Export prices for food and feed wheat began to decline in December 2025, according to the information and analytical agency APK-Inform.

“Demand for food wheat remained low throughout the reporting period, while the first half of December was characterized by good purchasing activity in the feed wheat sector, followed by a decline at the end of the month. This was due to military threats, a reduction in ship calls at ports, and systematic strikes on energy infrastructure, leading to emergency and rolling blackouts,” analysts said.

Experts noted that these factors complicated the work of Ukrainian ports and land logistics, caused interruptions and forced stoppages, and forced market participants to adjust all elements of the supply chain. In addition, weather conditions deteriorated at the end of December, which also affected shipments from ports.

This situation, combined with a seasonal decline in trading activity and high competition in foreign markets, according to analysts, put pressure on exporters’ purchase prices.

Thus, in the ports of Greater Odessa during the reporting period, purchase prices for food wheat of grades 2 and 3 fell by $6-9 USD/t and as of December 29 are reported to be in the range of $208-216 and $206-214 per ton (CPT-port). At the same time, the decline in demand prices for feed wheat averaged $9 per ton and is recorded in the range of $197-207 per ton (CPT port) compared to the beginning of this month, according to APK-Inform.

In 2025, the state-owned enterprise Lesy Ukrainy earned more than UAH 8 billion in profits, paid more than UAH 15 billion in taxes, and invested about UAH 2 billion in its restoration and development, according to the company’s CEO Yuriy Bolokhovets on Facebook.

He also noted that during the war, foresters were able to implement the president’s “Green Country” program and planted 1 billion trees, saved tens of thousands of hectares of self-seeded and undistributed forests, and reduced the area of fires by four times despite constant shelling.

“The company’s performance is not a coincidence or a gift of fate. It is the result of a consistent policy of strong centralized management and control, transparent procurement, and open and competitive sales,” Bolokhovets emphasized.

At the same time, he noted that “the pre-reform fragmented and corrupt system did not achieve even a tenth of the results of the Lesy Ukrainy state enterprise, but remained a source of enrichment for the select few.” That is why, according to the head of the state-owned enterprise, forest reform still faces fierce resistance, as shadow schemes and profits always find supporters. The remnants of the old system are finding new allies, he explained.

“The pressure and persecution that continued this year are not about me personally. These are attempts to stop the changes that, for the first time since independence, have made forests a truly state resource,” emphasized the CEO of Lesy Ukrainy, thanking the team of foresters who have come through this year with dignity, maintained unity, and delivered results.

Among the plans for 2026, Bolokhovets mentioned the digitization of management, new global control systems, mechanization and increased harvesting, and large-scale demining projects.

