The National Bank of Ukraine (NBU) has decided to cut its key policy rate again to 20% per annum from 22% per annum, effective September 15, in line with market expectations.

“Taking into account the balance of risks, the rapid decline in inflation and the ability to maintain exchange rate stability, the NBU Board has decided to cut the key policy rate to 20% (…) Further slowdown in inflation and the NBU’s ability to ensure exchange rate stability allow the NBU to continue the cycle of rate cuts while maintaining sufficient attractiveness of hryvnia savings. Such a step will support economic recovery and at the same time does not pose a threat to macrofinancial stability,” the central bank said on its website on Thursday.

The NBU noted that price dynamics were better than the NBU expected, primarily due to an increase in food supply, in particular, good harvests contributed to lower prices for cereals, flour, vegetables and some fruits.

“At the same time, the decline in core inflation (to 10% yoy in August) was close to the NBU’s July forecast. The NBU’s measures to ensure the attractiveness of hryvnia assets and the stability of the foreign exchange market played an important role in easing underlying price pressures. In particular, they contributed to further improvement of exchange rate and inflation expectations,” the central bank added.

It is noted that the general downward trend in inflation will continue, but the potential for a rapid slowdown is almost exhausted.

“On the one hand, better harvests will limit price growth in the coming months. The impact of fixing certain tariffs for housing and communal services will also remain,” the NBU explained.

The NBU will continue to ensure the stability of the foreign exchange market to keep exchange rate and inflation expectations under control, which will contribute to a further decline in

On the other hand, the pressure on business costs will be significant due to both war-related losses and rising electricity and fuel prices, which may restrain the slowdown in inflation, the NBU added.

In the future, the NBU expects to continue the cycle of key policy rate cuts, the implementation of which will be consistent with the need to maintain the attractiveness of hryvnia assets as a prerequisite for the stability of the foreign exchange market and a steady decline in inflation.

State-owned Oschadbank provided a UAH 250 million revolving credit line to Tavria Plus, a private enterprise (PE) that is part of the Tavria B retail chain, in August as part of the state program “Affordable Loans 5-7-9%,” the financial institution’s website reports.

“During the period of full-scale war, we have already signed five loan agreements with this retail chain totaling UAH 865 million,” said Yuriy Katsiyon, Deputy Chairman of the Board of Oschadbank in charge of corporate business.

Vyacheslav Pysmenyuk, director of Tavria Plus, noted that by combining different types of credit support, they managed not only to balance payments with suppliers but also to further develop the network.

It is noted that Oschadbank has been cooperating with Tavria Plus since 2014. In addition, during 2022-2023, the company additionally received support from the state bank on general terms.

The state bank clarified that the credit line for Tavria B was the third such line for retailers under the state program “Affordable Loans 5-7-9%”. Their purpose is to replenish working capital. The total amount of funding provided by the state program during the full-scale war amounted to UAH 580 million.

According to the retail chain’s website, Tavria V has been operating since 1992 and includes 135 supermarkets and shopping centers, meat and fish processing plants, confectioneries, culinary shops, bakeries, a brewery, garment and knitwear production, and a large logistics center. The chain employs 4,500 people.

According to Opendatabot, the ultimate beneficiaries of Tavria-V LLC are Boris and Mikhail Muzalev, with 60% and 40% of the company’s shares, respectively.

The number of dead as a result of flooding in Libya caused by Hurricane Danielle has exceeded 8 thousand people, more than 10 thousand residents are missing, Al Arabia reports.

“The death toll from the natural disaster in northeastern Libya has exceeded 8 thousand people. The number of missing people now exceeds 10 thousand,” a Libyan parliamentary advisor said in a statement.

Abdulmenam al-Ghaite, head of the municipality of the city of Derna, which has taken the brunt of the flooding, said it was predicted that the death toll from heavy rains and flooding could rise to 20,000.

