The January 20 meeting of the contact group participants in Germany on providing Ukraine with military assistance will strengthen Ukraine’s resilience, Ukrainian President Volodymyr Zelensky said.

“Today is the day of ‘Ramstein’ and defense news for Ukraine, which week after week brings our diplomatic marathon… Overall, we can summarize that today’s ‘Ramstein’ will strengthen our resilience. The partners are principled in their attitude: they will support Ukraine as long as it is necessary for our victory,” Zelensky said in a video message.

Thus, according to the president, it was possible to significantly strengthen the Ukrainian “artillery fist” with guns and shells, there are also good results regarding armored vehicles. In particular, the arsenal was replenished with several hundred combat vehicles.

In addition, Zelensky noted, significant results have been achieved with rockets for MLRS.

At the same time, according to him, Ukraine still has to fight for the supply of modern tanks, but every day Ukraine makes it more obvious that there is no alternative to the decision on tanks.

He thanked all the partners who clearly supported the Ukrainian position in the discussions.

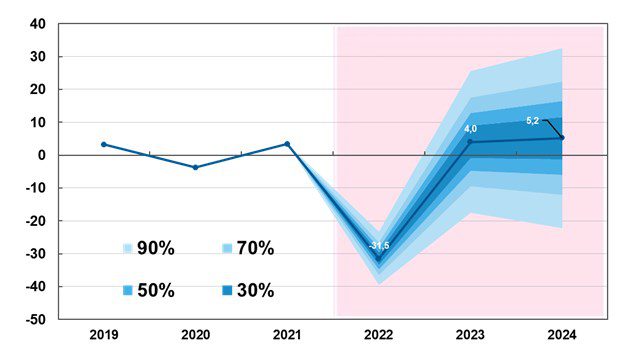

Forecast of dynamics of changes in GDP in % for 2022-2024 in relation to previous period

Source: Open4Business.com.ua and experts.news

Four dry cargo ships will deliver corn and wheat to China and Spain, the Joint Coordination Center (JCC) reported.

“Four vessels left Ukrainian ports on January 19, carrying a total of 229,749 tons of grain and other foodstuffs as part of the Black Sea Grain Initiative,” the report said.

Three vessels Star Sapphire (74 904 tons of wheat), Mana (47 267 tons of wheat and 11 420 tons of corn) and Serenity Ibtihaj (26 653 tons of corn) left for Spain. Vessel Andros Spirit will carry 69.505 tons of corn to China.

Four dry cargo ships are also on their way to Ukrainian ports, which passed through the maritime humanitarian corridor on Thursday.

“As of January 19, the total tonnage of grain and other agricultural products exported from the three Ukrainian ports is 18,051,260 tons. A total of 1,316 dry cargo ships have been allowed to move so far: 652 to arrive at Ukrainian ports and 664 to leave them,” the JCC summarized.

cargo ships, CHINA, CORN, SPAIN, WHEAT

Paper and cardboard mill “Papir-Mal” (Malyn, Zhytomyr region) at the end of 2022 increased production of paper and cardboard by 3% compared with 2021 – up to 42.31 thousand tons, according to statistics from the association “UkrPapir”.

According to statistics provided by “Interfax-Ukraine”, in January-November last year Papir-Mal showed negative dynamics in terms of production volumes of these products to the same period in 2021 – the decline was 4.5% up to 35.93 tons.

However, in December the factory increased the output of these products by 85%, to 6.4 thousand tons, and was able to reach a positive trend for the year.

In the total volume of paper and paperboard output increased by 10.4% to 38.28 thousand tons, while the production of base paper for sanitary products decreased by 37% to 4.03 thousand tons.

In monetary terms, the production volume of the company decreased by 4.7% to UAH 247 mln by 2021.

As reported with reference to the association “Ukrpapir” data collected from industry companies, last year the production of paper and paperboard in Ukraine decreased by 44.2% compared to 2021 – up to 500.6 thousand tons.

According to the information on the website of the company, with the beginning of a full-scale military aggression of Russia against Ukraine on February 24, 2022, the factory has completely stopped production, but in March it resumed production.

In addition, as reported, Papir-Mal, having incurred losses, was forced to stop the production and shipment of paper napkins and towels under the trademark “Zetka” registered back in 2014 due to the use of the Latin Z as a symbol of the aggressor state army.

To date, the factory has two cardboard machines (the second was put into operation last year). Also at the enterprise since 2019 there is a line for recycling of Tetra Pak packages.

