The European Bank for Reconstruction and Development (EBRD) is providing a risk-sharing guarantee without financing in the amount of UAH150 million (EUR3.1 million) to cover half of the loan issued by Ukrsibbank to retailer EVA for the development of its logistics hubs, the company’s press service reported.

“This agreement is an important milestone for EVA and our first experience of cooperation with the European Bank for Reconstruction and Development. We underwent a thorough analysis by the EBRD, which confirmed EVA’s financial stability, the compliance of our activities with the criteria of Ukrsibbank and the EBRD for borrowers, and the recognition of our company as a reliable partner capable of developing its business even in wartime,” said Lilia Volenko, CFO of Rush LLC (EVA and eva.ua network), in a press release.

It is noted that this agreement was the first time the bank used the EBRD’s risk-sharing program (individual investment loan guarantee) to provide an investment loan to a corporate client. Previously, risk sharing rules allowed the bank to share risks only for working capital financing transactions.

According to Volenko, this agreement is a signal to the market about the possibility of attracting long-term financing with the support of international institutions in wartime.

Rush LLC, which manages the EVA chain, was founded in 2002. The chain has over 1,100 stores.

According to YouControl, the owner of Rush LLC is listed as Cyprus-based Incetera Holdings Limited (100%), with Ruslan Shostak and Valery Kiptik as the ultimate beneficiaries.

At the end of the third quarter of 2025, Rush’s net income increased by 18.6% compared to the same period last year, reaching UAH 22.9 billion. Net profit decreased by 14.7% to UAH 1.7 billion.

On November 25, the Board of the insurance company ARKS (Kyiv) has decided to terminate the activity of Dnipro branch of Kyiv regional directorate. As the company reported in the information system of the NCSSM, the decision was made in connection with optimization of the company’s activities.

It is also specified that the separate subdivision is different from branches and representative offices, has no registration in the Unified state register.

ARKS is a part of the international insurance holding Fairfax Financial Holdings Ltd.

According to Serbian Economist, Montenegro will cancel visa-free entry for Russian citizens and introduce a visa regime by the end of the third quarter of 2026 as part of the harmonization of visa policy with the rules of the European Union.

“In accordance with the commitments undertaken by Montenegro on its path to full membership in the European Union, the country must fully harmonize its visa policy with the EU policy by the end of the third quarter of 2026. This includes, among other things, the introduction of a visa regime for Russian citizens,” the commentary reads.

Russian citizens can now enter Montenegro without a visa and stay in the country for up to 30 days under a bilateral agreement.

According to the national statistical service Monstat, in 2023 Montenegro was visited by about 247 thousand tourists from Russia, which provided 24% of all overnight stays of foreign guests; in 2024 their share amounted to 18.3% with a total flow of 2.6 million tourists. According to the Ministry of Internal Affairs of Montenegro, about 20 thousand citizens of the Russian Federation with temporary or permanent residence permits are officially registered in the country.

Thus, the tightening of the visa regime will potentially affect annually hundreds of thousands of tourist trips and tens of thousands of Russians living or regularly vacationing in Montenegro. Experts expect that part of this flow will be reoriented to other visa-free or easier destinations for Russians – primarily Turkey, Egypt, UAE, Serbia and a number of Asian countries.

https://t.me/relocationrs/1822

Local budgets received UAH 37.7 billion from land tax payments in January-October 2025, which is 15.3% or UAH 5 billion more than in the same period last year, according to Lesya Karnaukh, acting head of the State Tax Service (STS), on Facebook.

According to her, taxpayers in Dnipropetrovsk and Kyiv provided more than a third of all land tax revenues for the 10 months of 2025, with local budgets in Dnipropetrovsk receiving UAH 6.7 billion and the capital receiving UAH 5.3 billion.

In addition, Odessa (UAH 3.3 billion) and Lviv (UAH 2.6 billion) regions are among the leaders in land tax payments.

“Land tax is one of the most stable sources of local budget revenues. These funds are used specifically for communities and the implementation of infrastructure and social projects. I would like to thank all taxpayers who conscientiously fulfill their obligations. Every contribution works for the development of communities and the strength of the country,” Karnaukh concluded.

