As of September 13, 434 settlements remain without electricity due to hostilities and other reasons, NPC Ukrenergo reported on Telegram on Wednesday. “As a result of Russian artillery shelling of the frontline territories, there are new damages to the networks in Donetsk and Kharkiv regions. The power is being restored in a security situation and with the permission of the military,” the company said.

Due to technical reasons, there are also de-energized consumers in the city of Odesa. Restoration works are underway.

According to Ukrenergo, on Tuesday, September 12, the evening maximum consumption was 2% higher than on Monday, September 11.

Today, on Wednesday, electricity is being imported and exported from/to Slovakia and Moldova.

“Today we are importing electricity from Slovakia and Moldova. The total volume is 525 MWh, with a maximum capacity of up to 144 MW in some hours,” the NPC said.

In turn, on Wednesday, exports are carried out to Slovakia and Moldova in the total amount of 4260 MWh, with a maximum capacity of up to 392 MW in some hours.

The U.S. Department of Agriculture (USDA) has improved its forecast for Ukraine’s wheat harvest in the recently started 2023/24 marketing year (MY) from 21 million tons to 22.5 million tons, and for corn from 27.5 million tons to 28 million tons due to larger than expected planted areas and the second-highest yields on record.

In its September forecast, the agency also raised its wheat export estimates from 11 million tons to 11.5 million tons, while corn exports remained unchanged at 19.5 million tons.

The USDA raised its domestic consumption forecast for wheat from 8.1 million tons to 8.8 million tons, while maintaining its forecast for corn at 5.5 million tons, and at the same time raising its carryover forecast to 4.43 million tons from 3.89 million tons.

In general, the global wheat harvest forecast for 2023/24 MY has been lowered by 56 mln tonnes to 787.3 mln tonnes, which is 3.25 mln tonnes less than last year, due to the decrease in production in Australia, Canada, Argentina and the EU, which will not be compensated by the increased production of Ukraine.

The forecast of world wheat trade was also downgraded by 2.1 million tons to 207.3 million tons compared to 219.9 million tons last year due to the decline in production in the above countries, which is only partially offset by the growth of activity in Russia and Kazakhstan.

The USDA noted that such annual decline in the world wheat supplies is the first since 2018/19 MY. The agency also expects the reduction of the global carry-over stocks by 7 mln tonnes to 258.6 mln tonnes, which will be the lowest level since 2015/16 MY.

Demand for medical services for pregnancy management and routine medical examinations is growing in Ukraine, but there are many neglected cases, said Valery Zukin, chief operating officer of the Leleka multidisciplinary medical center.

“At the beginning of September, we can talk about a stable demand for childbirth, pregnancy management and other urgent and emergency health cases that cannot be planned or postponed in advance. At the same time, the demand for scheduled preventive examinations is growing. This is especially true for women – they are more likely to go to medical facilities for check-ups than men,” he told Interfax-Ukraine, commenting on the dynamics of demand for medical services in Ukraine.

Zukin also noted that “the number of ‘deferred’ medical care is growing – cases that do not require urgent resolution and can be returned to later, but should not be neglected at all.”

According to Zukin, in particular, there is an increase in surgical interventions for gynecological problems, hernias, gallbladder removal, removal of breast fibroadenomas, and various phlebology procedures and operations.

At the same time, Zukin emphasized that “since the beginning of the full-scale war, Ukrainians have become less health conscious.”

“As a result, medical experts note an increase in advanced cases. Therefore, I would like to emphasize that it is important to understand that it is better not to postpone treatment of some diseases,” he said.

Zukin also noted an increase in demand for so-called “non-medical” and “aesthetic services”.

“In our clinic, even before the full-scale invasion, such services accounted for a rather small percentage of the overall structure of the medical center’s services, but now various festive services during discharge from the obstetric hospital (photo and video discharge, a gala buffet, etc.) are quite popular. Also, aesthetic gynecology services and massages for pregnant women, etc. have gained considerable popularity,” he said.

In addition, the expert pointed out “the problem that is now gaining momentum in Ukraine is the unsatisfactory state of childhood vaccination.”

