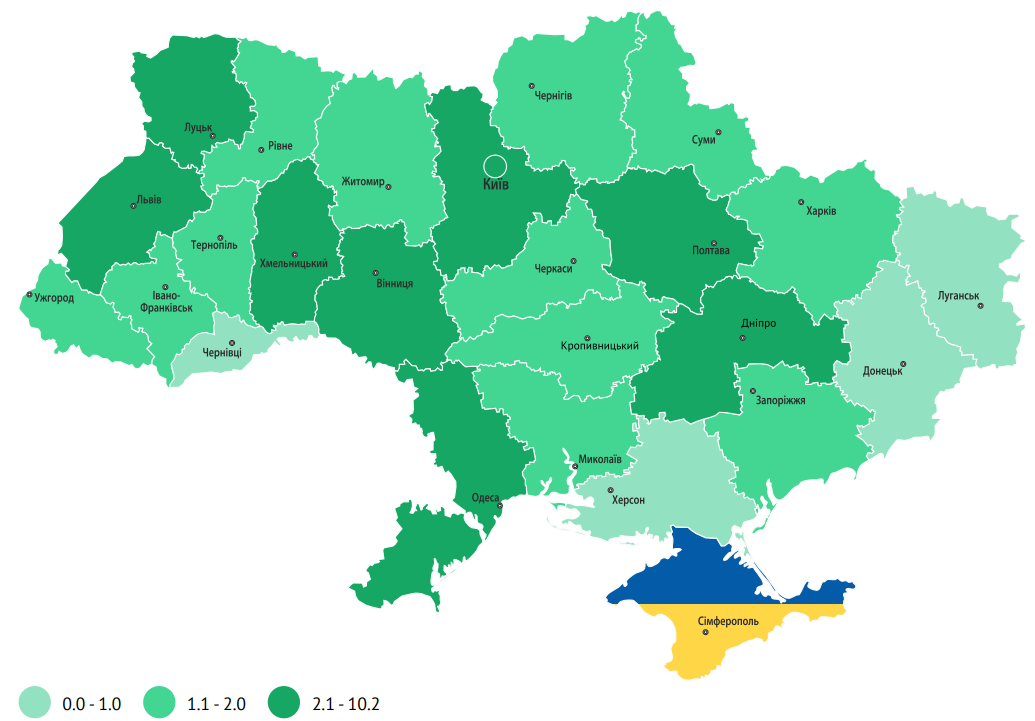

Number of vacancies as of 01.08.2023 (thousand units) according to data of state employment center

Source: Open4Business.com.ua and experts.news

Ukrainian farmers have already harvested 34 million tons of grain, Prime Minister Denys Shmyhal said.

“The harvest is underway. As of today, 34 million tons of grain have been harvested. In particular, 22 million tons of wheat,” Shmyhal said at a government meeting on Friday.

According to the prime minister, the domestic demand is about 6-7 million tons per year, so Ukraine feels quite confident in food security.

“We continue to work on expanding our export potential. It is important for our economy and important for global food security,” he added.

Lithuania on Friday handed over 4.5 million units of ammunition to Ukraine, the country’s Defense Ministry said.

According to the ministry, the military aid transferred by Lithuania to Ukraine until the fall of this year includes Mi-8 helicopters, L-70 anti-aircraft guns with ammunition, M113 armored personnel carriers, millions of rounds of ammunition, and ammunition for grenade launchers.

In the near future, Ukraine will also receive launchers of NASAMS mobile air defense missile systems, anti-drone systems, logistics and other auxiliary equipment.

The Ministry of Defense noted that, in addition to the transfer of military equipment, Lithuania is actively training Ukrainian soldiers, providing medical and rehabilitation assistance, and consulting experts.

Lithuania’s assistance to Ukraine has reached EUR 0.5 billion since the end of February 2022 and will continue, the ministry said. A military aid package of EUR200 million is envisaged for 2024-2026. The total amount of Lithuania’s assistance to Ukraine is more than EUR1 billion, or more than 1.2% of the country’s gross domestic product, half of which is military aid.

The Ministry of Economy has raised its forecast for Ukraine’s gross domestic product (GDP) growth in 2023 to 4%, First Deputy Prime Minister and Minister of Economy Yulia Svyrydenko said in Kyiv on Saturday at the annual meeting of the Yalta European Strategy organized by the Victor Pinchuk Foundation.

“This year, we believe that GDP growth will be 4%, although pessimists believe that 3%… We have maintained macro stability, this is the basis for further recovery of Ukraine,” she said.

Svyrydenko clarified to Interfax-Ukraine that the government has not yet approved the forecast for 2024, while the National Bank of Ukraine expects GDP growth of 3.5%, and up to 6.8% in 2025.

“We are always more optimistic than the National Bank,” the First Deputy Prime Minister and Minister of Economy said.

She added that inflation, according to the NBU’s forecast, will slow to 10.6% this year, and core inflation to 9%.

In her speech, the First Vice Prime Minister also reminded that the NBU had recently cut the discount rate to 22% per annum.

“As a participant in this discussion, I will say that I was in favor of a bigger reduction. I think that our macroeconomic situation allows us to be more flexible, but, as always, realistic,” Svyrydenko said.

