J.P. Morgan is committed to its forecast of 5.6% growth for Ukraine’s economy in 2021, despite continuing quarantine restrictions, the bank said in its April commentary.

The bank still believes that in 2021 growth will exceed 5%, mainly due to internal factors, but will also be supported by external demand. As the European and global economy recovers in the second half of 2021, Ukrainian exports should increase in volume and contribute to growth,” the analysts said.

They pointed to good performance in the fourth quarter of last year and strong growth in retail sales, confirming the view that consumption will be an important driver of growth this year as well.

J.P. Morgan said that a serious decline in investment and a reduction in inventories were the main negative factors in the decline in GDP by 4% last year, but this year the situation in these areas will improve. In particular, the analysts expect investments to rebound by almost 30% after falling by more than 24% last year and reaching pre-crisis levels. In their opinion, restocking will provide significant additional impetus to growth in 2021.

According to the bank’s forecast, vaccination will progress very slowly, more than half of the population will be vaccinated by about the middle of 2022; therefore, consumer spending will be mostly domestic.

J.P. Morgan pointed out a possible serious aggravation of the situation with COVID-19 or geopolitical events among the risks.

Commenting on cooperation with the IMF, the analysts maintain expectations that Ukraine will receive financing from the IMF in the third quarter, despite the slow implementation of the commitments. In their opinion, the IMF mission is likely to return in the second quarter of 2021 and among the main issues will be the discussion of the laws on the High Council of Justice, NABU and strengthening responsibility for electronic declarations introduced to the Rada, as well as the preservation of the NBU’s independence. J.P. Morgan also said that U.S. officials named the resumption of cooperation with the IMF and IFIs, as well as reforms in the justice sector, among the conditions of financial support for Ukraine.

Speaking of inflation, the analysts expect it to rise to about 9% by the third quarter of 2021 and increase the key policy rate by the National Bank by 50 basis points – to 7% at the next meeting. In their opinion, further this year the key policy rate will reach 7.5%, and next year – 9.5%. J.P. Morgan believes that 2022 will be more challenging for the NBU, as rather high real interest rates will be required to bring inflation down to 5%, especially given the expected current account deficit compared to a large surplus in 2020.

According to the document, a high GDP deflator (9.8% last year) implies an increase in budget receipts in 2021, in connection with which the analysts predict the budget deficit this year is slightly higher than 4% of GDP compared to 5.5% of GDP in the official forecast.

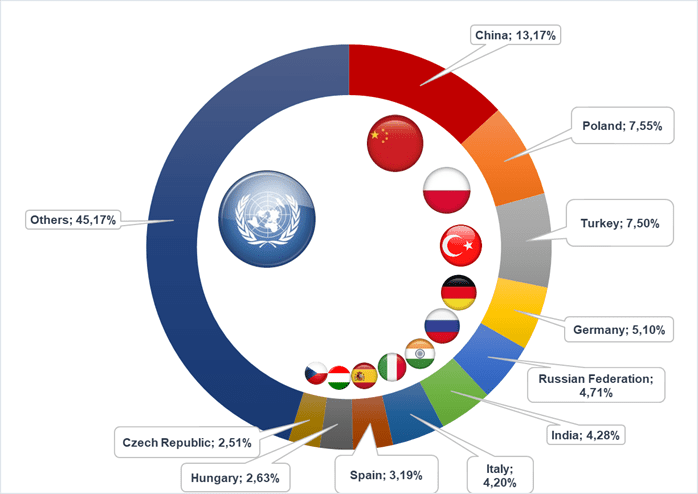

MAIN TRADE PARTNERS OF UKRAINE IN % FROM TOTAL VOLUME (EXPORT FROM UKRAINE TO OTHER COUNTRIES) IN JAN 2021

Weidmann Malyn paper factory (MPF, Zhytomyr region), the only producer of electrical insulating board for power engineering machines in Ukraine, increase production by 2.2% in January-March 2021 compared with January-March 2020, to UAH 133.15 million, the UkrPapir association has said.

