Ukraine’s positive foreign trade balance in services in January-September 2025 decreased by 47.3% compared to the same period in 2024, to $856.8 million (in January-September 2024, it was $1,652.8 million), the State Statistics Service reported on Friday.

According to its data, exports of services for the nine months of 2025 decreased by 15.7% to $6,338.7 million, while imports decreased by 7% to $5,481.9 million.

The export-to-import coverage ratio was 1.16 (1.28 for the first nine months of 2024).

Foreign trade operations were conducted with partners from 211 countries around the world.

The structure of foreign trade in services for the first nine months of 2025 can be found at:

Fixygen analyzed the importance of regulators and their role in the crypto asset market. The cryptocurrency market is becoming increasingly sensitive to the rhetoric of central banks and the actions of financial regulators. Against the backdrop of expectations of interest rate changes and tighter rules for stablecoins and exchanges, the regulatory agenda is becoming one of the main drivers of price movements.

In its latest comments, the US Federal Reserve has allowed for the possibility of lowering the key rate in 2025, provided that inflation is under control. For cryptocurrencies, this is a signal of a potential increase in risk appetite and growth in liquidity in financial markets. The Fed’s policy easing traditionally supports interest in Bitcoin, Ether, and major altcoins, as investors are more actively engaging in strategies in the high-yield asset segment.

The European Central Bank maintains a more hawkish rhetoric, emphasizing the need to keep rates high to combat inflation, but at the same time notes a slowdown in the eurozone economy. This situation limits the inflow of European institutional capital into the crypto market in the short term, but reinforces expectations of future easing, which could be an additional stimulus for digital assets in the medium term.

The UK, through the Financial Conduct Authority, is tightening rules for stablecoins and crypto exchanges. The regulator is introducing stricter requirements for issuers’ reserves, transaction transparency, and investor protection. This increases the reliability of large stablecoins and infrastructure players, but may drive some smaller and less transparent projects out of the market.

Japan and South Korea are continuing their policy of tightening control over the crypto market with a focus on protecting retail investors. This includes stricter token listing rules, increased requirements for proven reserves, and exchange liability for fraudulent schemes. At the same time, these countries remain among the most technologically advanced markets, where digital finance and trading platforms are actively developing.

China officially maintains a tough stance on cryptocurrency trading, but at the same time promotes state blockchain solutions and the digital yuan. Through Hong Kong and special regimes for fintech companies, projects in the field of Web3 and tokenization are supported. Any easing or new pilot regimes in Hong Kong quickly affect regional liquidity and activity on Asian platforms.

Taken together, the statements and actions of regulators are creating a complex but gradually more structured environment for the cryptocurrency market. The easing of US monetary policy, stricter requirements for stablecoins and exchanges in Europe and Asia, and experimental regimes in China and Hong Kong will remain key factors for price dynamics and investor sentiment in the coming months.

The cryptocurrency market is experiencing one of the sharpest declines in recent months. According to estimates by specialized media, over the past 41 days, the total market capitalization has fallen by approximately $1.1 trillion, and Bitcoin has fallen by almost 25% from its historic October high of over $126,000 to levels below $95,000.

Against this backdrop, most major cryptocurrencies are trading in the red. Over the past week, Ethereum has lost more than 11%, falling to around $3,200, Solana has fallen by about 15% to $141, and XRP has fallen by more than 9%. Analysts note that the fall in Bitcoin triggered a chain reaction among the major altcoins: XRP, BNB, Solana, Cardano, and Zcash showed declines of 5-12% per day on certain days.

The riskiest segments of the market fell the hardest. Against the backdrop of general uncertainty, the value of meme tokens and speculative altcoins is declining significantly. Certain themed coins, such as Rizzmas (RIZZMAS) and SANTA, lost about 30% and 48% respectively in a week, demonstrating high sensitivity to liquidity outflows and declining interest from retail investors. In annual terms, certain meme tokens, including PEPE, have already lost up to 80% of their value, according to analysts’ estimates.