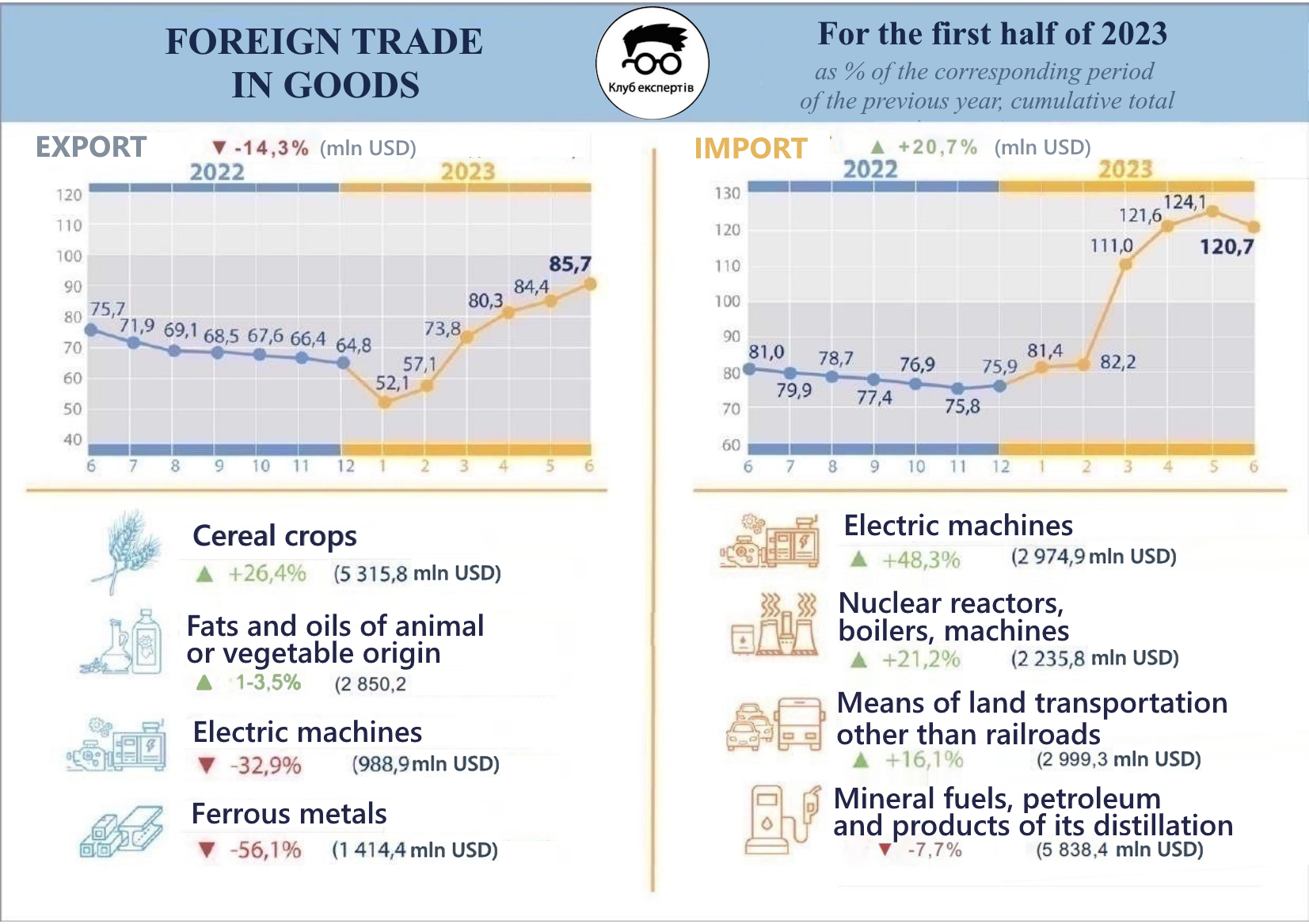

Foreign trade in goods in January-June 2023 (general infographic)

Source: Open4Business.com.ua and experts.news

The head of the association “Meat Industry” Mykola Babenko told the agency “Interfax-Ukraine” about the prospects of development of pig breeding and meat industry in the conditions of blocking grain exports.

– How much pork is consumed in Europe per person per year? Does Ukraine reach the European indicators or not?

– We are not even close to the European consumption of all livestock products and pork in particular. If before the war the average annual consumption of pork in Ukraine was 14.5-15 kg/year per person, now this figure has decreased to 11-12 kg. At the same time, the European figure is 40 kg/year per capita, and in some countries, where pig breeding is one of the leading industries – 60-80 kg.

There are two reasons: low purchasing power of the population and the price of pork. It has never been low in Ukraine. Proof of this is imports, which for the last 10 years amounted from 10 to 30% of the volume of pork consumption. This shows that it is cheaper to buy pork abroad than on the domestic market.

– From which countries did we usually import pork?

– In 2012-2013 Ukraine was in the top 10 world importers of pork, so there was even Brazilian pork on our market. We imported about 300 thousand tons of pork per year, 700 thousand tons produced independently and consumed 1 million tons in total. With the crisis of 2014-2015, with the devaluation of the hryvnia, imports decreased many times, but we remained importers. In recent years, the main suppliers of pork were the European Union countries, among which Poland, Belgium, the Netherlands and Denmark are the leaders.

