The Arsenal insurance company (Odesa) in January-September 2021 collected UAH 11.063 million in net premiums, which is 19.4% more than in the same period in 2020.According to a company’s report, posted in the information disclosure system of the National Securities and Stock Market Commission, its gross premiums for this period increased by 31.7%, to UAH 14.624 million. Some UAH 3.715 million was transferred to reinsurance (more by 67.5%).Over nine months, the company paid UAH 330,000, which is almost 50% less than in the same period a year earlier.Company’s administrative expenses amounted to UAH 2.452 million (more by 7.8%), and sales expenses – UAH 908,000.Gross profit amounted to UAH 10.733 million (more by 24.2%), net profit UAH 7.503 million, while in the same period a year earlier it was UAH 7.732 million.As reported, in October 2021, Vostok Capital LLC (Kyiv) became a new shareholder of the company with a block of 80.741% of shares, the main shareholder of which is PrJSC Fozzy Group.Fozzy Group is one of the largest Ukrainian retailers with nearly 690 points of sale throughout the country. As of 2019, the total area of its stores exceeded 1 million square meters.

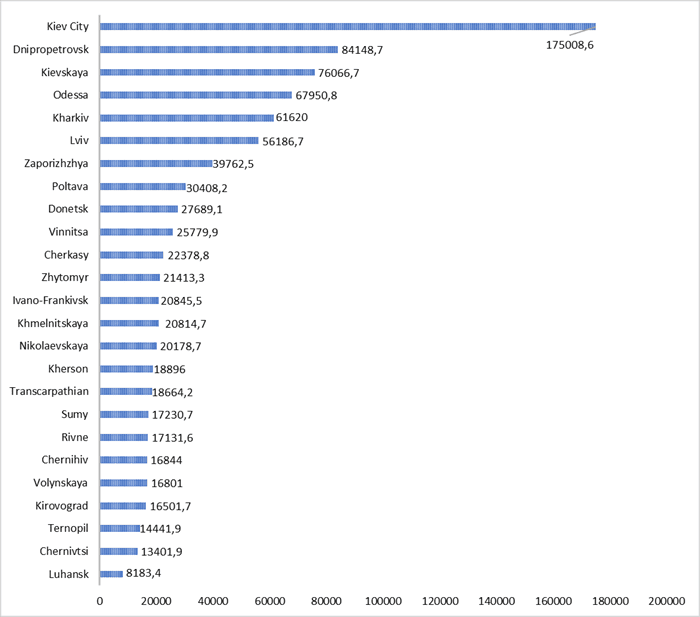

RETAIL TURNOVER IN UKRAINE BY REGIONS IN JAN-AUG 2021 (UAH MLN)

The COVID-19 pandemic has accelerated the merger of retail and warehouse real estate, leading to the emergence of a new hybrid store model of interest to both investors and tenants, according to a study by CBRE.

According to its data, disruptions in commodity supply in 2020 brought the concept of omnichannel to a new level – hybrid store models have emerged that allow shoppers to make purchases both offline in a physical store and online. Thus, retailers need multiple logistics channels to meet demand.

At the same time, transportation costs for direct shipments to consumers are high costs for the retailer, which stimulates the use of physical stores, including as distribution centers and pick-up points, the study notes. According to CBRE Supply Chain Advisory, typical online ordering costs exceed in-store costs by 10-15%.

“In order to meet today’s consumer demands, supply chains have evolved into a network of speed-optimizing facilities that increase capacity and minimize overall costs. Retail chains now have more distribution centers linked to smaller warehouses and distribution points to ensure the best inventory management, delivery and return of customer goods,” the report says.

According to CBRE experts, despite the growth of e-commerce, physical stores remain a sought-after asset, although they require a different development strategy, including the closure of inefficient locations, resizing stores, optimizing rental costs, and reducing delivery costs through the introduction of self-pickup services.

“This approach will allow us to preserve the traditional retail experience, while ensuring the growth of their e-commerce platforms in a single coherent ecosystem,” the study reads.

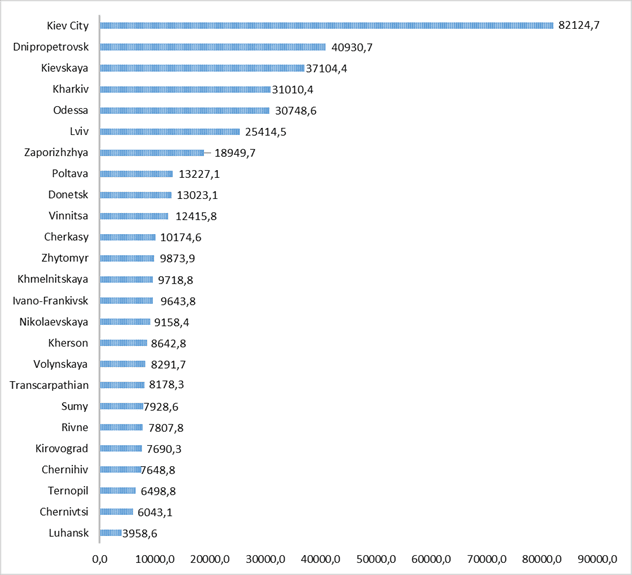

RETAIL TURNOVER IN UKRAINE BY REGIONS IN JAN-MARCH 2021 (UAH MLN)

Retail turnover in Ukraine in 2020 increased by 12.7% compared to 2019, which is associated with significant growth in the e-commerce segment and high domestic demand, the press service of CBRE Ukraine said.

