?Recovery Construction Forum Ukraine is a forum that brings together government officials and the construction community to discuss current industry challenges and effectively coordinate efforts to rebuild Ukraine.

The first block of the discussion will be devoted to the state policy of reconstruction of Ukraine:

?Dialogue with the authorities on reconstruction priorities and involvement of other countries

?Discussion panel “State support programs and transparency of Ukraine’s reconstruction”

During the second block, we will discuss community support – from service to opportunities:

?Dialogue with the authorities on cooperation between the authorities and communities

?Discussion panel “Rebuilding communities: opportunities and planning”

Within the third block, we will focus on the issues of launching the reconstruction processes – regulation and innovation:

?Discussion panel “Technical regulation and standards of reconstruction”

The forum will also include panel discussions on the following topics:

?”Modern development in the context of reconstruction: analytics and realities”

?”Reconstruction through the eyes of architects: proposals and cases for implementation”

Thus, the speakers will present an overview of the current residential and commercial real estate market, obstacles that hinder development, features of construction in regions that have been significantly affected, the dynamics of the eHouse program, proposals and case studies of projects that are already possible for implementation.

We invite you to get acquainted with the speakers in the video ? or on the website: https://recoveryforum.in.ua/programme

Join the discussion of topical issues that will make the reconstruction faster, better and more efficient!

❗Your participation is a contribution to the reconstruction of the affected communities, for which a part of the funds raised will be transferred.

Earlier, the KCU and its partners have already transferred more than UAH 1 million to the UNITED24 Fund for the “Reconstruction of Ukraine” program. Certificates for medical equipment worth more than UAH 1.5 million were also transferred to the communities.

❗For certain categories of visitors, participation in the forum is free of charge upon prior registration: https://recoveryforum.in.ua/#tickets

?️Ставайте part of the future reconstruction today!

To join the forum: https://recoveryforum.in.ua/#tickets

To book a stand: https://recoveryforum.in.ua/exhibitors#stand

Become a partner: https://recoveryforum.in.ua/exhibitors#partnership

Forum organizers: Confederation of Builders of Ukraine KBU and International Exhibition Operator Premier Expo Ukraine

General partner: Creator-Bud

Strategic partner: Caparol Ukraine, Würth – Ukraine, Kvertus

Financial partner: Globus Bank

Logistics partner: EURO Forwarding

Industry partners: Association of Ukrainian Cities, All-Ukrainian Association of Amalgamated Territorial Communities, Association of Small Cities of Ukraine, American Chamber of Commerce in Ukraine, ICC Ukraine, Ukrcement Association, Association of Consulting Engineers of Ukraine (AECU)

General media partner: Interfax-Ukraine

Media partners: Build Portal, ProfBuild, MIND, Property Times, LUN, RED Community, IRS, Polsko-Ukrainska Izba Gospodarcza (PUIG), TIME OF THE FIRST, zagorodna.com, TRUE, Address Group, KyivVlada, Capital Real Estate, Ukraine Communal, NGO “Living Planet”

WE WILL WIN AND REBUILD EVERYTHING!!!! ?

TOGETHER TO VICTORY! ??

GLORY TO UKRAINE!!!! ??

The article collects and analyzes the main macroeconomic indicators of Ukraine. In connection with the entry into force of the Law of Ukraine “On Protection of the Interests of Economic Entities during Martial Law or State of War” the State Statistics Service of Ukraine suspends the publication of statistical information for the period of martial law, as well as for three months from the date of its completion. The exception is the publication of information about the consumer price index, separate information on statistical indicators of 2021 and for the period January-February 2022. The article analyzes open data from the State Statistics Committee, the National Bank and analytical centers.

Maxim Urakin, PhD in Economics, presented an analysis of macroeconomic trends in Ukraine and the world based on official data from the State Statistics Committee of Ukraine, the NBU, the UN, the IMF and the World Bank.

Macroeconomic indicators of Ukraine

Maxim Urakin cited data from the National Bank of Ukraine on the improvement of the financial situation in 2023 compared to 2022.

“Last year was marked by a more favorable macroeconomic environment for the financial industry. GDP growth generally exceeded forecasts and inflation rates declined. Even after the downgrade, the discount rate remains high enough to make hryvnia investments attractive. Thanks to the efforts of the National Bank and market readiness, the transition to a policy of managed flexibility of the hryvnia exchange rate was successful. At the same time, this success was ensured primarily by stable receipts from partners within the framework of macrofinancial assistance and an increase in the share of exports of agricultural products,” Urakin emphasized.

The expert noted that the main risks for the economy remain the duration of the war and instability of international aid.

“In the third quarter of 2023, Ukraine’s GDP growth slowed to 8.2%. The negative balance of foreign trade increased by 3.2 times, which is a worrying signal. Public debt has slightly decreased compared to August figures, but in 2024 it may exceed the country’s GDP for the first time, which poses significant risks to economic stability,” the economist said.

The pace of international aid to Ukraine, in turn, has significantly decreased in the IV quarter of 2023 – I quarter of 2024, which could create significant risks to the country’s economic stability,” the economist said.