In 2021 “Papir-Mal” produced 259,14 mln UAH – 5% more than the year before.

Stock indices of the Asia-Pacific region (APR) rose in trading on Friday, not following the U.S. stock market, which closed lower the day before.

Japan’s Nikkei 225 stock index had gained 0.56 percent by close of trading.

Consumer prices in Japan, excluding fresh food (a key indicator tracked by the country’s central bank), rose 4 percent in December compared with the same month the previous year – the fastest pace since December 1981, according to the country’s Ministry of Internal Affairs and Communications.

The figure exceeded the Bank of Japan’s 2 percent target for the ninth consecutive month. It rose 3.7 percent in November. The consensus forecast of experts quoted by Trading Economics also envisioned an acceleration of growth to 4%.

Overall inflation in Japan last month was also 4% year-on-year, accelerating from 3.8% in November. The rate was the fastest since January 1991.

The leading gainers among indicator components are shares of construction company Taisei Corp. (+4.6%), owner of supermarket chain Isetan Mitsukoshi Holdings Ltd. (+4.2%) and metallurgical company Pacific Metals Co. Ltd. (+4.1%).

SoftBank Group shares slid 0.1%, Tokyo Electron gained 0.2% and Toyota Motor gained 1%.

Hong Kong’s Hang Seng stock index added 1.8% and China’s Shanghai Composite gained 0.8%.

The People’s Bank of China (NBK, the country’s central bank) again kept the benchmark one-year lending rate (LPR) at 3.65% per annum.

The rate for five-year loans remained at 4.3 percent per annum, the NBK said in a statement.

Thus, the NBK did not change them for the fifth month in a row.

Moreover, the NBK continued to inject liquidity into the financial system through open market operations. The Chinese Central Bank lent banks 62 billion yuan in seven-day reverse repo transactions at 2% per annum and 319 billion yuan in fourteen-day transactions at 2.15% per annum.

Oil and gas company CNOOC Ltd. (+5.4%) and Internet companies Meituan (+4.9%) and Baidu Inc. (+4.9%) were the growth leaders in Hong Kong.

Alibaba Group Holding Ltd. gained 3.7% and JD.com Inc. – up 3%.

South Korean indicator KOSPI gained 0.6%.

Producer prices in South Korea rose 6% year on year in December, the lowest since April 2021, official statistical data showed. A month earlier the growth of the indicator was 7.2%.

In monthly terms, the indicator declined by 0.2% (in November – 0.3%).

Stocks of one of the world’s largest chip and electronics maker Samsung Electronics Co. rose 0.5%, the value of automaker Hyundai Motor Co. Ltd. went up 0.3%.

Australia’s S&P/ASX 200 index rose 0.2%.

The capitalization of the world’s largest mining companies BHP and Rio Tinto rose by 0.5% and 1% respectively.

Whitehaven Coal Ltd. shares jumped 6.2%. The company cut coal production by 4% in the second fiscal quarter but increased sales, with prices remaining high.

Large Ukrainian producer of corrugated board – Poninkovsky Cardboard and Paper Mill-Ukraine (PKBF-Ukraine, Khmelnytsky region) in 2022 produced 2 billion 446 million UAH, which is 6.5% more than in 2021.

According to statistics from the association “UkrPapir” provided to the agency “Interfax-Ukraine”, in volume terms, the factory has reduced the output of packaging board (including paper for corrugation) by 23.7% – to 69.2 thousand tons, and the production of corrugated boxes on 14.8% of it – to 70.8 million square meters.

At the same time, paper output increased by 20% to 585 tons.

As reported with reference to the data collected by the Association of industry companies, last year, taking into account the fact that a number of companies in the industry are either destroyed or damaged or are on occupied territory, the production of paper and cardboard in Ukraine decreased by 44.2% compared to 2021 – to 500.6 thousand tons, corrugated boxes – by 41.1%, to 444.6 million square meters.

Ponikovskaya factory (formerly – Ponikovsky Cardboard and Paper Mill), once the largest producer of school notebooks, now has one main production – paper and cardboard, produces mainly corrugated packaging, as well as wrapping, waste paper.

The mill is part of the United Carton Company-Ukraine (UCCU, Lutsk), whose production assets include, in particular, the Lutsk Cardboard Mill-Ukraine (Volyn region), which last year reduced its production by 21% – to 21.5 thousand tons (including containerboard by almost 25% to 38.8 thousand tons, while the box production increased by 27% – to 8.5 thousand tons).