Medium and small-cap cryptocurrencies are seeing double-digit declines every day. According to some platforms, tokens such as Supra, DMAIL Network, Verasity, Stafi, and LooksRare regularly make it onto the list of daily outsiders, losing between 14% and 18% or more in a day. This segment is characterized by low liquidity, so any large sales lead to sharp price drops.

Macroeconomic factors are putting additional pressure on the market. Against the backdrop of declining expectations of a rapid easing of Fed policy, some investors are exiting risky assets. Spot Bitcoin ETFs in the US are seeing their highest outflows since February on some days, and the crypto market fear index has fallen to three-year lows, according to estimates by analytical resources.

For investors, the current correction means that the leaders of the decline are most often those assets that showed the greatest dynamics in the previous growth phase and attracted speculative capital. In the short term, the market remains influenced by sentiment and news related to the monetary policy of the largest central banks. In the medium term, the key issue will be the ability of the largest cryptocurrencies to maintain long-term support levels and restore the confidence of institutional players.

Source: https://www.fixygen.ua/news/20251117/kriptorinok-u-chervoniy-zoni-analiz-fixygen.html

In the first ten months of 2025, Ukraine increased imports of tin and tin products by 31.5% to $3.48 million, while exports decreased to $0.15 million.

In October, imports amounted to $0.41 million, and exports to $0.02 million.

In 2024, tin imports increased by 16.9% to $3.19 million, while exports amounted to $0.39 million compared to $0.16 million in 2023.

Tin is mainly used as a safe, non-toxic, corrosion-resistant coating in its pure form or in alloys with other metals. The main industrial applications of tin are in white tinplate (tinned iron) for the manufacture of food containers, in solders for electronics, in domestic piping, in bearing alloys, and in coatings of tin and its alloys. The most important tin alloy is bronze (with copper).

Serhiy Ustenko, owner of the Carpathian Mineral Waters group, signed a €11 million loan agreement with the European Bank for Reconstruction and Development (EBRD) during the ReBuild Ukraine 2025 conference in Warsaw, according to a Facebook post by the National Association of Extractive Industries of Ukraine.

“The investment will be used to build a modern, energy-efficient beverage production plant in Lviv region, which is an important contribution to Ukraine’s food security and the development of sustainable production,” the statement said.

It is expected that, as part of the implementation of an inclusive employment model, the company will create at least 50% of jobs for veterans and people with disabilities.

“The financing will allow us to expand our production capacity and make our business even more environmentally friendly and socially responsible. Thank you for investing in the development of KMW and food security in Ukraine,” Ustenko said, thanking the EU and the EBRD for their trust and support.

The association recalled that Karpatski Mineralni Vody purchased a special water permit for a new plant near Zolochiv. The company paid UAH 26 million for the plot at auction.

According to the Karpatski Mineralni Vody website, the company began operating in the mineral water market in 1996 with the first bottling of Karpatskaya Dzherelna natural mineral table water. In June 2002, it was reorganized into a plant for the production of mineral water and non-alcoholic beverages, Karpatski Mineralni Vody. At the same time, the company began producing sweet carbonated drinks under the Fruktova Dzherelna and Sokovinka brands, and in 2016, the Dragon energy drink.

