU is the only union of insurers providing compulsory insurance of civil liability of ground transport owners for damages, caused to third parties. There are 42 insurance companies that are members of the bureau.

The expenses of Ukrainian insurance companies on advertising and marketing in January-June 2022 increased by 29.9% compared to the same period a year earlier (UAH 38.8 million), according to the website of the National Bank of Ukraine.

In addition, administrative expenses for the reporting period amounted to UAH 2.568 billion, which is 13.1% less than in 6 months-2021, distribution costs amounted to UAH 951.8 million (+8.2%).

The cost of concluding and prolonging insurance contracts amounted to UAH 5.041 billion (-8.7%). Including expenses on agency fees decreased by 10.3% – to UAH 4.682 billion.

The cost of concluding and prolonging reinsurance contracts decreased by 36.9%, to UAH 27.5 million, including fees for brokers, by 39.6%, to UAH 25.1 million, while non-resident brokers increased by 20. 7% – up to UAH 12.8 million.

According to the regulator, over this period, expenses for the settlement of insured events decreased by 20.8% – to UAH 156.5 million. At the same time, the cost of paying for the services of appraisers decreased by 27.7%, to UAH 44.1 million.

Assistance costs decreased by 22.7% and amounted to UAH 80.9 million. At the same time, payment for the services of a non-resident assistance increased by 2 times – up to UAH 4.1 million.

It is also reported that the cost of insurers to conduct court cases for 6 months. 2022 amounted to UAH 10 million against UAH 9.9 million for the same period a year earlier.

As reported, Ukrainian insurance companies in January-September 2022 collected net premiums in the amount of UAH 17.134 billion, which is 27% less than in the same period in 2021 (UAH 23.480 billion). At the same time, the volume of gross insurance premiums amounted to UAH 17.619 billion (-28.9%). Including premiums received from individuals amounted to UAH 3.360 billion, from reinsurers – UAH 2.228 billion.

In January-June, insurers paid UAH 5.835 billion of net insurance payments (31.8% less). The level of net payments decreased from 36.4% to 34.1%. Gross insurance payments decreased by 31.8% to UAH 5.939 billion. The level of gross payments decreased from 35.1% to 33.7%.

The total number of insurance companies in Ukraine as of June 30, 2022 was 142 (6 months-2021 – 181), of which 13 (19) are “life insurance companies”. At the same time, the NBU noted that for 6 months. 2022 reports were submitted by 13 insurance companies.

Insurance companies of Ukraine in January-June 2022 collected net premiums in the amount of UAH 17.721 billion (which is 24.6% less than in the same period in 2021 (UAH 23.480 billion), according to the main performance indicators of insurance companies companies (by institutions) for the first half of 2022, published on the website of the National Bank of Ukraine (NBU).

According to the regulator, the volume of written insurance premiums collected by insurers for the specified period amounted to UAH 17.608 billion, which is 28.9% less compared to the first half of 2021 (UAH 24.780 billion).

In six months, insurers paid UAH 5.934 billion of insurance claims (which is 30.6% less than in the first half of a year earlier (UAH 8.552 billion).

As of June 30, 2022, the assets of Ukrainian insurers on the balance sheet amounted to UAH 65.474 billion, while as of the same date a year earlier – UAH 65.186 billion

The regulator also reports that in the first half of the year the volume of formed insurance reserves increased by 4% – up to UAH 36.438 billion.

According to the NBU, the total number of insurance companies in Ukraine as of June 30, 2022 is 137, while as of the same date a year earlier it was 181.

Performance indicators of the TOP-20 insurance companies for the first quarter of 2021 in terms of net premiums (UAH mln)

Data: NBU