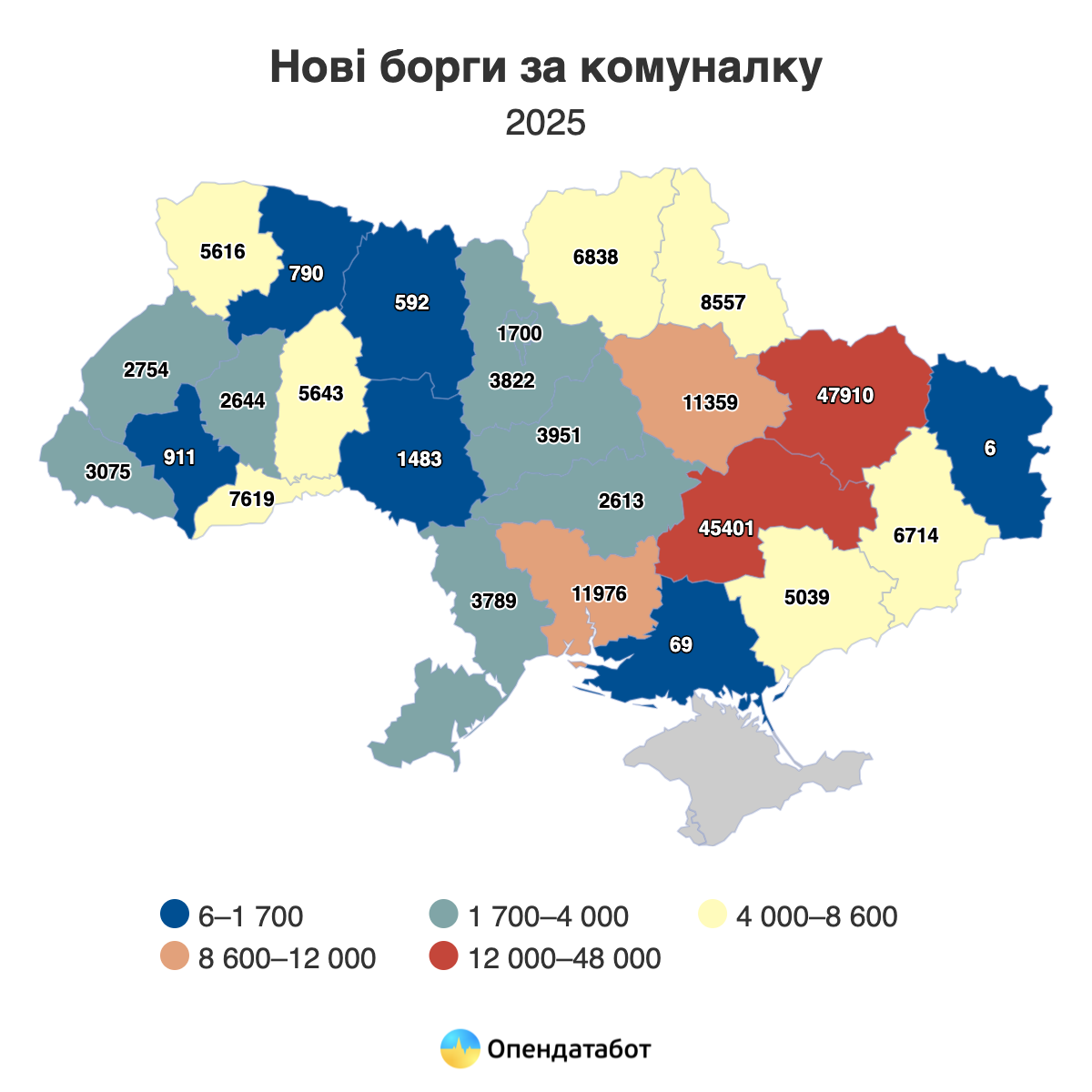

More than 794,000 enforcement proceedings for utility debts are currently registered in the Unified Register of Debtors. 60% of these debts have reached a dead end: they have been formally completed but not closed, and no money has been collected. 194 thousand new debts were added to the Register this year. Most often, Ukrainians accumulate debts for heat supply. More than a quarter of debtors are pensioners. A 71-year-old pensioner from Mykolaiv region holds the anti-record for the number of debts: 28 proceedings, all for electricity.