“At a time when parents are massively willing to pay for their children’s vaccinations on their own, certain bureaucratic problems prevent suppliers from importing a sufficient amount of the relevant drugs from abroad,” he said.

As reported, the number of medical services provided to Ukrainians in 2023 under the PMG has increased both compared to last year and the pre-war period. As of June, the number of patients who received medical care under each of the 2021 PFG packages amounted to 3.06 million patients, 3.55 million in 2022, and 4.22 million in 2023.

At the same time, 101.101 thousand patients received medical care during childbirth in 2023, 109.403 thousand patients in 2022, and 141.144 thousand patients in 2021.

Leleka Multifunctional Medical Center is one of the leading Ukrainian clinics in the field of obstetrics, gynecology, and general surgery. The medical center practices medical protocols approved in Ukraine, the United States and Western Europe. The Leleka Center for Modern Surgery provides surgical gynecology, mammology, vascular surgery (phlebology), proctology and urology, endocrine surgery, plastic, abdominal, bariatric, outpatient surgery, and endoscopy.

In 2019, Leleka was the first in Ukraine to receive JCI accreditation, one of the world’s most prestigious quality standards for medical institutions. The standard is based on the American system of medical accreditation of medical institutions based on the management of patient outcomes.

The JCI International Division accredits hospitals in Asia, Europe, the Middle East, Africa and South America, and now in Ukraine. JCI annually updates its accreditation standards to expand its patient safety goals.

Apple on Tuesday unveiled the iPhone 15 line and an updated smartwatch, the Apple Watch Series 9. The event was broadcast on the company’s YouTube channel.

One of the main distinguishing features of the new series of smartphones (iPhone 15, iPhone 15 Plus, iPhone 15 Pro and iPhone 15 Pro Max) is the transition from the Lightning charging port to the USB Type-C connector. Also, all devices will have Dynamic Island, a notch on the screen for the front camera that works as a separate mini-screen. Previously, it was only available in the iPhone 14 Pro.

The iPhone 15 and iPhone 15 Plus will be equipped with A16 Bionics processors, which were introduced last year with the iPhone 14 Pro and 14 Pro Max. The new Pro versions come with the A17 Pro processor.

The budget versions of the iPhone 15 will come in five new colors: black, blue, green, yellow, and pink. The Pro versions will have a titanium body in four shades to choose from. The diagonal of the screens of the iPhone 15 and iPhone 15 Pro is 6.1 inches, and the iPhone 15 Plus and iPhone 15 Pro Max are 6.7 inches.

According to the presentation, prices for the iPhone 15 will start at $799 (128 GB), and for the iPhone 15 Plus – at $899. The minimum price of iPhone 15 Pro is $999, iPhone 15 Pro Max – $1199. All smartphones of the series will be available for pre-order on September 15.

A new S9 processor has been announced for the Apple Watch Series 9 smartwatch. The maximum screen brightness has been increased to 2000 nits – Apple reports that the display is twice as bright as the previous version. In addition, the Double Tap function will appear. It allows the user to control the watch without touching the screen – by moving his fingers on the hand on which he wears the watch. Prices for the new watch will start at $399.

Apple Watch Ultra 2 is equipped with an even brighter screen – up to 3000 nits. The corporation promises 36 hours of battery life in normal mode and 72 hours in power saving mode. The minimum price of this version is $799.

In addition, during the presentation, Apple announced its intention to reach carbon neutrality by 2030.

