The rental market in Prague in 2025 remains one of the most dynamic in Central Europe. Demand exceeds supply, especially in the central districts of the city — Prague 1, Prague 2, and Prague 3, which traditionally attract both locals and foreigners, according to analysts at Relocation.com.ua, citing data from Global Property Guide and the Czech Statistical Office.

The average asking rent for a one-bedroom apartment in Prague in 2025 is around CZK 26,500 (≈ €1,050) per month. This is 8-10% higher than in 2024, when the average was around CZK 24,000.

Two-bedroom apartments in central areas (Prague 1, 2, 5) cost between €1,300 and €1,900 per month, while in residential areas such as Prague 9 or Prague 10, rents for similar accommodation range from €850 to €1,200.

According to the Sreality.cz portal, during the first half of 2025, the average rent in the capital rose by 5.7%, and compared to 2023, by more than 15%. The main drivers are the rising cost of new construction, high mortgage interest rates (which keep people in the rental market), and a steady influx of foreign workers.

The share of renters in Prague continues to grow and already exceeds 25% of households, which is the highest figure in the Czech Republic. Young professionals under the age of 35 account for more than half of all renters, while among foreigners, the most active groups are Ukrainians, Slovaks, Indians, and EU citizens.

The profitability of renting in Prague remains attractive to investors: according to Global Property Guide estimates, the average gross yield ranges from 4.8% to 5.4%, depending on the area and type of property.

Among the trends for 2025 is increased discussion around the regulation of short-term rentals (Airbnb): the municipality is considering options for limiting the duration of apartment rentals in tourist areas in order to balance the interests of local residents and the tourism business.

Experts predict that the housing shortage and growth in rental demand will keep the market buoyant until at least mid-2026. New construction in the center remains limited, with most growth in supply expected on the outskirts of the city, particularly in Prague 9, 10, and 13.

Source: http://relocation.com.ua/prague-rental-housing-market-analysis-by-relocation/