The main importers were and still are the members of the Meat Industry Association, i.e. some of the meat processing enterprises of our association. Currently, they are taking the first steps as exporters of Ukrainian pork. We are preparing for a different status for Ukraine – the world’s leading pork exporter.

By the way, Ukraine, which is 20 times larger than Belgium, had 2 times fewer pigs on its pig farms before the war than this small European country.

– The agrarian community has begun to say that in the context of difficulties with grain exports, it is advisable for farmers to pay attention to animal husbandry. Do you agree with this?

– The Ukrainian Meat Industry Association is one of the main ideologists of the concept of creating larger value chains within the country. Back in 2020, we developed the program “New Pig Production 2025”, which provides for a fourfold increase in the number of pigs in Ukraine, i.e. a return to the level of 1991. Unfortunately, dishonest lobbying by other agricultural sectors slowed down our plans before the war.

Let’s look at the statistics. Most of the closures of pig farms in Ukraine – 2190 enterprises – occurred in 2014-2020, and now there are only 1000 of them left. There has been a threefold decrease in the number of enterprises engaged in pig production.

– Why? Is it unprofitable?

– In addition to the association, I head the Center for Livestock Efficiency, which I founded. For more than 10 years, thanks to the crisis management we have applied, we have brought 20 enterprises, mainly pig farming, back to the market from bankruptcy.

I can say with confidence that pig farming in Ukraine has never been unprofitable in a single year with proper business organization. Those who say that pig farming is unprofitable are justifying their inability to organize the business effectively.

Ukraine imports pork from countries where feed is much more expensive, wages are many times higher, and pork is cheaper.

Since 2020, the Center for Animal Production Efficiency has been representing Ukraine in the international group of pig production efficiency researchers InterPIG, which includes representatives from the European Union, America, Brazil, Japan, China, Vietnam, Malaysia, and other countries.

It is known that pig farming is one of the most profitable ways to sell grain, as feed accounts for up to 80% of the cost of pigs, which is one of the most costly parts of the cost. While working at InterPIG, we were able to compare feed prices and feed consumption per 1 kg of pig cost in Ukraine and the EU in 2019. Feed prices in Ukraine were 30% cheaper than in the EU last year. But in the cost of pigs, feed costs in Ukraine were already 40% higher than in the EU. That is, Belgium and the Netherlands produce twice as much pig meat as Ukraine for the same amount of feed.

The Ukrainian pig industry has been turned into a kind of “factory for the production of humus” rather than meat. This is a very serious problem. We have calculated the total annual costs of pig production in Ukraine – the cost overruns on feed within the country were UAH 8 billion annually. This explains why Ukrainians pay so much for 1 kg of pork.

– You mentioned 20 companies that you helped to avoid bankruptcy. Can you name their typical mistakes that hindered their business?

– Firstly, falsification starts with genetics, which is the potential for a pig farmer to have the lowest cost in the world or lose money. In Ukraine, pseudo-genetics is still being sold on a massive scale. We often see conventional fattening under the guise of genetics. Such animals, in principle, are not able to provide normal production costs.

Secondly, falsification with feed. Everyone who went the wrong way in pig farming bought fake premixes, protein components, or ready-made feed that did not provide the required minimum level of nutrients. This led to cost overruns on feed and medicines, as pigs get sicker due to unbalanced feeding.

Third, counterfeit veterinary drugs are also a common practice. As well as the practice of using medicines “by eye”, without the necessary sensitivity testing, even without a diagnosis.

And the lack of objective accounting at the pig farm with cost control completes the work of this “business”. All of this then forms the overtime cost of pigs.

We started the audit at the level of pig production, because the development of the meat industry is directly dependent on its development. If there are no pigs in Ukraine, or their cost is the highest in the world, the meat industry will have no prospects for exports or satisfying the domestic market.

– Is there another problem in the shortage of decent personnel, in addition to imperfect accounting at enterprises?

– 100%. Specialists at enterprises are often simply underpaid, and it is difficult for many to stay honest and work for the result. There is always a choice – either you work for a salary of UAH 15,000 or you get monthly bonuses of UAH 50-100 thousand or more for buying genetics, feed, veterinary drugs from dishonest suppliers of counterfeit products.

– During the war, these trends are exacerbated. Is it worth investing in pig production now?