According to her, the Ministry of Economy sees improvements in the agricultural sector and expects that in November a working instrument for military insurance will be created through the efforts of both the Ukrainian government and the European Bank for Reconstruction and Development (EBRD).

The First Deputy Prime Minister emphasized that the government is also actively working on a four-year development plan under the Ukraine Facility program announced by the EU, which will start operating in early 2024 and will become the basis for further growth of its economy.

As reported, in June, the Ministry of Economy slightly downgraded its GDP forecast for this year from 3.2% to 2.8% due to the destruction of the Kakhovka hydroelectric power plant and pessimistic expectations for the upcoming harvest. According to Natalia Gorshkova, Director of the Strategic Planning and Macroeconomic Forecasting Department of the Ministry of Economy, in early August, the Ministry had already assumed economic growth of 5% in 2023, but so far it has conservatively maintained the 2.8% estimate, taking into account the existing risks. At that time, the Ministry of Economy predicted that GDP growth would accelerate to 5% next year, with inflation slowing to 10.8%.

At the end of July, the National Bank of Ukraine raised its forecast for Ukraine’s GDP growth in 2023 from 2% to 2.9%, but lowered it for 2024 from 4.3% to 3.5%. In addition, the NBU improved its inflation estimate this year from 14.8% to 10.6%, and next year to 8.5%.

In August, inflation in Ukraine fell to 8.6% in annual terms.

The Experts Club research project and Maksym Urakin recently released an analytical video about the economies of Ukraine and the world – https://youtu.be/zCJ1cU3n0sY?si=LFj-pDmojahwtHkA

You can subscribe to the Experts Club YouTube channel at https://www.youtube.com/@ExpertsClub

In addition to the report on the contract concluded without the use of the electronic procurement system, public procurement in the amount of UAH 50 thousand or more must also be accompanied by a justification for its implementation approved by the head of the customer, the government has introduced such changes to the rules for public procurement during martial law.

“A tender through Prozorro does not in itself guarantee an automatic positive result. Many people remember cases when the procurement was transparent, competitive and in accordance with the rules, but the validity of the need or the terms of the procurement caused a public outcry. Therefore, this change is primarily intended to improve the quality of work of those who announce the tender,” First Deputy Prime Minister and Minister of Economy Yulia Svyrydenko commented on the changes on Friday.

According to her, the resolution also reduces the list of grounds for which public procuring entities may sign contracts directly instead of competitive bidding, while increasing the responsibility of public procuring entities for abusing such grounds as urgent need.

In addition, amendments have been made to allow sanctioned participants whose assets have been transferred to the National Agency for Finding, Tracing and Management of Assets Derived from Corruption and Other Crimes (ARMA) to participate in public procurement.

The sale of a share (33.35%) of the Ocean Plaza shopping mall to Andrey Ivanov has been officially finalized, businessman Vasyl Khmelnitsky said.

“Last week were officially finalized all transactions on the sale of my share of Ocean Plaza shopping mall to my long-time partner Andrei Ivanov,” – said Khmelnitsky on Facebook.

Ocean Plaza shopping mall was opened in Kiev in December 2012 on Antonovycha Street, 176. Its total area is 165 thousand square meters. m. Investments in the mall amounted to about $300 mln. UDP Company and K.A.N. Development LLC acted as partners in the development of the project.

The mall was sold to Arkady Rotenberg’s Russian TPS-Nedvizhimost in 2012. Later, in 2019, businessman Vasily Khmelnitsky indirectly through UPD Holdings Limited acquired a 33.5% stake in Ocean Plaza shopping mall. In 2021 he sold his stake to entrepreneur Andrei Ivanov, the deal was finalized in the summer of 2023.

“More than three years ago, my partner Vasily Khmelnitsky and I reached an agreement under which I would gradually buy out the development company UDP, whose investments had been under my management for a long time. The agreement to buy out 33.35% of shares of Ocean Plaza shopping mall, which is part of UDP, is a logical continuation of the process”, – commented the owner of the investment company Q Partners Andrey Ivanov to the agency “Interfax-Ukraine”.

As reported, in June 2023, the FGI registered corporate rights to the state share (66.65%) in the shopping mall Ocean Plaza.

“In the public communication of the fund we hear intentions to sell their stake already by the end of this year. As a minority owner, we are fulfilling all the state’s requirements to prepare the company for sale. Our further view on the development of this asset will depend on the results of privatization,” – said Ivanov.

Earlier it was reported that the Cabinet of Ministers on June 9, 2023 adopted an order on the transfer to the FGI share of the authorized capital of LLC “Investment Union “Lybid”, which owns the shopping mall, in the amount of 66.65%. Previously, these corporate rights belonged to Russian sub-sanctioned businessmen Arkady and Igor Rotenberg, but in March 2023, the Supreme Anti-Corruption Court recovered them in favor of the state by its decision.

On March 3, the Ukrainian Justice Ministry filed a lawsuit with the HACC to confiscate the companies that own two-thirds of the Ocean Plaza shopping mall (Kiev), including the Rotenbergs’ assets. Earlier, as part of the criminal proceedings, the arrested corporate rights of the companies for more than 350m hryvnyas were transferred to the National Agency for Identification, Search and Management of Assets Derived from Corruption and Other Crimes.