The 2020 retail real estate market survey reports that in 2020 Ukraine recorded impressive annual sales growth rates in the e-commerce segment. According to Euromonitor International, the e-commerce segment achieved 8% of annual retail turnover, up 45% from 2019.

“Thanks to this significant growth in e-commerce, more and more retailretailers are focusing on the development of omnichannel commerce to compete with online platforms,” Radomyr Tsurkan, Managing Partner of CBRE Ukraine, said

A significant number of international brands such as Colin’s, IKEA, Miniso, Massimo Dutti, Uterqüe, Stradivarius and Pull & Bear launched online stores during 2020. Groceryretailer ATB launched its first online store during the lockdown and introduced a new click & collect service, which allows you to pick up groceries from the store after an online purchase.

The expert also noted the oncoming transfer from online to offline: some e-commerce websites (Rozetka, Makeup) actively opened click-and-mortar stores to complement the online experience for customers who want to check the goods live before buying.

“E-commerce will continue to expand towards multichannel retail, driven by a sharp increase in consumer dependence on online shopping during 2020. Rapid improvements in delivery services are also driving the expansion of online stores,” he commented.

According to the expert, with increasing competition, more and more e-commerce players will open and expand stores or points of delivery in order to improve or complement the online customer experience with a physical or offline experience. More traditionalretailers are also expected to focus on developing online platforms to keep up with consumer habits.

CBRE is the world’s largest commercial real estate consultancy and investment firm, with 2020 revenues of $ 23.8 billion. The company is one of the 500 largest companies in the world according to the Fortune 500 ranking (128th in 2020).

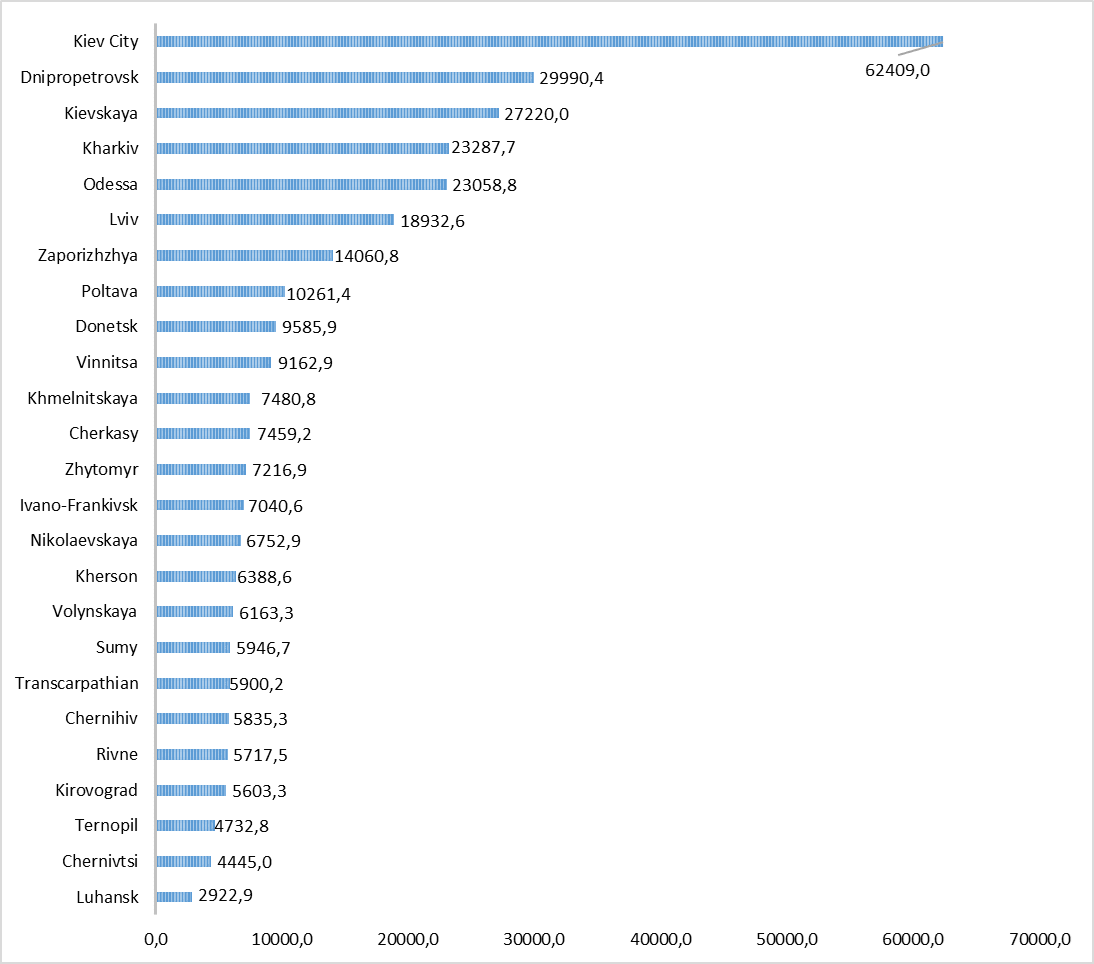

RETAIL TURNOVER IN UKRAINE BY REGIONS IN JAN-APR 2021 (UAH MLN)