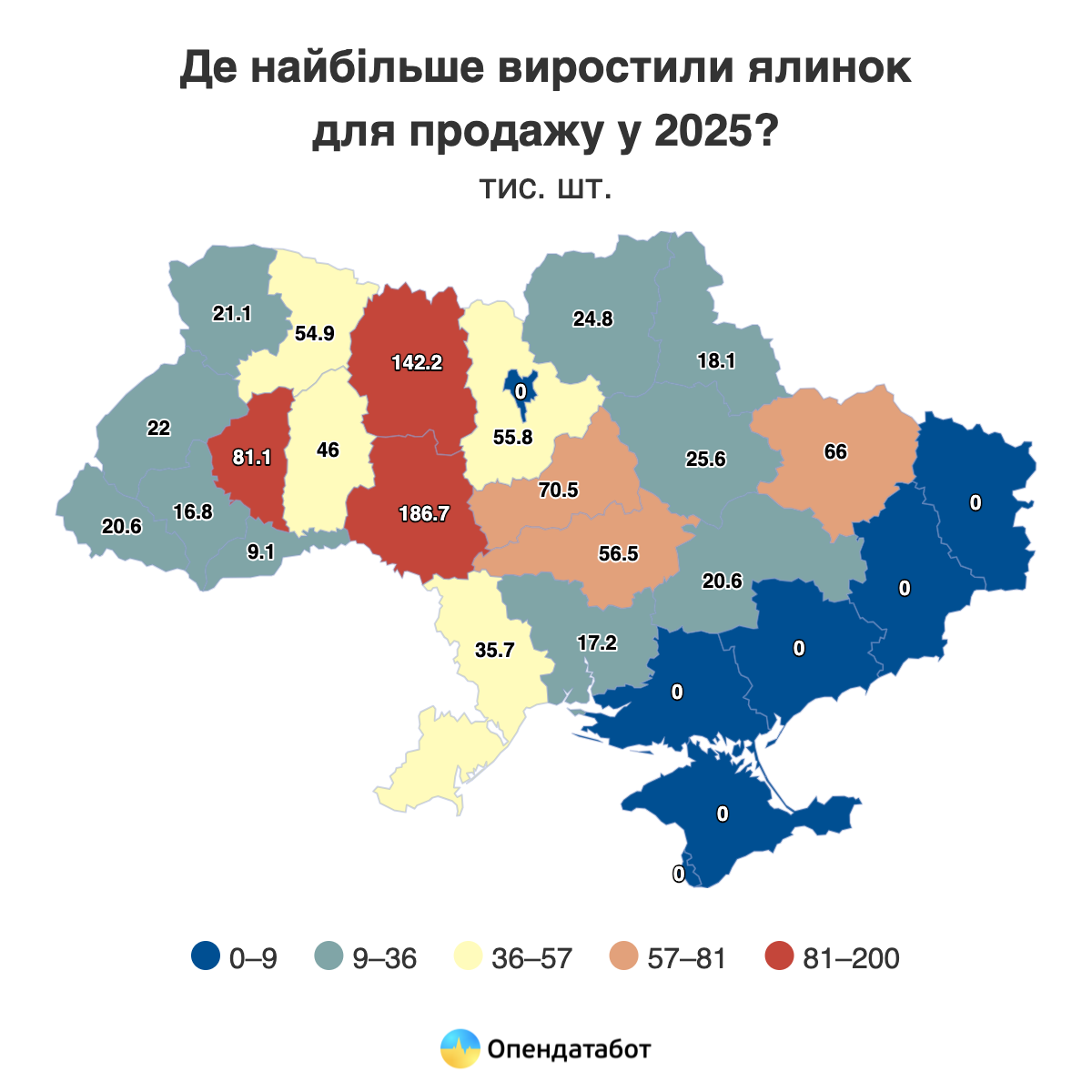

The Ukrainian Christmas tree market continues to decline, both in terms of the number of trees and demand. Thus, the State Forestry Agency has planned to sell 991 thousand Christmas trees this year. This is 8% less than last year. At the same time, Ukrainians are buying Christmas trees less and less – only 39.8 thousand Christmas trees were sold as of mid-December. This is 11% less than in the same period last year. Most Christmas trees for sale are traditionally harvested in Vinnytsia and Zhytomyr regions.

991 thousand Christmas trees were harvested for sale this season in Ukraine. This is 8% less than last year.

However, demand for live Christmas trees is falling even faster than supply. Thus, only 39.9 thousand Christmas trees were sold in Ukraine as of mid-December 2025. This is 11% less than in the same period last year. For comparison, during the previous season, forestry enterprises sold 153.7 thousand trees, which is 38% less than in the 2023-2024 season and almost a quarter less than in 2022-2023.

The largest volumes of holiday trees for sale this season are concentrated in two regions: Vinnytsia region – 187 thousand Christmas trees, or 19% of the total, and Zhytomyr region – 142 thousand, or 14%. At the same time, Zhytomyr region remains the leader in terms of land area for growing conifers – 640 hectares. This is almost a quarter of the total Ukrainian area. Over the past four years, it has decreased by 9%, but even in this area, about 1.9 million trees grow.