– Pig farming is one of the simplest businesses that exist. The business is systematic: all processes are typical and repeatable, like a conveyor belt in a factory. You just need to set them up once, and then you just need responsible executives and controllers to monitor compliance with the technological processes. Recently, the Center for Livestock Efficiency has been receiving more and more requests to monitor farm performance.

There is no need to be afraid of this business. A clear proof is the level of industry development in the EU, North and South America. In North America, unlike in the EU, where pig farming is a family business, pig farms employ many hired workers, Mexicans in particular, who have a similar attitude to animals to ours on many farms. At the same time, the industry, being properly organized, operates at a high level.

Ukraine has a successful example in poultry farming. Almost every Ukrainian poultry farm has a standard set of technological regulations that are repeated in the same way at each enterprise. Thanks to the introduction of the most modern methods, Ukrainian poultry farming is at the forefront of global poultry production, especially in terms of cost, and therefore successful in exports.

We are currently working on increasing the number of pigs. Ukraine needs to quadruple the number of pigs to be raised at the lowest cost in the world. The situation can be leveled through genetics, feed, accounting and management. When the war is over, feed will become more expensive. Ukraine will join international market processes, and we need to stay in the top, primarily because of the efficiency and cost of the industry, as it has already happened in our poultry industry.

There is no need to be afraid of a pork surplus and worry that the price of pigs will collapse in 2024.

First, the Meat Industry Association is actively working with our meat processing plants, which have experience in foreign economic activity, to create sustainable sales channels for the surplus pork produced in Ukraine. The meat industry is interested in a predictable market, stable and constant earnings, so that there are no fluctuations when either one or the other earns.

Is there a shortage? The price of pigs has risen, the population pays double the price and pig farmers make money. The market is oversaturated, the number of pigs increases, the price of pigs falls, and as a result, pig farmers break even or lose money. We need to balance demand and supply through exports so that pig farming always brings a sustainable income.

In 2022, the total global pork trade was just over 11 million tons. According to the forecast of the Organization for Economic Cooperation (OECD) FAO, by 2030, global pork consumption will increase by 16.5 million tons. That is, pork consumption will grow by an average of 2 million tons annually.

Secondly, before the war, the whole of Ukraine produced 0.6 million tons of pork in slaughter weight, and now it is less than 0.5 million tons. Our fourfold increase in the number of pigs will not even have a significant impact on closing the global pork deficit. We will not even close it by tens of percent.

The European Union, which was the world’s leading exporter of pork with a market share of 45%, that is, sold 4.9 million tons per year, due to the high concentration of pigs, environmental regulations and restrictions that came into force in this part of the world, is now planning to reduce the number of pigs in some countries to the level of self-sufficiency. Billions of euros are allocated annually to close down pig farms – the EU is withdrawing from markets where it has traditionally been present for decades. They remain free.

Ukraine needs to make an offer, demonstrate that we have a product and it will be sold. Farmers should look at pig production as a long-term option for selling their own grain.

The development of pig farming in Ukraine will bring an additional EUR 6 billion in added value annually.

The second problem that scared farmers away from pig farming was African swine fever. More than half of the ASF cases are far-fetched. This is how economic losses at enterprises were concealed or the number of pig farms was artificially reduced.

In 2023, the first vaccine against African swine fever was introduced in the world, demonstrating 95% effectiveness. It has already been authorized in a number of Asian countries. Work has begun on its registration in the EU. Ukraine has submitted the relevant documents and will be able to use the vaccine to prevent the spread of the ASF virus.

– What do you need to do to set up a pig farming business properly?

– Pig farming provides a 200% return on investment for more than a year. This is a good option for both businesses and the state, which is experiencing problems with the sale of crop production. This is one of the few ways to resolve the situation with the blocking of grain exports – to create a domestic market.

To enter this business, one sow with a train requires an investment of 5-6 thousand euros. This amount includes the construction of new premises, the purchase of equipment and genetics – capital investments that need to be made to start a business.

One sow and her offspring will consume up to 10 tons of grain per year of fodder grown on 1 hectare of land. That is, from one sow, the owner will receive offspring that will eat about 10 tons of feed during the year together with the sow. That is, one sow conditionally consumes what is grown on 1 hectare of land. Then everyone can calculate the reality of increasing the number of livestock based on their own land bank. In two years, the 5-6 thousand euros spent on a sow will be returned.

