A meeting of the Ukrainian-Polish intergovernmental commission for economic cooperation will be held in the near future, Ukrainian President Volodymyr Zelensky has said. “Poland is already our second largest trading partner in the EU, but the potential of this cooperation has no borders,” he said at a joint press conference with President Andrzej Duda in Warsaw, Poland, on Saturday.

Zelensky hopes for an active dialogue between the governments of the two countries in the framework of the intergovernmental commission for economic cooperation.

He expressed hope that the next meeting of the commission will take place in the near future.

Over 150 players from 12 countries took part in the Zenit Black Sea Open international annual tournament. Due to such a large number of players, the matches were held simultaneously on three courts of Sport Life organizer’s club and two courts of the Formula fitness club.

Almost all the best players of the country, as well as foreign delegations of athletes gathered at the most legendary tournament in Ukraine. Traditionally, the championship was visited by strong guests from the country of the founders of squash – England. For the first time in the history of Ukraine, it was at Zenit that the Masters 40+ and 45+ categories of men debuted. Thus, Zenit has already set Ukraine’s third squash record. So, in 2007, for the first time, it was at Zenit that the PSA debut tournament took place, in 2013 there was a debut of the children’s tournament under the auspices of ESF Zenit Junior Open, and this year the Masters categories started at the Zenit Black Sea.

The main organizer and fitness partner of the event traditionally was the national network of fitness clubs N1 Sport Life.

Many thanks to all the companies and people involved in organizing the tournament, namely:

Kronplast company represented by Andriy Sydorenko, Solaris Agrolux represented by Illia Shlayer, Li-Ning company represented by Artem Shandybin, Tecnifibre (http://tecnifibre.kiev.ua/) represented by Dmytro Scherbakov, Reima represented by Oleksiy Baryshnikov, Contigo represented by Halyna Dzhandan, Sweet Arte company represented by Oleksiy Kostiukov, More Emotions company represented by Iryna Lychak, the Ukrainain Squash Federation and the Interfax-Ukraine news agency represented by Maksim Urakin, MaxEvents company represented by Yekateryna Urakina.

We thank the Krayna mineral water and the Kompot chain of cafe for the treats.

The party and the award ceremony took place on the seashore in the beautiful club restaurant M1 Club Hotel (https://m1clubhotel.com/en).

Many thanks to Oleksiy Usenko and Mark Burden for financial assistance.

We thank Roman Dribny hosting the event and super impersonator Anatoliy Yurchenko for bright emotions!

The organizing committee of the tournament: Yuriy Maltsev, Serhiy Zakomlistov, Oleksandr Kostevych, Kostiantyn Reshetniak, Iryna Yakovenko, Maria Peltek, Tetiana Makivska.

See you in a year at the jubilee tenth Zenit Black Sea Open 2020 tournament!

The winners of the Zenit Black Sea Open 2019 tournament:

PSA Category Men

1. Ahmed Mohamed (Egypt)

2. Fedoruk Valeriy (Ukraine)

3. Khapun Vasiliy (Romania)

PSA Category Women

1. Usenko Nadiya (Ukraine)

2. Kostiukova Anastasia (Ukraine)

3. Kotova Olha (Ukraine)

Category Amateurs Men

1. Thornton Ben (England)

2. Popko Yevhen (Ukraine)

3. Laukart Yuliy (Ukraine)

Category 45+

1. Kovalchuk Viktor (Ukraine)

2. Kostevych Oleksandr (Ukraine)

3. Maltsev Yuriy (Ukraine)

Category Amateurs Women

1. Onegova Alexandra (Russia)

2. Strelnikova Olesya (Russia)

3. Yegorova Lyudmila (Russia)

Category BU-13

1. Khlus Nikita (Ukraine)

2. Scherbakov Yehor (Ukraine)

3. Panchenko Artem (Ukraine)

Category GU-13

1. Beheba Khrystyna (Ukraine)

2. Krykun Anastasia (Ukraine)

3. Suprun Yelizaveta (Ukraine)

Category BU-15

1. Scherbakov Dmytro-junior (Ukraine)

2. Zhivotovsky Yaroslav (Ukraine)

3. Hluschenko Lukyan (Ukraine)

Category 40+

1. Zheludkov Tymofiy (Ukraine)

2. Baluta Dmytro (Ukraine)

3. Sydorenko Andriy (Ukraine)

The main information partner of the tournament is Interfax-Ukraine.

