The ninth package of EU sanctions against Russia adopted on Friday allows Bulgaria, Hungary and Slovakia, which received a reprieve from the European Union’s oil embargo on Russian oil, to export oil products produced from it to Ukraine.

The EU Council resolution published in the EU Official Journal on December 16 says the decision “allows Hungary, Slovakia and Bulgaria to export to Ukraine certain refined products derived from Russian crude oil imported on the basis of the considered derogations (from the embargo – IF), including, if necessary, by transit through other member states.”

Another paragraph of the ruling allows Bulgaria to “export to third countries certain petroleum products derived from Russian crude oil imported on the basis of the derogations under consideration.

The publication attributes this to the need to “reduce environmental and safety risks, as such products cannot be safely stored in Bulgaria.

The document specifies that the respective annual exports should not exceed the average annual volume of exports of such products for the last five years.

A dry cargo ship with more than 32,000 tons of corn left a Ukrainian port on Friday, the Joint Coordination Center (JCC) reported.

“On December 16, the vessel Almeray left the port of Odessa, it is carrying a total of 32.4 thousand tons of corn to Libya as part of the Black Sea Grain Initiative,” the report said.

There are two dry-cargo ships headed for Ukrainian ports, which on December 16 passed through the maritime humanitarian corridor.

“As of December 16, the total tonnage of grain and other agricultural products exported from the three Ukrainian ports is 14,023,297 tons. A total of 1,112 vessels were allowed to move so far: 556 to arrive at Ukrainian ports and 556 to leave them,” summarized the JCC.

It is noted that from December 1 to 15, more than 1.6 million tons of Ukrainian food products were shipped to other countries.

As many as 13 million tons were shipped on December 5, 12 million tons on November 26, 11 million tons on November 16, 10 million tons on November 3, 9 million tons on October 28, 8 million tons on October 21, 7 million tons on October 12, 6 million tons on October 5 and 5 million tons on September 28.

The German government through the Reconstruction Credit Institution (KfW) will lend EUR32.5 million to Ukrenergo to restore eight high-voltage substations in the south and west of Ukraine, the company said.

According to its Facebook post on Friday, Ukrainian Finance Minister Serhiy Marchenko and NEC Board Chairman Volodymyr Kudrytsky signed the relevant agreements with KfW. This is NEC’s third project with the German state bank KfW, through which its government is providing financial support to Ukrenergo.

“These funds will already be working in the interests of Ukrainian consumers in the near future: equipment will be installed at the substations that will make it possible to control their work remotely from the central dispatcher’s office. The restored substations will be automated, require minimal staff and meet ENTSO-E requirements for reliability of the power transmission system and grid safety,” explained Ukrenergo.

The company expressed its sincere gratitude to its European partners for their timely assistance, which is very much needed today.

For its part, the Ministry of Finance said on its website that its head during a meeting with Anka Feldhusen, Ambassador Extraordinary and Plenipotentiary of Germany to Ukraine, signed a guarantee agreement with KfW for the new project “Increasing the Efficiency of Power Transmission (Substation Modernization) II”, and Ukrenergo head signed a loan agreement with KfW for EUR32.5 million for this project.

During the meeting there were also signed agreements on debt deferral between the government of Ukraine and KfW, the Ministry of Finance pointed out.

According to its report, an agreement was reached to postpone repayment of Ukraine’s debt under the attracted loans from KfW under the four existing projects from 2022-2023 to 2027-2031.

The Northern Mining and Processing Plant (SevGOK, Krivoy Rog, Dnipropetrovsk Region), which is part of Metinvest Group, intends to implement a technology to replace natural gas with solid biofuel.

According to the materials available to Interfax-Ukraine agency, the planned activity is “implementation of the technology of natural gas substitution by solid biofuel (chopped sunflower husk), installation of complex facilities and equipment, which will be connected to Lurgi-552 A, B roasting machines without any essential changes in the existing equipment”.

It is specified that the new construction of the complex of facilities for biofuel supply is expected to be carried out at the industrial site of SevGokhoz.

The timing of the project and the amount of its costs are not disclosed.

Northern Mining Company is one of the largest mining companies in Europe, which specializes in the production of iron ore concentrate with iron content of 65.8% and pellets with iron content of 63%. Its production capacity exceeds 13 mln tonnes of concentrate and approximately 8 mln tonnes of pellets a year. The enterprise includes the Pervomaysky and Annovsky open pits, two beneficiation plants, two pelletizing shops and auxiliary infrastructure.

SevGOK is part of Metinvest group, whose major shareholders are System Capital Management PJSC (SCM, Donetsk) (71.24%) and Smart Holding group of companies (23.76%).

The management company of the Metinvest group is Metinvest Holding LLC.

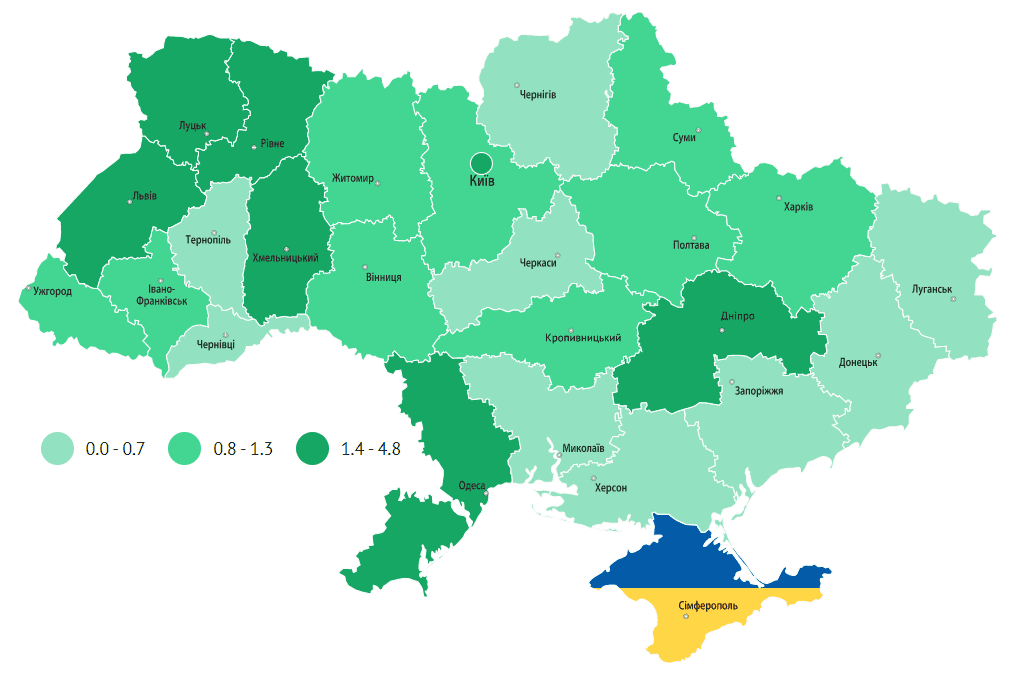

Anzahl der offenen stellen zum 01.11.2022 (ths. Einheiten)

State employment center