The World Bank (WB) has set up a multilateral trust fund to support the Ukrainian government, the WB said in a statement.

The fund has attracted $250 million in seed financing.

“The Ukraine Recovery, Rehabilitation and Reform Trust Fund (URTF), which will be managed by the WB, will provide a coordinated mechanism for financing and supporting government activities,” the WB said in a press release.

According to the Swiss government’s commitments to the founding contribution and contributions from the governments of Austria, Iceland, Lithuania, the Netherlands, Norway and Sweden, the initial total amount of the fund is $250 million.

Canada and Japan have also pledged to support the URTF. Other partners are expected to join, the report said.

As the bank notes, due to the uncertainty of the situation in Ukraine, Kiev’s partners have to take a long-term approach to supporting the government’s efforts. Therefore, the fund has the structure of a flexible platform, which will provide the ability to respond quickly to changing circumstances and the needs of the country in the first 10 years of its operation.

The URTF will operate within the overall Multidonor Fund for Ukrainian Institutions and Infrastructure, which is part of the broader international support for the country and is coordinated by the World Bank group.

The WB recalls that to date it has mobilized $18 billion in emergency financing for Ukraine, taking into account donor commitments, of which more than $13 billion has already been disbursed. The largest donor is the United States.

Ukrainian enterprises in January-November this year reduced imports of copper and copper products in value terms by 63.7% as compared to the same period last year – down to $59.263 million.

According to customs statistics made public by the State Customs Service of Ukraine, the export of copper and copper products for the period decreased by 56.6% – to $83.289 million.

In November, copper and copper products imported for $4.839 million, exported – $6.339 million.

As reported, Ukraine in 2021 increased imports of copper in value terms by 59% compared to 2020 – up to $183.161 million, and the export of copper and copper products has increased by 2.4 times – to $206.390 million.

Three bulkers loaded with corn, wheat and vegetable oil departed from Ukrainian ports on Sunday, the Joint Coordination Centre (JCC) said.

“The Joint Coordination Centre (JCC) reports that three vessels left Ukrainian ports today [December 18], carrying a total of 54,464 tonnes of grain and other food products under the Black Sea Grain Initiative,” the JCC said.

MV Lady Ayana (25,250 tonnes of corn) and MV Barbaros Hayrettin V (5,214 tonnes of vegetable oil) are destined for Italy. MV AK Halima is transporting 11,100 tonnes of wheat and 11,900 tonnes of corn to Spain.

“Grains that reach a destination may go through processing and be trans-shipped to other countries,” the JCC said.

Five ships, which transited the maritime humanitarian corridor on Sunday, are headed to Ukrainian ports.

“As of 18 December, the total tonnage of grain and other foodstuffs exported from the three Ukrainian ports is 14,194,211 tonnes. A total of 1,128 voyages (565 inbound and 563 outbound) have been enabled so far,” the JCC said.

Mass celebrations were held in the capital of Argentina after the national team won the FIFA World Cup final, the Spanish-language media reported.

Tens of thousands of people dressed in blue and white with flags in their hands and on their shoulders gathered on the streets of Buenos Aires. The main gathering place was Republic Square, where one of the main landmarks, the Obelisk, is located.

Central streets were filled with fans a few minutes after the final whistle. The crowd sang, danced and chanted the name of the national team captain – Lionel Messi. In addition, the fans unfurled banners, in particular with the image of the legend of Argentine soccer Diego Maradona.

In the center of Buenos Aires motorists actively honked in support of the team, the subway in the city center was closed, and public transport stopped working, so those wishing to celebrate the victory moved around the city on foot.

Argentine fans who came to Qatar for the World Cup also celebrated loudly. After the match, the national team players rode an open-topped bus through the streets. They were accompanied by a motorcade of security personnel and mounted police. The fans cheered, applauded and applauded them.

Argentina captain Messi said after the match that he “can’t wait to be in Argentina and see all this madness.” “It wasn’t easy for us, but we made it,” he added.