Ukrainian foreign trade in services by countries in I half-year 2019 (import)

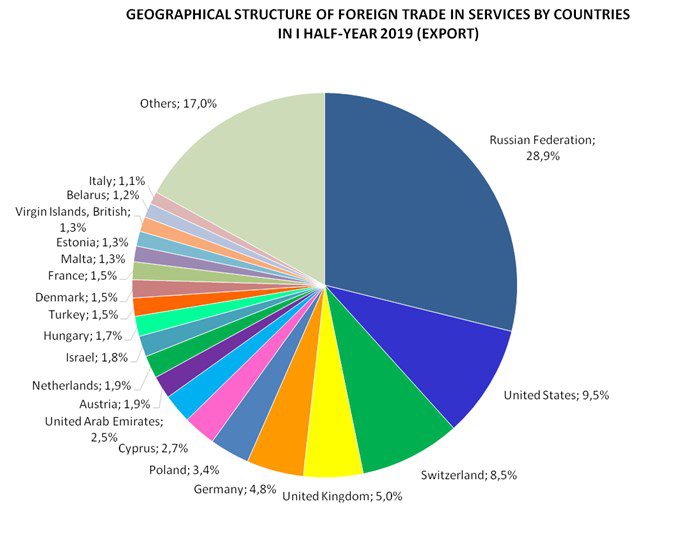

Ukrainian foreign trade in services by countries in I half-year 2019 (export)

Foreign direct investment (FDI) in Ukraine as equity capital as of July 1, 2019, was $33.724 billion, which was 2.6%, or $0.84 billion more than in the beginning of the year, the State Statistics Service of Ukraine said.

The growth of gross domestic product (GDP) of Ukraine in April-June 2019 was 4.6% compared to the same period in 2018, whereas the growth rate in the first quarter was lower, being fixed at 2.5%.

JP Morgan analysts have reviewed its GDP forecast for 2019 for Ukraine improving it from 3.6% to 4.3% along with the sharp growth of GDP to 4.6% in the second quarter compared with the expected growth of 3.8%, according to JP Morgan survey of emerging markets of Eastern Europe.

Capital investment in Ukraine in January-June 2019 grew by 12.3%, while in the first quarter of 2019 – by 17.8%, the State Statistics Service reported.

The Verkhovna Rada of the ninth convocation has appointed Oleksiy Honcharuk prime minister of Ukraine.

The deficit of Ukraine’s foreign trade in goods in January-June 2019 increased by 36.3% compared with January-June 2018, to $3.736 billion, the State Statistics Service has reported.

The surplus of Ukraine’s foreign trade in services in January-June 2019 increased by 13.3% compared with January-June 2018, to $2.937 billion ($2.593 billion in H1 2018), the State Statistics Service has reported.

The actual inflation rate in July 2019 exceeded the forecast published in the July 2019 Inflation Report, according to the website of the National Bank of Ukraine (NBU).

The deficit of Ukraine’s national budget in January-July 2019 totaled UAH 2.86 billion, including UAH 10.6 billion of the deficit of the general fund, according to the State Treasury Service of Ukraine.

The largest taxpayers of Ukraine in July 2019 increased tax payments by almost UAH 7 billion compared with July 2018, to over UAH 27 billion, the Office of Large Taxpayers has said in a press release.

Ukraine’s forex reserves in July 2019 grew by $1.2 billion or 5.8%, to $21.84 billion thanks to net purchase of currency on the interbank currency market by the National Bank of Ukraine (NBU), according to preliminary data posted on the central bank’s website.

Money stock in Ukraine in July 2019 expanded by 1.8%, to UAH 1.313 trillion, the relevant data of monetary statistics have been posted on the website of the National Bank of Ukraine (NBU).

The total state (direct) and state-guaranteed debt of Ukraine in July 2019 increased by 2.55%, or by $2.05 billion, to $82.4 billion, according to data on Finance Ministry’s website.

Ukraine saw a $1.2 billion surplus of a consolidated balance of payments in June 2019 compared with a $750 million deficit in May, a $45 million deficit in April, a $652 million surplus in March 2019 and a $23 million surplus in June 2018.

Industrial production in Ukraine in July 2019 fell by 0.2% compared with July 2018 after a decline of 2.3% in June and growth by 1.6% in May, by 5.2% in April and 2.1% in March, the State Statistics Service reported.

Prices in industry of Ukraine in July 2019 grew by 3.6% after a decline of 2.7% in June, the State Statistics Service reported.

The transport companies of Ukraine in January-July 2019 carried 2.474 billion people, which is 6.1% less than in the same period of 2018, the State Statistics Service has reported.

The transport enterprises of Ukraine in January-July 2019 increased freight transportation by 8.5% compared to the same period of 2018, to 386.5 million tonnes, the State Statistics Service has reported.

The volume of construction work in Ukraine in July 2019 increased by 1.8% compared to July 2018, while in June 2019 from June 2018 this figure rose by 1.7%.

Retail trade turnover in Ukraine (legal entities and individual entrepreneurs) in January-July 2019 in comparable prices increased by 10.1% compared with January-July 2018, the State Statistics Service has said.