CONSTRUCTION, EBRD, KMW, PLANT

Women predominate in the profession, but men have more work

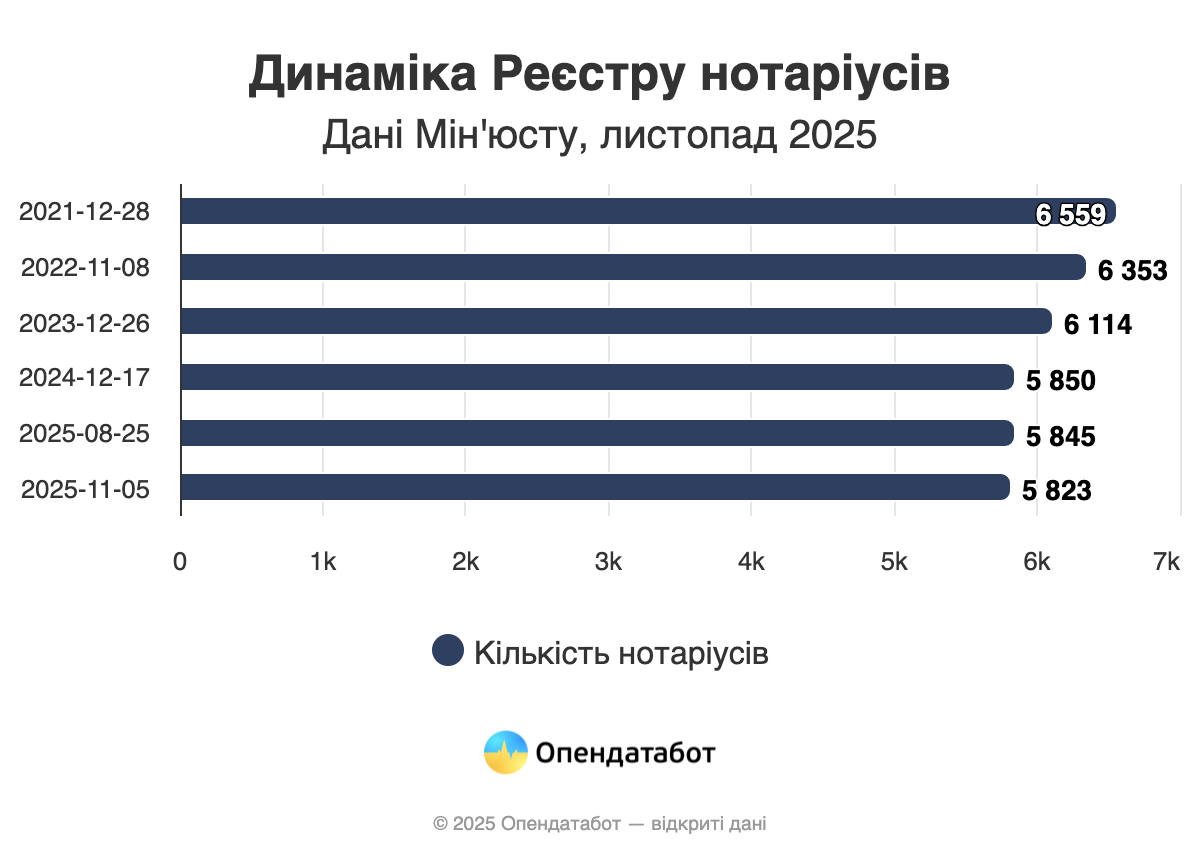

According to the Ministry of Justice of Ukraine, more than 5,800 active notaries are currently listed in the Register. The number of notaries has decreased by 11% since the start of the full-scale war. 82% of notaries in the Register are women, but men have a heavier workload. A notary from Lviv region used a record 24,600 forms this year. 63 practicing notaries have been working for over 29 years. One in five Ukrainian notaries works in Kyiv.

There are currently 5,823 practicing notaries listed in the Register of Notaries. Since the start of the full-scale war, the number of notaries has decreased by 11%. At the same time, 63 practicing notaries have been working for over 29 years — since 1996.

It should be noted that the Register is constantly updated: some specialists are added, some are removed. You can find, check, and select a notary on the Notary Register page in OpenDataBot. In addition, for each specialist, you can check the number and validity of their license, as well as see their workload — based on the number of notarial forms used year after year.