The day before, Argentina defeated France in the World Cup final.

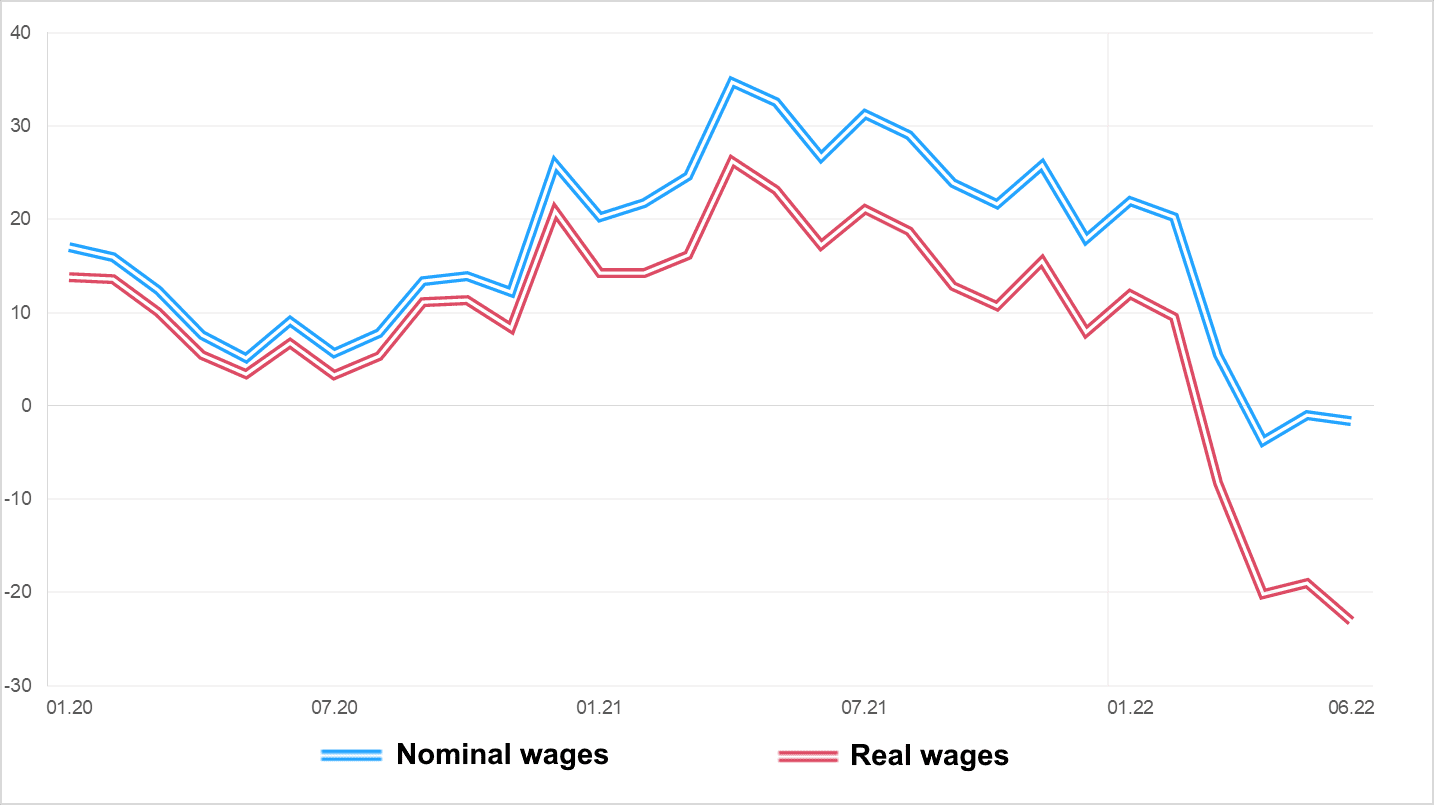

Dynamics of changes in level of wages in Ukraine for 2020-2022 (%)

NBU