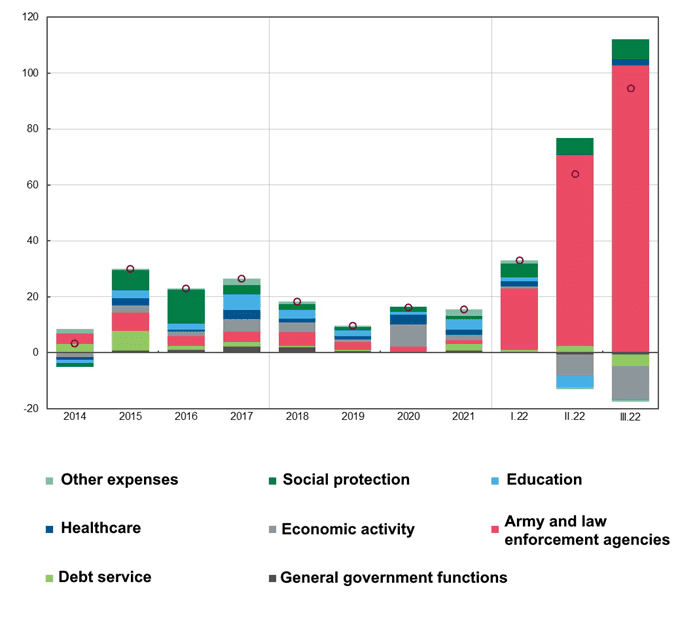

Changes in consolidated budget expenditures in 2014-2022 (%)

NBU

Dnipropetrovsk Aggregate Plant JSC (DAP, Dnipro) finished January-September 2022 with net profit of UAH 33.57 mln, a 14.8% increase from the same period of 2021.

According to the financial statements of the company, published on Monday in the information disclosure system of the National Securities and Stock Market Commission (NSSMC), its net profit increased by 6.7%, to 136.95 mln hryvnia.

The plant received almost UAH 50 mln of profit from operating activities, compared to UAH 43.6 mln a year earlier, while gross profit increased by 11.4% up to UAH 93.9 mln.

As it was reported, in the first half of the year DAZ increased its net profit by almost 40% against the same period of 2021 – up to UAH 31.25 mln, and net profit increased by 8% up to UAH 90.37 mln.

DAZ reduced its net profit almost threefold compared to July-September 2021, to UAH 2.32 mln, while its net profit increased by 4.2% to UAH 46.58 mln.

The company notes that in the third quarter inflationary processes continued, leading to higher prices for materials, equipment and energy resources, which reduces the ability to receive funds at a time when the need for them is growing.

DAZ also reminds that due to military aggression of the Russian Federation and introduction of martial law in Ukraine, production volumes and payments for manufactured products decreased, which negatively affects the financial condition of the company.

Founded in 1927, DAZ specializes in the production of aircraft equipment, hydraulic equipment for mines and general technical products. At the enterprise the complete cycle of aviation units production is created.

By the beginning of the current year the company employed more than 600 people.

In 2021, its net income increased by 17% to 173 million hryvnias, and its net profit by 17 times to 31.8 million hryvnias.

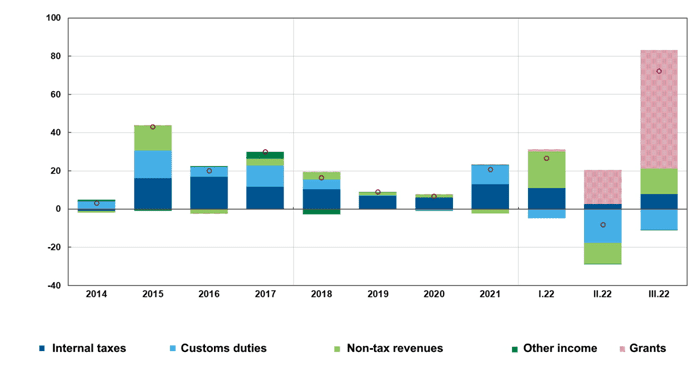

Changes in revenue of consolidated budget in 2014-2022 (%)

NBU

Flashpoint, an international technology investor in a B2B SaaS company that manages six funds with a total value of over $450 million, intends to raise a new Ukrainian Tech Fund of about $75 million focused only on Ukraine, Ihor Bilous, managing partner of the company, who once headed the State Tax Service and the State Property Fund of Ukraine, has said.

“We want to focus a little more on Ukraine… to raise this small fund of $75 million and have more founders from Ukraine build more businesses, invest in them,” he said at the Ukrainian Investment Roadshow conference last week in London.

Bilous said that the company is currently negotiating with leading international financial institutions and the British government about the possibility of financing this fund.

According to him, an advisory board has been created, which includes ex-Deputy Minister of Economy Nataliya Mykolska, CTO People.ai Andriy Axelrod, former adviser to the Minister of Economy and well-known in the field of direct investment in Ukraine Marko Ivashko, CEO and co-founder of Revenue Grid Vlad Voskresensky and Executive Director of the Ukrainian Association of Venture and Private Capital UVCA Dmytro Kuzmenko.