I quarter of 2024, which may negatively affect the recovery of the economy in the current year under the conditions of war.

Global Economic Outlook

Maxim Urakin also analyzed the global economy, noting a slowdown in growth to 2.2% in 2024.

“Analyzing the dynamics of global GDP shows that the global economy continues to recover from the pandemic, but geopolitical instability has a restraining effect on this growth. According to Maxim Urakin, it is important to monitor developments and adapt to changing conditions to ensure sustainable economic growth in the future. Ukraine, in this context, needs to focus on strengthening domestic political stability, restoring its economic potential and continuing reforms to improve its post-war prospects and strengthen its position on the global stage,” the expert explained.

According to the expert, the current macroeconomic situation in Ukraine and the world requires further analysis. For Ukraine, the main challenges in the coming years will be the need to rebuild Ukraine after the war and public debt management.

Earlier, the Experts Club analytical center released a video on how the GDP of countries has been changing in recent years, more video analysis is available here.

During a visit to India, Ukrainian Foreign Minister Dmytro Kuleba pointed to positive changes in bilateral relations between Ukraine and India, Interfax-Ukraine reports, citing the Foreign Ministry’s press service.

Kuleba emphasized that India is gradually changing its understanding of Russia’s war against Ukraine and clearly realizes that Ukrainian-Indian relations have a great future.

“If we compare the state of our relations in the first year of the war and now, we can observe important positive changes. New Delhi has seen Ukraine as an important partner,” he emphasized.

The minister emphasized that Ukraine appreciates India’s desire to establish sustainable peace in our country and its comprehensive participation in meetings on the implementation of the Peace Formula of Ukrainian President Volodymyr Zelenskyy. According to him, Ukraine is working together with India and other countries to involve them in the Global Peace Summit to be held in Switzerland.

Summarizing, Kuleba named three key tasks for the development of relations between Ukraine and India.

“The number one task is to return the level of cooperation in trade and politics to the pre-war level. The pre-war level means multibillion-dollar trade between our countries, which means, first of all, attracting money to the Ukrainian economy, creating jobs, selling Ukrainian goods in the world; it means promising joint developments in high-tech industries; it means the arrival of Indian companies to the Ukrainian market,” the minister explained.

The second task is to work on new projects and programs that should bring Ukrainian-Indian relations to a new level, he said.

“Task number three is the Peace Formula. India’s further participation in the implementation of the Peace Formula will be an important signal to many countries in the region that are focused on New Delhi, convincing them to join this initiative of President Zelensky,” the minister emphasized.

Kuleba also said that Ukrainian diplomacy is working to organize visits by Indian Prime Minister Narendra Modi to Ukraine and by President of Ukraine Volodymyr Zelenskyy to India.

The new leadership of the High Qualifications Commission of Judges (HQCJ) should be virtuous and independent, the Italian Presidency of the G7 Ambassadors Support Group in Kiev said in a statement published on social network X on Thursday.

“The G7 Ambassadors are closely following the news of the High Qualifications Commission of Judges and call for a transparent selection process for the new leadership, which should be virtuous and independent. Advancing reforms and filling the courts with vetted judges is critical to public confidence in the judiciary and private sector investment,” the statement reads.

According to Interfax-Ukraine, on March 27, the HQCJ granted the application of the commission’s chairman, Roman Ihnatov, to dismiss him from the position of a member of the commission at his own request. He had been heading the commission since June 6, 2023.

President of Ukraine Volodymyr Zelensky during his working visit to Sumy region took part in the first regional meeting on the new program of economic policy “Made in Ukraine”.

“For the first time held a regional meeting regarding our new program of economic policy “Made in Ukraine”. There is a substantial amount of funds for this year for all regions of our state. Guaranteed for Sumy region as well,” he said in the evening video message.

Thus, according to him, as a result of this meeting, there are already specific tasks for members of the government, the State Property Fund, the Office of the President and regional authorities, and there are signed contracts for the Ukrainian defense-industrial complex.

Zelensky, in particular, said there are new contracts for automated fire-fighting systems, new FPV drones, and simulators for mobile firing teams to help shoot down Shaheds more effectively.

“I am proud that every month more and more companies, more and more developers are offering concrete samples of weapons, shells, equipment, mine clearance vehicles and everything that is needed on the frontline and will save the lives of our people,” he said.

In addition, during his visit to Sumy region, the president held a lengthy coordination meeting on internal security in the region – from shelters to countering crime, and on all defense issues.

“Very substantive. As for the economy and the social situation: now the general task – and the government, and the regional authorities and heads of communities to give every opportunity that here in our Sumy region there were jobs, that social protection worked, that there were reliable revenues to the budget,” – said Zelensky.

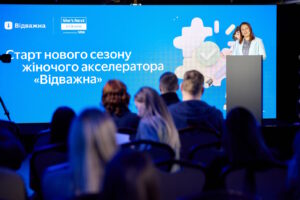

On March 26, Kyiv hosted the presentation of the new season of the visionary women’s accelerator “Vzvazhna 2. Scaling and Digitalization”. Its goal is to help Ukrainian women start or develop an existing business. The new season of the Vzvazhna accelerator is a logical continuation of the first iteration of the project and is aimed at digitalizing and scaling up their own business.

