The Swedish presidency of the European Council officially announces the adoption of the tenth package of sanctions for Russia.

“A year has passed since Russia’s brutal and illegal invasion of Ukraine. Today the EU approved the 10th package of sanctions against Russia,” the presidency’s official Twitter page said.

It specifies that the package includes, for example, tougher export restrictions on dual-use and technology, targeted restrictive measures against individuals and entities that support the war, spread propaganda or deliver drones used by Russia in the war, and measures against Russian disinformation.

“Together, EU member states have imposed the most decisive and far-reaching sanctions in history to help Ukraine win the war. The EU is one with Ukraine and the Ukrainian people. We will support Ukraine for as long as it takes,” it said.

Ukraine did not export coke in January this year, as it did in December last year, whereas in January 2022 it exported 1.012 thousand tons.

According to statistics released by the State Customs Service (SCS), last month Ukraine imported 5.289 thousand tons of coke and semi-coke, which is 93.9% less than in January 2022.

In monetary terms, imports fell by 95% to $2.388 million.

Imports came mainly from Poland (64.26% of supplies in monetary terms), Colombia (24.01%) and Hungary (11.73%).

As earlier reported, in 2022, Ukraine reduced the export of coke and semi-coke in volume terms by 98% compared with the previous year – up to 3.856 tons, in monetary terms by 97.6% – to $1.011 million. The main export was carried out in Hungary (42.63% of supplies in monetary terms), Georgia (37.69%) and Turkey (17.41%).

Ukraine imported 359.192 thousand tons of coke and semi-coke in 2022, down 54.5% compared to 2021. In monetary terms, imports decreased by 50.3% to $174.499 million. Imports were mainly from Russia (43.43% of supplies in monetary terms, before the war), Poland (30.07%) and the Czech Republic (13.15%).

As a result of the war, a number of mines and coke plants found themselves in territories temporarily outside Ukrainian control.

Ukraine in January this year reduced the export of pig iron in physical terms by 29.6% compared to the same period last year – to 135.073 thousand tons.

According to statistics released by the State Customs Service (SCCS), exports of pig iron in monetary terms fell by 47.4% to $48.513 million for the period.

At that, exports were carried out mainly to Spain (38.10% of supplies in money terms), Poland (37.40%) and Italy (21.10%).

In the first month of the year, Ukraine did not import pig iron, as in January 2022.

As reported, Ukraine in 2022, Ukraine reduced the export of pig iron in volume terms by 59% compared to the previous year – up to 1 million 325.275 thousand tons, in monetary terms by 61.1% – to $638.774 million.

In 2022, Ukraine imported 40 tons of cast iron worth $23 thousand, while in 2021 – 185 tons of cast iron worth $226 thousand.

Exports were mainly to the United States (38.47% of supplies in monetary terms), Poland (32.91%) and Turkey (8.12%), and imports were from Germany (100%).

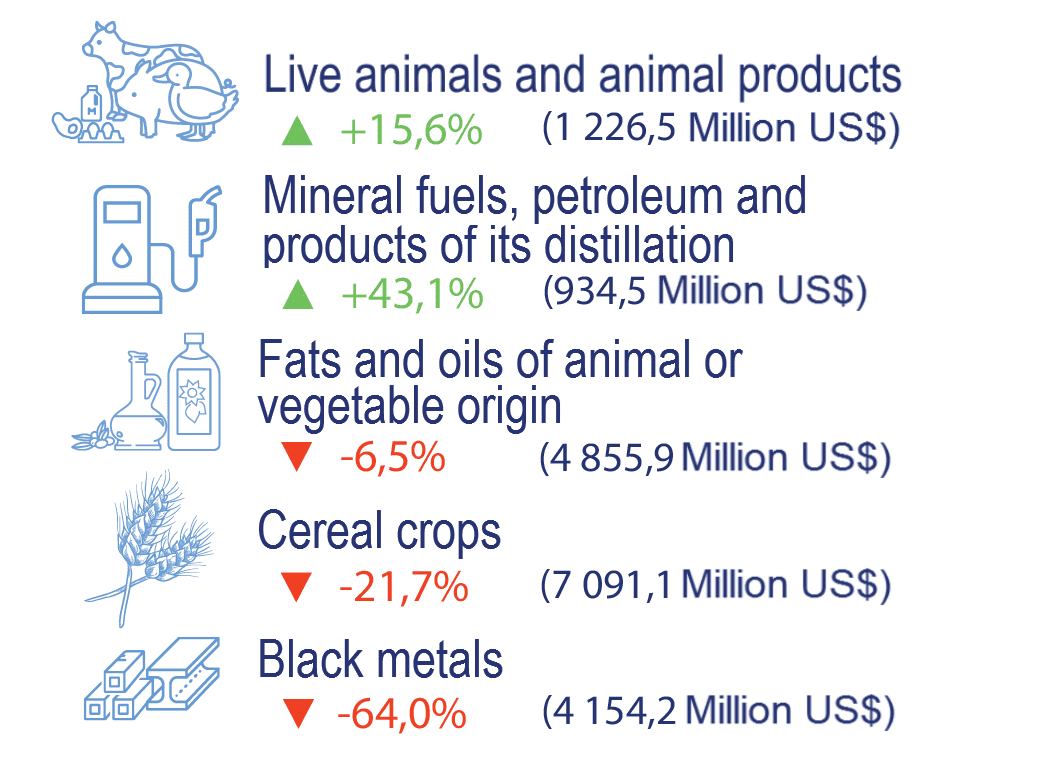

Export of goods in jan-oct 2022 to most important positions and in relation to same period of 2021

Source: Open4Business.com.ua and experts.news

During the last week, the daily volume of grain export by rail decreased by 2-3 thousand tons per day on average – down to 108 thousand tons per day because of artificial delays in the registration of vessels by Russian representatives in inspection groups under the Joint Coordination Center in Istanbul and reducing the effectiveness of the “grain corridor”, said Valery Tkachev, Deputy Director of the department of commercial work UZ at a meeting with market participants on Thursday.

“If we compare the current daily average with a week ago, we can state a slight decrease in the average daily volume of grain transportation in the export direction: today we carry an average of 108 thousand tons per day, while a week ago – 110 thousand tons, mainly due to lower traffic volumes to sea ports,” – said Tkachev.

At the same time, he said, the volume of grain transportation in the direction of overland railroad crossings has increased on average by 1 thousand tons per day – up to almost 34 thousand tons per day.

In February (February 22) UZ already transported 2.37 million tons of grain for export.

Earlier Yuri Vaskov, deputy minister of reconstruction, said on Aljazeera English live broadcast that since October the efficiency of the “grain corridor” does not exceed 40% of the available export capacities.

On February 15, Ukraine issued a statement calling on the international community, particularly the United Nations and Turkey, as guarantors of the Black Sea Grain Initiative, to demand that Russia immediately stop its artificial delays and unblock commercial shipping to Ukrainian Black Sea ports.

The Ukrainian side notes that Russian representatives in the inspection teams under the Joint Coordination Centre in Istanbul have been systematically delaying for several months in a row the inspection of vessels transiting the Bosporus Strait to/from Ukrainian ports. Every day less than half of the planned 10 inspections usually take place. As a result, in the last three months alone the world was short 10 million tons of Ukrainian food, and the queue of ships waiting for inspection in the Bosporus exceeded 140 units.

Representatives of Ukraine noted that at the same time, Russia enjoys the opportunity of unimpeded commercial shipping from Russian Black Sea ports: the volume of traffic through Russian seaports in the Azov-Black Sea basin in 2022 was more than 250 million tons, which exceeded the figures in 2021.