The fund will be able to invest $1-3 million in 12-15 companies at the lead stage, buying shares from 10% and actively participating in portfolio management.

“This is not charity, this is a real business. And we would like to invest today, without waiting for the end of the war,” Bilous said.

He said that the company currently employs 30-35 people, three of its four leaders are Ukrainians, and it is represented by headquarters in London and offices in New York, Warsaw, Budapest, Riga “and, hopefully, soon in Ukraine.”

According to the managing partner, the company has made 59 entries and 12 exits, has a broad base of more than 130 investors from different countries.

Flashpoint’s portfolio includes three companies from Ukraine, in which more than $17 million has already been invested, Bilous said. They are Preply, allset and All Right. However, more than 450 companies were analyzed and an in-depth analysis of 205 of them was carried out.

Flashpoint plans for 2027 to have 20 new portfolio companies in Ukraine with more than 1,000 specialists, as well as its own office in Kyiv, consisting of five people.

The European Bank for Reconstruction and Development (EBRD) plans to close 2022 with investments in Ukraine of over EUR 1.5 billion, Matteo Patrone, EBRD Managing Director for Eastern Europe and the Caucasus, said at the Ukrainian Investment Roadshow conference last week in London.

Next year the EBRD is going to do as much, if not more, depending on how the situation develops, he said.

Patrone said that the EBRD typically invests around EUR 10-11 billion a year in its countries of operations, so the amount allocated to Ukraine shows its role for the bank.

The Managing Director explained that the EBRD is able to provide such significant funds because it takes part of the risk on its balance sheet, while donors cover the rest.

Patrone said that while this year a significant portion of funding went to support liquidity, next year, according to his forecasts, the share of investment funding will increase – not only for recovery, but also for new projects.

He, in particular, recalled the allocated funds for the new direct investment fund Horizon Capital and announced the project of a Polish investor being considered by the bank, which is already present in Ukraine and who wants to invest another EUR 40 million in the country.

Speaking about work in the near future, Patrone called for more focus not on the 10-year outlook, but on what will happen in the next 12-18 months, how to win the war on the economic front during this period.

According to him, the second important point is the coordination of Ukraine’s international partners, building an effective and efficient coordination platform for channeling funds to support the country with the participation of Ukraine.

And the third question worth mentioning is that not to lose focus on the reform agenda, both in the short and medium term, he said. Therefore, reforms, in particular, reforms in corporate governance, the rule of law, which have been discussed for the past six to eight years and where Ukraine has made significant progress, should remain in the spotlight, the EBRD Managing Director for Eastern Europe and the Caucasus said.

As reported, in 2021 the EBRD invested EUR 1 billion in Ukraine.

Stock indices of major Asia-Pacific countries are mainly down in trading on Monday except Japan Indicator amid a decline of Wall Street last week due to concerns about further interest rate hikes in the United States.

Investors fear that multiple key rate hikes by the U.S. Federal Reserve (Fed) and central banks in Asia and Europe to combat high inflation could push the global economy into recession, Trading Economics wrote.

By 8:17 Moscow time the value of Japanese index Nikkei 225 increased by 0.02%.

The most significant rise among the components of the indicator was demonstrated by share prices of beer producer Sapporo Holdings Ltd. (+2.9%), chemical company Teijin Ltd. (+2.8%) and insurer Tokio Marine Holdings Inc. (+2.3%).

By 8:21 Moscow time, China’s Shanghai Composite Index was down 0.7 percent and Hong Kong’s Hang Seng was down 2.1 percent.

The People’s Bank of China (NBK, the country’s central bank) kept its benchmark one-year lending rate (LPR) at 3.65% per year.

The rate for five-year loans was left at 4.3 percent per annum, the NBK said in a statement.

The regulator left the rates unchanged amid continued downward pressure on the yuan and a slowdown in economic activity amid rising coronavirus infections and new restrictions or lockdowns in a number of cities, Trading Economics wrote.

In Hong Kong, stocks of companies providing consumer goods and services declined significantly on Monday as investors’ attention shifted back to the coronavirus situation amid a rise in infections and the first report of a fatality from the effects of COVID-19 in nearly six months, Trading Economics wrote.

Hong Kong Chief Executive John Lee tested positive for COVID-19 after returning from the Asia-Pacific Economic Cooperation (APEC) summit in Thailand, the PRC Special Administrative Region government said.

According to the statement, Lee tested negative for COVID-19 all four days he was in Thailand. However, upon his arrival at Hong Kong airport, the head of the special administrative region’s administration received a positive test.

Leaders of the decline on the Hong Kong Stock Exchange include shares of restaurant chain owner Haidilao International Holding Ltd (-7.5%) and casino operators Sands China (SPB: 1928) Ltd (-7.4%) and Galaxy Entertainment Group Ltd (-7.3%).

The value of South Korea’s Kospi index by 8:15 Moscow timeframe dropped 1.3%.

One of the world’s largest chip and electronics maker Samsung Electronics Co. dropped 1.5%, while car maker Kia Corp. dropped 1.7%.

Australia’s S&P/ASX 200 index fell 0.17%.

Share prices of the world’s largest mining companies BHP and Rio Tinto fell by 2.25% and 2.3%, respectively.