“The development of Ukrainian entrepreneurship is one of the main priorities of the Ministry of Digital Transformation. That is why we have launched the Diia.Business project and are implementing services in Diia that accelerate and simplify the launch and scaling of your own business. We also continue to implement programs and initiatives that help entrepreneurs develop their businesses. One of them is the visionary accelerator Vzvazhna, which has united a community of 5,000 entrepreneurs. In the first season, the project’s winners raised UAH 1.3 million to develop their businesses. The new season will allow us to launch and scale even more businesses, as small and medium-sized businesses are the backbone of our economy,” said Mykhailo Fedorov, Vice Prime Minister for Innovation, Education, Science and Technology, Minister of Digital Transformation of Ukraine.

“Vzvazhna offers future and active entrepreneurs a 4-month course in financial planning and management, marketing and sales, business digitalization tools, taxation, accounting, and tools for entering foreign markets.

“Supporting Ukrainian women on their way to entrepreneurship has always been one of our priorities. Especially now, when 60% of new sole proprietorships are started by women. Last year, together with our partners, we launched the Vzvazhna accelerator. It brought together thousands of women entrepreneurs in a large community. Each participant gained the necessary knowledge and support on their way to starting or scaling their own business. Their stories inspired us to continue the program. Today, we are launching the second season of the accelerator to provide even more opportunities for Ukrainian women in the entrepreneurial sphere,” said Valeria Ionan, Deputy Minister of Digital Transformation of Ukraine for European Integration.

Based on the results of the training, 40 participants will receive UAH 100,000 each to implement their business ideas. At the final event, Grand Pitch Day, 12 finalists will compete for the main project incentive in the following categories: “Debutante, Visionary, and Barrier-Free Business Project. The three business projects with the highest scores from the jury will each receive an additional UAH 400,000 to develop their own business.

“The successful launch of the Vzvazhna project is an appropriate and timely occasion to emphasize the need to digitalize even more Ukrainian SMEs, which is one of Visa’s main focuses. The goal of this year’s accelerator is to scale and take the businesses of brave Ukrainian women to the next level. Owning their own successful business gives women access to shaping the country’s economic agenda, financial independence and mobility, creating new jobs, increasing production or services, filling the state budget with taxes, and, as a result, strengthening Ukraine’s role on the global business map. Mza is ready to support entrepreneurs in every step of their journey, thus expanding access to the digital economy,” said Svitlana Chyrva, Vice President, Regional Manager for Ukraine and Moldova at Visa.

The accelerator will combine two learning formats:

The accelerator participants will also receive additional offers that will accelerate business digitalization from Visa: monobank, Ukrposhta, Checkbox, Shop-Express.

“According to a study on the needs and problems of women entrepreneurs, more than a third of Ukrainian women surveyed say that one of the most common obstacles is lack of access to free training programs, noting financial literacy as one of the most popular areas for improving competencies. It is important to note that other important areas of development identified by entrepreneurs are the digitalization of business processes and the systematization of information. All of this data is concrete evidence that future and active entrepreneurs are striving to improve their skills, develop their own businesses, scale up, and innovate. The Vzvazhna accelerator will become a catalyst for meeting these needs by providing the necessary knowledge and resources for successful business operations,” said Andriy Remizov, Director of the State Agency “Office for Entrepreneurship and Export Development.”

The accelerator participants will also receive additional offers that will accelerate business digitalization from Viza’s partners: TopBank, Ukrposhta, Checkbox, Shop-Express.

“According to a study on the needs and problems of women entrepreneurs, more than a third of Ukrainian women surveyed say that one of the most common obstacles is lack of access to free training programs, noting financial literacy as one of the most popular areas for improving competencies. It is important to note that other important areas of development identified by entrepreneurs are the digitalization of business processes and the systematization of information. All of this data is concrete evidence that future and active entrepreneurs are striving to improve their skills, develop their own businesses, scale up, and innovate. The Vzvazhna accelerator will become a catalyst for meeting these needs by providing the necessary knowledge and resources for successful business operations,” said Andriy Remizov, Director of the State Agency “Office for Entrepreneurship and Export Development.”

To learn more about the project and apply for participation, please visit the Program’s landing page here: https://www.vidvazhna.com.ua/#about. The application deadline is April 28, 2024 (23:59).

The project will run from April to September 2024. You can watch the recording of the Program presentation here.

In 2023, Vzvazhna brought together more than 5,000 Ukrainian women who received online and offline training at 10 Diia.Business entrepreneurial support centers. As a result of the program, 6 Ukrainian women raised UAH 1.3 million to start and develop their own businesses.

The new season of the visionary women’s accelerator “Vzvazhna 2. Scaling and Digitalization” is being implemented by the Diia.Business network of entrepreneur support centers with the assistance of the Ministry of Digital Transformation of Ukraine, the Office for Entrepreneurship and Export Development, and with the support of the USAID Ukraine Confidence Building Initiative (UCBI) and the global initiative She’s Next Empowered by Visa.