The National Bank of Ukraine (NBU) notes the presence of a number of factors on the market that contribute to the improvement of the price situation, and may reduce the inflation forecast for the current year, which was set at 31% in July, said Deputy Head of the NBU Serhiy Nikolaychuk.

Our last forecast for July (inflation) is about 30%, next year it will be about 20%. The risks are down: most likely, it will be revised (inflation forecast) a little lower, but not significantly,” he said at the Forbes conference “Without rose-colored glasses. Business and the state during the war” on Thursday.

Nikolaychuk explained that this was due, in particular, to the improvement in the situation with the supply of vegetables and fruits.

He added that fuel prices fell more than the National Bank expected, which is also related to logistics.

“The situation with the opening of ports also gives more reasons that there will be no large exchange rate fluctuations,” the deputy head of the National Bank said.

He also noted that in the July forecast, the National Bank included the introduction of an additional import duty and a higher excise tax on fuel, but these measures were not implemented, and this is also an additional deterrent effect on prices.

“Next year, the main disinflationary factor is the improvement in the ability of Ukrainian businesses to increase agricultural production, and logistics capabilities will improve,” Nikolaychuk said.

As reported, consumer price growth in Ukraine in August 2022 accelerated to 1.1% from 0.7% in July, and in annual terms, in August this year, inflation rose to 23.8% from 22.2% in July and 21.5% in June.

As reported, in 2021 inflation in Ukraine rose to 10% from 5% in 2020 and 4.1% in 2019, while core inflation rose to 7.9% against 4.5% a year earlier.

The NBU predicted an acceleration of inflation this year to 31%, including up to 25.6% in the third quarter.

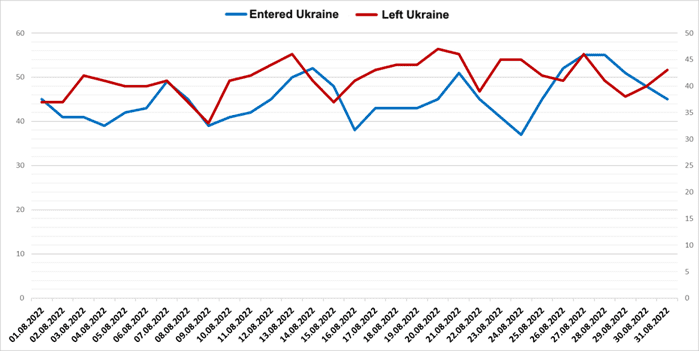

Passenger flow through the western border of Ukraine in June 2022, thousand (graphically)

Data: State Border Service, graphics of the Club of Experts

The UAE authorities have changed the rules for issuing visas for foreign tourists: the validity of tourist visas has been increased to 60 days, five-year visas and other new types of documents have appeared, Gulf News reports.

“The new rules, which expand the opportunities for traveling to the country, came into force on October 3. Updating the visa issuance system will streamline the process of obtaining entry documents and meet the needs of all categories of foreigners and tourists in the future. It is aimed at increasing the population of the UAE through qualified entrepreneurs , scientists, successful students and graduates, workers,” the newspaper writes.

According to the portal, the validity of tourist visas has been extended from 30 to 60 days. It is also now possible to apply for a five-year multi-visa tourist, which will allow foreigners to stay in the UAE for 180 days a year or 90 days in a row. Foreigners can apply for a visa directly and the visa fee is 650 dirhams or $177. The application can be submitted through the UAEICP application.

The UAE authorities have also approved a new type of visa – a five-year resident Green Residence. Holders of such a visa will be able to sponsor their close relatives and easily obtain a residence permit for themselves and family members. Three categories of foreign citizens will be able to obtain such a visa: freelancers / self-employed, qualified employees, investors and partners.

“The UAE has also introduced visas to explore labor market opportunities and another type to explore investment and business opportunities without the need for confirmation from a sponsor or host,” writes Gulf News.

According to the publication, the new visa policy expands the opportunities for UAE Golden Visa holders and allows job seekers to enter the country with flexible visit periods and a simple extension of up to one year without the requirement of a sponsor or employer.

In January-August 2022, Ukraine doubled its revenue from the export of oilseeds compared to the same period last year – up to $1.71 billion, but reduced the supply of vegetable fats and oilseed processing products – by 11%, to $3.65 billion

As reported on the website of the National Research Center “Institute of Agrarian Economics” on Friday, during the specified period, 1.6 million tons of sunflower seeds were exported for $823 million, 0.9 million tons of rapeseed for $415 million and 0.8 million tons of soybeans for $413 million. .

It is specified that the largest buyers of oilseeds for the eight months of 2022 were Romania (19.3% of the total), Bulgaria (18.0%), Turkey (16.9%), Poland (12.2%), Hungary (7. 9%), Germany (5.9%), Moldova (3.7%) and the Netherlands (3.1%). The total share of these eight countries in domestic exports of oilseeds was 87%.

In turn, in January-August 2022, Ukraine exported vegetable oils and fats of all kinds for $3.65 billion, which is 11% less than last year’s figures for the corresponding period.

According to the IAE, the main export product of this group is sunflower oil, whose export earnings for eight months of this year amounted to $3.36 billion, or 92% of all supplies of oil and fats.

The largest buyers of Ukrainian vegetable oils and fats of all kinds in January-August 2022 were Poland with a share of 14.5%, followed by India (11.7%), Turkey (9.8%), the Netherlands (8.1% ), Italy (5.4%), Bulgaria (4.9%), Spain (4.7%), Romania (4.5%). Together, these countries account for about 64% of the export value of vegetable oils and fats.

“The final figures for the export of oilseeds and vegetable oils in 2022 will largely depend on the ability of Ukrainian exporters to make the most of the established routes for exporting products, including through seaports using the “grain corridor,” the IAE summed up in the message.

FAO (Food and Agriculture Organization of the United Nations) in September raised the forecast for world wheat harvest in 2022 to 787.2 million tons, which is 1% more than was harvested in 2021, according to a summary of the organization.

“And, perhaps, (the indicator) will reach an even higher, record level. This is due to a higher than expected harvest in the European Union and the Russian Federation,” the document says.

In general, world grain production will decrease by 1.7% – to 2 billion 768 million tons, including feed grain – by 2.8%, to 1 billion 468 million tons, “due mainly to unfavorable agrotechnical conditions in the United States “explain FAO experts.

In addition, global rice production in 2022 is expected to reach 512.8 million tonnes, down 2.4% from the all-time high of 2021. The decline in the forecast compared to September is due to a prolonged summer drought, high temperatures in China and flooding in Pakistan, the document says.

As expected, grain consumption in the 2022/2023 agricultural year may decrease by 0.5% – to 2 billion 788 million tons, mainly due to a decrease in feed consumption.