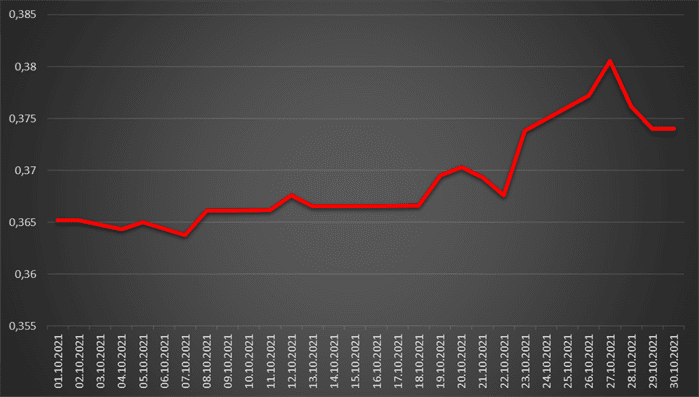

Quotes of interbank currency market of Ukraine (UAH for 1 rub, in 01.10.2021-30.10.2021)

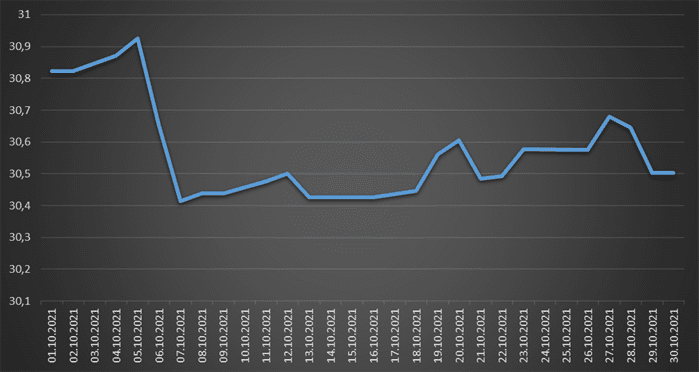

Quotes of interbank currency market of Ukraine (UAH for €1, in 01.10.2021-30.10.2021)

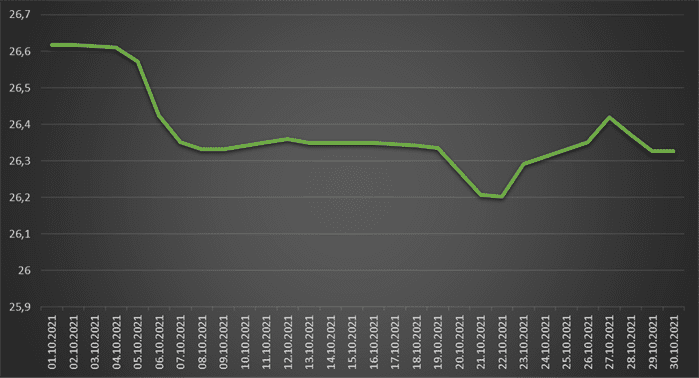

Quotes of interbank currency market of Ukraine (UAH for $1, in 01.10.2021-39.10.2021)

The share of illegal tobacco products in the Ukrainian market over the past five years has increased 18 times – from 1% in 2016 to 18.1% in August 2021 and reached a historical peak, its growth was caused by the increase in excise tax, which the government plans increase by 2025 to the EU level – EUR 90 for 1,000 cigarettes.Such data were released in a joint statement by the CEOs of the largest tobacco companies, adopted during a conference in Kyiv on Monday. The event was attended by Philip Morris Ukraine CEO Kostas Salvaras, BAT Ukraine CEO Kakhaber Benidze, JTI Ukraine CEO Paul Holloway and Imperial Tobacco Ukraine CEO Rastislav Cernak.“A year ago, when JTI launched information campaign on the illegal tobacco market, its share amounted to 6.9% of the Ukrainian market. A year later, this figure reached 18.1% – almost 300% growth in 12 months. This is more than UAH 14.4 billion of lost revenue to the budget of Ukraine,” Holloway said with reference to the preliminary results of the Kantar Ukraine research institute.According to industry representatives, the illegal tobacco market in Ukraine began to grow back in 2014, but this year it crossed a dangerous border: tax-free cigarettes have become readily available. This poses a problem for legal cigarette manufacturers losing market share to illegal cigarette manufacturers and smugglers.In addition, the total legal cigarette market is now estimated at 32.7 billion units, which is 18% less than in 2020, and over 40% less than its volume in 2018.To reduce the growth rate of the illegal tobacco market, the largest manufacturers propose to extend the period for reaching the European level of excise tax of EUR 90 per 1,000 cigarettes in Ukraine by five years – from 2025 to 2030, whereas now it is EUR 48.4 per 1,000 cigarettes.“There was an unprecedented rise in prices for any category of consumer goods, which significantly outstripped inflation, and became the main factor in the reduction of the legal market for tobacco products and the growth of illegal trade […] We propose to expand the schedule for increasing excise taxes on tobacco products until 2030, providing for an annual increase in rates at the level of 10% [instead of current 20%]. This will stabilize the situation in the tobacco market,” Cernak said.He also proposed to “freeze” the increase in the excise tax on heated tobacco products for three years, until 2024.“This approach will give the consumer more time to adjust to higher prices and deprive the illegal market of the potential for growth,” Cernak said in a statement.The unpredictability of regulation of the tobacco industry in Ukraine affects not only business income, but also its future investments, the Philip Morris Ukraine CEO said.“Three of our companies [from those present at the conference] are ready to consider the possibility of localizing production of tobacco-containing products for electric heating in Ukraine, if the state creates the appropriate conditions,” Salvaras said.According to the calculations of market participants, the localization in Ukraine of production of such products with reduced harm from smoking can bring the country more than UAH 6 billion of investments and about UAH 4 billion of additional income tax in three years.As reported with reference to the Kantar Ukraine study in May this year, in January-May, the share of counterfeits in the domestic cigarette market increased by 3.1 percentage points compared to the data for 2020, to 5.1%, the share of tobacco products marked as intended for export and illegally sold in Ukraine increased by 4.8 p.p., up to 7.6%. At the same time, the share of smuggled cigarettes decreased by 0.5 p.p., to 1.7%.

Experts of the European Business Association (EBA) insist on the obligatory revision of the draft law on the timber market taking into account the proposals of the business, in particular, it should provide for a cascade principle of the auction.

“In our opinion, priority access to the resource should be provided to companies that have production facilities and carry out wood processing in Ukraine,” the EBA said in a press release on Thursday.

In addition, according to the press release, it is necessary to significantly revise and simplify the rules of administration of transactions with wood products.

“According to business, they are not only excessive but also inappropriate given the specifics of the market. Businesses find it inexpedient to declare transactions related to wood products, instead of focusing on declaration of the procurement and sale [resale] of wood,” the association’s experts said.

The EBA also notes the need to revise the list of wood products requiring a certificate of origin and exclude from it products that are not of primary wood processing.

The press release notes that the consideration of this bill (No. 4197-d) in the Verkhovna Rada is scheduled for October 22.

“It is worth noting that the updated version of draft law No. 4197-d took into account certain important proposals from businesses. These are provisions that provide a mechanism for the sale of timber on the terms of the offer in parity with the auction and the restructuring of state forestry enterprises by separating the woodworking units of state forestries,” the press release states.

The association notes that it continues to develop proposals for the wording of the bill, which will be submitted additionally.

As reported, revised draft law No. 4197-d on the timber market envisages the abolition of the moratorium on export of unprocessed timber from Ukraine and the introduction of a transparent timber market.