2753.5 hectares is the total area where conifers are grown in Ukraine for the New Year holidays. This is 6% less than last year and 35% less than in 2021. In some regions, the decline is particularly dramatic: in Ivano-Frankivsk region, the area decreased from 9.6 hectares in 2021 to only 1.7 hectares in 2025.

Along with the land, the number of trees is also decreasing. While in 2021 there were almost 12.4 million conifers in Ukraine, now there are about 7.8 million.

Amid the shrinking legal market, the number of illegal logging operations has also fallen sharply. Only 34 cases of illegal harvesting of Christmas trees were recorded as of early December 2025. One third of the total number was detected in Kharkiv region – 10 cases. In total, there were 328 such violations last season.

https://opendatabot.ua/analytics/legal-christmas-trees-2025

Failure to meet nine indicators in Q4 2025 under the Ukraine Facility program could result in a loss of €2.3 billion under the program, according to a presentation by the #RRR4U Consortium on the implementation of program indicators.

According to the published presentation, for October-December 2025, the list of unfulfilled indicators includes amendments to the legislation on civil service, the repeal of the suspension of the law on state aid, the entry into force of the law “On the Basic Principles of Housing Policy,” deregulation in certain sectors, and improvement of licensing procedures for investments in renewable energy sources (RES).

This list also includes the appointment of a nominated electricity market operator, the determination of the special status of the National Commission for State Regulation in Energy and Utilities (NKREKP), support for the development of efficient and more sustainable centralized heat supply, and the entry into force of the law on traffic safety and interoperability of rail transport.

In addition, indicators from previous periods of 2025 remain unfulfilled: from the first quarter – an increase in the staff of the High Anti-Corruption Court (HACC) (the estimated cost of the unfulfilled indicator is EUR 0.3 billion), in the second quarter – changes regarding the review of judges’ integrity declarations and their verification, and the reform of the digitization of enforcement proceedings (EUR 0.7 billion), in the third quarter – the adoption of legislation for the electricity integration package (EUR 0.3 billion).

According to the information in the presentation, Ukraine’s failure to meet the indicators cost it EUR 3.6 billion for the whole year.

Ukraine Facility is a EUR 50 billion EU financial support program for Ukraine aimed at macroeconomic stability, modernization, reconstruction, and acceleration of Ukraine’s European integration in 2024-2027. Funding is provided in tranches after Ukraine confirms that it has met the agreed structural indicators. After August this year, Ukraine’s Plan was updated compared to its initial version two years ago.

The total amount of assistance to Ukraine under the Ukraine Facility, which has been allocated since March 2024, is EUR 26.8 billion, which corresponds to almost 70% of the funds available under the first component of the Ukraine Facility. The last tranche from the European Commission was received on December 22 in the amount of EUR 2.3 billion.

The Bucharest authorities plan to introduce a tourist tax of €2 per night for each visitor to the city from 2026.

The tax will be levied on tourists staying in hotels and hostels, as well as in apartments rented through booking platforms, including Booking and Airbnb.

According to city hall estimates, revenue from the new tax could reach 15 million lei per year. The funds raised are planned to be used to develop tourist infrastructure, promote Bucharest as a tourist destination, and improve services for visitors to the city.

Romanian border guards are not allowing many cars arriving from Ukraine to cross the border without proof of technical inspection, according to eyewitnesses.

To cross the border, drivers are required to present a technical inspection certificate confirming that the vehicle is in good working order. It is also necessary to have documents for entry and travel, including passport documents, car papers, and insurance, and in some cases, confirmation of the purpose of the trip and a power of attorney when driving someone else’s car.

The Romanian border police previously indicated that during border control, drivers must present an identity document, a valid driver’s license, vehicle registration documents, and confirmation of a valid periodic technical inspection, which must be valid at the time of presentation at the checkpoint.

In addition, border guards remind travelers that customs restrictions on entry into Romania apply to meat and dairy products, honey, and cash in excess of €10,000, which must be declared.