In January-June 2025, BBC Insurance (formerly Brokbusiness Insurance, Kyiv) collected UAH 444.23 million in gross premiums, which is 86.9% more than in the same period a year ago, according to Expert-Rating in its report confirming the insurance company’s financial stability rating at “uaAA+” on the national scale.

According to the RA, the share of insurance premiums belonging to reinsurers grew 2.3 times in the company, while in the structure of gross premiums it decreased by 0.34 percentage points (pp) to 2.04%.

In the first half of the year, BBC Insurance made 89.2% more insurance payments and reimbursements than in the same period a year ago, and the level of payments increased by 0.43 p.p. to 35.62%.

The company’s equity as of the reporting date increased by 19.92% to UAH 175.52 million, and its gross liabilities increased by 61.60% to UAH 358.22 million. Cash and cash equivalents increased by 61.36% to UAH 341.05 million, while the ratio of cash to liabilities decreased by 0.14 percentage points to 95.21%.

Thus, as of the beginning of the second half of 2025, IC “BBS Insurance” was secured by highly liquid assets, which covered 95.21% of its liabilities.

At the end of the first half of 2025, the company’s net profit increased by a third (+33.42%) compared to the same period in 2024, reaching UAH 23.9 million, while the company’s operating profit was slightly lower at UAH 10.67 million (-7.22%).

BBS Insurance has been operating in the Ukrainian insurance market for over 25 years and is represented in all regions of the country.

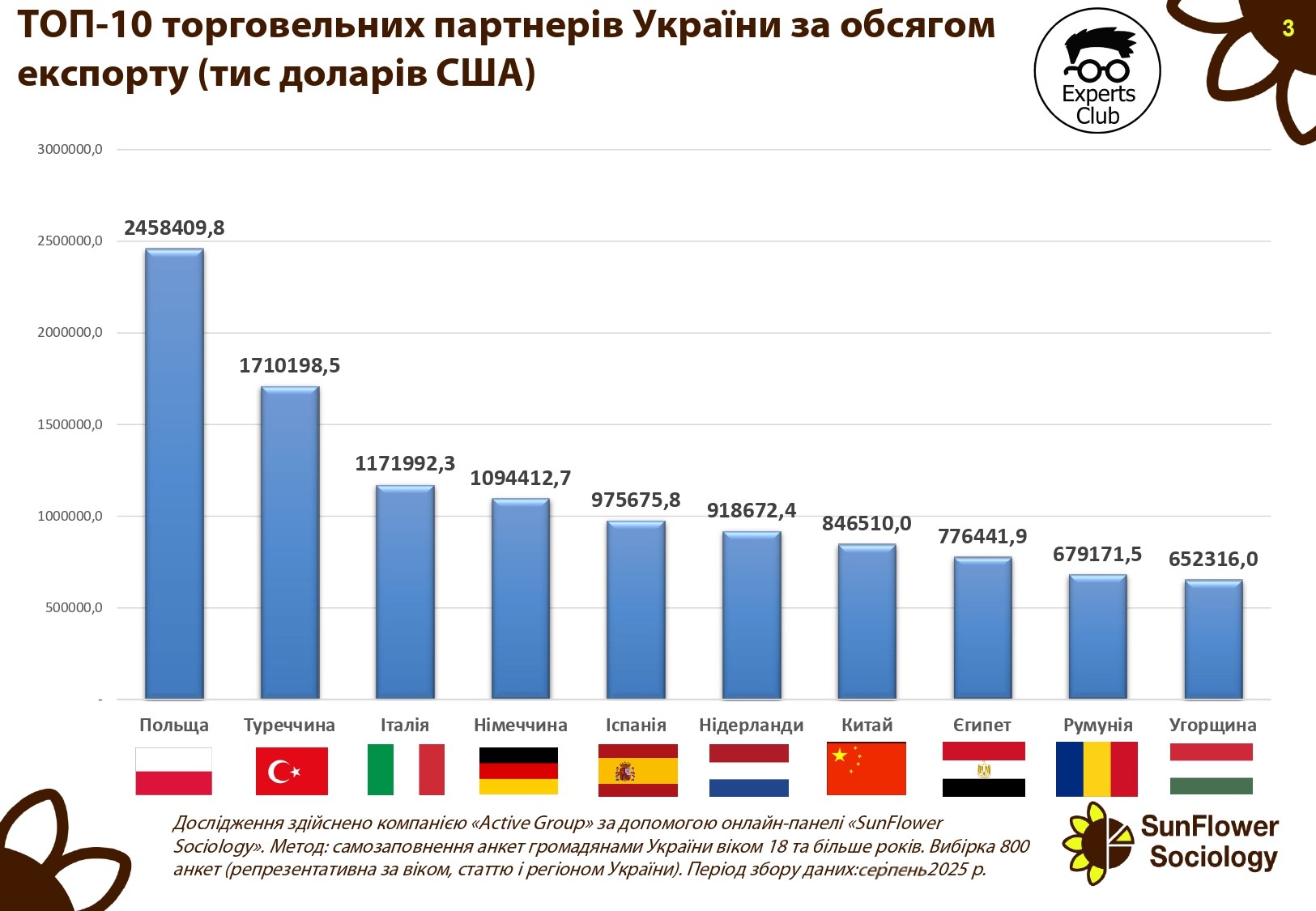

According to the results of the first half of 2025, Poland remains Ukraine’s main trading partner in terms of export volumes. According to research by Active Group and Experts Club, exports to Poland amounted to US$2.45 billion.