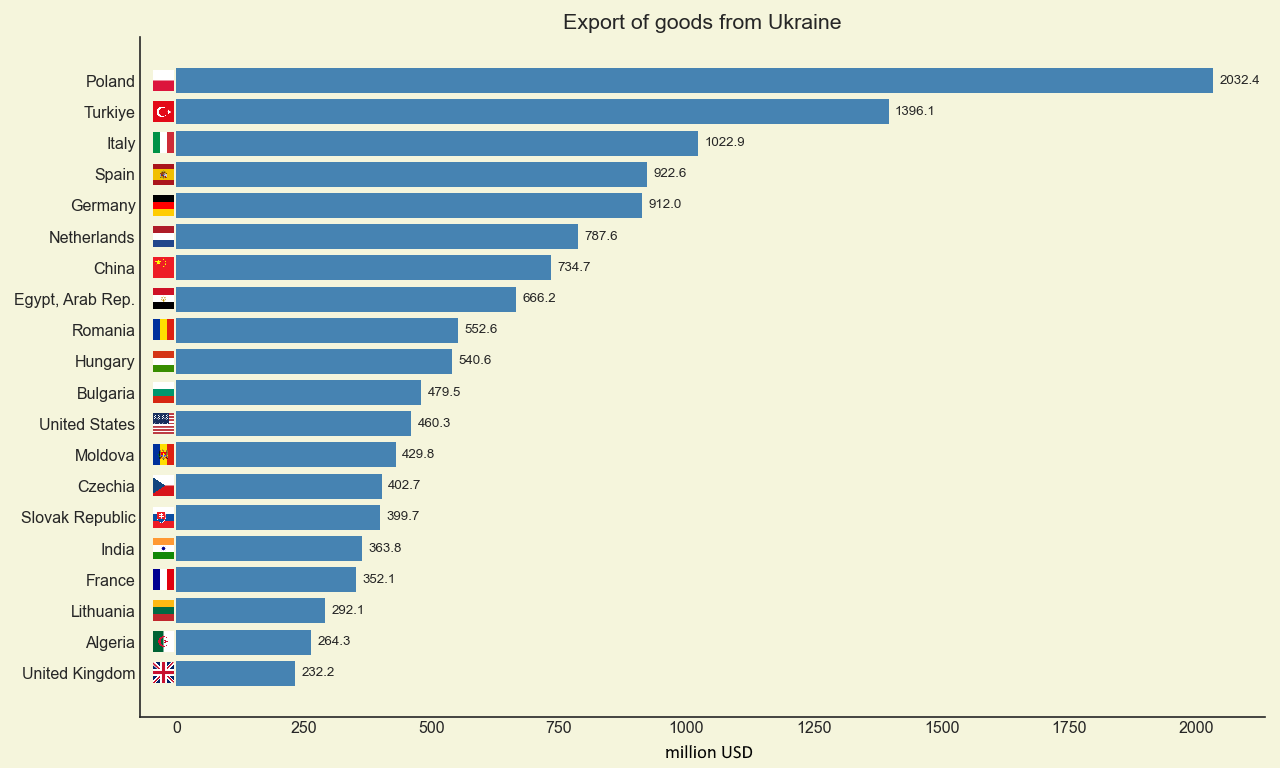

Geographical structure of Ukraine’s foreign trade (exports) in January-May 2025, million USD

Source: Open4Business.com.ua

Retail trade turnover in Ukraine increased by 6% in January-September 2025 compared to the same period in 2024, according to the State Statistics Service (SSS).

According to its data, in nominal terms, retail trade turnover in January-September of this year amounted to UAH 1.892 trillion.

Retail trade turnover in September decreased by 4.8% compared to August of this year, but in annual terms, it increased by 7.1% compared to September 2024.

The State Statistics Service specifies that the turnover of retail trade enterprises (legal entities) in January-September 2025 increased by 5.5% compared to January-September 2024 and amounted to UAH 1.310 trillion.

At the same time, in September compared to August of this year, the retail turnover of enterprises decreased by 4.6%, and compared to September of the previous year, it increased by 6.4%.

According to the statistics agency, Ukraine’s retail trade turnover in the first half of 2025 grew by 6.3% and amounted to UAH 1.213 trillion in nominal terms.

The State Statistics Service notes that the data does not include territories temporarily occupied by the Russian Federation and parts of territories where hostilities are (were) ongoing.

Deputy Head of the Department for Financial Technologies, Digitalization and Artificial Intelligence of the Presidential Administration of Uzbekistan Hikmatilla Ubaidullaev said that the first working meeting with OpenAI representatives was held. Valerie Fokke, Dips Patel, Shaig Ali, and Carlotta Serrano, Heads of Education and Partnerships, participated in the meeting.

The main topic of the talks was the introduction of ChatGPT EDU platform for teachers and students. This tool will allow using powerful OpenAI language models in a secure environment, creating personalized learning materials and own AI assistants.

The parties paid special attention to personalized learning, where artificial intelligence helps to adapt the educational process to the individual characteristics of each student, such as their pace, level of knowledge, and interests. Such a system will allow teachers to quickly identify gaps, create individualized assignments, automate work checking, and reduce bureaucratic procedures.

It was agreed that OpenAI will not create a separate program but will join the national initiative 1 Million AI Leaders, supplementing it with its own courses and expertise. This will allow Uzbek schoolchildren, students, and teachers to master artificial intelligence technologies at the level of world standards.

A separate area of discussion was the support of local startups. OpenAI expressed its readiness to consider providing preferential access to APIs and loans, as well as participation in hackathons and acceleration programs in Uzbekistan. This will create additional opportunities for young teams developing their own AI products in education and business.

The Uzbek side also presented plans to create a GPU cluster and an Uzbek-language data corpus for localization and adaptation of AI models. OpenAI representatives noted that their systems already demonstrate a high level of understanding of the Uzbek language and expressed interest in further cooperation in this area.

Following the meeting, the parties agreed to prepare a roadmap for cooperation in three key areas:

1) implementation of ChatGPT EDU at universities;

2) development of mass AI education;

3) support for startups and hackathons.