According to UkrPapir data provided to Interfax-Ukraine, in kind during this period the factory cut industrial paper production by 0.7%, to 1,540 tonnes, whereas transformer board production remained unchanged at 1,160 tonnes.

MPF Weidmann, founded in 1871 and a member of the Weidmann international group from 2000, is the only company in Eastern Europe that can supply almost all kinds of electrical insulating paper and cardboard meeting regional and international standards.

The factory produces transformer board, electrical insulating paper for power cables and transformer windings, crepe paper and other types of paper for industrial use, such as, packaging, filtration, and wallpaper.

The number of banks expecting an increase in the volume of their loan portfolio over the next 12 months amounted to 78% for the corporate segment and 82% for lending to the population, according to the results of a survey conducted by the National Bank of Ukraine (NBU) on the conditions of bank lending.

“The survey participants positively assess the prospects for lending in the next 12 months: 78% of respondents predict the growth of the loan portfolio of corporations, 82% of households. These are the highest estimates of the growth of the loan portfolio of the population since 2015, however, some large banks expect a certain deterioration in its quality,” the review says.

According to the report, the optimism of the respondents regarding the further increase in funding has grown, in particular, 77% of respondents expect an increase in household deposits, 78% – funds of enterprises.

The banks note that despite expectations of the introduction of new quarantine restrictions, the demand for loans increased from business and the population, in particular, the demand for mortgages was the highest in the entire history of observations.

It is indicated that in January-March 2021, the demand for business loans increased, primarily for loans to SMEs, in hryvnias and long-term loans.

The main factors behind the revival of demand are still cited by banks as a decrease in interest rates, the need of enterprises for capital investments and working capital, as well as debt restructuring.

The banks explain the softening of the creditworthiness for business by the high level of liquidity, increased competition with other banks, as well as improved expectations regarding the overall economic activity and the development of certain industries, primarily for SMEs.

According to the survey, almost a quarter of the surveyed respondents noted an increase in the level of approval of applications for business loans and easing requirements for the size of the loan.

It is indicated that 92% of financial institutions rated the debt burden of household borrowers as average, and more than 80% of financial institutions also rated the debt burden of corporate borrowers.

The survey was conducted from March 19 to April 9, 2021 among credit managers of 23 banks, whose share in the total assets of the banking system of Ukraine is 88%.

The National Energy and Utilities Regulatory Commission of Ukraine (NEURC) has set a feed-in tariff for the first stage of a wind power plant of EuroCape Ukraine I LLC (Zaporizhia region) with a capacity of 98.01 MW in the amount of 8.82 eurocents per kWh.

According to the decision adopted at the meeting on April 22, the tariff is valid until January 1, 2030.

The first stage of Zaporizhia wind farm consisting of 27 GE Renewable Energy wind turbines with a capacity of 3.6 MW in accordance with the SACI certificate was commissioned on April 7, 2021. The planned annual volume of electricity supply from the facility is 325.5 million kWh.

As reported, EuroCape Ukraine I announced plans to build 500 MW wind farms in Zaporizhia region back in 2009, however, in particular, due to problems with land allocation, the project entered the construction stage only in mid-2019.

Lending for the construction of the wind farm is carried out with the financial support of the U.S. International Development Finance Corporation (DFC, formerly OPIC), which in December 2017 approved a loan for $ 150 million and insurance with reinsurance in the amount of up to $ 320 million. The total cost of construction of the wind farm was then estimated at EUR466 million ($ 560 million).

In July 2019, General Electric (GE) and LongWing Energy SCA (Luxembourg) issued a $ 150 million debt financing package for the first stage of Zaporizhia wind farm.

EuroCape Ukraine I is part of EuroCape New Energy Ltd of the international concern Eurocape Group, which is engaged in the development and construction of wind and solar energy facilities. In addition to its activities in Ukraine, the concern also has large-scale projects in France, Italy, Romania and Poland.

Cyprus-based LongWing Ukraine Limited (formerly Eurocape (Ukraine) Limited) is a 100% beneficiary of EuroCape Ukraine I.