Under current market conditions, the profit in pig farming is over 200%. Before the war, the cost of pigs was 30-35 UAH/kg, and the selling price was 45-50 UAH/kg. In 2022, due to the blocking of grain exports, feed prices dropped significantly. For example, wheat bran fell fivefold, while soybean cake and sunflower meal fell 2-3 times, and cereals fell 2 times. At the same time, global prices for pigs and pork doubled in July 2022. In Ukraine, the cost of pigs was less than 20 UAH/kg. Now it has risen to 25-30 UAH/kg, and the selling price is up to 85 UAH/kg. Pigs grow up in 6 months. That is, the pig farm will have two livestock turnovers in a year.

If we take the maximum cost price that should be without cost overruns – 35 hryvnias, and sales of 85 UAH/kg and 2 production turns per year, the profitability has increased to 300% during the war.

– You mentioned that you are working on opening pig exports. What stage are you at?

– Our meat processing plants that imported pork have many years of experience in pork trade, primarily with the EU. But for Ukraine, the most important countries are Asia and Africa, where the EU used to export pork and is still present. The list of priority countries: Philippines, Vietnam, Malaysia, South Korea, Singapore, and South Africa. They consume millions of tons of pork.

Memories of the unsuccessful experience of Ukrainian grain exports in the 2022/23 marketing year are fresh, as a result of which Poland, Hungary, Romania, Slovakia, and Bulgaria blocked the transit and sale of grain from Ukraine on their own territory. Later, transit was resumed, but the sale of Ukrainian grain in these countries is still prohibited. Restrictive measures are likely to be extended.

To prevent the example of grain exports from repeating itself with pork, we are deliberately building relationships with new markets. We have many partners in the global market who help us and enter into partnerships in pork supplies.

We urge representatives of all sectors of the Ukrainian agro-industrial complex to realize that we all have enough space on the global market. In contrast to previous years, when associations were created to oppose one industry to another, it is time to think about partnership. The Meat Industry Association declared this goal back in 2020 to concentrate efforts and win in the global market. We must focus on making sure that everyone can earn. Only through synergy can we achieve maximum results.

In terms of technology development, Ukrainian meat industry companies are on par with the best European companies. We are not inferior to them and are ready for any audits. For three years, we have been persuading the State Service of Ukraine for Food Safety and Consumer Protection to initiate an audit to assign Euro numbers to the enterprises of the Meat Industry Association. Having a European license plate will help us enter new markets, particularly in Asia and Africa. We understand that there are several stages of approval of veterinary and other certificates ahead.

Among the first companies to be ready for export are those in the western part of Ukraine, which were the main importers and are logistically closer to the border – Agro-Invest, Euro-Commerce, Exim Food, Lembergmith (Lviv region), and Meat Processing Plant Antonivsky from Kyiv region.

We recognize the responsibility and importance of making cross-sectoral decisions to formulate a comprehensive strategy for the development of the Ukrainian agro-industrial complex. The business relies primarily on its own capabilities, but also counts on the support of the State Service of Ukraine for Food Safety and Consumer Protection, the Ministry of Foreign Affairs, and the Ministry of Agrarian Policy. The business has already reached an agreement with each other. We believed in each other and in the prospects of investing in pig production and the development of the meat industry.

It is worth mentioning the prospects for cooperation between the pig and bioethanol industries.

Ukraine exports 7-8 million tons of corn to a number of countries, including China, for bioethanol production. After bioethanol production there, the waste – the alcoholic bard – is fed to pigs, thus creating added value and reducing the cost of pigs. What prevents us from doing the same? Is it natural to process grain into bioethanol, which can be exported, to get added value from it and get cheap pork in the face of blocked grain exports and expensive logistics? Pork will become critically cheap if we use waste from biobased ethanol production and other food industries.

In this way, we can create several more added values within the country and export alcohol, pork, and meat products instead of grain, and in total, even without bioethanol, bring 6 billion euros of added value to the state budget of Ukraine annually and twice as much with bioethanol.

We invite agribusinesses that used to trade grain and now consider pig breeding as a market for their grain, existing enterprises that want to scale their business, meat industry enterprises that have started raising pigs for their own processing needs, and bioethanol enterprises to cooperate, formulate a common strategy for the development of the Ukrainian agro-industrial complex, and find ways out of the current situation with grain exports at the Grain. Pigs. Meat -2023″ and after its completion.

I would like to emphasize that due to the grain export restrictions, the Ukrainian pig industry has great opportunities for value-added industries in Ukraine. The Ukrainian Meat Industry Association and its partners are ready to help everyone take advantage of them.