The Kryvyi Rih Mining and Metallurgical Plant PJSC ArcelorMittal Kryvyi Rih (AMKR, Dnipropetrovsk region) increased its net loss by 11.9% in January-June this year compared to the same period last year, from UAH 3 billion 769.944 million to UAH 4 billion 219.136 million.

According to AMKR’s interim report, net income in the first half of 2025 decreased by 10.4% to UAH 33.818 billion from UAH 30.621 billion.

The uncovered loss at the end of June 2025 reached UAH 28 billion 162.682 million.

According to the AMKR annual report, in 2024, the company reduced its consolidated net loss by 25.5% compared to 2023, to UAH 8 billion 841.812 million from UAH 11 billion 875.984 million. At the same time, net income decreased by 54.3% to UAH 64.599 billion from UAH 41.873 billion. Retained earnings at the end of 2024 amounted to UAH 24.039 billion.

As reported, AMKR ended 2022 with a net loss of UAH 49.9104 billion, while in 2021 it received a net profit of UAH 25.282951 billion.

ArcelorMittal Kryvyi Rih is the largest producer of rolled steel in Ukraine. It specializes in the production of long products, in particular, rebar and wire rod.

ArcelorMittal owns Ukraine’s largest mining and metallurgical complex, ArcelorMittal Kryvyi Rih, and a number of small companies, including ArcelorMittal Beryslav.

In 2024, PJSC Nikopol Ferroalloy Plant (NFP, Dnipropetrovsk region) increased its net loss by 15.9% compared to 2023, from UAH 2 billion 620.399 million to UAH 3 billion 35.966 million.

According to NZF’s annual report, net income for the past year decreased by 17.7% to UAH 7 billion 813.056 million from UAH 9 billion 493.059 million.

Retained earnings at the end of 2024 reached UAH 4 billion 128.280 million.

As reported, in January-June of this year, NZF reduced its net loss by 69.6% compared to the same period last year, to UAH 458.274 million from UAH 1 billion 505.962 million. In the first half of 2025, NZF increased its net income by 11.7% to UAH 3 billion 915.368 million from UAH 3 billion 505.483 million. Undistributed profit at the end of June 2025 reached UAH 3 billion 778.047 million.

In 2020, the company received a net profit of UAH 456 million 162,764 thousand. In 2021, the company received a net profit of UAH 5 billion 139 million 528,911 thousand. In 2022, NZF received a profit of UAH 910 million 452,147 thousand.

The plant ended 2023 with a net loss of UAH 2 billion 620 million 398,599 thousand.

In addition, it was reported that the Pokrovsky Mining and Processing Plant (PGZK, formerly Ordzhonikidze Mining and Processing Plant) and the Marganetsky Mining and Processing Plant (MGZK, both in Dnipropetrovsk region), which are part of the Privat Group, ceased the extraction and processing of raw manganese ore at the end of October-beginning of November 2023, while NZF and ZZF stopped smelting ferroalloys. In the summer of 2024, ferroalloy plants resumed production at a minimum level.

The business of ZZF, NZF, Stakhanovskyi ZF (located in NKT), Pokrovskyi and Marganetskyi GZK was organized by Privatbank prior to nationalization.

NZF is Ukraine’s largest producer of silicon and ferromanganese. The average monthly output of ferroalloys during stable operation of the enterprise is about 55-60 thousand tons.

According to NDU data for the first quarter of 2025, Sofalon Investments Limitad owns 15.503% of the shares of the private joint-stock company, Rougella Properties Ltd. owns 9.6904%, Dolemia Consulting Ltd. owns 15.7056%, Sonerio Holdings Ltd. holds 9.2158%, Manjalom Limited holds 5.8824%, and Treelon Investments Limited (all based in Cyprus) holds 15.1013%.

The authorized capital of PJSC NZF is UAH 418.915 million.

NZF is controlled by the EastOne group, created in the fall of 2007 as a result of the restructuring of the Interpipe group, as well as the Privat group (both based in Dnipro).

FERROALLOY, LOSS, NIKOPOL, PLANT, НЗФ