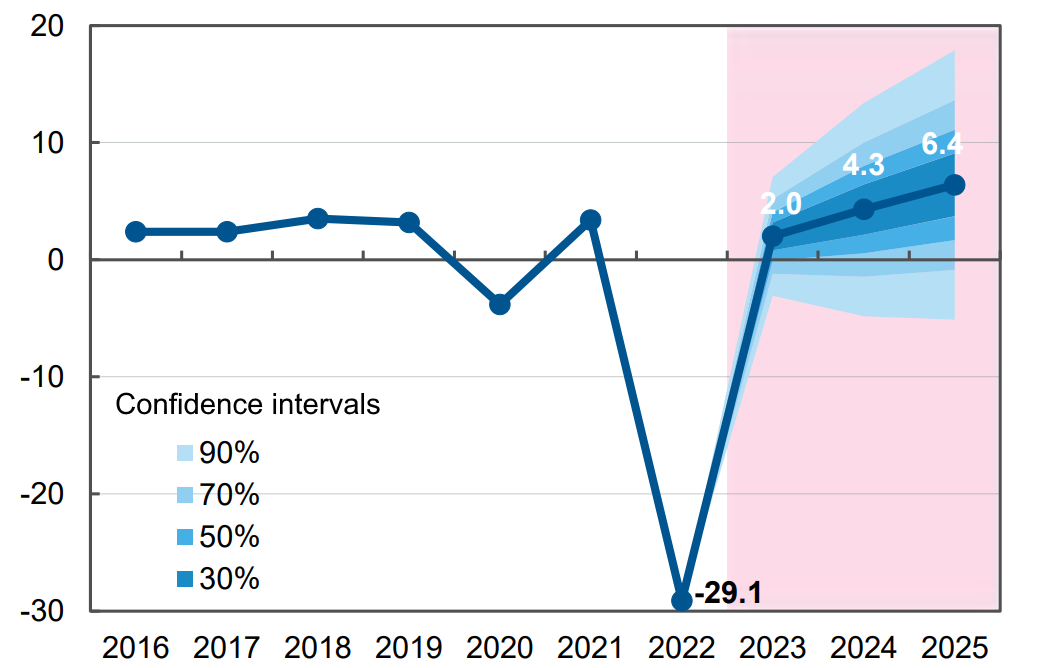

Forecast of dynamics of changes in ukrainian GDP in % for 2022-2025 in relation to previous period

Source: Open4Business.com.ua and experts.news

The Cabinet of Ministers of Ukraine has appointed Ukrnafta PJSC as the asset manager of the Glusco gas station network, Naftohaz Ukrayiny’s board head Oleksiy Chernyshov has said.

“Also the Cabinet set the task to settle the issue of reimbursement of expenses incurred by Naftogaz Oil Trading LLC (“NOT”, a network of gas stations U.GO), which was engaged in restarting the arrested commercial assets of Medvedchuk”, – he specified on his page in Facebook.

As reported, the Cabinet of Ministers of Ukraine in May 2022 agreed the proposal of ARMA to transfer to the management of NJSC “Naftogaz of Ukraine” arrested assets of the company Glusco (until 2018 – the network of NK “Rosneft”), which were associated with Viktor Medvedchuk,

NOT was identified as the asset manager, with which ARMA subsequently entered into a fixed-term management agreement.

At the end of July 2023, ARMA head Olena Duma said that the National Agency would conduct audits of the efficiency of management of the largest assets, and the audit of the efficiency of Naftogaz’s management of the Glusco network of gas stations has already begun.

In early August, ARMA announced the termination of contracts with NOT to manage the assets of the Glusco gas station network.

At the same time, Naftogaz said that 81 filling stations and one oil depot, which had been out of operation for a year and a half, were resumed under the management of NOT, and that employees’ salaries were paid in a timely manner. From August 2022 to July 2023, 289 million UAH of mandatory payments to the state and local budgets were paid.

The head of Naftohaz Ukrayiny, Oleksiy Chernyshov, said that during the period of managing the Glusco assets, the group had invested significant funds in restoring the network’s operation, repaid its debts, and, at ARMA’s request, paid them “for some part of future profits, as they are not yet in question”.

On November 5, 2022, the Supreme Commander-in-Chief decided to seize the shares of Ukrnafta and Ukrtatnafta (except for the controlling and blocking stakes in Naftogaz Ukrainy, respectively) from the state as military property for the duration of martial law. Prior to the seizure, the structures of Ihor Kolomoyskyy and Hennadiy Boholyubov owned about 42% of Ukrnafta shares and, together with other partners, a controlling stake in Ukrtatnafta.