As of the beginning of November 2025, there were 794,604 active debts for utilities in Ukraine. Despite their active status, most of these proceedings have actually reached a dead end: 60% of the cases, or more than 476,000, have already been completed without any real recovery. The debts have remained in the Register, but the enforcers have simply failed to collect the debt.

194 thousand new proceedings for utility debts have already been opened this year. Two-thirds of them are still open (132,578 proceedings).

The largest amount of utility debt is owed in Kharkiv region: 47.9 thousand proceedings. Dnipropetrovs’k region is slightly behind with 45.4 thousand proceedings. Other regions are at least three times behind: Mykolaiv region (11.9 thousand), Poltava region (11.3 thousand) and Sumy region (8.5 thousand).

In 40% of cases, Ukrainians will owe for heat supply in 2025. Water supply is in second place (18%), followed by gas supply (15%) and housing services (10%). Garbage collection and electricity account for 8% and 6%, respectively.

This year, the largest number of proceedings were opened against people aged 46-60, accounting for almost 36% of all cases. And every fourth debt falls on pensioners.

More than half of the proceedings (55%) were opened against women this year. And the anti-record belongs to a 71-year-old pensioner from Mykolaiv region, against whom 28 proceedings were opened for electricity debts this year alone. All of them were terminated due to the impossibility of collection. In fact, the debts remained, and the system only accumulated new “dead” cases.

Context

As a reminder, the Verkhovna Rada supported in the first reading the draft law No. 14005, which is supposed to significantly change the rules for working with debtors. The document proposes automatic inclusion of debtors in the register and a ban on the sale or donation of property until the debt is fully repaid. The new rules will make it easier to seize assets and prevent attempts to re-register them.

Andriy Avtorgov, a private enforcement officer, comments on the hype surrounding the yet-to-be-adopted law:

“Some of the loud statements around the project are based on a misunderstanding of the current legislation: the Unified Register of Debtors has been operating since 2017, and foreclosure on the only housing, under certain conditions, was possible even earlier. The new draft law actually brings back the rules that existed before and makes life easier for debtors by making it easier for them to pay the debt, as the enforcement proceedings will be automatically closed and the debtor will be excluded from the Unified Register of Debtors.”

The bailiff notes that the implementation of such decisions should be carried out with some caution so as not to destroy the already fragile architecture of the enforcement process, as the percentage of enforcement is already extremely low.

Despite the panic on social media, even if the law is passed, the mechanism for seizing a single home will not change significantly. It will be possible, as it is now, only if the debts exceed 20 minimum wages (UAH 160,000) and with the mandatory involvement of guardianship authorities if children are registered in the home. The law is still being finalized for the second reading, so the final rules may change.

https://opendatabot.ua/analytics/debts-bills-2025-11

JSC Ukrzaliznytsia (UZ) has determined the empty run coefficients and average daily transport speed for 2026, according to the company’s website.

According to the report, the largest increase in empty run coefficients will affect specialized rolling stock, namely: food tank cars will increase in price from 1.03 to 1.44, fitting platforms — from 0.45 to 0.70, Euro gauge (1435 mm) tank cars — from 0.77 to 1.04, grain cars — from 1.06 to 1.11, and semi-cars — from 0.85 to 0.89.

The most significant drop will affect container platforms — from 1.50 to 0.97. A significant reduction in costs is expected for carriers of mineral fertilizers and raw materials: the coefficient for mineral carriers will decrease from 1.28 to 0.79.

At the same time, the average daily transport speed in the export direction via land crossings will increase for most types of cars. At the same time, a decrease in the average speed will be recorded for most types of rolling stock in the direction of port stations.

The speed for exports will increase by 115 km/day for covered railcars/container shipments converted from refrigerated railcars, and by 113 km/day for route or container trains in the direction of ports for tank cars that have been converted and modernized.

The speed for cement carriers will drop almost everywhere, and for export trains, the reduction will be 89 km/day (-146 km/day).

Grain carriers on routes to ports for route/container trains will slow down to 255 km/day.

For fitting platforms, the speed will be reduced for all types of shipments and in all types of transportation.