Turkey ranks second with USD 1.71 billion, and Italy ranks third with USD 1.17 billion. Other major partners include: Germany ($1.09 billion), Spain ($976 million), the Netherlands ($919 million), China ($847 million), Egypt ($776 million), Romania ($679 million), and Hungary ($652 million).

“The structure of Ukraine’s exports shows a clear focus on European Union countries. Poland, Italy, Germany, Spain, and the Netherlands together account for more than half of total exports. This indicates Ukraine’s strategic integration into the European economic space,” emphasized Maksim Urakin, founder of Experts Club and economist.

He also noted that Turkey remains a critically important partner for Ukrainian agricultural and metallurgical exports, while China and Egypt are key markets for agricultural products, particularly grains.

“The presence of trading partners such as Egypt and China diversifies Ukrainian exports,” Urakin added.

CHINA, ECONOMY, EGYPT, EXPERTS CLUB, EXPORTS, GERMANY, HUNGARY, ITALY, POLAND, ROMANIA, TRADE, TURKEY, UKRAINE, МАКСИМ УРАКИН

In January-August 2025, Ukraine exported nearly 1.4 billion eggs worth $119.5 million, which is 2.6 times more than in the same period of 2024, according to the Ukrainian Poultry Union.

The industry association noted that in August, Ukrainian producers exported 168.2 million eggs worth a total of $16.4 million, which is 81.9% more than in the same period of 2024.

The main buyers of Ukrainian eggs in January-August 2025 were Spain (11% of total exports), Croatia (10.9%), and the United Kingdom (10.6%).

The largest shipments in August were to Spain (37.1 million eggs), the Czech Republic (28.9 million eggs), and Poland (21.7 million eggs).

Kazakhstan has introduced its own cryptocurrency, the Evo stablecoin (KZTE), issued with the support of the international payment system Mastercard. The new digital asset is pegged to the national currency at a ratio of 1 to 1 with the tenge, which ensures its stability and transparency.

According to the developers, Evo will become a universal tool for cashless payments and online transactions both within the country and abroad. In the future, the coin may take the place of a full-fledged means of payment, integrated into the financial system of Kazakhstan and supported by leading banks and fintech companies.

Experts note that the launch of KZTE reflects Kazakhstan’s desire to strengthen its position in the field of digital finance and accelerate the introduction of blockchain technologies into the economy.

Source: https://www.fixygen.ua/news/20250924/kazahstan-zapustiv-natsionalniy-steyblkoin.html

According to Serbian Economist, the Serbian Economists’ Association (SEA) will host the 11th World Congress of Economists, which will take place in Belgrade from June 22 to 26, 2026, the SEA announced.

More than 1,000 leading global economists from prestigious universities are expected to attend. A delegation from the International Economic Association (IEA) was in Belgrade during this time, with SES representatives, led by Chairman Aleksandar Vlahovic, agreeing on the organizational and program details of the forum.

“We had very productive meetings, discussed key issues, and proved that we are ready to organize such a prestigious event at the highest level,” Vlahovic said.

According to him, the importance of the congress is underscored by the fact that the program committee is headed by Harvard University professor and Nobel Prize winner in economics Eric Maskin. Other Nobel laureates and experts who have held key positions in the economic policy of the world’s leading countries are also expected to arrive in Belgrade.

The congress is being held in Southeast Europe for the first time and is returning to Europe after 20 years. The SES believes that this forum will be an opportunity for universities and research institutes in Serbia and the region to establish strong ties with the global academic community, and for businesses and authorities to receive direct recommendations from leading economists.

The World Congress is organized by the International Economic Association (IEA) every three years. The forum brings together hundreds of scientists and experts to discuss global economic trends and new scientific approaches. In 2023, the congress was held in Medellin, Colombia, and brought together representatives of the academic and business worlds from all continents.

The main role of the congress is to bring together academic science and practice, develop dialogue between economists and politicians, and shape innovative solutions for the global economy.

https://t.me/relocationrs/1463

The Argentine government has temporarily abolished high export duties on grain, soybeans, and soybean products, which previously ranged from 25% to 31%, until October 31, 2025, according to GrainTrade. The move is aimed at increasing foreign exchange earnings and stabilizing the national currency amid the economic crisis.

The political context of the decision is linked to the defeat of President Javier Milei’s party in local elections in the province of Buenos Aires. This has heightened investor doubts about the government’s stability and caused the peso to devalue. The central bank has spent more than $1.1 billion of its reserves over the past three days to support the currency market. In total, Argentina has already used $20 billion in funding from the IMF this year.

The abolition of tariffs will sharply increase the supply of soybeans, soybean meal, and oil on the global market. On September 22, November soybean futures in Chicago fell by 1.5% to $371.1/t, and over the week, the decline was 3.3%.

Experts predict further pressure on prices, especially if trade negotiations between the US and China stall.

China, which diversified its imports after the trade war with the US, increased its purchases of Argentine soybeans to a six-year high of 8.81 million tons last year. This reduced domestic processing: in July, about 31% of enterprises were idle, and now the figure is even higher, according to the CIARA-CEC exporters’ association.

For Ukraine, Argentina’s decision means:

increased competition in key markets in Europe and Southeast Asia;

lower export prices for soybeans and soybean products;

pressure on domestic prices from processors due to cheaper soybean meal and oil from Latin America.