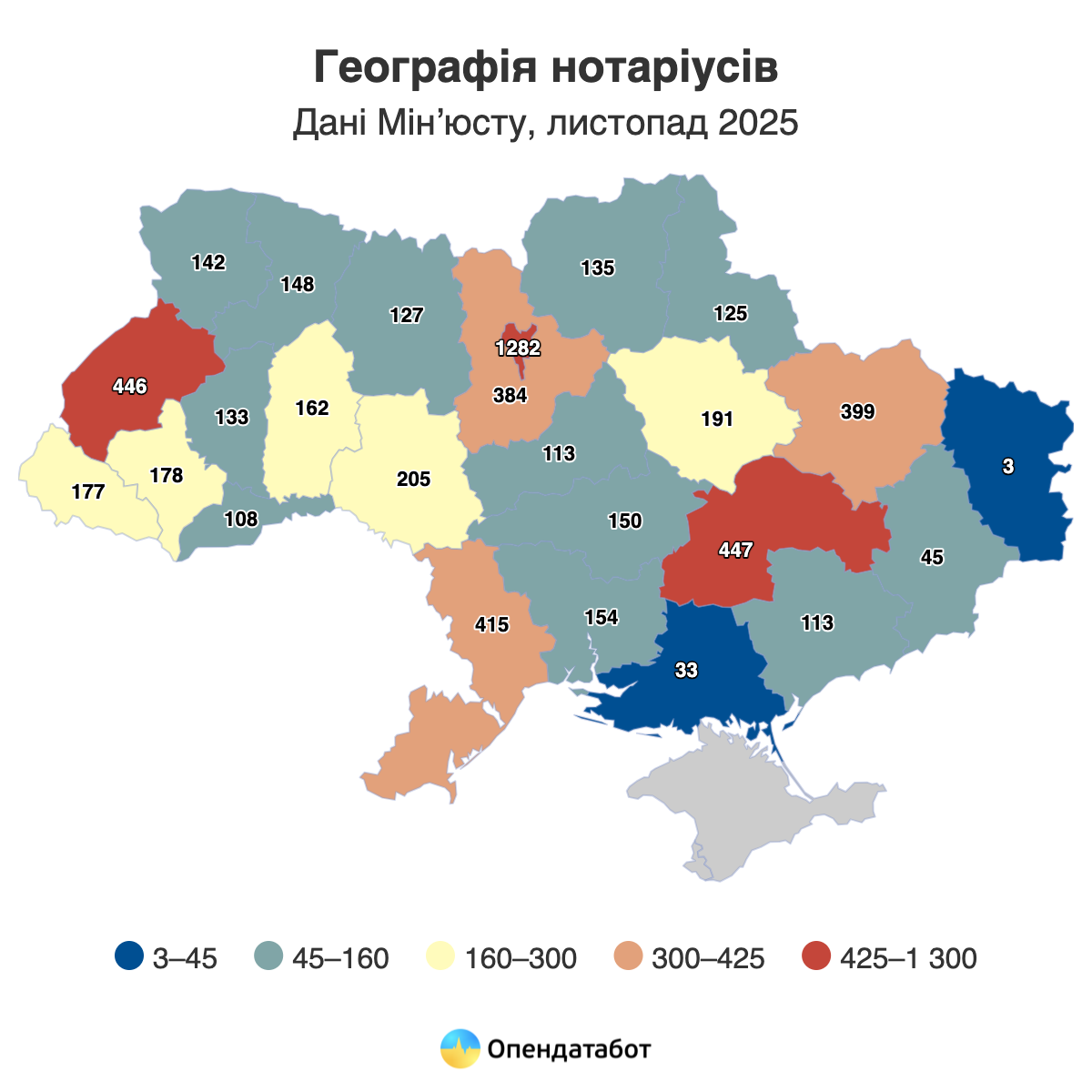

The highest concentration of notaries is traditionally in the capital — 1,282, meaning that one in five Ukrainian notaries works in Kyiv. This is followed by Dnipropetrovsk and Lviv regions — 447 and 446 respectively, as well as Odesa (415) and Kharkiv (399) regions.

Women significantly dominate the profession, accounting for 82% of practitioners. At the same time, men have more work: 702 notarial forms per year for women versus 992 for men. On average, one notary uses more than 60 forms per month.

The busiest specialists are in the Cherkasy region, where one notary uses 1,287 forms per year. High figures are also seen in the Zhytomyr and Khmelnytsky regions — 1,054 each, in Vinnytsia — 1,043, and in Ivano-Frankivsk — 959.

This year’s absolute record belongs to a notary from Lviv region, who used 24,606 forms this year — that is, about 78 forms per day, working without days off. This is a record for the entire country.

https://opendatabot.ua/analytics/notary-2025-11